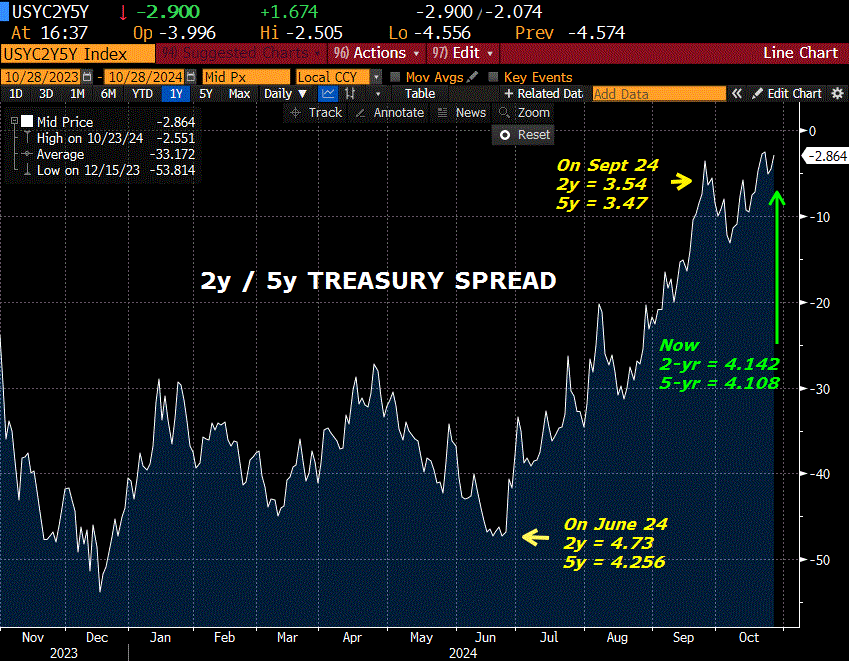

Yields on 2s and 5s nearly equal. 7y auction today

October 29, 2024

******************

–Yields rose further with relentless put buying on TY. 10y yield rose 4.6 bps to 4.276%. Curve had a slight flattening bias as 2’s and 5’s were auctioned (both tailed, 0.8 bp on 2y at 4.130% and 1.6 bp on 5y to 4.138%). New recent low on 5/30 spread at 42 (4.108/4.528). I’ve included a chart of 2y/5y spread as yields are now close to equal.

–The 2y yield plunged from the end of June going into the Sept FOMC, from 4.73 to 3.54 (-119 bps). In the same period 5s went from 4.25 to 3.47 (-78 bps). Even as yields bounced since the FOMC, with both 2s and 5s up about 60 bps, the spread has steepened toward zero, as can be seen from yesterday’s auction yields. It would make sense to me that the 2/5 spread would have flattened post-FOMC with the yield run-up, but so far that hasn’t occurred. SOFR prices and straddles on this part of curve:

SFRH6 9642.0 0QH5 9637.5^ 64.5

SFRH7 9637.5 2QH5 9637.5^ 61.5

SFRH8 9633.0 3QH5 9637.5^ 58.5 (straddle spreads have tightened over past couple of weeks)

–Large new buying in TY puts yesterday (TYZ4 settled 110-225, -11.5)

+30k TYZ4 109.5p 30 to 31; 35s

+30k TYZ4 110.0p 44 to 48; 46s

+25k TY wk2 109/108.25ps 8, 7s

+10k TY wk5 WED 111.5p 50 (expires tomorrow)

–News today includes: JOLTS, Consumer Confidence, 7 year auction.

–Alphabet earnings today (also MCD, AMD, Visa).

META and MSFT tomorrow

AAPL and AMZN Thursday