Yield implosion

July 20, 2021

–Yields plummeted as stocks wobbled, tens and thirties fell 12 bps to 1.18% and 1.815% respectively. This, as SPX eased 1.6% with Nasdaq down just slightly over 1%. I guess it’s due to the delta variant. All curve trades were obliterated, making new recent lows. 2/10 down 10.4 bps to 97. Red/gold eurodollar pack spread down just over 10.5 bps to 94.25. EDZ2/EDZ3 spread hit a recent high of 33.5, but closed down 6 at 23.5 (less than one hike). Financials were clobbered relative to the broader market as the curve flattened. XLF fell 2.8%. On the opposite end of the spectrum, Peloton rose 7% as the next covid inspired stimulus bill will have a provision paying for all indoor exercise programs. Of course that’s a joke. But really… PTON up 7% ?!?! We’ll only see later if Nancy Pelosi’s husband is long calls…

–Implied vol jumped to new recent highs, though it will probably deflate on this morning’s stock rebound. I marked TYU at 4.8. Not really panic levels, but certainly firm. New buyer of 60k 3EQ 9862.5p for 4.0 indicates that there are still some willing to fade the move (or perhaps trying to protect gains from longs). Settled 3.5 against underlying EDU’24 9888.0.

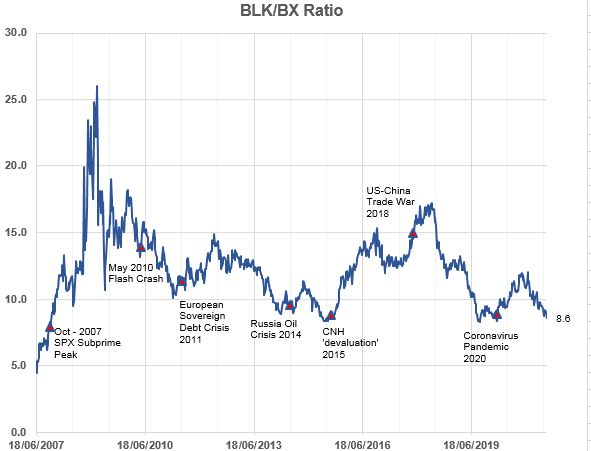

–I saw a rather interesting idea/chart on LinkedIn from Buena Patria, a ratio of BlackRock to Blackstone, the chart of which is attached. The idea is that BLK underperforms in times of financial stress; that with $9 T aum, and its deep ties to the Fed and administration, it is systemically important. Yesterday BLK was down 3.4%. BX was down 2.4%.

Another interesting clip (thanks YZ) shows the incredible consolidation in US banking. Which I suppose is another way of saying concentrated positions in credit markets that can overwhelm other factors. Flood these guys with reserves and leave funding rates at zero and I guess a bond rally is inevitable no matter where inflation prints. (I’m a little dismayed that one of my former employers, Manufacturers Hanover, didn’t even make the list). Russell Napier’s recent interview where he says the gov’t will force banks to hold down long rates and that the Fed becomes less relevant going forward makes sense in this context.

https://5minforecast-uploads.s3.amazonaws.com/wp-content/uploads/2021/07/Visual-Capalist-FULL.jpg