Wrath of the Market Gods

March 8, 2020 – Weekly comment

This past week was the stuff of Greek mythology. Everything is going along fine, and the next thing you know you’re chained to a boulder on a mountain and an eagle swoops down to eat your liver every morning (it grows back overnight). This of course, is the story of Prometheus, who was punished by Zeus for stealing fire of the gods and giving it to mankind.

The name Prometheus is translated as the ‘forethinker’ or ‘the one who thinks ahead’. According to a post in wikipedia, “Prometheus became a figure who represented human striving, particularly the quest for scientific knowledge, and for the risk of overreaching, or unintended consequences.” From D’Aulaire’s classic Book of Greek Myths, Zeus wasn’t finished with the punishment. He also had to deal with mortals. “He sent to earth a beautiful but silly woman. Her name was Pandora.” [all this by the way of background for my friend Beth].

You know how it goes from here. No, I am not talking about the chaos unleashed by Pandora’s box, although that might be an apt analogy at this point. I’m talking about the Fed, the champion of all humanity, playing with fire and operating with unintended ‘foresight’. Several Fed officials have concluded in previous speeches that negative rates aren’t a good idea for the US economy. So now, we’re going straight to QEEEEE. Sure, the $60 billion of t-bill buying is going to end sometime after the April tax date. Only to be supplanted by a much larger QE operation designed to cap long rates. Or that’s what they will say. The problem with that is, rates have already imploded. The two year fell 39 bps this week to just under 49 bps. Tens down 42 to 70.3 bps. 30’s down over 45 to 1.204%. I can’t even fathom this last one. US thirty-year bond at 1.20%!! Why, that has even matched the ten year yield in Greece. : – l

The real purpose of the new round of massive QE will be to monetize the unconstrained government debt. Deficits are already explosive and a slower economy with more emergency government spending like the $8 billion dollop passed for COVID is not going to help. By the way, in Japan, Abe is offering free loans to companies hit by the virus, and subsidies to affected workers. Northern Italy is going on lockdown. NY declared a health emergency. In skimming the Reuters main news site this morning, the first 20 out of 20 articles mentioned COVID-19.

The former incarnations of QE didn’t lead to inflation, but rather tended to be deflationary, as money created by the Fed flowed into investment funds smothering yields rather than juicing consumer spending. This time may be different… eventually. The political landscape has changed. Well-oiled global supply chains may now require duplicate structures; another layer of cost. For the companies that survive, there will be a big incentive to make up for lost revenues. In the medium term, there is certain to be economic harm from cancelled events which trickle down to all sorts of support businesses. For example, at Chicago’s McCormick Place convention center, the Housewares Show slated for March 14-17, with 60,000 attendees, has been cancelled. The economic slowdown is pretty obvious from the price of oil, where WTI CLJ0 fell 8% this week and is down a third from the start of the year. More on oil and the new and improved PRICE WAR below.

Let’s take a look at a few prices. Star performer this week was April FF which rallied 70 bps to close at 99.49 or 51 bps. Money market curves have forecast continued front-loaded easing. The peak on the Eurodollar curve is now the first red, EDH21, which also settled 99.49. All the easing is priced for the next few months. Be careful of what you wish for President Trump… For example, April to Aug FF is a spread of -26 bps, while April’20/April’21 is -28.5. I.e. the meat of the inversion is up front. On the FF curve, the peak contract is Jan’21 at a price of 99.805, just under 20 bps. Of course, with the post-ease Fed effective of 109 bps, another 50 bp cut at the March 18 FOMC would put it at 58 to 60 bps, and the price on FFJ20 at 51 bps implies even more of an ease. It’s incredible.

There are stories circulating about various funds and option market makers blowing up last week, Completely corroborated by price action. These moves simply don’t happen without extreme duress. One upstairs market maker we transact with said their systems were down on Friday afternoon when we asked for a quote. Maybe the systems did have a glitch. Then again, maybe the plug was pulled. There was talk of a fund being forced to liquidate shorts on the long end on Friday. Makes complete sense from price action. (BBG’s Beth Stanton article notes that long end futures were halted 5 times Friday due to the extreme move). 5/30 treasury spread which had soared up to 90 bps after the surprise cut, plunged an astonishing 25 bps on Friday alone, back to the levels from early in the month, ending 64.5 at the time of futures settlement. There was talk of a forced market-maker liquidation in equity options. Again, pretty apparent from VIX which exploded to 54 on Friday before coming back to close just under 42. The risk guys don’t pay all that much attention to market nuance when exiting positions. I recall I was once handed a fairly large ED option position on the CME floor and instructed to exit it by a friend at another clearing firm. Not at all large by today’s standards, and the market wasn’t particularly volatile at that time, but it still took me half the day to try to minimize damage. I am guessing the shoulder taps were occurring all week, with no one wanting to keep undercapitalized risk on the books over the weekend.

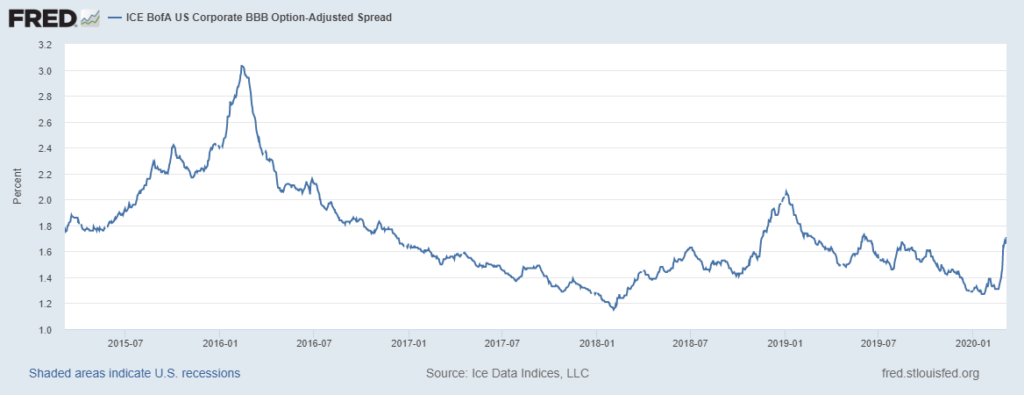

And there’s good reason to fear Monday. On Friday, the OPEC+ meeting in Vienna collapsed as Russia refused production cuts, and want US shale producers to feel the burn. WTI fell about 8% this week. The Saudis had shouldered a large part of the burden to keep production off the market, but now MBS has declared a price war, opening the production spigots and slashing the price of KSA’s crude to $8-$10 below the Brent benchmark. This, at a time when the House of Saud is already under severe pressure, with MBS arresting a few royals for plotting a coup. In late 2015 to early 2016 as WTI tumbled to $27/bbl, BBB credit spreads gushed to 300 bps. Most of the damage was in energy names. Currently, the BBB spread is around 170 bps, at a time when the virus is already causing companies to cut revenue guidance, which may, in turn, imply that debt servicing is suspect. The first victims in the BBB cliff have already been pushed over the edge. Perhaps there will be some forbearance in downgrades by the rating agencies. Then again, maybe not. In any event, there was significant buying of April and June puts on EDM0. A cascade of credit events is quite plausible.

OTHER MARKET/TRADE THOUGHTS

So what’s crazy? I reviewed my note from two weeks ago and I had cited the EDM0 atm 9850 straddle which had settled at 22.0, up from the previous week’s 20.5. On Friday the new atm strike was 99.375 and the straddle settled 34.5! The EDZ0 9937.5 straddle, with SIX months longer until expiration, settled 36.0 vs 9943.5. The EDU0 9950 straddle settled 31.0 vs 9947.0. I’ve only seen straddle inversion once before and that was during the financial crisis.

Another sign of extreme stress is in libor vs OIS. I will just give futures pricing examples. This week, forward implied lib/ois spreads surged 27.5 bps for March to 42.5 and 18 bps for June to 34.5! If Central Bankers have lost all control, who knows where spreads *SHOULD* be.

Treasury auctions 3, 10 and 30 year paper this week. From these yield levels I would think auctions will be sloppy and have significant tails.

| 2/28/2020 | 3/6/2020 | chg | |

| UST 2Y | 88.1 | 48.8 | -39.3 |

| UST 5Y | 91.3 | 55.9 | -35.4 |

| UST 10Y | 112.7 | 70.3 | -42.4 |

| UST 30Y | 165.7 | 120.4 | -45.3 |

| GERM 2Y | -76.9 | -85.8 | -8.9 |

| GERM 10Y | -60.7 | -71.0 | -10.3 |

| JPN 30Y | 27.9 | 31.1 | 3.2 |

| EURO$ H0/H1 | -56.5 | -42.5 | 14.0 |

| EURO$ H1/H2 | 3.0 | 9.5 | 6.5 |

| EUR | 110.27 | 112.86 | 2.59 |

| CRUDE (1st cont) | 44.76 | 41.28 | -3.48 |

| SPX | 2954.22 | 2972.37 | 18.15 |

| VIX | 40.11 | 41.94 | 1.83 |

https://en.wikipedia.org/wiki/Prometheus

https://www.greekmythology.com/Titans/Prometheus/prometheus.html