WIN (Whip Inflation Now)

Feb 10, 2022

Whip Inflation Now was a 1974 attempt to spur a grassroots movement to combat inflation in the US, by encouraging personal savings and disciplined spending habits in combination with public measures, urged by U.S. President Gerald Ford.

Currently the US Gov’t is the number one undisciplined spender!

–CPI today expected 7.2 or 7.3% yoy, vs 7.0% last, which was the high since the early 1980’s. By 1986 it had fallen to 1.1% then shot back up to 6.3 in 1990. So whether it’s 7.3 or 6.8 it’s still at 40 year highs. More importantly, real rates across the curve are extremely negative. Inflation will almost certainly begin decelerating as the year advances, but consumer behavior has changed, and businesses have become accustomed to pushing through wage and price increases. It’s gotten to the point that central bankers are suggesting that workers not ask for large pay raises: “When asked by the BBC whether the Bank[BOE] was asking workers not to demand big pay rises, Bailey said: “Broadly, yes.” He said that while it would be “painful” for workers, some “moderation of wage rises” is needed to prevent inflation from becoming entrenched.” That is simply idiotic. Is the Biden admin handing out crack pipes to central bankers too?

–The 30 year auction also occurs today. Tens went well yesterday, but couldn’t sustain a bid in the afternoon. USH2 settled 153-09 but within 20 minutes had sold off to 152-27, where it is hovering now. At the 2:00 CST settle tens were 1.927 (-2.5 bps) and thirties were 2.231 (-1.7).

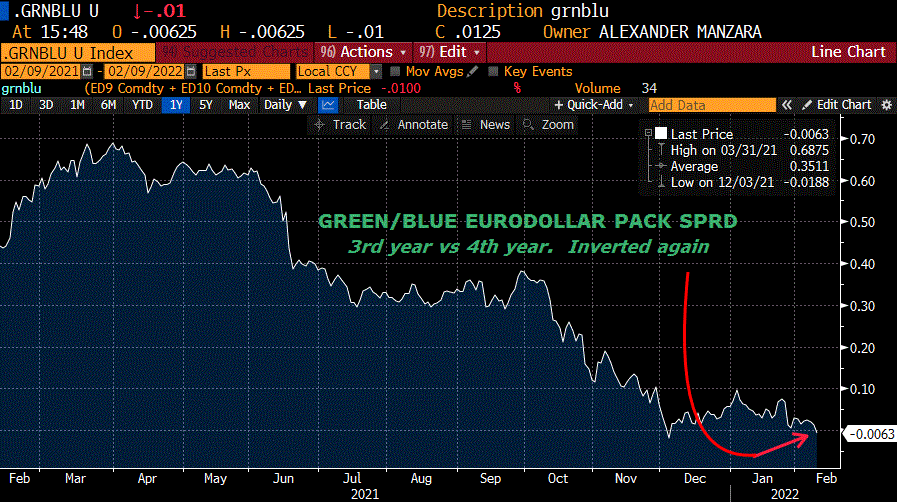

–I’ve attached a chart of the green/blue eurodollar pack spread (3rd vs 4th year forward). This spread inverted yesterday with the green pack at 97.82875 and the blue pack 97.83375. So both are at a yield of around 2.17%. It’s the same thing on the SOFR curve, though the prices there are around 99.09 or 1.91%. That is, by the time we’re out to year 3, or 2024, with SOFR 1.91 and the ten year yield at 1.927 there’s no carry. Green/blue had inverted in early December, but all the chatter about a 50 bp hike has helped to re-invert the back of the curve. 2/10 ended at a new low of 58 bps down 3 on the day. Recall at the December FOMC, when asked if he was concerned about the flatness of the curve and the economic implications, Powell noted 2/10s at 75, and said he had no concerns about the curve.

–March beans $16 bushel this morning, a new high. At the winter solstice they were $13.

–Still not seeing a date on the Fed calendar for the Fed’s semi-annual testimony, usually in late Feb. The State of the Union address will occur on March 1.