Whispers of 1987

August 6, 2023 – Weekly Comment

*************************************

When you tell the truth, have one foot in the stirrup

A friend who related this proverb last week said it was Spanish (he probably heard it first in that language) but apparently it’s of Turkish origin. Like all great proverbs, it’s universal. Truth can be dangerous.

And why downgrade now? At $1.4 TN, the federal deficit for the first nine months of the fiscal year was up 170% from comparable 2022. –Credit Bubble Bulletin

Fitch downgraded the US and faced a firestorm of (feigned) outrage from public officials and semi-public commentators. However, as everyone knows, there have been countless news articles about the explosion in interest owed on the ever-expanding government debt. Many Fed Chairs have warned about unsustainable US fiscal policies over time.

The US thirty-yr yield rose over 18 bps last week to 4.21%. Tens were up 9 bps to 4.058%. Perhaps one of the timeliest blogs I have seen relating to this week’s bond sell off was by Harris Kupperman “Kuppy”. It’s just a short read, dated July 23, but it questions market faith in the idea that US bonds will rally if equities roll over. “What if during the next time down, the US bond market rolls over, and acts more like Turkey’s bond market, instead of the US of old?? What is the financial outcome that would destroy the most speculators? Probably this outcome.”

https://pracap.com/when-the-log-rolls-over/

There are many hints that the tide of US liquidity which had been supporting US risk assets, has turned. For example, the TGA (Treasury General Acct) is back up to $460b from a low in May of about $50b, but probably needs to be replenished up to about $900b. After the blip higher in March related to banking failures, the Fed’s balance sheet has made a new recent low at $8.207T, having reached $8.734T in late March. In his last missive, Lacy Hunt cited the US non-bank domestic investor as the primary funding source for the US deficit. I.e. that money is sucked into treasuries as opposed to other assets. The Bank of Japan’s recent tweak of the JGB cap to 1% creates conditions for repatriation of Japanese capital. The 10-yr JGB ended the week at 65 bps from 47 bps last week. Monday’s SLOOS report noted tightened credit conditions. You can observe a lot just by watching.

According to TBAC schedule, the increase in this week’s auctions are as follow: July vs August:

3y $40b to $42b

10y $32b to $38b

30y $18b to $23b

And then there’s AAPL. A loss of about 7% this week equates to the evaporation of about $200 billion. In the grand scheme of things, no big deal…except that the US consumer is losing steam.

Here’s an update of “Blues and Spoos”, first cited by David Zervos, that I had written about on May 28 (Feeling the blues). At that time I thought increased forward rates would negatively impact stocks. Very UN-timely. Since the end of May SPX rose 9% at last week’s high and is still up 6.5% even with last week’s sell off. The yield on the rolling blue pack is only 17 bps higher, from 9669 to 9652. However, I think the gap bears watching as many equity cheerleaders cite lower forward yields as evidence of ‘normalization’ that will normally result in new all-time highs for stocks. It’s normal.

Below is an interesting tweet from CME Group Interest Rates:

Long-end in focus: On an elevated volume day for Treasury options Aug. 3, T-Bond options traded 375,000 contracts. This was the highest in 2.5 years and ranks 11th all-time. Notably, this accounted for 23% of the day’s total UST options volume vs. the YTD avg. of 11%.

All of a sudden it’s the long end of the treasury curve that appears to be untethering. In that connection, I am showing charts below using the 30y yield as opposed to tens. On the SOFR curve the longer end is more correlated with blues. Net changes on the week: SFRM4 +16 to 9529.0, SFRM5 +13 to 9639.0, SFRM6 unch’d at 9653.5 and SFRM7 DOWN 7.5 to 9650.0.

Comparing 1987 to Now

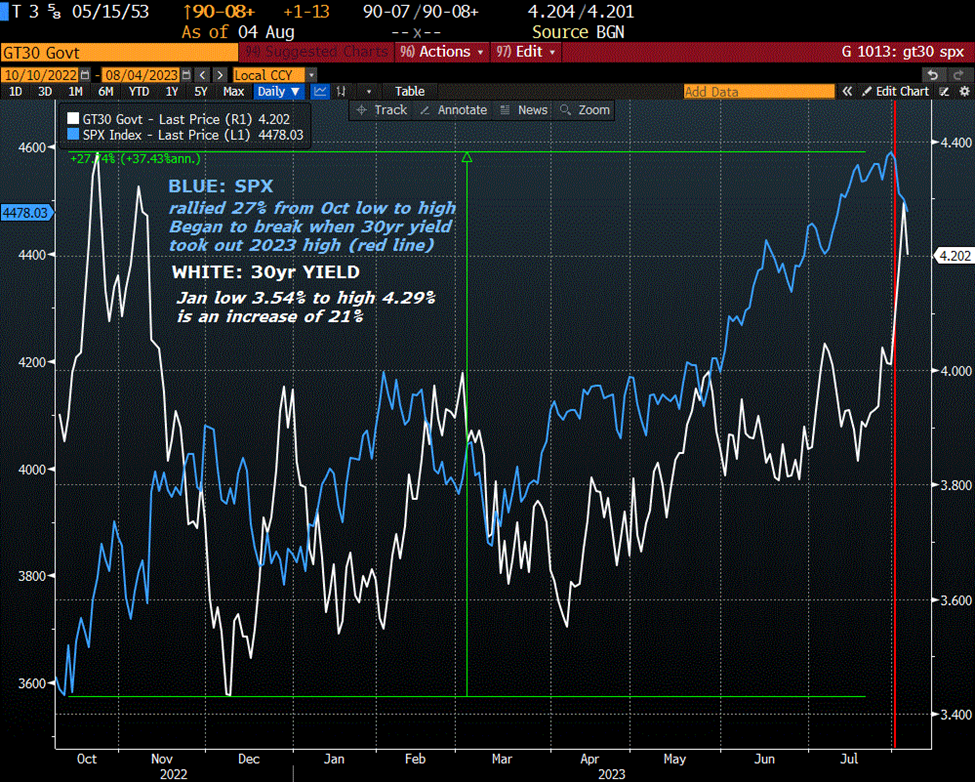

I have included two charts. The top is from 1987, leading up to the Black Monday crash, October 18, 1987. From October 1986 to the high in August, SPX rallied 35%. There was a pullback in April as bond yields rose. In late August, as the 30y yield exceeded the May high, which had been the high for calendar year 1987, stocks began a more serious decline (red line). From the low in January to the high yield in October, the 30y went from 7.28% to 10.22%, a move of 40pct.

Below is the current situation. From October 2022 to August (so far) SPX has rallied 27%. As the 30yr yield exceeded the high for this calendar year, stocks have turned lower (red line). The 30y yield increase from January to last week’s high is 3.54% to 4.29%, only about 21pct. Perhaps, because the magnitudes of this year’s moves have been a bit more subdued, the October crash will only be 10 to 15% instead of 20-25% from 1987. Oh, I’m just kidding of course. But there does seem to be a certain amount of symmetry. THIS IS NOT A RECOMMENDATION TO BUY OTM OCT SPX PUTS.

By the way, the title of the 1987 Jackson Hole Conference held August 20-22 was ‘Restructuring the Financial System’. One of the first presenters was Franklin R Edwards with this (pre-crash) zinger: ‘Can Regulatory Reform Prevent the Impending Disaster in Financial Markets?’

https://www.kansascityfed.org/research/jackson-hole-economic-symposium/restructuring-the-financial-system/

This year’s Conference is slated for August 24-26. “Structural Shifts in the Global Economy”

| 7/28/2023 | 8/4/2023 | chg | ||

| UST 2Y | 489.3 | 478.9 | -10.4 | |

| UST 5Y | 419.3 | 416.3 | -3.0 | |

| UST 10Y | 396.7 | 405.8 | 9.1 | wi 405.0/04.5 |

| UST 30Y | 402.7 | 421.1 | 18.4 | wi 420.5/20.0 |

| GERM 2Y | 305.1 | 301.4 | -3.7 | |

| GERM 10Y | 249.2 | 256.1 | 6.9 | |

| JPN 30Y | 138.5 | 160.9 | 22.4 | |

| CHINA 10Y | 266.3 | 265.7 | -0.6 | |

| SOFR U3/U4 | -91.0 | -108.0 | -17.0 | |

| SOFR U4/U5 | -86.0 | -77.5 | 8.5 | |

| SOFR U5/U6 | -20.5 | -8.5 | 12.0 | |

| EUR | 110.19 | 110.10 | -0.09 | |

| CRUDE (CLU3) | 80.58 | 82.82 | 2.24 | |

| SPX | 4582.23 | 4478.03 | -104.20 | -2.3% |

| VIX | 13.33 | 17.10 | 3.77 | |

https://fred.stlouisfed.org/series/D2WLTGAL

https://fred.stlouisfed.org/series/WALCL