What’s the rush?

February 23, 2024

*******************

–Hard flattener yesterday as the higher for longer theme dominated. Several Fed officials including Waller, “What’s the rush?” Jefferson and Cook echoed the same message of patience with respect to rate cuts. Cook gave a thorough overview of the economy and did note some deterioration of household balance sheets: [unless they’re long NVDA].

In addition, consumer spending growth may face increasing headwinds from deteriorating household balance sheets. Savings built up during the pandemic are diminishing, especially for those with low or moderate incomes. Some measures of credit use, such as credit card and buy-now-pay-later use and the share of households carrying a credit card balance, have risen above their pre-pandemic levels. And delinquencies on auto loans and credit cards, which fell to near-record lows during the pandemic, have risen back to near their long-run averages. Thus, although the consumer has been surprisingly resilient, there are reasons to expect some moderation going forward.

Most commentators seem to think households have solid balance sheets, which may be true in aggregate due to wealth disparity, but not for a large percentage of consumers. The question becomes “how long can a smaller group of households maintain aggregate spending?” Of course, pre-election gov’t efforts to juice the economy might mask underlying problems…for a while.

–The two-year yield jumped 6 bps to 4.712%, while the 10y was nearly unch’d at 4.325% and 30s fell by 3.7 bps to 4.462%. On the SOFR curve reds -6.625, greens -2.25, blues -0.25 and golds +1.75. I attached a couple of charts showing notable spread shifts. First, on the treasury curve 5/10 inverted for the first time since December (4.33/4.325), having been as high as +12.5 in Jan.

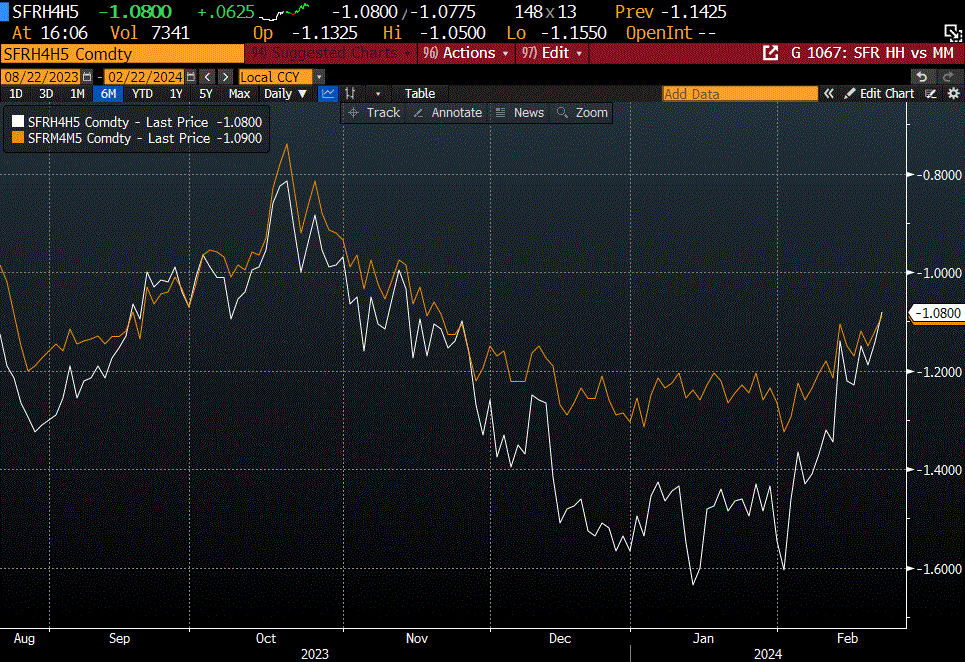

Second, in SOFR, the first one-year calendar, H4/H5 at -106.75 is no longer the most inverted, as the second slot M4/M5 settled -108.5. It’s all indicative of the same sentiment, namely that the Fed is going to slow-play any cuts. SFRH4/H5 had actually settled as low as -163.5 in mid-Jan (when 5/10 was +12.5). Now all the one-year spreads suggest only about 100 bps of ease over a given year. (FFG4/G5 settle -95 and FFJ4/J5 settle -107.5).

–Art Main of TJM sums up SOFR options plays:

A notable theme was liquidation of upside on SFRU4 and SFRZ4 via call spreads and call condors as follows:

-30k SFRU4 95.25/95.4375 call spread at 5.75

-20k SFRU4 95.00/95.50/95.75/96.25 call condor from 13 to 12.75

-20k SFRZ4 95.50/96.25/98.00/98.75 call condor from 19 to 18.75

-20k SFRZ4 95.50/96.50/97.50/98.50 call condor from 21 to 20.5

From a new directional risk perspective flows were balanced with the most notable as follows:

+8k SFRJ4 95.25/95.75 call spread covered 94.91 delta .10 at 1.75

+10k SFRK4 95.0625/95.1875 call spread covered 94.925 delta .10

+15k SFRM4 94.875/95.00/95.125 call fly from 2.25 to 2.5

+9.5k SFRM4 95.50/96.00/96.50 call fly at 1.25

+55k SFRJ4 94.9375/94.8125/94.75/94.625 put condor from 4.875 to 5

+20k SFRU4 95.25/95.00 SFRN4 94.875/94.625 put spread at 7.5 (+SFRU4 -SFRN4)

+8k 2QM4 96.00/95.625 put spread vs. 2QJ4 96.00 put at 0.5 (+2QM4 -2QJ4)