What the Fed says, What the market hears

February 11, 2020

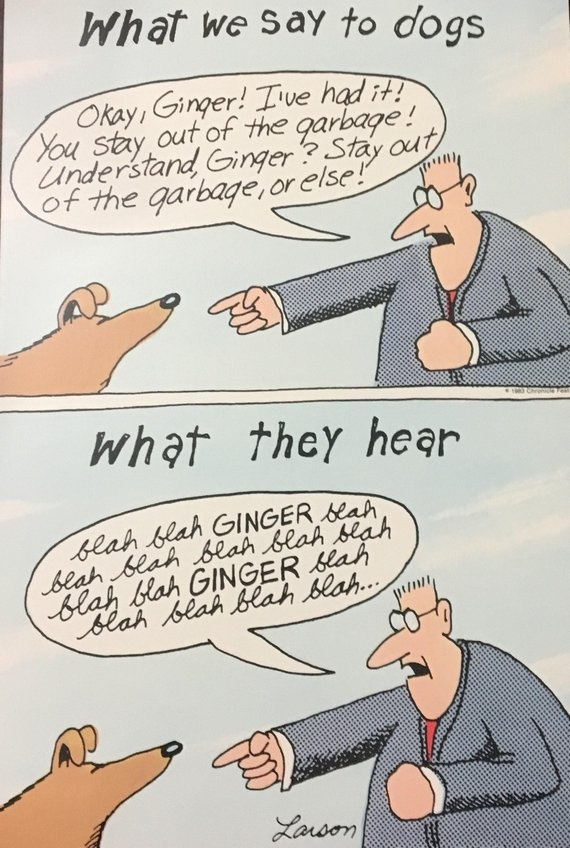

–Starting this morning with another Far Side cartoon, as Powell gets ready to testify in front of the House today.

–I would simply re-caption: ‘What the Fed says to markets’ followed by ‘What the market hears

‘”Monetary policy is in a good place. Consumer spending and employment are solid, capex is soft. We must acknowledge possible risks due to the coronavirus. If the effects were to spill over into the US economy, the Fed would take appropriate steps to loosen financial conditions.”

What the market hears: Blah, blah, POLICY blah blah blah blah blah MUST blah blah blah LOOSEN blah blah.

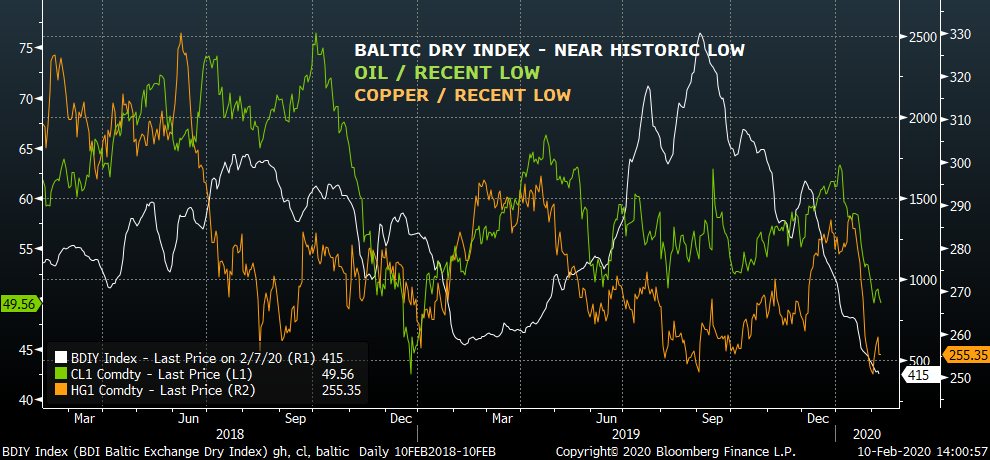

–Price action shows that real economic commodities like oil and copper, and the Baltic Dry Freight Index are reflecting big problems while stocks float to new highs. Stocks are responding to liquidity prospects, not to a rebound in economic activity. The chart below shows SPX divided by the Bloomberg Commodity Index. Up 14% in a month! The longer term chart shows SPX/BCOM is up 9x since 2009! That’s a lot of airpods and cloud computing. We can’t keep buying physical inventories that we’ve already accumulated, let’s buy back our own stock!

–One analyst suggested that all government announcements regarding the virus should be ignored, rather one should watch what steps private firms are taking. British Airways cancelled all mainland China flights until the end of March.

–Rates fell yesterday with tens down another 3.3 bps to 1.547%. Most euro$ contracts rose 3.5 to 4.5, but it was again a December contract that was the star performer: EDZ21 +5.0. Year-end turns are no longer considered much of a risk post-Quarles. There was a new buyer of 40k 0EU 9837.5 puts for 5.0 covered EDU21 9875. Settled 4.25 vs 9877.5. The 9825 strike continues to be hammered in near contracts: EDM0 9837/9825p 1×2 bought for 2.5 in 40k. (settled 3.0 vs 9848.5).