We can absorb delinquencies on credit cards. CRE?

December 30, 2024

********************

–Big trade Friday as stocks slid: New buyer of 50k SFRM5 9612.5/9662.5cs vs 9556.25p for 3.0 to 3.5 covered 9592. 9612.5c 13.0s OI +43.5k. 9662.5c 6.0s OI +54k. M5 9556.25p 4.0s, OI +42k. Spread settle 3.0 ref 9592.0 settle. Stocks are slightly easier this morning and SFRM5 is 9593.5.

—Curve steepened Friday with 2’s down slightly in yield, and 10’s up 4.2 bps to 4.619%. 2/10 spread ended at the high of the year 29.5 bps. Similarly, red/gold pack spread in SOFR at a new recent high of 14.0. Red pack ended -1.375 at 9597.125 and gold pack -5.375 at 9583.125. All SOFR contracts settled under 9600 or 4%. Peak contracts now SFRZ5 and H6 at 9599.

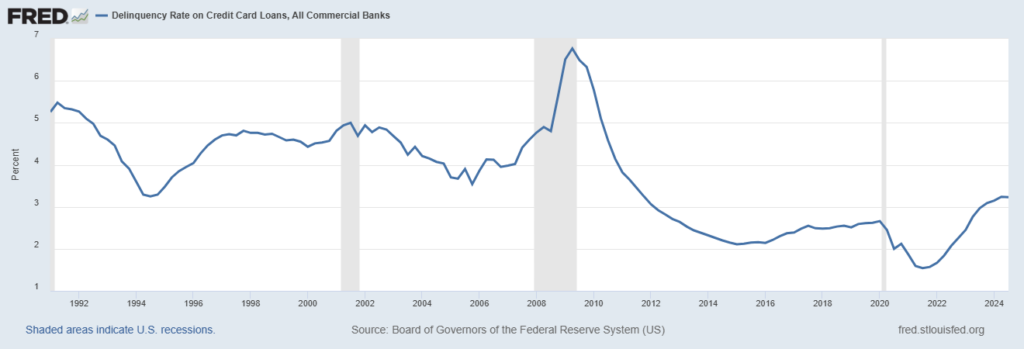

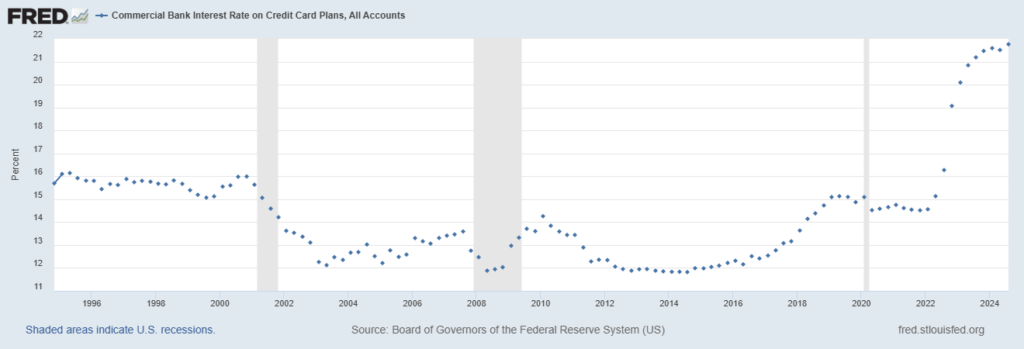

–Financial Times leads with an article ‘US credit card defaults jump to highest level since 2010’. Sounds ominous, but the default rate according to St Louis Fed is 3.23%. The interest rate charged on credit cards, all accounts, is 21.76%. Therefore, the spread is 18.5%. In 2010, the high interest rate was 14.25, so call it a spread of 11%. In other words, it doesn’t seem like a particularly big deal….for now anyways. If there’s a story here, it seems to me that whether it’s credit cards, mortgages, insurance rates, etc. the spreads seem to be extraordinarily high.

Below are St Louis Fed graphs of delinquency rates and credit card interest rates.