Waller pushes ease further back

January 17, 2024

******************

–Waller indicated yesterday that while inflation is within striking distance of target, he’s in no hurry to ease, and he doesn’t see any real urgency to taper QT (and doesn’t want MBS on the Fed’s balance sheet). As a result, SOFR strip was down 8.5 to 12.5 across the board, with noticeable long liquidation in near contracts. SFRH4 settled 9494.5, -8.5 with open interest down 31k. SFRM4 9546, -11.5, OI -73k. SFRU4 9591, -11.5, OI down 42k. However, there are still huge buyers of call spreads in H4, for example 9493.75/9500cs 3.0-3.25 paid 50k (2.75s). SFRH4 9512.5/9518.75/9525c fly 0.25 for 10k. SFRJ4 9531.25/9556.25cs 11.75 – 13.0 paid 20k. It’s worth noting that Empire State Mfg was a huge downside miss, expected -5 but actually -43.7, easily the lowest print outside of the worst of covid.

–From Nick Timiroas of WSJ: Also, small but important: Waller says he’s already circled Feb. 9 on his calendar. That’s when the BLS will release recalculated seasonal adjustment factors, which last year suggested the declines in inflation over the turn of the year had been illusory.

–Lagarde also suggested ease in the summer, later than market expectations. While US equities sometimes react to bad news as good news with the idea that the Fed will save the day, in China bad news is bad news. Q4 GDP slightly missed expectations and China’s population fell 2 million last year. From CNBC, “…CSI 300 fell to an almost five-year low…fell 2.18%. Hong Kong’s Hang Seng tumbled 3.68%.” From the high around 31k in HSI at the start of 2021, it’s now 15275, down 50%. Shanghai Comp is thru the lows of 2022; it started that year around 3600 and is now 2833. A similar decline of just over 20% in SPX would send shockwaves through the US economy.

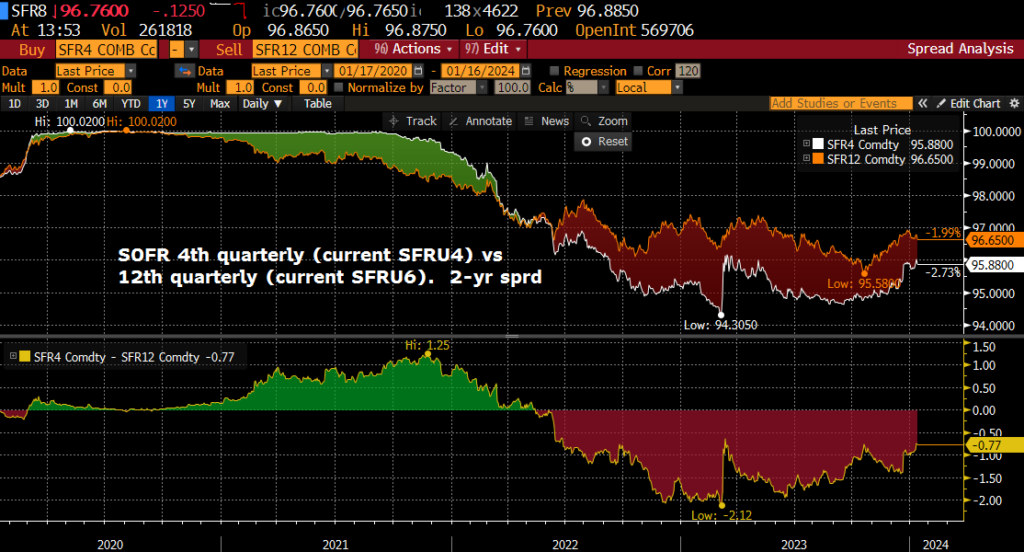

–Attached chart relates to a trade yesterday: +20k SFRU4 9675c vs -20k 2QU4 9750c, pay 3 for front Sept. Synthetic long U4/U6 spread which settled -76.5 (diff between strikes is -75). This trade should work fabulously well if the Fed eases aggressively this year, the earlier the better.

— Retail Sales today expected 0.3 to 0.4. Industrial production 0.0%. 20 year auction, Beige book, several Fed speakers.