Trend in financial conditions has reversed

December 20, 2024

*********************

–Usually I jot down a few notes about changes in SOFR spreads, or maybe an interesting macro tidbit. But current market moves appear to me to be a complete change in market dynamics, with signals of a harsh reversal in liquidity and financial conditions. Instead of BTFD it’s now STFR (sell rallies). I might be incorrect, but whether you think it was Powell that created the change or the bond vigilantes, or the market in general, I am marking Q4 2024 as a sea change, starting with the Sept 18 FOMC.

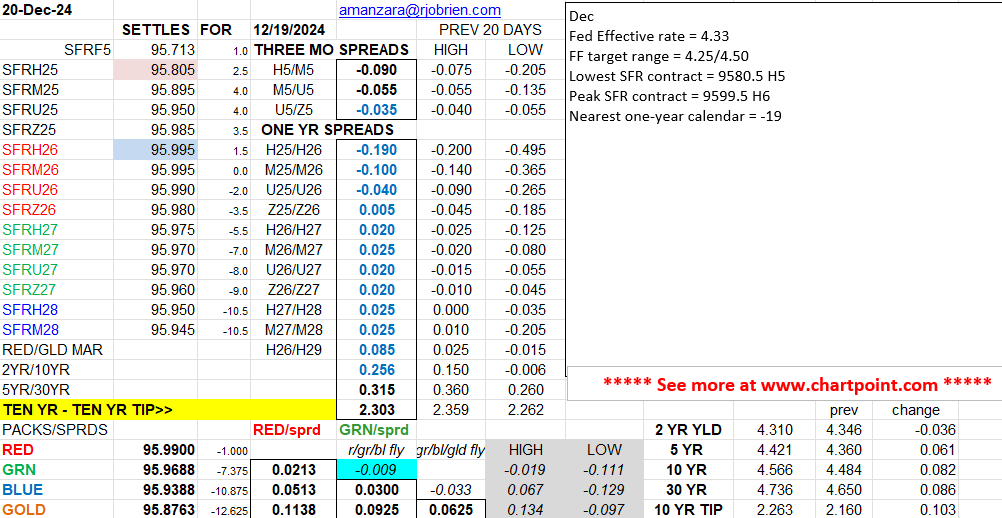

–As mentioned before, Dudley, former president of the NY Fed listed financial conditions as short and long term rates, the value of the dollar, equities and credit spreads. The 30y bond yield ended at 4.736 (ref USH5 settle 114-01). It’s nearing the high of the year set April 25, 4.813%. Tens ended 4.566%, the April high was 4.706%. The change in the SOFR strip has been dramatic. Just before the Sept FOMC, the reds were above 9700, as high as 9720. That is, forward rates were 3% or a bit lower. Those forward levels provided a pillar of support for equity valuations. Yesterday was the first time that all SOFR contracts 5 years out had a 95 handle…now there’s no longer any contract above 9600 (sub-4%). On the attached pdf I note the lowest SOFR contract and the peak. The lowest contract has been the first quarterly, formerly SFRZ4 when it was the lead, and now SFRH5 at 9580.5. The peak contract had been back further in the greens, at least a couple of years away. As of last night it’s SFRH6 at 9599.5. SFRH5/H6 spread settled at a new high -19.0. Equities have been hammered since Powell’s presser. DXY set a new high for the year yesterday at 108.40. Credit spreads have been extremely tight, but take a look at hi-yield ETFs JNK and HYG – cliff dives in the past two days. I’m not saying we can’t get bounces, but the trend in conditions has changed.

–News today includes PCE prices expected m/m 0.2 from 0.2 with Core 0.2 from 0.3. Yoy 2.5 from 2.3 and Core 2.9 from 2.8.

–The new Fed Effective should be 4.33%. That’s a price of 9567.0. Jan FF settled 9567.5 and Feb FF, which prices the Jan 29 FOMC settled 9569.5. So there’s a tiny bit of ease priced, but not much. If the Fed were to cut by another 25 that spread would be valued at -23.4. Headline on FT this morning: ‘China’s short-term bond yields fall back below 1% for the first time since 2009’.