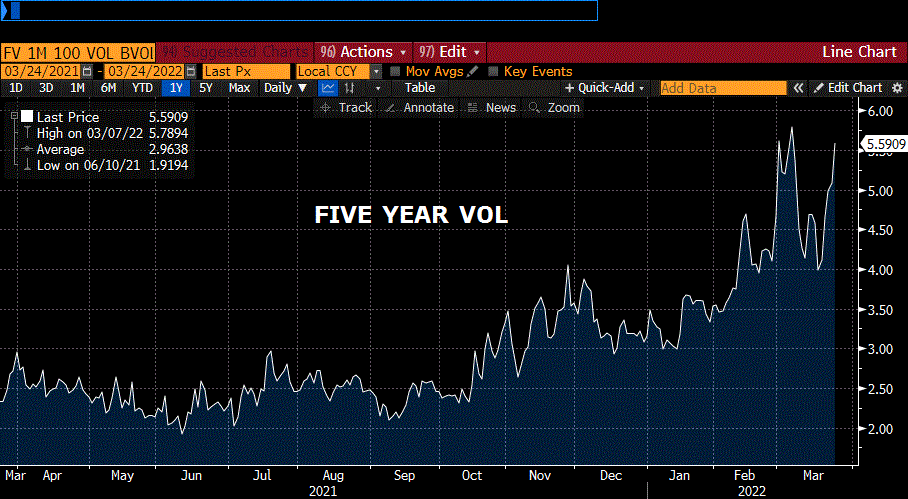

Treasury vol bid

March 25, 2022

–Treasury vol closed very strong. As attached chart shows, FV is near the high. The chart looks like oil or gold…spikes on initial Ukraine aggression, then a pullback mid-month. Oil and gold rebounded off the retracement lower, but are not near the highs from the early part of the month; in fact oil was down $3.50 late yesterday. The bid in treasury vol might be a signal of stress in financial markets in general, but stocks were strong, continuing the post-FOMC surge. Market makers pointed to a midday block of +30k FVK2 116.25c for 16 covered 114-305 with 22 delta (settle 15.5 ref 114-3125), and noted that trading conditions are rather thin, but it feels like it could be more than that. The ten-year yield was up 2.4 on the day to 2.34%, but the 5/30 treasury spread made a new low at 13.7 bps with the 5y yield +3.6 to 2.371% and 30’s down -0.8 bp to 2.508%.

–One other item worth mention. Yesterday I looked at a couple of near FF spreads regarding market expectations of (front-loaded) tightening. As of Thursday’s close, note that FFN’23/FFF’24 settled zero. Both contracts at 9728.5 or 2.715%. I.e. NO TIGHTENING expected in the last half of next year with rates expected around 2.75%.

–Of course the back end of the euro$ curve is heavily inverted, while EDM2/EDU2 made a new high at 59.5, EDM2 9843.5, -2.5 and EDU2 9784.0, -6.0.