Transmission Protection

July 22, 2022

–Blistering rally in fixed income even as the ECB hiked 50 to end the negative rate regime. At futures close tens were down 12.4 bps to 2.91%, and in another hour and a half at 3:30 CST TYU had rallied from 118-29 at the 2:00pm settle to 119-05 and the cash yield had dropped to 2.875. There was an early 40k block buyer of FVU at 111-240; FVU2 settled 112-095 and was 112-130 late. Philly Fed was -12.3 vs +0.8 expected. It was the lowest print since 2012 outside of the brief covid spike down. This morning’s FT reports: Eurozone business activity falls to 17 month low, raising recession fears.

–After CPI data, as FFQ2 panicked toward the possibility of a 1% hike at the July 27 FOMC. Aug/Nov FF spread, which captures FOMC meetings on Sept 21 and Nov 2, traded over 100 (two 50 bp hikes). The spread then fell back close to 80, then powered back above 100 this week. Yesterday it settled 91.5. Of course, the Nov 2 meeting is just prior to midterm elections. The idea of at least 50 per meeting is being scaled back, even though FFQ2 is clearly priced for 75 next week.

–Yesterday I had mentioned that red and green straddles had firmed by several bps on Wednesday. Yesterday those gains evaporated. For example, SFRZ3 9700 straddle was 153 bid early, then 152/54, and was sold down to 148 by the end of the day.

–This is a link of Putin describing inflation pressures in the west.

https://twitter.com/DWhitmanBTC/status/1550009946384879616

from the subtitles (not exactly the Laughing Spaniard):

Everyone’s blaming Russia for the coming food crisis. You as specialists would know that the crisis emerged from the times of the anti-pandemic measures where some well developed economies abused their monopoly powers in terms of currency monopolies. They turned on the printing press in the US and printed $5.9 T, that’s 38% of the entire money supply. They printed it over 2 years – which is roughly the sum of what was printed in the previous 40 years. ..and in the EZ they printed 2.5t euro. They released this money into the economy and gave it out to people, which isn’t bad per se – we utilised a similar tactic. But we were careful, it was sparingly done and as such didn’t lead to such a wave of inflation. Over there measures were funded from budget deficits, which led to them buying up food supplies from global mkts. In previous years US was a net exporter of food, they are now a net importer of food. They bought $17b more than they sold. What does that say? They exacerbated problems for developing/poor countries and closed their own problems off. This is the result of a monopoly on reserve currencies – dollars and euros. This started end of 2019, beginning of 2020. Then the anti-Russian sanctions made the situation worse; they made a bunch of mistakes in the energy sector, gas prices went up. And access to gas is the foundation of many fertilizers. As fertilizer became more expensive, we’ve seen enterprises shut down, particularly in europe and food prices skyrocket further.

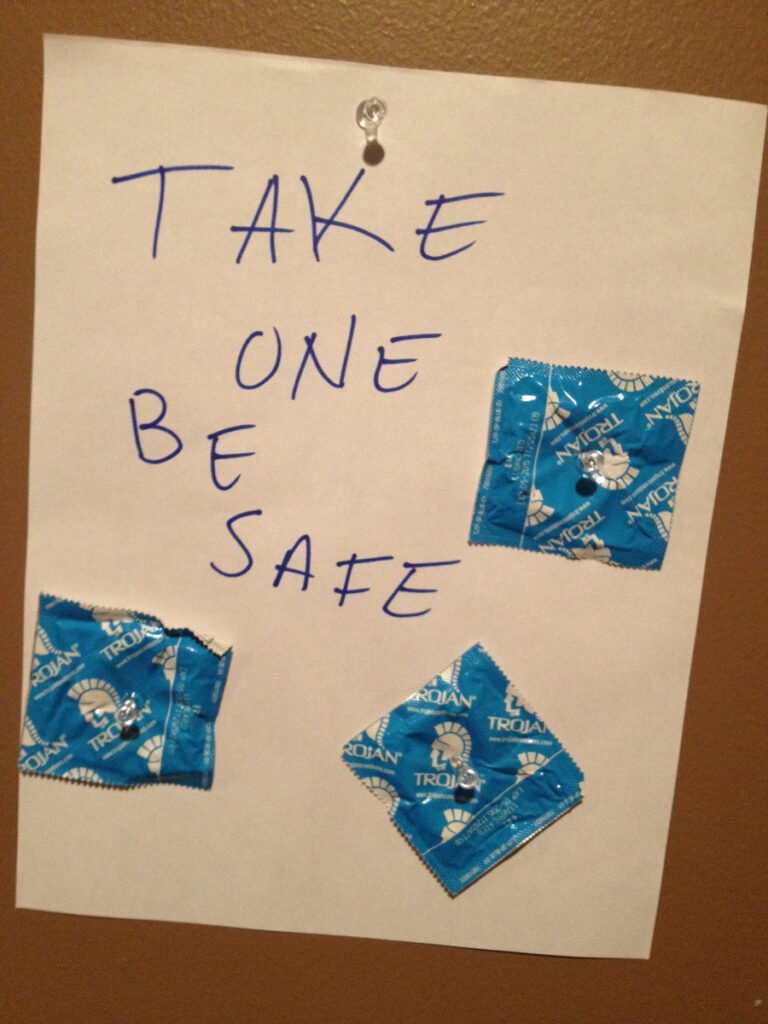

–I am adding a link to the ECB press report on the Transmission Protection Instrument, which is supposed to act as a protective cap on bond spreads in the eurozone. But for those who don’t care to read it, here’s a helpful picture that pretty much sums it up.

https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220721~973e6e7273.en.html