They’re not buying puts and they’re not buying foward SOFR calendar spreads

January 6, 2022

–NFP today looking for 202k. Jobless Claims yesterday were only 204k and ADP surprised to the upside at 235k vs 150 expected. ISM Services expected 55.0 vs 56.5 last.

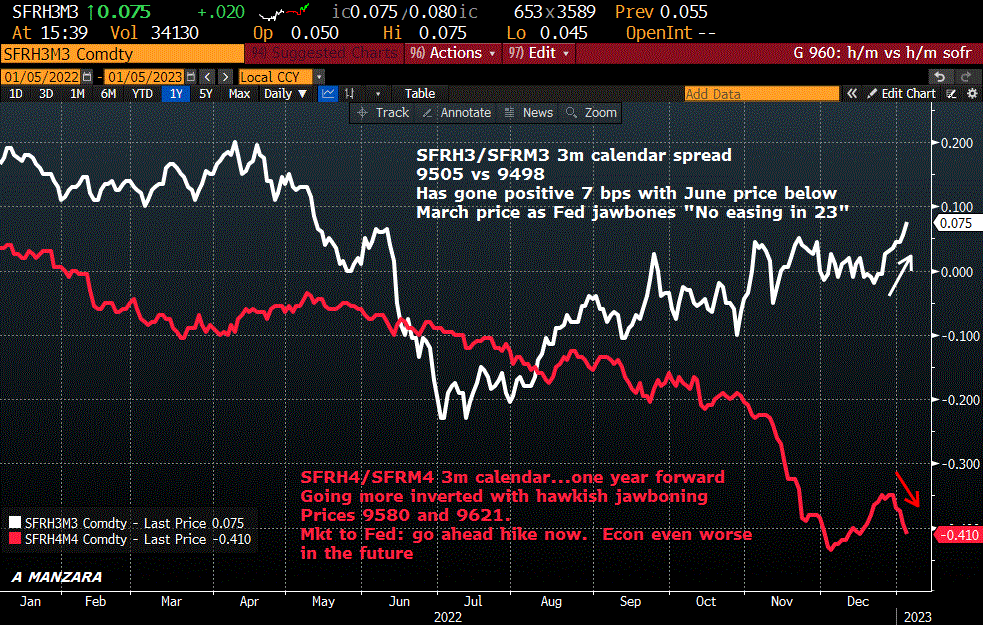

–Fed continues to guide toward higher for longer with Esther George looking for terminal above 5%; Bullard said data will determine whether next month’s FOMC is 25 or 50 (market currently leaning towards the former). The curve flattened with the two-yr yield up 6.4 to 4.449% and tens up only 1.3 to 3.72% (spread -72.9, much closer to the recent low of -84.5 than the high of -47.0). On the SOFR curve Z’23 and H’24 were weakest contracts settling -8.5 (9539.5 and 9580.5). While these contracts adjusted to hawkish data and rhetoric, it’s instructive to note that the spread is still -41. The attached chart reflects market sentiment: SFRH3/M3 rose 1.5 bps to a new recent high of +7.0 (9505/9498) while the same spread one year forward, SFRH4/M4 fell 1 bp to -40.5.

–At the same time, as near contracts decline in price, atm straddles are compressing. For example on Friday SFRZ3 settled 9547 and the 9550 straddle settled 100. Yesterday SFRZ3 settled 9539.5 and the 9537.5 straddle at 90.5. Not exactly indicative of fear to the downside; there is no mad bid for puts in a declining market. Just the opposite. On Friday SFRZ3 9550p 51.5, and with a 7.5 decline in futures (47 to 39.5) the same put settled 51.0 yesterday. Also decent selling in treasury vol in front of today’s data. Example -5k TYH 111/115 strangle at 63. Settled 63 ref 113-005 (32, 31). On Wednesday vs 113-06 this same strangle was 1’03 settle (35, 32). Again, no bid for puts.

Image: SFRH3/M3 in white. 3m calendar spread. Red is one-year forward, SFRH4/M4. Near spread goes +tive bid with Fed convincing mkt ‘no near term ease’. The market is responding with an even more INVERTED frd sprd. ‘hike more now you’ll have to ease more later’