The Price is … Uncertain

August 27, 2023 – Weekly Comment

**************************************

Bob Barker, host of the legendary game show ‘The Price is Right’ passed away at 99 this weekend. He seems to have identified a winning formula, subtly alluded to in the picture below. He was confident of the price and of the strategy.

In the classic 1979 movie The In-Laws, there’s a scene with Vince Ricardo (Peter Falk) in a dive bar with a cab driver. The Price is Right playing on TV. The dialogue captures the essence of the program.

Vince: What is this show?

Cab driver: Are you kiddin’ man? It’s The Price is Right. This is the all-American game show

Vince: And they’re supposed to guess what all that crap is worth? Is that the principle?

Cabbie: right

Vince: How long has this show been on the air?

Cabbie: Since about 1911

https://www.youtube.com/watch?v=p5FO9-3nXvg

Our Fed Chairman, Jerome Powell, is a bit less confident in the price, but maybe that’s because he doesn’t have the same sort of back-up as Bob. Can hardly blame him. From his speech:

We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.

For Powell, it’s not just the ‘price’. It’s the change in price. He talks about breaking down core PCE inflation into three parts: “inflation for goods, for housing services, and for all other services, sometimes referred to as nonhousing services.” Not really new, but for me, the takeaway is that rates are likely high enough with respect to the FF target, and now we need to let the passage of time do its work, and we absolutely need to see the labor market weaken further. For a while there, the Unemployment Report was relatively unimportant. It’s moving to center stage once again.

Powell notes that:

Core goods inflation has fallen sharply, particularly for durable goods, as both tighter monetary policy and the slow unwinding of supply and demand dislocations are bringing it down.

Mission accomplished on this bucket.

On the interest-rate sensitive housing sector, there has been progress, but time needs to elapse:

The slowing growth in rents for new leases over roughly the past year can be thought of as “in the pipeline” and will affect measured housing services inflation over the coming year.

The Fed knows this will take some time for all the reasons that have been described by analysts. However, the confidence level for being on the right track appears high.

The final category, nonhousing services, accounts for over half of the core PCE index and includes a broad range of services, such as health care, food services, transportation, and accommodations. Twelve-month inflation in this sector has moved sideways since liftoff.

Here is where the labor market comes in:

Production of these services is also relatively labor intensive, and the labor market remains tight. Given the size of this sector, some further progress here will be essential to restoring price stability.

On Friday, the Employment report is released, expected 170k with the rate at 3.5%. Anecdotal reports indicate softening in the labor markets, for example GM just announced it’s shuttering an IT innovation center in Arizona, costing 940 jobs.

Where Powell IS clear and certain is here:

Two percent is and will remain our inflation target. We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time.

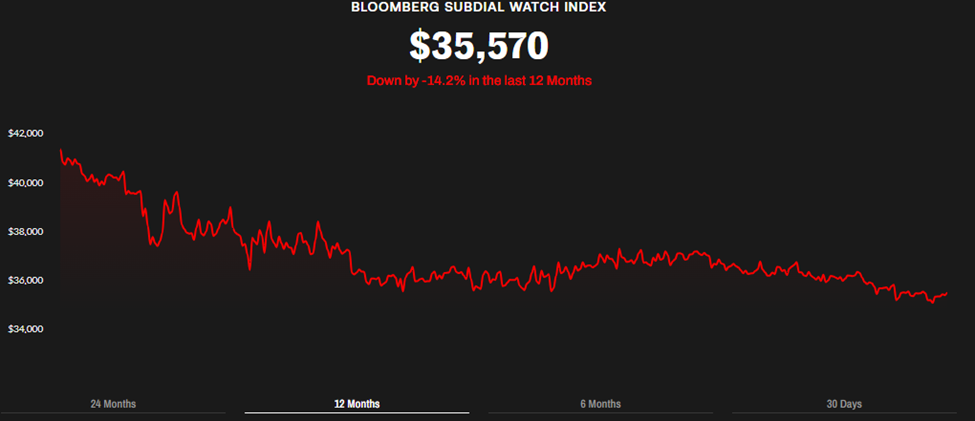

Speaking of time, it’s worth a mention that the BBG Subdial [luxury] Watch Index is -10.8% in the last 24 months, down 14.2% in the last 12 months.

https://subdial.com/market

Lower end consumers are also being squeezed. From CNN Business, “…new credit card and auto loan delinquencies have now surpassed pre-Covid levels, according to Moody’s Investors Service.” Powell mentioned more stringent credit as well, saying “…bank lending standards have tightened and loan growth has slowed sharply.”

In terms of market pricing, shorter maturities are at new highs for the cycle. The 2y note ended the week at 5.06%, up 11 bps from last Friday. Fives gained nearly 10 bps to 4.44%. While the 2y note is fairly close to the high from June 2006 (5.28%) which was the end of the 2004/06 hike cycle, longer maturities aren’t testing 2006 highs. For example, the 5yr in June ’06 was 5.23% vs 4.44% now, and 10s were 5.22% vs 4.29% now. The curve actually flattened somewhat this week, with the 10y yield down 4 bps to 4.24% and the 30y -8.4 to 4.293%.

One place where long yields have significantly exceeded the highs from 2006 through 2008 is the 30y Mortgage. The high in the Bankrate 30y mortgage was 6.4% in 2006 and 6.5% in 2008, now it’s 7.6%.

On the SOFR curve, the pullback in one-year forward contracts since the banking turmoil of mid-March (really since early May) has been absolutely astounding. For example, SFRZ4 settled Friday at 9564.5. The contract low was set on Tuesday at 9564. The high settle in the past year was May 4 at 9734.5. A decline of 170 bps!

This week the Green SOFR pack (3rd year forward) posted a low of 9609 (ended Friday 9620), nearing the October 2022 low of 9604. The blue pack (4th year) made a new low at 9614 (Friday 9625). However, the red pack made a low of 9551 in October, a new low of 9544 in early March, and 9571 this past week.

Since early June the Z3/Z4 spread has rallied from -161 to -113.5. For all the talk of the Fed having lost credibility, it’s interesting to note that the last dot plot in June had the end of 2023 FF projection at 5.6% and end of 2024 projection at 4.6%, a spread of -100 bps. The SOFR curve is in alignment, at least according to this particular spread. SFRZ3 settled 9451 or 5.49% and Z4 at 9564.5 or 4.355%. (FFF4/FFF5 settled -107, even closer).

Apart from Powell being steadfast in his quest for a 2% target, weakness in the front end was partially due to the continued supply of treasuries. On Monday the treasury auctions, 62b 6m bills, 69b 3m bills, 45b 2y notes and 46b 5yr notes. On Tuesday, 60b 42day CMB and 36b 7 year notes. On Thursday, PCE prices are expected 3.3% yoy, up from 3.0 last, with Core 4.2%, up from 4.1. Friday brings the Employment report and ISM Mfg.

OTHER THOUGHTS / TRADES

On Friday 0QV 9606.25/9637.5/9668.75 c fly traded for 2.25. Settled 1.75 ref SFRZ4 9564.5, but I’m pretty sure it would have been hard to buy 2s. Call flies like this make a lot of sense as a countertrend idea. Expiration is 13-October. Prior to expiry there are two employment reports, Friday and 6-Oct, two PCE prices, Thursday and 29-Sept, two CPI reports, 13-Sept and 12-Oct and of course, the Sept 20 FOMC. 0QV 9600/9650/9700 c fly settled 4,0. The 50% retrace from May’s high print of 9743 to Friday’s low 9558.5 is 9650.75.

There has been a decent amount of call spread buying in SFRZ3. For example, SFRZ3 9475/9487.5 bought 125k between Thursday and Friday for 1.25 to 1.0 (settled 1 ref 9451). Buyer of 25k SFRZ3 9468.75/9481.25/9493.75c fly for 0.5, settled there. Current EFFR is 5.33% essentially at the low strike of the fly. If the Fed holds fire for the rest of the year, this trade could easily play.

| 8/18/2023 | 8/25/2023 | chg | ||

| UST 2Y | 494.5 | 505.6 | 11.1 | wi 501.7 |

| UST 5Y | 438.7 | 448.5 | 9.8 | wi 441.7 |

| UST 10Y | 427.8 | 423.9 | -3.9 | |

| UST 30Y | 437.7 | 429.3 | -8.4 | |

| GERM 2Y | 305.9 | 303.5 | -2.4 | |

| GERM 10Y | 262.2 | 258.7 | -3.5 | |

| JPN 20Y | 134.9 | 139.0 | 4.1 | |

| CHINA 10Y | 256.0 | 256.7 | 0.7 | |

| SOFR Z3/Z4 | -114.5 | -113.5 | 1.0 | |

| SOFR Z4/Z5 | -43.0 | -55.0 | -12.0 | |

| SOFR Z5/Z6 | -5.0 | -6.0 | -1.0 | |

| EUR | 108.73 | 107.96 | -0.77 | |

| CRUDE (CLV3) | 80.66 | 79.83 | -0.83 | |

| SPX | 4369.71 | 4405.71 | 36.00 | 0.8% |

| VIX | 17.30 | 15.68 | -1.62 | |