The Playbook

October 27, 2024

******************

Friday began with a buyer of 50k TY wk1 MONDAY 111.75c for 3. These calls expire Monday, 28-Oct. [Symbol on BBG for Mon options is VBYA; VBYZ4 <commdty> OMON. On CME Daily Bulletin VYO]

This was probably a hedge for an Israel response to Iran that could spin out of control. Note too, that on Monday, 10/22, there was a buyer of 50k TYX4 111.75p for 26 ref 111-17. These options expired Friday and were 44/64s in-the-money against TYZ4 settle of 111-02. Likely the same player.

But I want to focus a bit more on otm put buys which occurred Friday, coincidentally following comments Tuesday by Paul Tudor Jones concerning unsustainable US budget deficits (in an interview with CNBC’s Andrew Ross Sorkin):

Financial crises percolate for years. But they blow up in weeks. That’s kind of the history of them, right.

https://www.youtube.com/watch?v=49-2-NWoiLI

Here are the buys, all TY Nov wk1 FRI puts. These puts all expire on Nov 1, payrolls day.

+20k 109.25p 2

+15k 109.25p 3 Settled 4, open interest +37k to 44.6k

+12k 109.00p 2

+20k 109.00p 3 Settled 3, open interest +40k to 48k

+20k 108.75p 3 Settled 3, open interest +20k to 21k

Given a settle in TYZ4 of 111-02 and current DV01 in the contract of $64.20, the 109 strike is about 32 bps away. Last week, cash tens rose 15.7 bps to end at 4.23% (at futures settlement). Also last week, on Wednesday, there was a buyer of 30k USZ4 109p, 10k each at 10,11 and 12. USZ4 settled Wednesday at 118-01, and on Friday at 118-09; USZ4 109p settled 9 on Friday. Roughly 7.7 bps per point in USZ4 contract.

Another comment by PTJ:

I think all roads lead to inflation… I’m long gold. I’m long bitcoin. I think commodities are so ridiculously under-owned, so I’m long commodities… The playbook to get out of this is that you inflate your way out.

Everyone knows the “inflate your way out of it” play. It’s another ploy that can get out of hand. But take a look at the chart below. It’s the Bloomberg Commodity Index since the turn of the century. Same now as it was then. But there are several positive bursts over that timeline showing annual gains of over 50%. Could that happen again?

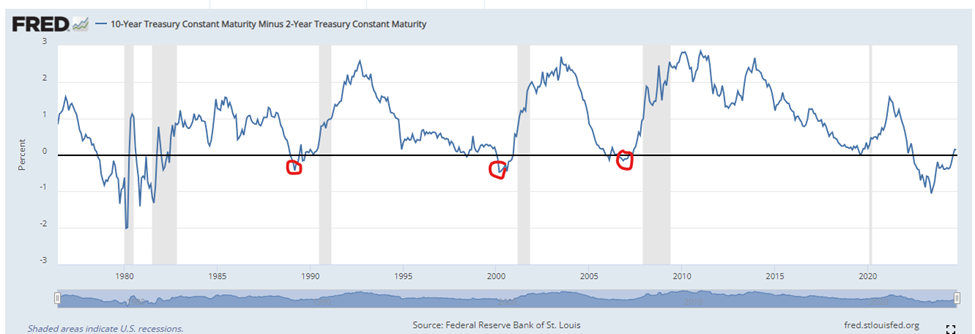

Another item in the “Could it happen again?” playbook: In looking at periods when 2/10 spread was inverted, the last three times coming out of the inversion the spread rallied over 250 bps: 1990 to 1992, end of 2000 to 2003 and 2007 to 2010. Of course, that typically occurs because of a plunge in the 2y yield as FF are cut. From April 1990 to September 1992, 2s went from nearly 9% to 4%. In 2000, from 6.7% in May to 2% by November 2002, and in June of 2007 from 4.90% to 0.75% by December 2008. Will we see the same sort of decline from April 2024 high of 5%? [2/10 chart below. A bit hard to see but peak is 2.84 in Jan’11]

It’s a big week, capped by the Employment report (and Mfg ISM) on Friday. Election and FOMC in the following week.

Monday: 2 & 5 year auctions. Treasury Refunding Estimates.

Tuesday: JOLTS, Consumer Confidence and 7yr auction.

Wednesday: ADP and Q3 GDP (estimated 3.0). Atlanta Fed GDP Now estimate is 3.3 and the NY Fed Nowcast is 2.91.

Treasury Refunding Announcement. As an aside, it was one year ago when Treasury loaded issuance into the front-end, sparking a Q4 rally from 4.9 to 3.8 in the 10y, coupled with a blistering 14% surge in SPX.

Thursday: PCE Prices, expected 0.2 with Core 0.3 from 0.1. YOY 2.1 and Core 2.6.

Employment Cost Index expected 0.9 from 0.9. Jobless Claims 232k. Chgo PMI 47.0 from 46.6

Friday: NFP expected 110k (impacted by Boeing strike). ISM 47.6 from 47.2.

OTHER THOUGHTS

I ROUGHLY track FV vs US DV01 to vol ratios. Typically, the DV01 ratio is 3 to 3.4, currently around 3.1 ($42.40 in FVZ vs $130.00 in USZ). Vols are 5.65 (FV) and 15.85 (US); ratio 2.8. Generally the ratio of ratios is around 0.7 to 0.8. I marked Friday at 0.92. If it were 1, that would mean that the DV01 ratio was exactly equal to the vol ratio. Very rarely occurs as 5’s are more volatile in terms of yield. My only point here is that 30y vol seems a bit expensive relative to 5y, especially in context of 5/30 yield spread. I don’t have any specific trade to do… just a function of “term premium” expansion on the long end. My only interpretation is that the long-end is vulnerable to a rapid move to higher yields.

| 10/18/2024 | 10/25/2024 | chg | ||

| UST 2Y | 395.0 | 409.2 | 14.2 | wi 408.4 |

| UST 5Y | 387.5 | 405.1 | 17.6 | wi 405.3 |

| UST 10Y | 407.3 | 423.0 | 15.7 | |

| UST 30Y | 438.0 | 449.9 | 11.9 | |

| GERM 2Y | 210.8 | 211.7 | 0.9 | |

| GERM 10Y | 218.3 | 229.1 | 10.8 | |

| JPN 20Y | 174.9 | 177.9 | 3.0 | |

| CHINA 10Y | 212.3 | 215.8 | 3.5 | |

| SOFR Z4/Z5 | -99.0 | -81.0 | 18.0 | |

| SOFR Z5/Z6 | -3.0 | -0.5 | 2.5 | |

| SOFR Z6/Z7 | 7.5 | 4.5 | -3.0 | |

| EUR | 108.70 | 107.99 | -0.71 | |

| CRUDE (CLZ4) | 68.69 | 71.78 | 3.09 | |

| SPX | 5864.67 | 5808.12 | -56.55 | -1.0% |

| VIX | 18.03 | 20.33 | 2.30 | |