The Labor Market Has Turned

November 5, 2023 – Weekly Comment

*******************

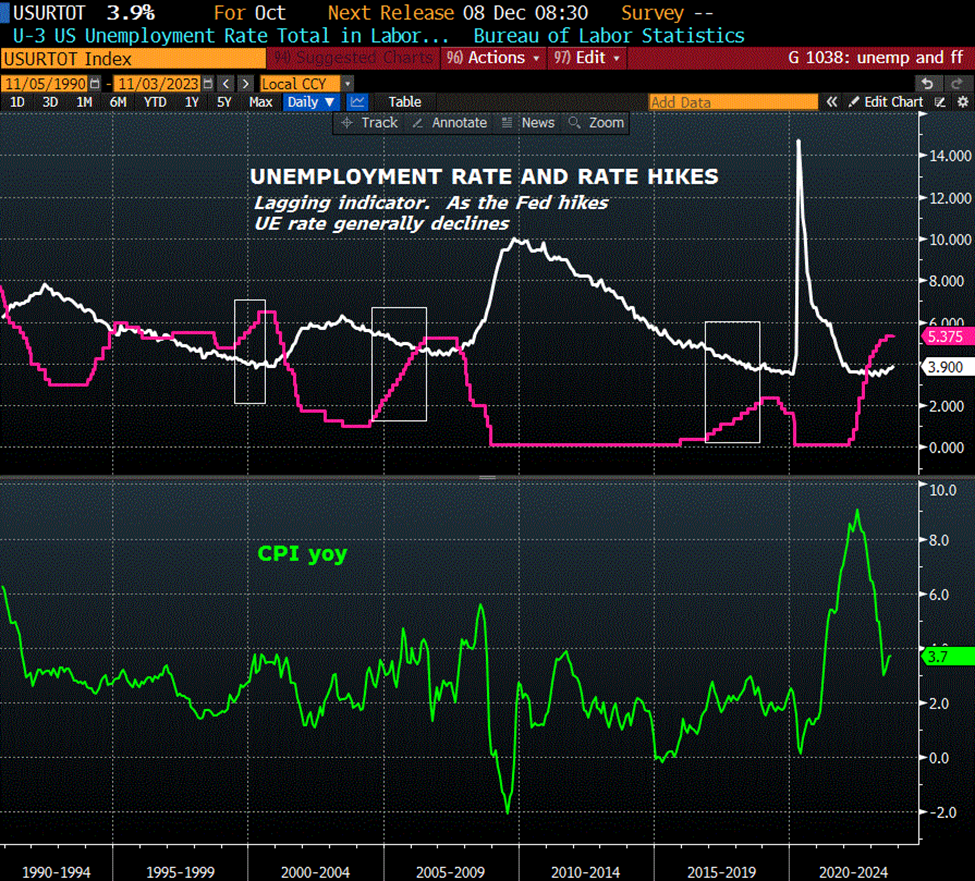

Chart below is the unemployment rate and the midpoint of the FF target range. It’s clear from the chart that the UE rate is a lagging indicator. It generally declines even as the Fed is hiking, then changes all at once. When the unemployment rate makes a new high over the previous 12 months, as it did on Sept 1 at 3.8%, it generally signals a change in trend. On Friday the rate was 3.9%. I am going to guess that by somewhere in the first half, the unemployment rate will cross the FF mid-range rate. And that’s almost certainly going to be above 5%.

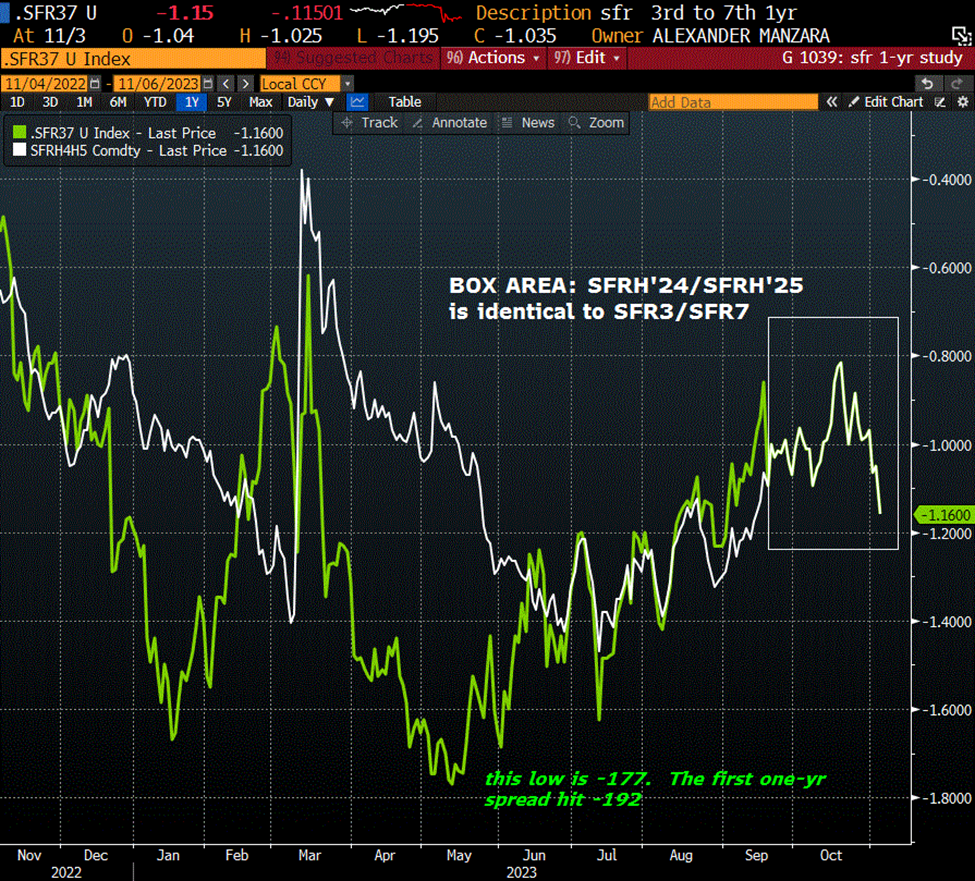

The chart below is SFRH’24/SFRH’25 one year calendar overlaid with the constant slot 2nd to 6th quarterly spread. Obviously, since the September IMM date, the spreads are one and the same. I focus here because this spread is the most inverted on the strip at -116, down an astonishing 11 bps on Friday (9477.5/9593.5). The deepest inversion of any one-year calendar was in May after the regional bank flare-up, where the lowest settle was -192 (1st to 5th). At the current level of -116, H4/H5 indicates about 4 or 5 eases over the year in question. Rarely does the spread turn out to be ‘right’, I would say that perhaps 175 bps is a more appropriate guess for easing to come…but that’s just my guess. FFF4/FFF5 settled at -101.5 (9465.5/9567.0) indicating rate cuts totaling 1% next year.

Obviously the panic -192 print in May was nowhere close to being correct. At that time, it was the first one-year spread, June’23/June’24, and there has not been an ease yet, nearly halfway through the period. However, there are significant bets for sub-4% rates reflected in SFR call options, as detailed below.

A few notes about SOFR options. Some positions are quite large, especially in SFRZ3, where option expiry is 15-Dec. SFRZ3 settled 9462.0, +3.5 on the week. Open interest on the contract is 1.6 million. The 9462.5 c has 443k open and settled 4.5. The 9512.5c settled 1.25. All call strikes from 9462.5 to 9512.5 have total open int of 2.537m. From PNT Options on X:

Above I referenced sub 4% rate plays, most obvious in SFRH4 and M4 options relating to 9600/9700 call spreads. Most of these spreads were bought 8-13 bps. These strikes are the peak open interest levels.

SFRH4 settle 9477.5. 9600c 7.75s OI 283k. 9700c 3.75s OI 256k. CS settle 4.0

SFRM4 settle 9506.5. 9600c 17.25s OI 259k. 9700c 7.75s OI 239k. CS settle 9.5

SFRU4 settle 9539.0. 9600c 34.75s OI 60k. 9700c 16.75s OI 58k. CS settle 18.0 and SFRU4 9625/9725cs has similar size open, settled 15.75.

On the week the ten-yr yield dropped 29 bps to 4.554%. The thirty year ended the previous week at 5.02% and fell over 27 bps to 4.747%. In addition to weakness in Friday’s employment report, the Treasury’s borrowing plans for the quarter were lower than expected, ISM Mfg was only 46.7, and the FOMC press conference was interpreted as dovish. SPX soared nearly 6% on the week.

This week features auctions of 3s, 10s and 30s. Last week I noted that all had tailed in the October auctions and yields popped after a poor thirty year: “At the October 12 thirty-yr bond auction the yield jumped after weak results (3.7 bps tail to 4.837, low bid/cover). At futures settle the 30y yield was 4.87%, up 14 on the day. The next 30y auction is November 9, preceded as always by threes and tens. On Friday, October 27, the 30y yield was 5.02% at futures settle. (USZ3 109-16, WNZ3 112-17).”

So, last month the yield was about 4.80% on the thirty year going into the auction, a bit higher than Friday’s mark of 4.747%. Perhaps last week’s events have changed sentiment such that demand will actually be much better at lower yields, but I wouldn’t bet on it. Friday’s USZ3 settle was 113-21 and WNZ3 117-19.

Note from msn money citing BofA:

“We expect defaults to continue to accelerate going into 2024,” Bank of America warned in a note on Friday. “From $30bn in DM USD HY impaired face value over the past 12 months, we project the pace to increase 1.5x to $46bn over the next year for a 3.4% default rate.”

Most of those defaults are likely to take place in three areas, the bank said, with an estimated $14 billion of distressed debt showing up in technology, media, and telecom, $13 billion in the health sector, and $8 billion in the cable sector.

| 10/27/2023 | 11/3/2023 | chg | ||

| UST 2Y | 501.2 | 483.0 | -18.2 | |

| UST 5Y | 476.9 | 448.6 | -28.3 | |

| UST 10Y | 484.3 | 455.4 | -28.9 | wi 454.053.5 |

| UST 30Y | 502.1 | 474.7 | -27.4 | wi 474.0/73.5 |

| GERM 2Y | 303.7 | 296.1 | -7.6 | |

| GERM 10Y | 283.2 | 264.5 | -18.7 | |

| JPN 20Y | 166.4 | 169.0 | 2.6 | |

| CHINA 10Y | 272.0 | 266.7 | -5.3 | |

| SOFR Z3/Z4 | -85.0 | -106.5 | -21.5 | |

| SOFR Z4/Z5 | -46.5 | -51.0 | -4.5 | |

| SOFR Z5/Z6 | 10.0 | 5.5 | -4.5 | |

| EUR | 105.64 | 107.32 | 1.68 | |

| CRUDE (CLZ3) | 85.54 | 80.51 | -5.03 | |

| SPX | 4117.37 | 4358.34 | 240.97 | 5.9% |

| VIX | 21.27 | 14.91 | -6.36 | |