Tempering speculative froth

April 30, 2024

***************

–Cocoa slumped yesterday and is lower today: “Cocoa extended a slump in London and New York, dropping 26% over the past two days, following a record-breaking rally.” (BBG)

Sign of a broader speculative unwind? Other commodities are also falling, with gold down over $30 this morning. Copper down a bit as well, though yesterday it posted a new recent high 4.6765 (HGN4) which is up about 26% from early February’s level of 3.70, said to be supported by China stockpiling.

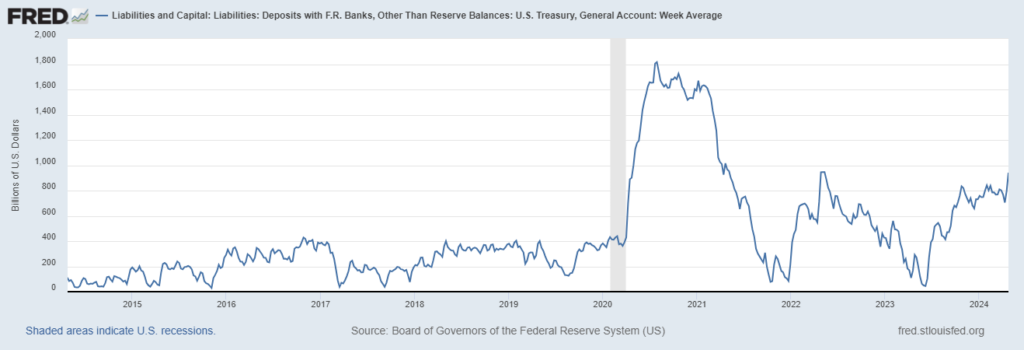

–Rate futures were fairly quiet with yields easing across the board. Ten year down 5.7 bps to 4.612%. At the time of futures settlement, the Treasury released its borrowing estimate for the April-June quarter, which was higher than expected $243 billion (vs $202b). Composition of issuance will be released on Wednesday morning. Tax receipts and borrowing are padding the Treasury Gen’l Account which is back up to $941 billion [chart], essentially matching the last peak in May 2022 of $945b. This provides dry tinder for Fed’l Gov’t objectives, like winning re-election. Fortunately the administration has enlisted the help of Only Fans creators to shower with TGA funds and steer the political narrative. It’s like a Seinfeld episode.

https://www.zerohedge.com/political/do-not-disclose-ad-onlyfans-creator-says-biden-admin-paid-full-political-propaganda

–$/yen holding around 156.60, having been turned away from the surge to 160 yesterday. AMZN and MCD report today.