Tastes Like Malort – Weekly

In a week that was trying on many levels, I couldn’t help but laugh when Dave Lutz of Jones Trading succinctly started his always informative missive with: “Tastes Like Malort”. And so, with Lutzie’s gracious permission, I decided to run with the theme, although it’s almost funnier to just leave the phrase alone.

This will be hard for some to believe, but I had never had Malort before. In my formative college years I had worked as a clerk in a liquor store in Chicago and never recalled seeing it. In fact, my older and wiser brother, no stranger to spirits, had told me about doing shots of this horrible drink called Malort, and I actually had always thought it was “Mi Lord”, lending it a certain air of medieval respectability. I was wrong. Oh. It’s medieval alright, like a spiked mace. Malort is a hometown favorite, having been produced in Chicago since the 1930’s by a Swedish immigrant Carl Jeppson. Again, borrowing stealing from Lutz, and putting social media in its place, is a Malort tagline:

From the original label:

Most first-time drinkers of Jeppson Malort reject our liquor. Its strong, sharp taste is not for everyone. Our liquor is rugged and unrelenting (even brutal) to the palate. During almost 60 years of American distribution, we found only 1 out of 49 men will drink Jeppson Malort. During the lifetime of our founder, Carl Jeppson was apt to say, ‘My Malort is produced for that unique group of drinkers who disdain light flavor or neutral spirits.’ It is not possible to forget our two-fisted liquor. The taste just lingers and lasts – seemingly forever. The first shot is hard to swallow! Persevere. Make it past two ‘shock-glasses’ and with the third you could be ours… forever.

I didn’t know any of this when, on a drizzly late winter afternoon, I took the el up to Addison Street, (where the platform stands in the shadows of Wrigley Field) having been invited to a friendly poker game in that area. It was right around 5 o’clock and the event was set for 7 with warm-up cocktails at 6. I decided to kill some time and took shelter by ducking into Joe’s on Broadway, a storefront neighborhood tavern. I had never been in that particular establishment, but it had a jovial group of Friday afternoon regulars and I thought it best to quietly take an open stool and try to fit in by putting down a 20 and ordering the $3 draft special which was either Pabst or Old Style, and the bartender, a woman of indeterminate age welcomed me by making sure I had a Pabst cardboard coaster to go under my pint. It wasn’t long before I noticed at the end of the bar, a slight-of-build girl, pretty but tom-boyish, in jeans and a sweater, with dark hair nearly shaved on one side regularly interspersing her sips of beer with shots of Malort with the bartender. After making her acquaintance it was only right to buy a round of Malort, and may I add, it’s everything that it’s advertised to be. It’s here that my years of market experience came in handy, because they wouldn’t have missed my presence (only my buy-in fee) at the tournament. I immediately realized that if I stayed, this waif of a girl would easily outdrink me, let alone the bartender, who might have had Malort running through her very veins, and they were already at least 3 shots into it. When you have a suspicion that you’re outgunned, and that your capital relative to other participants may fall short, it’s probably best to step away. Don’t let your winners turn into losses, as we like to say. I left.

The stock market provided rugged, unrelenting, and even brutal losses this week. Stock investors were unceremoniously unfriended. Treasuries were the beneficiary, with fives leading the way, down over 15 bps in yield to just over 2.90%. Tens fell 12.4 bps to 3.074%. After a rollicking start to the year on the back of the tax program and repatriation, most major averages are now lower on the year, DJIA -0.1%, SPX -0.6%, Russell 2k -3.4%, but Nasdaq is still +7.1%. Banks and builders have taken heat, with financials down about 10% on the year and the SP Homebuilders ETF (XHB) down 25%. What is somewhat interesting is that the eurodollar curve, from reds back, slipped into inversion pretty much right after the June FOMC hike. From July forward, reds/greens (2nd to 3rd year forward) and reds/blues (2nd to 4th) have been hovering just below zero. One might say that the euro$ curve has unrelentingly signaled a growth slowdown since summer. In fact, if we just concentrate on XHB homebuilders, it would appear as if Trump is right, it’s the Fed that has been too tight. After the June hike, XHB held up, but after the Sept hike it’s been a straight down slide of nearly 20%, from just over 40 to Friday’s close of 32.59. As I’ve mentioned repeatedly, the withdrawal of central bank liquidity is the main driver, in the form of higher short-end funding costs and scheduled balance sheet reduction of $50 billion per month since the start of October. Friend RM notes that rate hike expectations are generally shattered when SPX trades 10% under the 200 DMA. Makes sense as an indicator to keep an eye on; certainly the 200 DMA has provided support and SPX is now about 4% below that level. The shape of the euro$ curve would suggest 10% below the 200 DMA sometime next year. Currently, the nearest one-year calendar spread that is inverted is EDZ19/EDZ20 at -2.

The upcoming week brings the employment report on Friday. Almost all aspects of the labor report have been strong, and wages have become the primary factor. Though jobs data is a lagging indicator, the Fed’s concern about inflation (wages) make it unlikely that the mantra of gradual increases is altered. The Fed will enter a blackout period this week prior to the November 8 FOMC. The other cloud over financial assets has been deepening trade war rifts. On Tuesday the White House confirmed a meeting between Trump and Xi at the G20 later in November. Perhaps this announcement was partially repsonsible for Tuesday’s surge off the lows, but by Wednesday SPX had buried whatever hopes had been kindled. In any case, Scott Minerd of Guggenheim suggested on a CNBC interview that Trump would likely soften trade threats significantly at that meeting in an attempt to save the stock market. However, this weekend the South China Morning Post reports that the WH is considering removing trade from the agenda. (trial balloon?) While China’s yuan remains close to the psychological level of 7, and unlikely to break that level before the meeting, a rancorous outcome would likely see further immediate yuan depreciation with global ramifications. G20 Nov 30 – Dec 1.

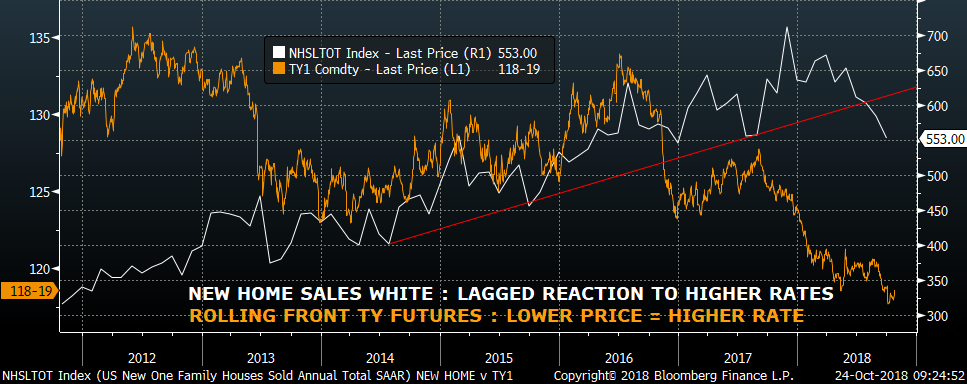

Financial conditions in general remain key, and these operate with lags on various sectors of the economy, occasionally morphing from nagging concern to sheer panic in a rapid acceleration. The lag in housing is shown below.

Nowhere does the sense of panic grip more tightly than fear of a loss of funding. As has been noted the past couple of weeks, the rollover of corporate debt is going to be at higher rates, and might be less congenial than in the recent past. On a more immediate note, the Fed Effective rate is now printing 2.20%, exactly at the Fed’s IEOR rate.

An article on Bloomberg from mid-September cited CS’s Zoltan Poszar flagging the problem of the Fed Effective hugging the upper band; the article noted several options to rectify it. For example, cutting the rate on IEOR, which many now expect in November. Or here was another idea from the article: “…a reverse twist where the Fed sells longer dated treasuries from its portfolio and buys t-bills on the open market.” There are certainly plenty of t-bills for sale. (And it would be nice to see a 4 handle on long bonds).

I would note that 5/30 treasury spread this week closed at a new recent high of 41 bps. During the 2004 to 2006 tightening cycle, the 5/30 spread had bottomed in February, four months before the last hike. It dipped at the last hike in June and then traded sideways for a long period of time before moving higher. In the current cycle, the spread bottomed in July, after the June hike, and dipped again around the Sept FOMC hike, but now appears poised for better levels. Toss a reverse twist into the mix of already heavy treasury supply and watch the long end crater.

If the Federal Home Loan Banks are not lending into the FF market due to, for example, competition from t-bills with ever-increasing supply, then rates at the short end might burst higher. Weakness in global financials could easily figure into higher eurodollar rates. We’ve gotten into an environment where various players wait for others to blink. If the Fed blinks, (by suspending rate hikes) the curve would likely steepen In a ‘risk-on’ party. If Trump blinks with China, it might spark risk on, but add to the Fed’s resolve of tamping down on financial imbalances. If Italy blinks on its budget, the euro will likely rally. If everyone tenuously holds onto their positions, then its going to become a massive de-risk, exacerbating what Volcker referred to as “a hell of a mess in every direction.” And THAT’S when we reach for the Malort. With both fists.

| 10/19/2018 | 10/26/2018 | chg | |

| UST 2Y | 293.0 | 280.6 | -12.4 |

| UST 5Y | 305.7 | 290.4 | -15.3 |

| UST 10Y | 319.8 | 307.4 | -12.4 |

| UST 30Y | 338.2 | 331.3 | -6.9 |

| GERM 2Y | -58.0 | -63.0 | -5.0 |

| GERM 10Y | 46.0 | 35.2 | -10.8 |

| JPN 30Y | 90.9 | 85.7 | -5.2 |

| EURO$ Z8/Z9 | 50.5 | 40.0 | -10.5 |

| EURO$ Z9/Z0 | 2.5 | -2.0 | -4.5 |

| EUR | 115.14 | 114.04 | -1.10 |

| CRUDE (1st cont) | 69.28 | 67.59 | -1.69 |

| SPX | 2767.78 | 2658.69 | -109.09 |

| VIX | 19.89 | 24.16 | 4.27 |

https://www.bloomberg.com/news/articles/2018-09-14/fed-seen-facing-hard-choices-to-keep-control-of-overnight-rates