Targeted ease plays

February 28, 2024

*******************

–SOFR theme yesterday: plays for ease. In the beginning of last year that theme consisted of 100 bp wide call spreads being bought for significant premium, 8-12 bps. Yesterday, trades were more targeted and less aggressive. Buyer 35k SFRM4 9500/9525/9550c fly for 2.5 (settle 2.75 ref 9486). Buyer 45k SFRM4 9525/9550/9575c fly 0.75 (settled 0.75). Buyer 25k SFRU4 9506.25/9518.75/9550/9562.5c condor for 3.0-3.25.

–With respect to the first fly, I looked at the last time SFRH4 settled above 9500, which was Jan 12 at 9501. That date is about two months before option expiration. The 9500/9525/9550c fly settled 3.0 on Jan 12, so just 0.5 over the price paid for June yesterday, which is about 3.5 months away from expiry. If the Fed skips the March 20 FOMC as is expected, then May 1 is in play. Yesterday’s trade was mostly at 9472 in FFK4, or 5.28, as compared with the current 5.33 EFFR. If the Fed eases in May then the contract should settle just above 9491. Then there are meetings June 12 and July 31. Final for SFRM4? 9512 to 9518 seems reasonable (just my opinion). While the Fed might see deterioration in the private sector that justifies easing, the fiscal authorities are not likely to take the foot off the gas (and/or electric) pedal going into the election. It’s likely to make the Fed’s job harder.

–Q4 GDP revision expected 3.3%. Yesterday’s Atlanta Fed GDP Now model has 3.2% as a forecast for Q1. Bostic, Collins and Williams today.

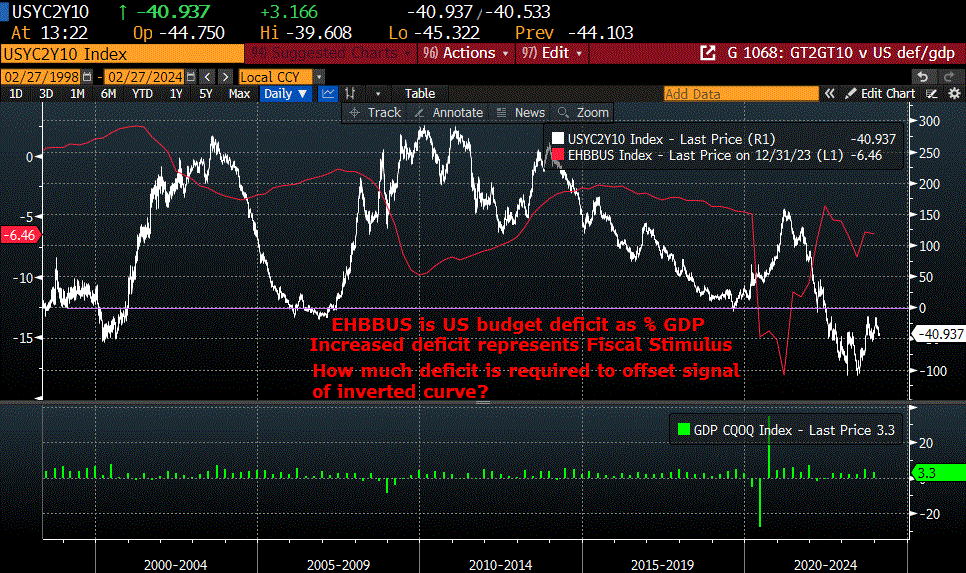

–Attached chart is the Federal Budget Deficit in red, vs 2/10 treasury spread in white. When the curve inverted at the end of the hiking cycle in 2006, the budget deficit was around 2.5 to 3%. Even at that time, many were wondering whether curve inversion was giving a “false” signal with respect to future econ activity. It wasn’t. In the current case, the inversion has been much more dramatic, reaching -108 bps, and the same “false signal” with respect to forward growth has been a topic in the financial press. My thought is that a budget deficit that’s more than twice the percent of GDP (-6.5%) as it was in 2006 has masked the message of the curve, but hasn’t changed the basic forecast.