Stubborn Authority

And though authority be a stubborn bear,

yet he is oft led by the nose with gold[s]

Comment – March 21, 2021

************************************************

Now is the winter of our discontent made glorious summer by this sun of York.

And so, it’ll turn out to be a one-time sort of bulge in prices. But it won’t change inflation going forward. Because inflation expectations are strongly anchored around 2%.

Every part of me looks at this and says this is insane. …I think you’re actually placing too much value on the work. I think we’re in some level of a bubble.

***

I’m starting with three quotes. The first is, of course Shakespeare from Richard III. I am not referring to this play to conjure comparisons to political intrigue at the level occurring on today’s geopolitical stage, though there are worthy parallels. I only start with it because the winter of 2020/2021 is over with the first official day of spring and I’m hopeful the covid winter is also behind us. (The title quote is from The Winter’s Tale).

The second quote is from Jay Powell’s FOMC news conference. As everyone in the markets knows, Powell isn’t inclined to budge on rates until he sees the whites of inflation’s eyes. But the above comment captures the absolute core of the debate occurring in markets: Is inflation transitory or gaining traction? Are expectations REALLY anchored at 2%? Gold Eurodollars think not.

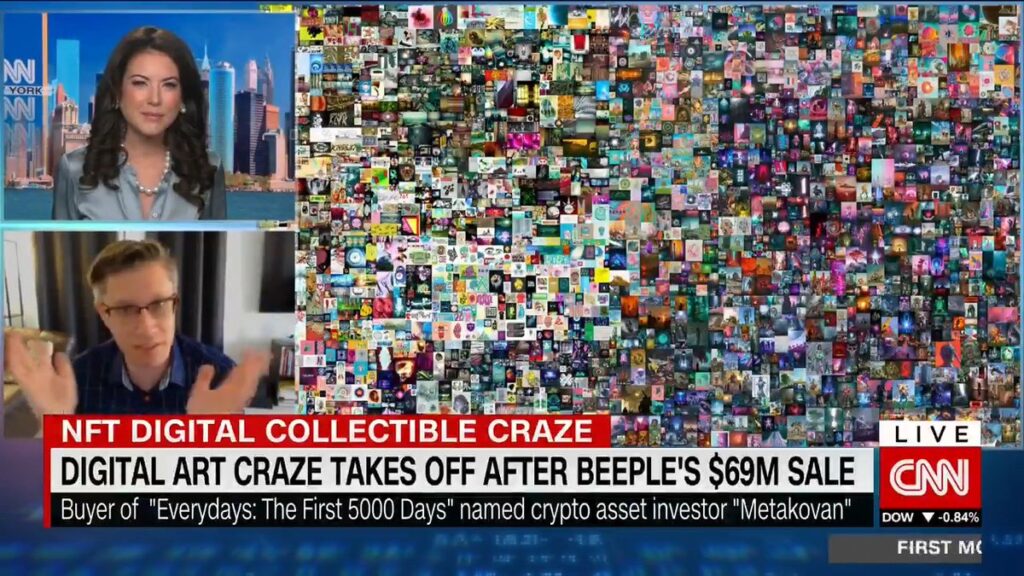

The final quote is, of course, a hedge fund manager excoriating his peers and calling stocks a bubble. No. Actually it’s not. It’s an opinion from the artist BEEPLE, whose digital work sold for $69 million. He was interviewed by Julia Chatterley on CNN. The link is below. I LOVE this guy, Mike Winkelmann. He is articulate, thoughtful and genuine; within a few minutes I got a much better sense of the world of NFTs.

***

I read Richard III in highschool. My English Literature teacher deconstructed this play and all of the characters and their relations to one another. She translated the meanings of some of the more complex passages. This class helped me appreciate English language and history and political psychology. Thank you Miss Schultz. Somehow I think coursework like this is no longer deemed important as it chafes against the equality narrative. It is.

At the margin, those who take issue with the idea of inflation expectations being firmly anchored have already had their way with the yield curve. As I noted during the week, the red/gold euro$ pack spread has moved with greater intensity and about the same magnitude as occurred during 2013’s taper tantrum. By definition, tantrums pass. I’m not so sure about this one.

Yields ended the week at new highs, with the five year at 87.6 bps (+3.1), tens at 172.6 (+9.4) and bonds at 244.8 (+4.9). On the week, the 5/10 treasury spread rose 6.3 bps to 85. However, 10/30 actually declined by 4.5 to 72.2. The fact that 10/30 eased should act as a potential warning signal that some aspects of the curve move have stalled. Steepening thus far has been fierce. However, on Friday the gold euro$ pack was still the weakest thing on the strip. EDZ’25 which had been featured in a couple of large block trades and is now the 3rd gold, ended the week down 15 at 9777.0! More on golds below.

What about the SLR? Well clearly it hit banks somewhat, with JPM tumbling 4% to 151.19 on the news that the Fed will let loosened regulations expire, before snapping back at the end of the day to close down only -1.6%. The biggest issue with the SLR decision is this: the US treasury has a LOT of bonds to sell, and the market is nervously wondering how they get absorbed. The last 7-year auction went poorly, and we have another one this week. These higher yields will likely attract buyers. Are they high enough? The Feb 25 auction went off at 1.195% with bid to cover of only 2.04. On Friday, the WI 7yr was 1.38%.

Look at the image below of curve steepening. In 2013’s taper tantrum I marked the move from late April to December at 142.5 bps to 305 for a total of 162.5. Eight months. The current magnitude of the move has been 146 bps starting from the “new framework Fed” in August. Seven months. In the 2013 episode, the Fed did not actually hike from zero (0-0.25%) until two years after the curve peaked. The first hike was in Dec 2015. In the current incarnation, the market also expects a hike in about two years. However, is there anything stopping the curve from running another 100 bps?? In 2013, I’m sure there was a bit of “pent-up demand”. But can it be anything like post-covid demand? In the wake of the GFC there was robust government spending with programs parceled out over a few years. Is it anything like today’s gargantuan spending? Back then the Fed’s balance sheet was exploding, from $2.92T at the start of 2013 to $4.0T by the end of the year. Since last August’s change in framework, the Fed’s balance sheet has exploded from $6.9T to a new high at $7.7T. What is going to arrest this move?

One other key note: On May 1, 2013, the 18th quarterly euro$ contract (2nd gold) was 98.245. By Sept 5, when the contract bottomed, it was 96.17, or 3.83%. With funds at 0.125%, same as now. On Friday, EDM’25, the 2nd gold, settled at 97.885 or 2.115%. Catch the falling piano.

During the Julia Chatterley interview Winkelmann outlines the inherent value of blockchain tokens across the economy. At the end Chatterley asks, “Did Beeple just call NFTs a bubble?” The response, “One Hundred Percent”. Is it just me or does he look a little bit like Powell in that picture?

This week features 2, 5 and 7 year auctions of $60 billion, $61 billion and $62 billion. Staggering numbers. Powell speaks on Monday, Tuesday and Wednesday. However, he was very clear, organized and eloquent in presenting his argument for transitory inflation. There is simply no reason to forecast a change in tone. Although there are a lot of Fed speakers over the week, Tuesday is likely the most important, with Powell and Yellen in front of the House and Brainard also speaking.

OTHER MARKET THOUGHTS/ TRADES

The peak one-year ED calendar on the curve is now 76.5 bps, EDM23/M24 up from 70 bps last week. The only inverted spread is EDZ1/EDH2 at -4.0, a sign that credit concerns could yet bubble to the surface.

Comments last week were pretty much on the mark, if not conservative regarding new inflation projections. About the dots I wrote…

All wrong. All of them. All too low, starting in 2021. There is talk that some dots will move up, given the vaccine progress and stimulus, and that investment committees will convene and, in careful consideration and deliberations will react to this change in official circumstances… by puking bonds. I wouldn’t be surprised to also see Core PCE Inflation projections move up by 1/10 each in 2021 and 2022. [Core PCE projections were actually adjusted upward by 0.4 in 2021 to 2.2 and 0.1 in 2022 to 2.0]. The question is whether the existing shorts will take such an opportunity by covering some positions, or whether they will press. I expect the latter.

On the curve I wrote:

On 5-March, red/gold euro$ pack spread ended at 157, a new high. I suggested targeting 175 to 185. On Friday this spread (which will now be the old red, vs old gold pack, as March contracts roll forward) settled 162.625.

Red/gold pack spread actually settled 177.125 on Friday, in the target area.

From last week:

FFN1/FFN2 settled 2.0. No one thinks the Fed can hike by June 2022. I do; it’s 15 months away. For comparison, FFV1/FFV2 which I had recommended buying for 3, settled 8 on Friday.

FFN1/FFN2 settled 5.0.

| 3/12/2021 | 3/19/2021 | chg | ||

| UST 2Y | 14.9 | 14.7 | -0.2 | w/I 15.5/15.0 |

| UST 5Y | 84.5 | 87.6 | 3.1 | w/I 90.0/89.5 |

| UST 10Y | 163.2 | 172.6 | 9.4 | |

| UST 30Y | 239.9 | 244.8 | 4.9 | |

| GERM 2Y | -68.7 | -69.5 | -0.8 | |

| GERM 10Y | -30.6 | -29.4 | 1.2 | |

| JPN 30Y | 68.7 | 66.7 | -2.0 | |

| CHINA 10Y | 325.9 | 323.7 | -2.2 | |

| EURO$ M1/M2 | 9.0 | 9.5 | 0.5 | |

| EURO$ M2/M3 | 45.5 | 44.0 | -1.5 | |

| EURO$ M3/M4 | 70.0 | 76.5 | 6.5 | |

| EUR | 119.55 | 119.07 | -0.48 | |

| CRUDE (active) | 65.61 | 61.42 | -4.19 | |

| SPX | 3943.34 | 3913.10 | -30.24 | -0.8% |

| VIX | 20.69 | 20.95 | 0.26 | |

http://creditbubblebulletin.blogspot.com/