Stockholm Syndrome

December 8, 2019 – Weekly Comment

“That was totally worth it,” she says one morning, eyes pleading through the camera for relief from her torment. The final moments show her sitting on the couch with her partner—the man who gave her this albatross in the first place—to review her video diaries from the past year. He smiles, and she looks at him with the sort an expression that manages to convey duty and fear, mixed with a dash of Stockholm syndrome, all at once.

(Link is below, credit to the author Reid McCarter, avclub.com).

The above quote is a review of the Peleton ad, ‘The gift that gives back’ which managed, in my opinion, to destroy any cachet the product might have had. The stock sold off this week in reaction to the ridicule heaped on the company. Aviation Gin created an immediate response ad which subtly captures the next step in this insecure, beautiful young woman’s journey, ‘The gift that doesn’t give back’. At an upscale holiday-decorated bar, two supportive girlfriends toast “To new beginnings” and she gulps down (the first) martini. One friend reassuringly says, “You’re safe here.”

Here are the links to the two ads. Amazing that this actress agreed to do the gin response.

In a way, the market reminds me of the Peleton ad. Stocks nervously but dutifully pedaled up near new highs to close the week. The Fed is assuring us of the gift of never ending liquidity, right? [ I can stay in the tastefully appointed house in the suburbs with the sliding glass doors opening to the deck and lovely yard?] Isn’t that what they’re going to say this week? That they will officially tolerate inflation overshoot so we can just keep buying. It’s a strong counter to the insecure Fear Of Missing Out. “You’re safe here.”

I’m not even sure how I should frame the analogy. Maybe the Fed has Stockholm Syndrome – hostage to Trump and no longer even bothering to look for a graceful exit from the path of capital misallocation and malinvestment. “I just want to please my captor”.

Economic news articles continue to paint a mixed picture. A BBG piece touts this: “US Wage Growth Eclipses Mortgage Rate for the First Time Since 1972.” Average hourly earnings for production and nonsupervisory employees – who comprise more than 80% of the US private sector workforce – rose 3.8% from a year earlier in October [Friday’s data was 3.7%]. The average 30-year fixed mortgage rate in the US in October was about 3.7%.” That’s great right? In fact, the current rate of cited wage increase hasn’t occurred since January 2009, when it was on the way down. Charlie Bilello tweets, “US hourly earnings up 3.1% in the past year, outpacing core inflation (YoY) for the 84th consecutive month.” Gee, that’s great for the household sector but probably not so good for company earnings right? Oh. Corporate earnings growth has been declining. Pedal harder.

John Mauldin’s Thoughts From the Frontline this week is titled ‘Inflationary Angst’ and it outlines another side of cost of living increases, including now common huge healthcare deductibles. “Try to look at this like an average worker. Your rent keeps rising, your kids can’t go to college without racking up debt, your health insurance is astronomical, and your wages, while up a bit, aren’t keeping up with your living costs.”

I looked at it another way on Friday, comparing Avg Hourly Earnings (total private) of +3.1% with the University of Michigan’s long-term inflation expectation survey which was released Friday, bouncing along multi-year lows at just 2.3%. Which scenario will win out?

For a long time, the last piece of the missing economic puzzle for the Fed was wage growth. Now, the Fed is promising to ignore wage increases. Shouldn’t that augur poorly for the longer end of the curve? This week, the short answer to that question was ‘yes’ though the response to the strong employment data was still fairly tepid. The two year yield rose 1.7 bps on the week to 1.619% while tens rose 6.6 to 1.842% and 30’s gained 8 to 2.283%. The curve thus ended on a firm note, with 2/10 at 22.3 bps and red/gold euro$ pack spread at the same level, 22.0. 5/30 ended at 61.5. For context, the highs in these spreads were around the summer solstice, with 2/10 28.5, red/gold euro$ pack spread 43.0 and 5/30 79.8.

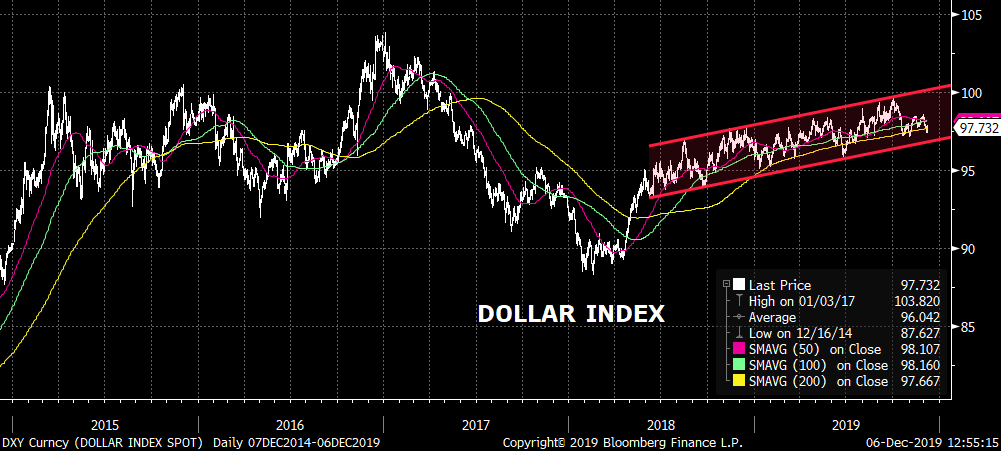

My contention is that these curve highs will all be revisited and exceeded, due to central banks’ policies, and, in the US, due to supply. We will have a test this week with both factors figuring into the equation. There are auctions of $38 billion 3-yrs on Monday, $24b tens on Tuesday, and $16b thirties on Thursday, raising $54 billion in new cash. In the midst of this supply, the FOMC meeting is Wednesday, widely expected to endorse the current policy stance (no ease but a flood of liquidity to prevent another repo accident, and to provide the lubricant to positively carry the unending weight of supply). An additional factor is the dollar, which has been in a steady upward sloping channel for a year and a half, but which now appears to want to test the lower boundary. As an aside, note that 10-yr JGB ended at a new recent high of -1.4 bps, a level not seen since early in Q2, with a high in 2019 just above zero and a low of -29.5.

Apart from the auctions and FOMC, inflation data are released Wednesday and Thursday. Retail Sales on Friday. The December 15 tariff deadline is one week from today. Pass the gin.

OTHER MARKET/TRADE THOUGHTS

Large trades Friday featured the purchase of Jan/Feb call calendars in treasuries. TYF/TYG 130 call calendar was paid 14 to 16 for 100k. With TYH0 settling at 128-28+ TYF0 130c settled 11 with a delta of 21, open interest was +78k and TYG0 130c settled 27 with 30 delta and an open interest increase of 90k. The expiration dates are 27-Dec (just after the Christmas holiday) and 24-Jan. A slow rally works best for these trades…the thought is probably that China trade deal talks will drag on, and the market will grind higher in holiday trade.

Apart from the ten year, this same view was expressed in FV: +30k F0/G0 119.5

call calendar, settles of 3.5, 13d and 12.0 ref 118-21.25, 25d and in US, +15k

F0/G0 161 call calendar, 14s with 13d and 47s with 25d ref 157-20.

There continues to be buying for forced easing, I will just highlight EDU0 9887.5/9937.5, 5.5 was paid this week ref 9848, then 4.5 on Friday ref 9841 with a settle of 4.75 vs 9844.0. The two strikes have 269k and 287k open, so the core long in this spread is ~150k or more. This call spread prices aggressive easing going into the election; it would take at least three 25 bp cuts to get above breakeven (9892.5) in the contract.

| 11/29/2019 | 12/6/2019 | chg | |

| UST 2Y | 160.2 | 161.9 | 1.7 |

| UST 5Y | 161.8 | 166.8 | 5.0 |

| UST 10Y | 177.6 | 184.2 | 6.6 |

| UST 30Y | 220.3 | 228.3 | 8.0 |

| GERM 2Y | -62.6 | -62.5 | 0.1 |

| GERM 10Y | -35.3 | -28.6 | 6.7 |

| JPN 30Y | 40.7 | 44.4 | 3.7 |

| EURO$ H0/H1 | -26.0 | -20.5 | 5.5 |

| EURO$ H1/H2 | 3.0 | 6.0 | 3.0 |

| EUR | 110.19 | 110.62 | 0.43 |

| CRUDE (1st cont) | 55.17 | 59.20 | 4.03 |

| SPX | 3140.98 | 3145.91 | 4.93 |

| VIX | 12.62 | 13.62 | 1.00 |

https://news.avclub.com/this-peloton-commercial-needs-to-calm-down-1840147803

https://news.avclub.com/ryan-reynolds-helps-the-peloton-lady-off-the-bike-and-o-1840286248