STFR

March 11, 2022

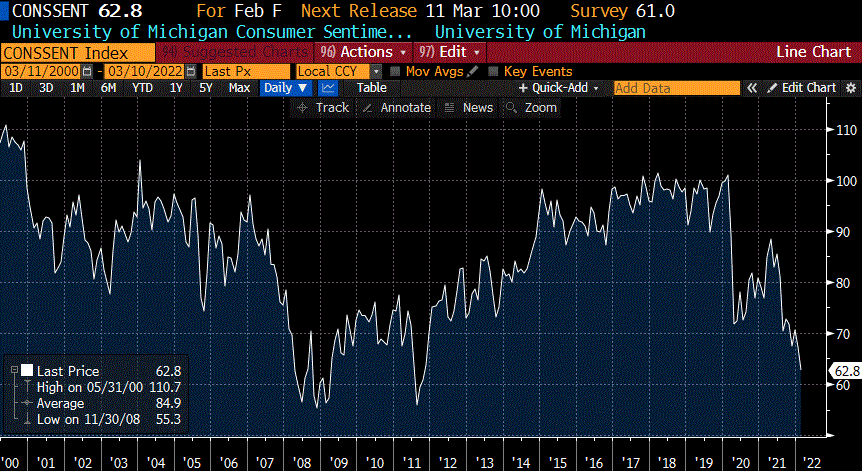

–As advertised, yoy CPI was 7.9% and absorbed by the market without mishap. The thirty year auction was well-received as yields are finally moving toward a respectable level with the 30y ending 2.394%, though certainly not on an inflation-adjusted basis. Today we get University of Michigan’s Consumer Sentiment number, shown on the attached chart. The last 20 years have seen a range of 103.8 to 55.3, the low related to the GFC in October 2008. Last was 62.8 with an expectation today of 61.0. Imagine if unemployment were high and mortgage rates were on the rise.

–Yesterday EDZ2 9800/9750/9700 put tree settled 2.5, 45.0, 26.5 and 16.0. Tuesday, it traded -2, with paper selling the 9800p at a discount to the lower legs. The extreme bid for downside in dollars has likely peaked.

–Atlanta Fed GDPNow estimate is 0.5% for Q1 (From 3/8). FOMC projection for GDP in 2022 is 4.0% (from December). Yellen warning inflation to get worse. STFR

–March midcurve eurodollars expire today.