Steeper

June 5, 2020

–May jobs report today with nonfarm payrolls expected down 8 million and an unemployment rate of around 20%. You guessed it: BUY STOCKS. Stock futures are up this morning as the ECB heaped on stimulus yesterday and US is looking at spending another trillion to board up storefronts.

–Curve steepened to new highs, with 2/10 at 62.3 bps, up 6 bps on the day and 5/30 at 121.6, up 4. Ten-yr yield up 5.4 to 81.5 and 30’s rose 6.6 to 1.616%. Red/gold ED pack spread jumped nearly 6 bps to 54.5. Deferred one-year euro$ calendars made new highs from reds back. For example, there is continued heavy buying of EDM21/EDM22 which settled at a new recent high of 7.5 bps (now over 100k). However, the EDM22/EDM23 one-yr calendar settled 18.5, also a new high. And EDM23/EDM24 settled 21.5. Steepness on the dollar curve is further out because the Fed is jawboning forward guidance and may strongly hint at yield curve control at next week’s FOMC. But the market is beginning to indicate that unfettered stimulus combined with short end repression might cause the dam to break.

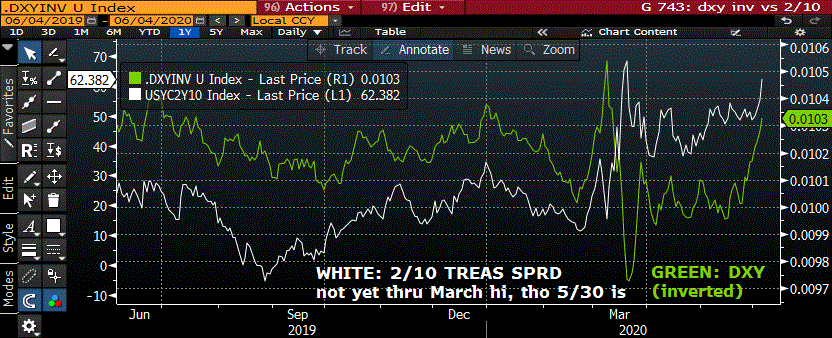

–Below I have included a chart of the dollar index inverted (green line, as it rises, the dollar is weakening) overlaid with the 2/10 treasury spread. As the dollar approaches the March low, the curve looks to re-test the March high. Of course, 5/30 has already taken out the March high. A steeper curve indicates a looser Fed, which undermines the dollar, providing a global boost in the form of easier financial conditions. It’s all great until higher treasury rates cause gov’t expenditures on interest to eat a growing portion of the budget. Which causes the Fed to emphasize forward guidance, further weakening the dollar…

–Yesterday only one US contract was at zero percent, and that was FFV’21 which settled exactly at 100. Happy Friday.