Steel

December 24, 2023 – Weekly comment

******************************************

I worked my whole life in the steel mills of Gary

Like my father before me I helped build this land

Now I’m seventy-seven and with God as my witness

I earned every dollar that passed through my hands

Minutes to memories – John Mellencamp

I had watched a TV documentary about old-time steelworkers working the mills. Hard, dirty work. I wish I could find the clip, but one of the men interviewed said (paraphrased). “You were something if you worked in the steel mill. You were paid well. You could afford things.” Pride in the work and in the community, in the classic sense of the word.

I’m a fan of Michael Every of Rabobank, who was recently interviewed on Adam Taggert’s Thoughtful Money. Not that I agree with Every one of his arguments (see what I did there), but he has a breadth of knowledge and historical context that I can only envy. In any case, the main thrust of his comments during the interview was that America’s outsourcing of production and transition to what he calls “frivolity, fictitious capital, and bullshit” is not working. The financialization of the American economy is no longer likely to bring dominant results in a changed global order. So, the idea of some sort of industrial policy, with tariffs and subsidies is his suggestion. I’m not so sure if that’s the correct path to a better tomorrow, but the inward turn toward production and sourcing of inputs makes some sense.

And that’s why the sale of US Steel to Japan doesn’t sit well with me, as I think steel is a strategically important industry. And that’s why the addition of Norinchukin to the Fed’s list of Standing Repo Facility counterparties on Dec 1, while perhaps understandable raises a few questions. If the big banks are strategically critical in our economy to the point of supporting non-US based entities, maybe big supply-chain industries require consideration.

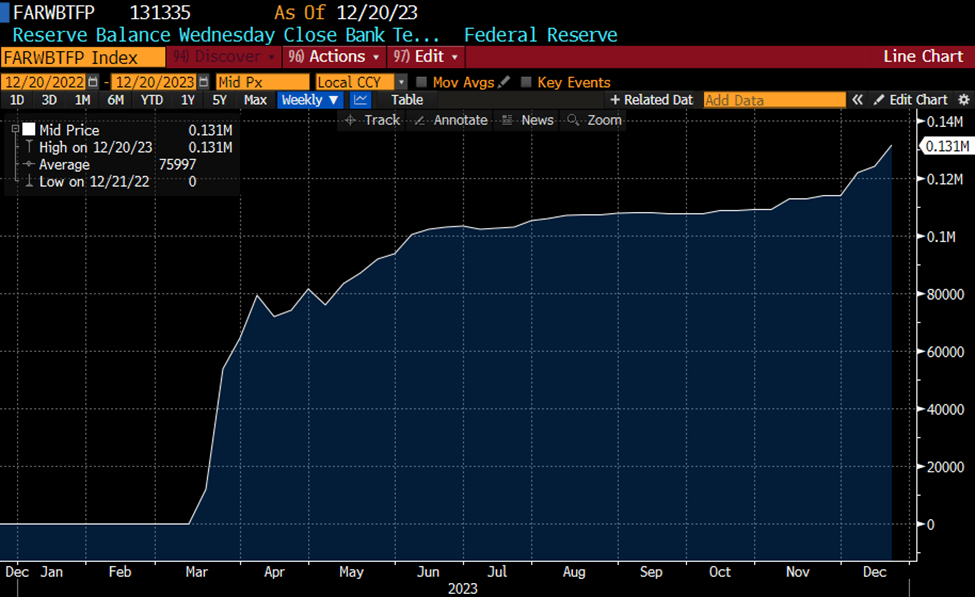

In terms of financialization, the Fed’s Bank Term Funding Program is a case in point. The outstanding amount is currently only $131 billion, not huge in the big picture. It surged with the regional banking crisis of course, but has recently re-accelerated in December. This program allows a bank to pledge treasuries at par value and obtain credit for up to a year, at a rate of the one-year overnight index swap plus 10 bps. Current rate 4.85%. https://www.frbdiscountwindow.org/

Obviously that’s an attractive funding rate, especially given that treasuries trading well below par value can be pledged at par. Below is a chart of BTFP outstanding balance. Though it’s relatively small, is there a possibility of renewed fragility in the system? Note as well that Ueda just signaled a possible shift in the Bank of Japan’s ultra-easy policy. Next BOJ meeting is Jan 22/23.

Treasury is doling out $1 trillion a year in interest on US debt. Outstanding credit card debt (revolving) is around $1.3 trillion, and “accounts assessed interest” are at 22.77%. Excluding non-revolving auto loans, it’s reasonable to assume interest payments of nearly $200 billion per year. Those flows are likely affecting very different parts of the populace. In the aggregate, things may look ok, but certain segments are under increasing duress. Changes at the margin affect the whole.

*******************************

The inflation numbers came in favorably. As Nick Timiraos wrote: “The Core PCE index rose 3.2% in November from a year earlier. Over the last six months, the core PCE price index rose 1.9% at an annualized rate.”

In other words, the Fed’s at target.

So, there is justification to cut. Which the market has priced. In the clearest example, consider Friday’s settle of FFJ4 at 9492.5, a rate of 5.075%. Current EFFR (Fed Effective) is 5.33%, a price of 9467.0. In other words, for the first time, at settlement, there is slightly MORE than 25 bps of ease reflected in this contract. (FOMC meetings are Jan 31 and March 20). FFF4/FFG4 settled -3.5 (9467.5/9471.0) so there’s a bit over 10% priced for a 25 bp ease at the Jan meeting. Feb/April settled -21.5 (9471.0/9492.5). They’re pretty sure the first ease comes in March. On the SOFR curve, SFRH4/SFRM4 three-month calendar spread settled -49.0 (9501.5/9550.5). A lot of observers are saying an ease will NOT come in the first half. The market is sending a very clear signal that it will.

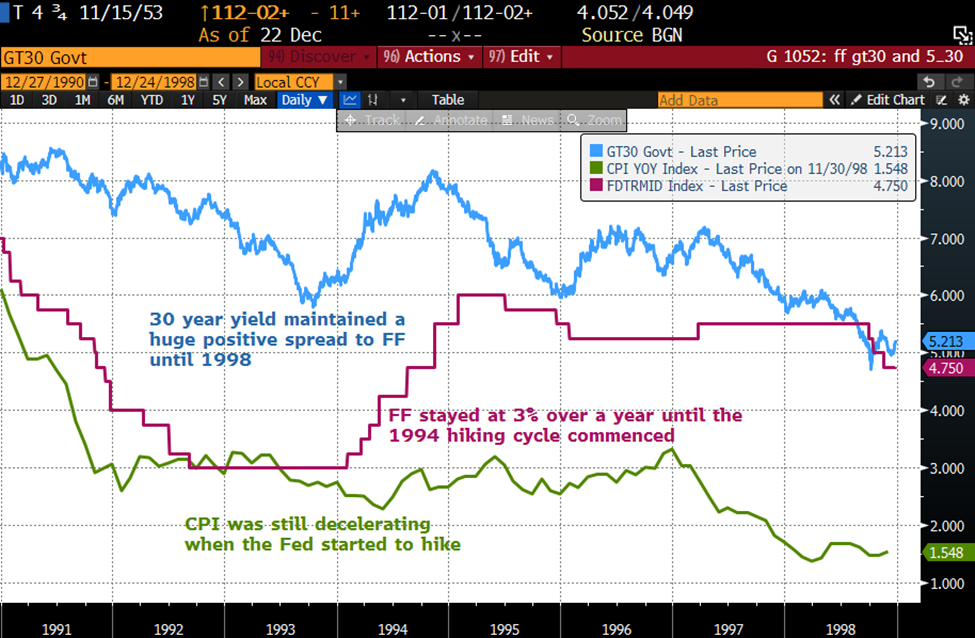

I would note that the highest contract on the SOFR curve is now SFRZ5 at 9684.5 or 3.155%. In the panicked period from March to May, no sofr contract settled above 9750. Perhaps it’s fair to say that the terminal ease won’t go below 2.5% this time around. In that connection, I looked back at 1994. The Fed had eased to the then-low FF rate of 3%. That rate held for over a year. Of course, at that time the thirty year yield had a hugely positive spread to FFs, though the spread declined through 1991.

Perhaps this time the Fed won’t have to test the zero-bound. On Friday, SFRZ4 settled 9624.5 or 3.755%. Given today’s treasury curve, 5’s (3.89%) 10’s (3.90%) and 30’s (4.06%) would all have positive carry by the end of next year.

Could we have a scenario where the BOJ starts to tighten, pulling capital away from longer dated US assets, with the unemployment rate starting to rise, justifying Fed cuts of 125 to 175 bps next year as inflation stabilizes around current levels? Positive curve, but real rates still at relatively restrictive levels.

Treasury auctions of $57b 2-years, $58b 5-years and $40b in 7-years, Tues, Wed, Thurs. Perhaps a bit much to digest in a holiday week.

https://www.youtube.com/watch?v=H4QTQQytnd8

| 12/15/2023 | 12/22/2023 | chg | ||

| UST 2Y | 445.1 | 434.2 | -10.9 | wi 429.0/428.5 |

| UST 5Y | 392.6 | 388.8 | -3.8 | wi 388.5/388.0 |

| UST 10Y | 392.6 | 390.6 | -2.0 | |

| UST 30Y | 402.5 | 405.8 | 3.3 | |

| GERM 2Y | 250.4 | 240.0 | -10.4 | |

| GERM 10Y | 201.6 | 196.5 | -5.1 | |

| JPN 20Y | 142.1 | 133.0 | -9.1 | |

| CHINA 10Y | 263.6 | 261.0 | -2.6 | |

| SOFR H4/H5 | -148.0 | -151.0 | -3.0 | |

| SOFR H5/H6 | -32.5 | -31.0 | 1.5 | |

| SOFR H6/H7 | 5.0 | 7.5 | 2.5 | |

| EUR | 108.97 | 110.14 | 1.17 | |

| CRUDE (CLG4) | 71.78 | 73.56 | 1.78 | |

| SPX | 4719.19 | 4754.63 | 35.44 | 0.8% |

| VIX | 12.28 | 13.03 | 0.75 | |

From the Fed

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), such as U.S. Treasuries, U.S. agency securities, and U.S. agency mortgage-backed securities. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.