Spreads indicate a tightening vise

July 24, 2022

On July 21, Scott Minerd of Guggenheim tweeted this:

After four consecutive monthly declines, the leading economic indicators signal that recession is on the way. You’ve been warned.

Of course, the Eurodollar curve inversion has warned for many months that recession is on the way. On March 3, I mentioned it in a tweet as red/gold euro$ pack spread was inverting to new lows. “…chart is telling you a recession is coming.” On April 28, I cited inversion in June’23/Sept’23 spreads in both ED and SFR contracts as another indication of recession in late 2023.

This week however, the interest rate markets seemed to eliminate all doubt. The ten year yield dropped around 15 bps to 2.787% while fives fell 18 to 2.875% as weak global PMI data indicated recession. The Atlanta Fed’s GDP Now is currently -1.6% for Q2, and has been below -1% throughout the month of July, as the BEA releases the advance Q2 GDP estimate on Thursday (expected +0.3 to +0.5%).

It’s often said that monetary policy takes six months to a year to really take effect. The Fed’s first real hike was in March, about four months ago. At that time, the Fed Funds midpoint was 12.5 bps. On Wednesday, we’re expecting the Fed to hike by 75, taking the target to 2.25 to 2.5% (the peak in 2018), with a midpoint of 2.375 and Fed effective rate of 2.33, as indicated by August Fed Funds, which settled 9765 or 2.35%. This rapid tightening is expected to squash inflationary expectations.

I have attached a chart showing that the new Fed Effective of 233 bps will just be equal to Friday’s close of the ten year breakeven of 234 bps. In 2018, when the former crossed the latter it spelled trouble, but bear in mind it took a lot longer to get there in 2018. It took three years from the end of 2015 to the end of 2018 to go from 12.5 bps to 237.5. Markets and consumers had some time to adjust. Just for a bit more background, the ten year b/e got to a high just above 300 bps in March. The 5y b/e peaked at a bit over 370 and is now 258. So the new EFFR will not exceed the 5y b/e… yet.

I have also included a chart of the yield on SFRZ2 (which is December SOFR) vs the current 10-yr treasury yield. SFRZ2 is the lowest contract on the curve, and likely the best predictor of what the FF rate will be by the end of the year. It settled Friday at 9668.5 or 3.315%. The January 2023 Fed Fund (FFF3) contract which conveys much the same info, settled at 9664.5. What does it mean? That if you are long treasuries and funding with repo then you are incurring large negative carry (shown on the chart as the red shaded area in the lower panel). Indeed, even SFRU2 is 9692 or 3.08%, well above the ten-yr yield, and as of Friday, above all other treasuries besides the 20-yr. Short term funding costs above long term lending rates is not particularly conducive to granting the credit which keeps the ball spinning.

It always comes down to leverage as alluded to in this BBG clip:

Speaking at the Bloomberg Crypto Summit this week, Novogratz implied crypto’s issue was a “confidence” crisis. “I didn’t realize the magnitude of the leverage in the system… It turned into a full-fledged credit crisis with… huge damage of confidence in the space.” Novogratz went on to point the finger at the SEC,” saying, “They didn’t do a lot to protect the retail investors.”

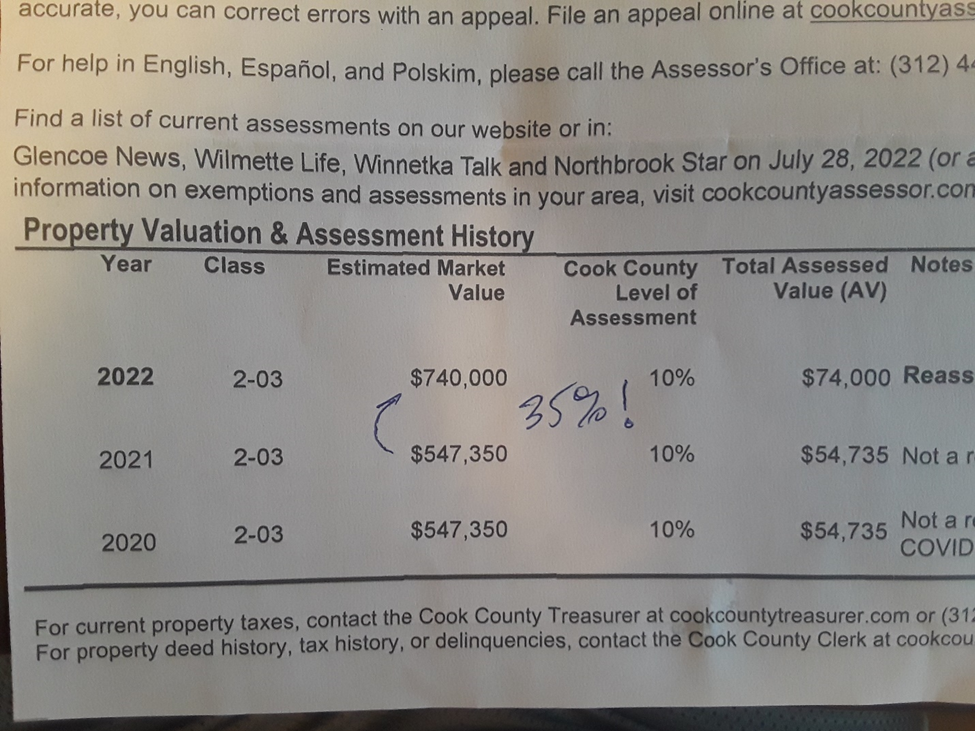

Tighter conditions are working their way through the economy, and the rapidity of changes has caused a shock to the system. Last week AT&T said that customers are starting to put off paying their phone bills (BBG). Said analyst Peter Supino, “I’m not worried so much for AT&T as I am for the broader economy. You wonder if this is the canary in the coal mine.” Actually, a lot of canaries have dropped from their perches. Thankfully, my investing prowess has insulated me. You can see it right here on my official Property Assessment for my new tax bill. I’m up 35% in ONE YEAR!

Of course, I’m joking. I did not MAKE 35% in a year, but I am getting ready for a major increase in my property tax bill, which, here in Illinois is already the second highest rate in the nation. And I can’t wait to see what the heating bills will look like this winter. Those higher costs aren’t likely to abate even if official inflation figures start to come down.

How is a ten-yr yield of 2 ¾% justified with yoy PCE prices expected 6.7% on Thursday? I’m starting to think TINA will be applied to treasuries rather than equities. The issue in forecasting lower yields in longer dated treasuries is the negative carry, along with continued supply that the Fed is no long buying. However, on a technical basis the 10y yield has formed a head and shoulders top projecting down to 2.1%; 2.41 is the 50% retrace from the low in December to high in June. In the 30y, 2.58 is the projection, while 2.55 is the 50% retrace.

Given that the highest price contract on the SOFR curve is SFRH5 at 9766 (2.34%) there won’t be negative carry forever!

This is a big news week, with the FOMC on Wednesday, expecting a 75 bp hike to 2.25-2.50%. There is not a ‘dot’ projection; SEP are only released quarterly. Auctions of 2, 5 and 7 year notes begin on Monday.

In terms of economic releases:

Monday: Chgo and Dallas Fed. Dallas Mfg expected -22 which would be the lowest since 2009 outside of a spike lower in 2016 and the 2020 covid plunge.

Tuesday: Richmond Mfg should show the same thing. Also New Home Sales and Consumer Confidence

Wednesday: FOMC and Durables

Thursday: GDP (Q2 advance) and Jobless Claims

Friday: PCE price data and Chgo PMI. Final Michigan numbers for July.

According to CNBC 175 S&P companies report earnings this week. Big ones:

Tuesday: MSFT and Alphabet

Wednesday: Meta (the name change from FB to Meta in October ’21 almost perfectly top-ticked the Nov peak in Nasdaq Comp)

Thursday: AAPL and AMZN

| 7/15/2022 | 7/22/2022 | chg | ||

| UST 2Y | 314.0 | 299.1 | -14.9 | |

| UST 5Y | 305.6 | 287.5 | -18.1 | |

| UST 10Y | 293.4 | 278.7 | -14.7 | |

| UST 30Y | 309.2 | 300.3 | -8.9 | |

| GERM 2Y | 46.7 | 45.2 | -1.5 | |

| GERM 10Y | 113.3 | 103.1 | -10.2 | |

| JPN 30Y | 120.2 | 122.5 | 2.3 | |

| CHINA 10Y | 278.7 | 278.6 | -0.1 | |

| EURO$ U2/U3 | -10.0 | -27.5 | -17.5 | |

| EURO$ U3/U4 | -45.5 | -43.5 | 2.0 | |

| EURO$ U4/U5 | -9.0 | -5.5 | 3.5 | |

| EUR | 100.82 | 102.16 | 1.34 | |

| CRUDE (active) | 94.57 | 94.70 | 0.13 | |

| SPX | 3863.16 | 3961.63 | 98.47 | 2.5% |

| VIX | 24.23 | 23.03 | -1.20 | |