Risk off in US bonds, but risk ON in mideast

Oct 11, 2019

–Yields continued to press higher, with tens up 7 bps to 1.656% as trade optimism leads to paring back of “risk-off” trades. Eurodollars from reds to golds were -8.5 to -7.0. Going into today’s October midcurve expiration, it’s worth noting that Green Dec (EDZ21) has dropped 17 bps in the week from last Thursday to yesterday, 9881 to 9864, bringing the 9862.5 put into play. –While Core yoy CPI remained at 2.4%, the monthly figures were lower than expected. The NY Fed also released its Underlying Inflation Gauge (UIG) yesterday, which showed a drop of 0.1 in the ‘Full data set’ to 2.4%. This measure has been on a downward slide through 2019, having spent the last half of 2018 above 3%. However, energy prices are making an effort this morning to buck the disinflation trend, as an Iranian oil tanker was struck by missiles near a Saudi port. CLX9 is up $1.00/bbl to 54.55. Stocks are also starting the morning with strong gains.

–FFX9 (Nov Fed Funds) was a star performer yesterday, closing +0.5 at 98.36 when every other interest rate contract closed lower on the day. Oct/Nov FF spread settled -19.25, still showing better than 3 out of 4 odds for a cut at the end of the month. However, Nov/Jan is back to -14.5, so forward expectations of easing have, well, eased. The most inverted one-year euro$ spread remains EDZ9/EDZ0 at -43.0, which rallied 5.5 bps on the day. This spread had been around -60 in the early part of September.

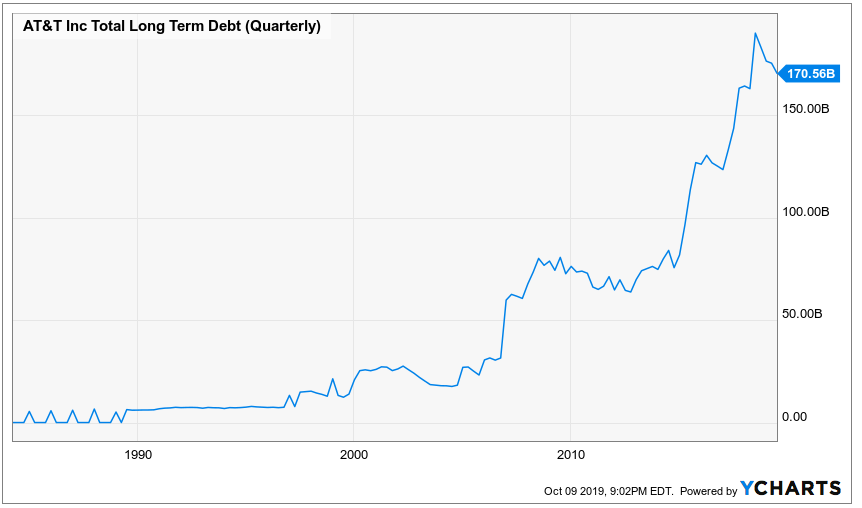

–Below is a twitter chart from @michaelbatnick showing the explosive increase in debt for just one company, AT&T. It shows an increase from around $60b in 2011 to $170b currently. These guys make the federal gov’t look downright miserly (Fed debt has only doubled since 2009).