Relief that Powell wasn’t more hawkish

May 2, 2024

*************

–Yields fell as Powell’s press conference progressed. The FOMC statement cited a “lack of further progress toward the Committee’s 2 pct inflation objective.” However, balance sheet run-off was trimmed from $60b per month of treasuries to $25b, more than expected, while MBS remains at $35b. Powell sought to characterize the QT slowdown as a step to prevent repo rates from experiencing a surge, but the market apparently took it as a step toward ease. On the SOFR curve, SFRU4 +4, U5 +13.5, U6 +11.5 and U7 +10.0 (9483.5, 9558, 9589.5, 9598.5, with U7 being the peak price on the strip). In treasuries, 2’s rejected the pop over 5%, falling 10.4 bps to 4.937% while tens fell 9.1 to 4.591%.

–Powell described current policy as restrictive / weighing on demand. Rate futures slightly lower this morning.

–Buyer yesterday (adding) 50k SFRZ5 9475/9425/9375p fly for 5.0. Only -0.02 delta. Same in U5 settled 4.5 (was 4.5/5.0). Same in M5 and H5 settled 5.0. No benefit from roll. Also a short cover of SFRU4 9462.5p, paying 4.75 to 5.0 before the Fed. Open int fell 38k, settled 4.0.

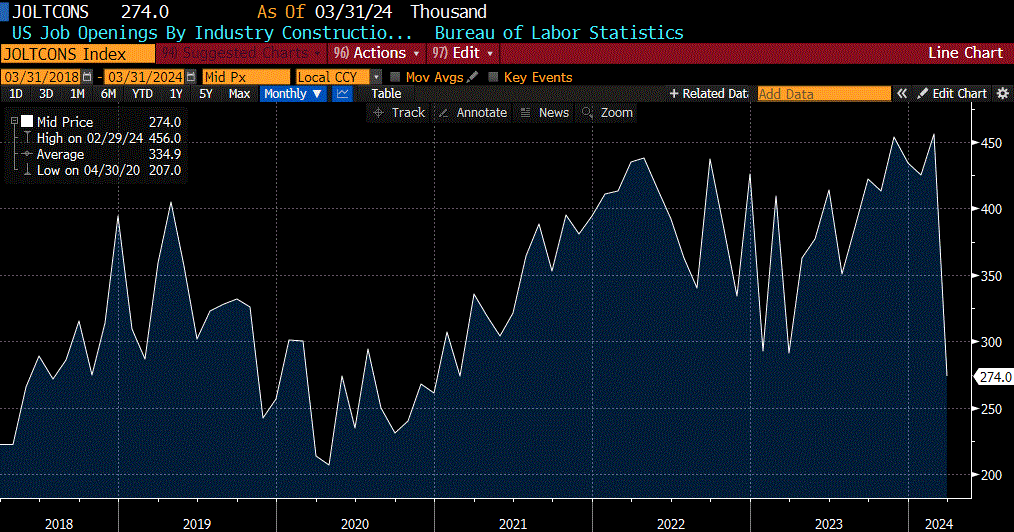

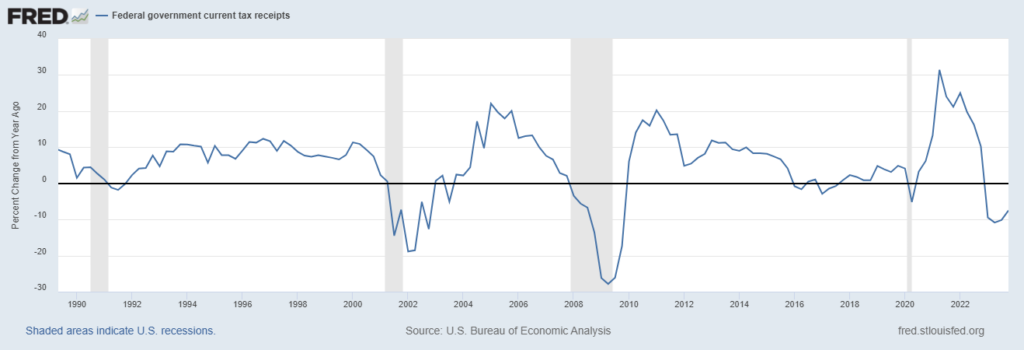

–ADP yesterday was slightly higher than expected at 192k. JOLTs only 8488 vs expected 8680 (chart of Construction Job Openings attached). ISM Mfg 49.2 while prices paid soared to 60.9 from 55.4 expected. New Orders 49.1 vs 51 exp. The other chart is pct change from year ago Federal Tax Receipts. When this goes negative, as it is now, we’re in recession. Treasury’s refunding announcement revealed more than expected issuance of about $40b on the quarter due to less than expected taxes. So the Fed is shaving supply by $35 billion a month while treasury adds about $13b per month ($13b more than expected).

–Japan intervened, likely adding some weight on treasuries. Today’s news includes Jobless Claims and Factory Orders. NFP tomorrow expected 243k. AAPL reports today; the stock has been in a steady slide since February.

% chg year over year tax receipts above

CONSTRUCTION JOB OPENINGS below