Rates plunge

December 14, 2023

******************************

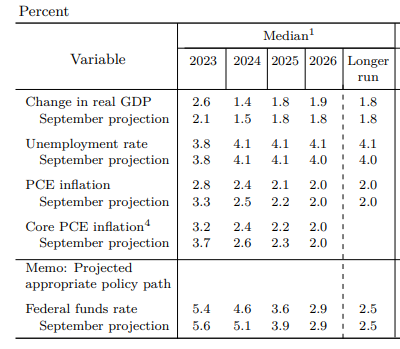

–Monster rally in rate futures resulting from the Fed’s rate cut projections embedded in the dot plot. The FF projection for year-end 2024 was 4.6% in June, then jacked up to 5.1% in Sept and slashed back down to 4.6% yesterday, representing three 25 bp cuts next year. It was shortly after the Sept FOMC that tens tested 5%. Now we’re at 4%. Gundlach said yesterday afternoon: “I would guess that we will see the 10-yr treasury yield in the low threes sometime next year.” This morning I saw a Bill Gross response tweet, “Forecasts of 3% 10-yr in 2024 are farcical. If FFs rest at 3% then 10 year avg term premium of 1.1 indicates at 4% that we are there.”

Farcical! And it was a bit like a farcical aquatic ceremony. Hey Powell, Milei is slashing government and Central Bank jobs in Argentina, NOT in the US! Today we have Lagarde. An article on Reuters features these bullet points:

Lagarde seen pushing back against rate cut bets.

End of bond buys may be brought forward.

Powell did not push back…and Lagarde is on the same script as Powell.

We’re right back to the model of letting inflation occur in financial asset prices (and gold! up $50/oz), rather than goods and services.

–Core PCE inflation was cut to 2.4% at end of 2024, from 2.6%. If we accept the dots, 4.625% FF against 2.4% inflation is still very restrictive. And I certainly think the 4.1% estimate for unemployment will prove to be low.

–Around the futures settle, the 2y was down 27 bps to 4.462% and tens were down 19 bps to 4.018%. Perhaps notable is that the ten-yr inflation indexed tip yield broke decisively under 2% ending at 1.846. Again, it was shortly after the Sept FOMC that the 10y tip yield surged over the 2% barrier to 2.5% a level unseen since the GFC. It held above 2…until yesterday.

–On the SOFR curve near one-yr calendars made new lows as reds led to the upside. SFRZ3/Z4 collapsed by nearly 30 bps to -145.25 as Z4 surged 31, the biggest gainer on the strip. SFRH4/H5 dropped 15 to -141.5 (9494.0/9635.5). M4/M5 was little changed at -119, with front June rallying an astonishing 25 bps to 9535.5 while M5 jumped 26.5. Just to put in perspective, the rate on SFRM4 is 4.645%, already at the END-OF-YEAR dot forecast. SFRM4 9537.5 straddle settled 60.5 (b/e 9477 and 9598.0). There was a huge early block buy of 45k SFRM4 9612.5c for 8.5 covered 9514.0 with 17d. Those calls settled 12 vs 9535.5, slightly underwater if hedge was kept. SFRM4 9637.5c settled 9.0 (100 out) and 9437.5p settled 2.0. Focus is obviously skewed to the upside.

–Retail Sales today expected -0.1%. Jobless Claims 220k.