Push and pull on the Fed’s timetable for ease

January 18, 2024

******************

–Price movements continue to be outsized. For example, on Jan 10, SFRZ4 settled 9608. On Friday the 12th, the settle was 9637.5, 29.5 bps higher. Yesterday’s settle was 9609, a round-turn of over one-quarter percent in a few days. The overall theme of the last several days seems to be that the Fed is now gently pushing back on the idea of a Q1 ease, but option flows are overwhelmingly hedging or speculating on fairly aggressive cuts. For example, yesterday there was a buyer of over 30k SFRJ4 9543.75/9568.75/9593.75c fly for 3-3.5. Settled 3.5 ref SFRM4 9533.0. From the standpoint of futures settle, it seems quite reasonable as the lower strike is only 11 away from the bottom strike. However, the yield on that strike is 4.56%, just over ¾ percent lower than the current Fed Effective.

–Yesterday’s Retail Sales and Ind Production slightly stronger than expected. Today we have Jobless Claims, Housing Starts and Philly Fed Mfg. The latter was -10.5 last, expected -7; we’ll see if it mirrors the plunge in the Empire State survey.

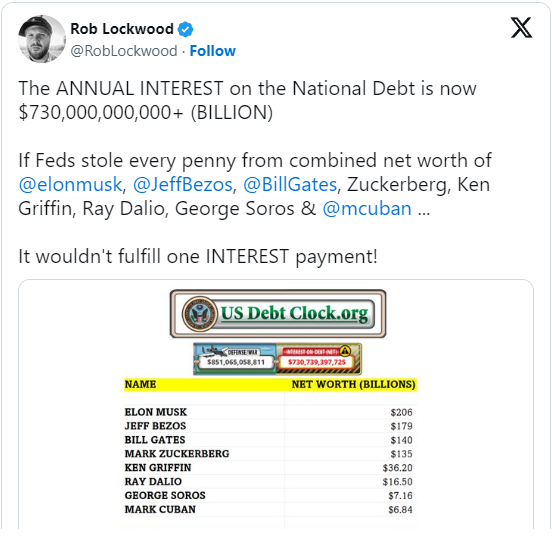

–Stephanie Kelton, the driving force behind MMT is fond of saying that the US gov’t budget isn’t at all like a household budget. I agree, as the gov’t numbers are staggeringly large. However, this little tidbit captures the gargantuan parameters of gov’t (and why “tax the rich” has lost even a slender thread of connection with “paying their fair share”).