Projecting

Weekly comment – December 22, 2024

*****************************************

As mentioned in Friday’s note, I think Q4 2024 has marked a huge turning point. My focus is on liquidity and a tightening in financial conditions, punctuated by the dramatic rise in yields since the Fed’s initial 50 bp FF cut in September. The 30-yr yield has gone from 3.93% on Sept 16 to 4.73% Friday, a rise of 80 bps. Of course, from last December 2024 to the high in April, almost the exact same yield jump occurred, from 3.95% to 4.81%, a slightly larger surge of 86 bps. But that move wasn’t accompanied by an aggregate cut of 100 bps in Fed Funds. DXY also powered higher in Q4, from nearly 100 in late Sept to a new high for the year 108.40 on Thursday. Even the vaunted equity market reacted to the Fed’s admission that inflation is more stubborn than originally thought, with NDX taking a 4.5% tumble after last week’s FOMC. On the other hand, when the 30y hit 4.81% in April, NDX eased to 17000; it’s now 25% higher at 21290.

Political tumult has made market moves seem relatively tame, with Trump’s election sparking government collapse throughout the world. Up next, Trudeau. Amazingly, gold has had a muted response, from 2580 on 9/16 to 2620 Friday. It’s a different story for Bitcoin, from 60k to 100k.

The most important event last week was the Fed’s tacit swing back to inflation as the most important mandate. Projections for PCE inflation jumped from September to December, while the UE rate projection was trimmed. My guess is that the pendulum will swing back to employment as the No. 1 concern, probably by mid-year. Financial Stability might also press its case for official mandate status.

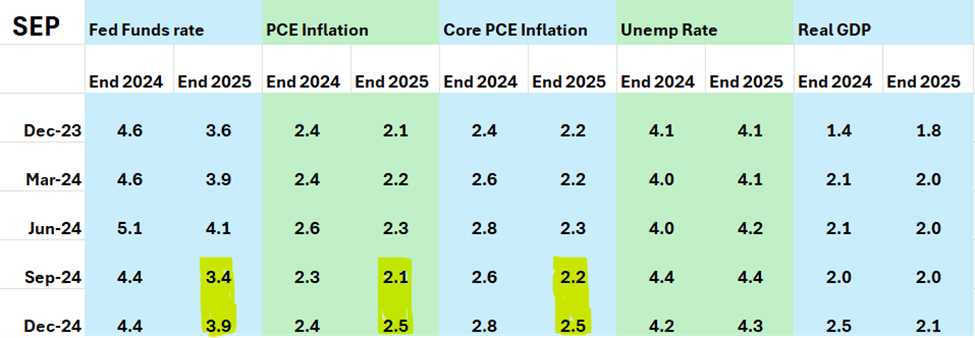

The table below is created from the Fed’s Summary of Economic Projections. There are a few things to notice, but the most glaring are highlighted in yellow: changes for end-of-2025 forecasts regarding Fed Funds and inflation. FF’s are up 50 bps from the September projection (3.4% to 3.9%) and inflation measures are up 3 to 4 tenths, with both headline and core now projected at 2.5%.

Moving from left to right, in the FF columns, the Fed had pretty much penciled in a cut of 100 bps in 2025, except for March which only had a 75 bp projection. For example in Sept, the Fed estimated 4.4% for the end of 2024 (correct) but 3.4% for end of 2025. However, it’s now just 50! (4.3 to 3.9). End-of-2025 inflation guesses were steady until last week’s jump which now forecasts a significant delay in reaching the goal of 2% inflation. The unemployment rate and GDP are relatively stable for 2025, but UE went down 1 tenth and GDP up 1 tenth in the last SEP. In my opinion, that’s a nod to the idea that the new administration is going to try to run things just a little bit hot.

The other thing perhaps worth mention regards the ‘neutral rate’. If the unemployment rate and real GDP are relatively stable, (as is the case in 2025 projections) then I think it’s fair to say that FF minus PCE inflation is the neutral rate. In Dec of last year 1.5, in March 1.7, in June 1.8 in Sept 1.3 and at the last FOMC 1.4. So maybe 1.3 to 1.4 runs things warm and 1.5 to 1.6 is neutral. Fed officials often seem bewildered when asked to identify the neutral rate, but it’s right there in the table. Most recent CPI is 2.7%, with PCE 2.4% and PCE Core 2.8%. FF effective is 4.33%. SOFR is 4.30%. So we’re currently 4.3 – 2.6 or 1.7%. It can be argued that we’re at neutral NOW.

On September 10, SFRZ5 settled at the high of the year 9720. On Friday it settled 9599.5, a jump in yield of 120 bps. The current level is only 30 bps below SOFRRATE. It’s more-or-less in line with the Fed’s most recent projection of 3.9% for end-of-year FFs. Is it “right”? To be determined. I would also note that on Friday, every SOFR contract from December 2025 to December 2028 settled between 9599.5 and 9603, right around 4%. As I wrote Friday, in September the reds (second year forward) were all around 2.8- 2.9% in yield. If you think that a higher discount rate applied to forward earnings is a negative headwind for asset prices, then it’s right to exhibit a modicum of caution. If you think that deregulation, lower taxes, and on-shoring of US manufacturing is a gale-force tailwind that will overwhelm a few bps of higher rates, then just stick with the advice that every ‘wealth manager’ repeats (as if recent history has increased their respective IQs by the same percentage as AI stock gains): Buy more.

OTHER THOUGHTS/ TRADES

The new Fed Effective rate of 4.33% is below every treasury yield except the 2y which ended Friday 4.314%. It’s 20 bps below tens (4.526%).

FFF5/FFG5 settled -2.0 (9567.5/9569.5). The next FOMC is Jan 29, so if the Fed were to ease at that time, FFG5 would go to 9592 or 4.08% Fed Effective. Clearly, the market is anticipating a ‘skip’. What is somewhat surprising is FFG5/FFJ5 spread at -12 (9569.5/9581.5). Both Feb and April are ‘clean’ months, i.e. no Fed meetings. March FOMC is 3/19. As of now, the market is pricing near 50/50 odds of an ease in March. I would think that spread would be more appropriately priced around -7. Also, at 9569.5 FFG5 has 2.5 bps of likely risk. January covers the inauguration and the FOMC meeting. Ukraine just rammed drones into a high-rise building in Kazan. A missile from Yemen penetrated Tel Aviv. The US has unexplained drones buzzing around cities and military installations. Is long FFG5 a worthwhile insurance policy? Not sure, but I’ve seen (and done) worse things.

A couple of weeks ago I recommended buying USF 118/116.5/115 p fly for 10/64s. At the time USH5 was 120-05. My thought was that USH5 could retrace lower, to around the middle strike of the fly. Good example of the right idea with the wrong vehicle. The market sold off so quickly that the fly settled Friday at 16, with USH5 now under the bottom strike at 114-16. Expiration is Friday. I had also suggested buying TYH 108/115 strangle for 30 as I thought treasury vol was underpriced. On Friday the strangle settled 50 ref 108-195. Needs to be delta hedged or exited.

Regarding SFRZ5, on Nov 14 there was a seller of about 50k Z5 9600p at 37 ref 9614.5. There’s nothing tremendously special about this trade; I just mention it due to the 2025 ‘dots’. Just prior to the sale, Z5 9612.5 atm straddle was 90, and it immediately fell to 88.5. By Dec 6, the contract was 9629 and the 9600p was 29.0. On Friday the contract settled 9599.5 and the put 39.0. The atm straddle is now 77.5. According to the current SOFR setting, (equal to 9570) that put short should be safe. Equidistant 9675c and 9525p settled 16.75 and 12.75, so there’s a bit of upside skew, but not nearly as much as there had been a couple of months ago. The question is, can the market possibly start tilting towards the idea of hikes rather than cuts in 2025?

I’m not making projections. Just considering possibilities. I think the range of scenarios for 2025 is enormous. Happy Holidays!!!!!!!

Treasury auctions this week:

MON 2y, $69b

TUES 5y, $70b

THUR 7y $44b

| 12/13/2024 | 12/20/2024 | chg | ||

| UST 2Y | 424.9 | 431.4 | 6.5 | |

| UST 5Y | 425.2 | 438.0 | 12.8 | |

| UST 10Y | 439.9 | 452.6 | 12.7 | |

| UST 30Y | 460.3 | 471.8 | 11.5 | |

| GERM 2Y | 207.1 | 202.7 | -4.4 | |

| GERM 10Y | 225.7 | 228.5 | 2.8 | |

| JPN 20Y | 184.1 | 185.5 | 1.4 | |

| CHINA 10Y | 178.2 | 171.8 | -6.4 | |

| SOFR H5/H6 | -30.0 | -20.5 | 9.5 | |

| SOFR H6/H7 | -3.0 | -1.0 | 2.0 | |

| SOFR H7/H8 | -0.5 | 1.0 | 1.5 | |

| EUR | 105.01 | 104.30 | -0.71 | |

| CRUDE (CLG5) | 70.82 | 69.46 | -1.36 | |

| SPX | 6051.09 | 5930.85 | -120.24 | -2.0% |

| VIX | 13.81 | 18.36 | 4.55 | |

| MOVE | 85.66 | 90.41 | 4.75 | |

This material is not a research report prepared by R.J. O’Brien & Associates LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. You must be in possession of a functioning brain.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. Copyright 2024. Alex Manzara