Projected easing

March 24, 2023

–Here we go again. Yields cratered with short maturities leading. On the SOFR curve SFRZ3 rallied 27.5 bps to a price of 9610.5 or 3.895%. 120 bps lower in yield than the just-released 2023 Fed dot of 5.1%. Banking issues remain at the forefront, with Yellen’s tepid guarantees of deposits falling short of instilling confidence. The 2y note sank 16.4 bps to 3.806%. The highest settle for SFRZ3 was 9616.5 last Friday. It currently trades 9623.

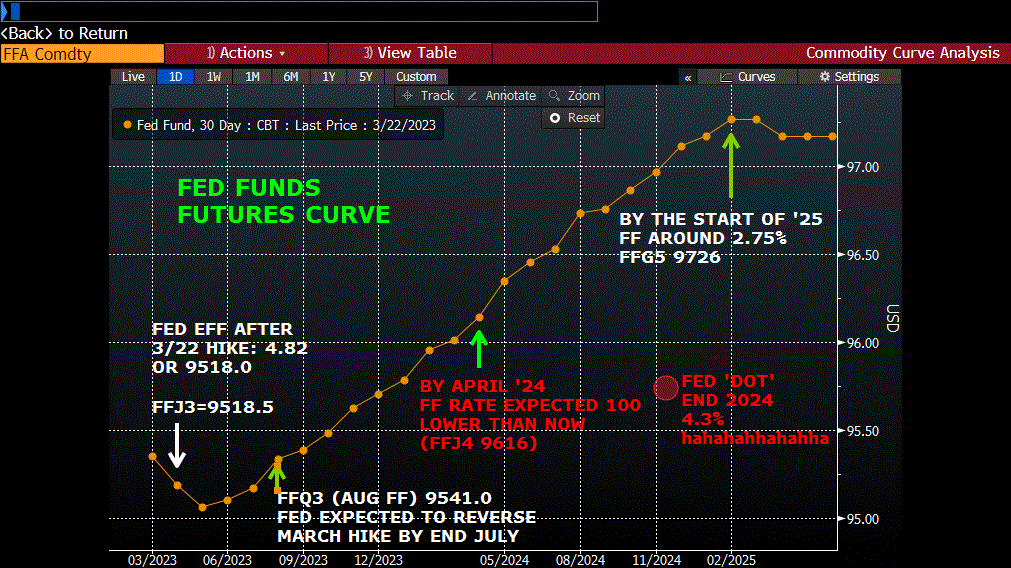

–I’ve attached a plot of Fed Funds futures prices. The upward slope indicates a consistent expectation of ease. (And the chart was out of date as soon as I printed it as prices rallied further). FFJ3 settled 9519 or 4.81%, within a couple of bps of the new EFFR. FFQ3 (August) settled 9551 or 4.49%, a spread of -32 to April, indicating a full reversal of this week’s hike, and then some. The April’24 contract, one year from now, settled 9640.5 or 3.595%, almost 125 bps lower in yield than the current EFFR. The peak FF contract is the last one listed which has any open interest, Feb’25 at a price of 9739.5 or 2.605%. Worth noting that the 2024 Fed dot was 4.3%, and FFZ4 settled 9724.5 or 2.755%, more than 150 under the Fed’s projection. So…if the local bank now has to offer CDs over 4% in order to cover vanished deposits that swooshed over to Chase or BofA, might as well lock it in. Yellen’s got your back. Sorta.

–Unsurprisingly, the 30y yield was unchanged yesterday as the curve steepened, with a yield of 3.68%. Perhaps as Japan closes the fiscal year, some selling of long-dated US paper is occurring. Perhaps the Fed’s renewed balance sheet expansion is engendering thoughts of renewed inflation. Maybe term premium is coming back into play. Today is April Treasury option expiration. Peak open interest in April TY calls is the 116 strike with 38k open and 22/64 settle. TYJ 116p settled 23 and has only 5k open; peak OI is the worthless 112.5p with 96k expiring. On the US side, nothing stands out except for 17k open in 129 puts, which settled 1 ref 131-25.

–SOFR straddles are back to being 8-10 bps wide bid/ask. Early yesterday it started to feel like things were tightening up and getting closer to ‘normal’ but the end of the day was more panicky. Lowest one-yr SOFR calendar is June’23/June’24 at -143 bps (9539.5/9682.5).