Poco a poco? Not any more

November 17, 2024 – weekly comment

*****************************************

This note is not about the market, but about the realignment of incentives.

I think this clip of Nayib Bukele, President of El Salvador, crystallizes the inflection point where we now find ourselves.

https://x.com/nayibbukele/status/1846375736308887723

In summary Bukele’s advisors said:

“You know that you can’t eliminate crime all at once, right?” Bukele asked, “Why?” Because the money the criminals make is recycled into the legitimate economy. “All of that economic activity will fall all at once, without a legal, parallel economic structure to replace it at the same speed. He [the advisor] said “you need to stop crime little by little (poco a poco) so that poco a poco you can offset that criminal economy.”

Bukele: ‘These are the kinds of theories that sound good to intellectuals but don’t apply in reality. The reality is that crime is crime. Punto. (Period).’

Bukele goes on to talk about incentives for the youth. “We’ll never be able to win the war of incentives. We found out the only way was to go after the gangs and arrest them. Not to punish them, but to remove them from society. They have to be out of the equation.” “So this young man [in his example] now thinks about his new incentives and says: ‘What should I do? Be a gang member and end up in prison, or should I get to work and earn money that now nobody [the gangs] will take from me?’ The point is that the incentive structure becomes right for society.”

“We understand we’ll pay an economic price for eliminating crime. …The alternative is to do nothing. …Our calculations – not from our financial cabinet, but from within our security cabinet – were that we would have a cost of 10% of our GDP. GDP would fall by 10% to eliminate crime. But our GDP didn’t fall by 10% it GREW by 3.5%.”

A good plan violently executed now is better than a perfect plan executed next week.

General George Patton

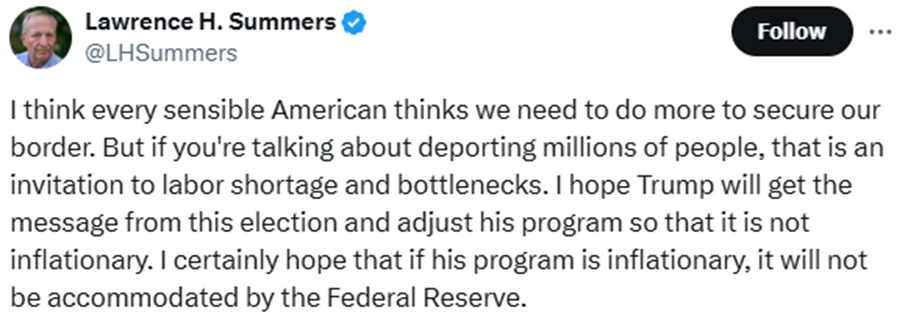

Here’s a typical response from the “intellectuals”:

I’m not personally on board with the idea of mass deportations. But it’s NOT because I am afraid it could be slightly inflationary. I think Summers’ argument is pretty stupid. The point is that INCENTIVES are changing, not only with respect to illegal immigration, but across the spectrum. Slow and sensible are out. There will be wrenching changes.

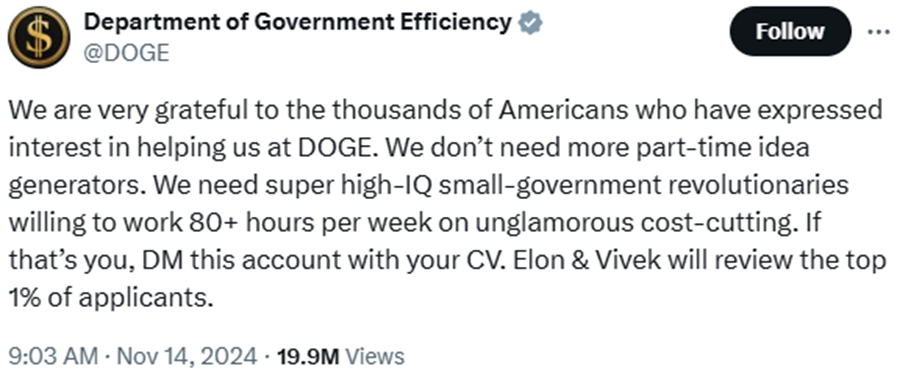

Consider this X post from DOGE:

https://x.com/DOGE/status/1857076831104434289

Notice what they did NOT say: “Go to this site and fill out an application. We’ll review your education credentials, mindful of our diversity goals, etc.” What they want: RESULTS. High IQ hard workers who share a vision. I doubt they care about anything else.

It’s like one of my favorite scenes in Ghostbusters, where Dr Ray Stantz (Dan Akroyd) tells Venkman (Bill Murray). “Personally I like the university, they gave us money and facilities. We didn’t have to produce anything. You’ve never been out of college. You don’t know what it’s like out there! I’ve worked in the private sector. They expect results.”

https://www.youtube.com/watch?v=RjzC1Dgh17A

I’m not saying it’s good. I’m not saying it’s bad. But there is a new reality to adjust to.

Bukele, Millei, Musk, Trump. Disruptors. The old order is obsolete. There are many legacy columnists and authorities demeaning Trump’s choices for important posts. I googled “editorials condemning Trump’s choices for policy roles”. Starts with NY Times (of course) ‘Reckless Choices for National Leadership’. They’re all there. Wash Post, LA Times, Vox, etc. Michael Bloomberg warning on RFK. Shrill admonitions on Gabbard. The key word is ‘legacy’. You lost. Your authoritative proclamations will now just bounce around sidelined echo chambers like the 4B movement.

The change in incentives already has created initial winners and losers in markets. Gone is the ‘participation trophy’. Passive investing might fall by the wayside. Banks soared. Big pharma was crushed. Bitcoin’s a winner. Gold’s a loser (for now). A friend had mentioned that the Defense Dept was already shifting funding and emphasis to smaller, more nimble companies working on drones, cybersecurity, etc. That dynamic will surely accelerate. In terms of rates, a new burst of entrepreneurial energy argues for higher base rates (in my opinion). In the short term, perhaps there will be economic pain as government transfers to households and the private sector are cut. The bar for Druckenmiller’s ‘hurdle for capitalism’ will probably be set to a higher standard. That means higher rates / higher neutral.

OTHER THOUGHTS / TRADES

Government hiring and spending has been an undeniable prop for stocks since covid. The broad equity market has also been supported by the idea of less restrictive forward rates. Both of those tailwinds are in jeopardy. Last week Powell indicated the Fed could take more of a wait-and-see posture given the resilience of the economy and balance in the labor market.

The green sofr pack, 3rd year forward, ended Friday at 9617.25, nearing 4%. It’s down 99 bps since Sept 10, just prior to the FOMC. Chart below.

The election surge in SPX retraced by exactly half (Nov 4 low 5696 to Nov 11 high 6017, halfway is 5857; Friday’s close 5870). It wouldn’t be surprising if stocks correct lower due to perceptions of renewed restriction by the Fed, and the realization that reduced gov’t spending will negatively impact GDP. Such a move might provide temporary support for fixed income, but the trends of a more normal positively sloped curve and funding rates that stay high relative to the past decade are likely to persist.

| 11/8/2024 | 11/15/2024 | chg | ||

| UST 2Y | 425.0 | 429.5 | 4.5 | |

| UST 5Y | 419.0 | 429.4 | 10.4 | |

| UST 10Y | 430.4 | 442.4 | 12.0 | |

| UST 30Y | 447.6 | 459.7 | 12.1 | |

| GERM 2Y | 218.5 | 212.2 | -6.3 | |

| GERM 10Y | 236.7 | 235.6 | -1.1 | |

| JPN 20Y | 183.1 | 188.4 | 5.3 | |

| CHINA 10Y | 210.7 | 207.3 | -3.4 | |

| SOFR Z4/Z5 | -60.5 | -57.0 | 3.5 | |

| SOFR Z5/Z6 | -7.5 | -5.5 | 2.0 | |

| SOFR Z6/Z7 | -2.0 | -1.5 | 0.5 | |

| EUR | 107.20 | 105.36 | -1.84 | |

| CRUDE (CLF5) | 70.11 | 66.92 | -3.19 | |

| SPX | 5995.54 | 5870.62 | -124.92 | -2.1% |

| VIX | 14.94 | 16.14 | 1.20 | |