Unhinged

December 4, 2023

*******************

–Attacks on a US warship and commercial vessels in the Red Sea sparked huge volatility in gold. Dec Gold is currently nearly unchanged at 2069, but made a new high of 2130 and has had a range so far of $69. Bitcoin also exploded higher but is holding gains above 42k, high since April 2022. I would suspect that these moves support a steeper US curve.

–In any case, SFRZ3 currently trades 9463.5 after having printed 64.75 Friday. Going into option expiration on Dec 15, 2 days after the FOMC, open interest is as follows:

Z3 future 1.49 million.

9462.50c 429k

9468.75c 419k

9475.00c 495k

9462.50p 325k

9456.25p 289k

On Friday before the settlement, Z3 9468.75c were 0.5/0.75. If a market as large as gold can experience wild volatility, then Z3 also has a chance to become temporarily unhinged.

–On Friday near calendars imploded, as SFRZ4 was the strongest contract on the strip at 9601, +21.5 on the day. Z3/Z4 fell nearly 20 bps to -137. H4/H5 barely held on to its status as the most inverted 1-year, falling 11.5 to -137.0 (9491/9628.5). Powell’s tepid comments suggesting risks are balanced between more tightening and more ease convinced the market that the next move is a cut, and the timing of that move was pushed forward, right into JP’s face.

–With just ten trading sessions to go, 0QZ3 9600 straddle settled 31.5 vs Z4 at 9601. Prior week atm 9550 straddle was 25.5.

Gimme Three Steps

December 3, 2023 – Weekly Comment

****************************************

I was cuttin’ a rug

Down at place called The Jug

With a girl named Linda Lou

When in walked a man

With a gun in his hand

And he was looking for you know who…

As everyone knows, there was an explosive bond rally in the past week. All I could think of is the shorts making this request to the margin clerks (like Ronnie Van Zant in the Lynyrd Skynyrd song):

Gimme three steps, gimme three steps, mister

Gimme three steps towards the door?

Gimme three steps, gimme three steps, mister

And you’ll never see me no more

Star performer on the week in rate futures was SFRZ4 which sprinted nearly half a percentage point to settle Friday at 9601.0 or 3.99%. Even though SFRU4 saw some of the largest outright futures and options trades and closed +47 on the week, I’ll summarize by the day using SFRZ4:

Monday: New Home Sales and Dallas Fed Mfg weak. Poor 2-yr auction was immediately followed by a solid 5-yr. Buyer of 50k SFRU4 9700/9800cs for 5.75 to 6.0

SFRZ4 +6.5 to 9558.0

Tuesday: Fed Gov Waller suggests “…the Fed could lower the policy rate just because inflation is low.”

White-lung respiratory issues are spreading through China and parts of Europe.

SFRZ4 +15.5 to 9573.5

Wednesday: Bill Ackman says the Fed may cut in Q1. Huge block buys in SFRU4, 70k.

SFRZ4 +14.5 to 9588.0

Thursday: PCE prices moving in the right direction. Core PCE yoy 3.5% but WSJ’s Timiraos notes the six-month annualized rate is 2.5%, near the Fed’s 2% target.

SFRZ4 -8.5 to 9579.5

Friday: Powell does NOT protest easier financial conditions, and echoes Timiraos on the six-month Core rate of 2.5%.

SFRZ4 +21.5 to 9601.0

Instead of a hard push-back against rapidly easing financial conditions, Powell chose a balanced message, which the market interpreted as “Fed’s done, when’s the first ease?”

BOOM! Net gain 49.5 in SFRZ4 on the week from a rate of 4.5% to 4%.

Now, I know that some of you might not feel like an old song from the Southern Rock era appropriately captures this week’s market dynamics. I just got it stuck in my head and couldn’t get it out. In a nod to today’s environment of diversity and inclusivity, I’m glad to provide an alternative from The Allman Brothers:

Well, I’ve got to run to keep from hidin’

And I’m bound to keep on ridin’

And I’ve got one more silver dollar

But I’m not gonna let ’em catch me, no

Not gonna let ’em catch the midnight rider

Maybe this one IS better, as Dec Silver ran over 14% from the Nov 10 low of 22.28 to Friday’s settle 25.499. Gold was up 7% from the Nov 10 low. Charlie Daniels:

And if you win, you get this shiny fiddle made of gold

But if you lose, the devil gets your soul

Ok. Enough with the southern rock lyrics, right?

It’s worth noting that on Friday, November 24, the midcurve Dec straddle on SFRZ4 settled 25.5 vs 9551.5 (0QZ3 9550^, expires 15-Dec). Not too often that the straddles are so horribly wrong.

In terms of financial conditions, on the week the two-year yield fell by about 36 bps to 4.567% (marked at Friday’s future settlement). Thirties were down 19 to 4.419%. The ten-year yield was down 25.4 to 4.226 at futures settle (TYH4 110-215s), but was 4.196 late (110-28). The 50% retrace from the year’s low in April of 3.308% (after the regional bank turmoil), to the year’s high in October of 4.991% is 4.15%. 4.07 to 4.15 should serve as huge yield support/ price resistance. The BBB/Baa spread to the ten-year plunged from 169 bps at the start of October to 143 bps at month’s end. The dollar index fell over 3% in the month of November from 106.66 to 103.27. And, of course, equities surged with SPX +8.9%. Looser financial conditions could easily contribute to another round of price pressures. We’re now in the blackout period before the December 13 FOMC, so we’ll just have to wait on Powell’s press conference for a change in tone.

Near-term ease odds are represented by Fed Fund futures. After the Dec 13 FOMC there are meetings on Jan 31 and March 20. On Friday Nov 24, FFF4/FFG4 was +2.0 (9465.5/9463.5). In a week the spread flipped negative to -3.5 (9467.0/9470.5). So, FFF4 is right on top of EFFR (5.33%) and FFG4 indicates small odds of an ease. FFJ4 which encompasses both Jan and March FOMCs went from 9469.5 to 9485.0 last week. I had suggested selling Jan/April a while ago at -2 to -3. That spread settled -18.0. By the way, three steps, or a cumulative 75 bps of easing, is first reflected in the FF strip by the August’24 contract which settled 95.445 or 4.555%, which is 77.5 bps lower than current EFFR 5.33%. NOW, I’m done with the song references.

Of course, the respiratory ailment spreading from China is following the covid script fairly closely. The NY Post reports “Massachusetts is 2nd state with child pneumonia outbreak – as questions remain about virus sweeping China”, while CBS News says “Ohio ‘white lung’ pneumonia cases not linked to China outbreak or novel pathogen, experts say”. Trust the science, right?

This week features ISM Services and JOLTs on Tuesday. ADP and Unit Labor Costs Wednesday. Payrolls on Friday. NFP expected 180k while the Unemployment rate could easily tick into the 4% handle (from 3.9% last).

On Wednesday, the Fed releases the quarterly Z.1 report, with data on aggregate debt levels and Household Net Worth, for Q3. In the quarter, SPX was actually down about 3.7%. Real estate will be marked higher for the quarter. However, Melody Wright notes that 42 of the 75 metropolitan areas she tracks are down month/month even as aggregate Redfin data are higher. The Household Net Worth number isn’t closely watched by the market. However, Q2 2023 at $154.281T finally exceeded the previous peak of $152.49T which was in Q1 2022. Q3 could dip back below the Q2 22 level.

OTHER THOUGHTS

Above is 5/30 treasury spread. Typically bottoms before actual ease starts. Current level is +26 bps (4.13%/4.39%). The low in 2018 was around 20 bps, and the spike low before the Covid surge in 2020 was around 50 bps. Several analysts have noted that long bond yields could actually go UP on a new Fed ease cycle. The 50% retrace in the 30 yr yield from the year’s April low to October high is 4.33% (4.39% late Friday). Around that level I would buy 5/30 with an initial objective of 50; my stop-out level would be 10-12. I would also look at buying US put spreads if the 30y yield gets near 4.33%. Can also consider long midcurve gold SFR put spreads to express the same idea.

SFRM4/M5 one-year calendar settled -117.0. Look to sell with target -140, buy-stop close above -110. Dec/Dec settled -137 and March’4/March’5 at -137.5.

Be a simple kind of man… and go with the negative curve roll.

| 11/24/2023 | 12/1/2023 | chg | ||

| UST 2Y | 492.0 | 456.7 | -35.3 | |

| UST 5Y | 448.0 | 415.6 | -32.4 | |

| UST 10Y | 448.0 | 422.6 | -25.4 | |

| UST 30Y | 461.0 | 441.9 | -19.1 | |

| GERM 2Y | 307.1 | 268.2 | -38.9 | |

| GERM 10Y | 264.7 | 236.2 | -28.5 | |

| JPN 20Y | 149.1 | 143.7 | -5.4 | |

| CHINA 10Y | 270.6 | 268.3 | -2.3 | |

| SOFR H4/H5 | -110.0 | -137.5 | -27.5 | |

| SOFR H5/H6 | -39.5 | -26.0 | 13.5 | |

| SOFR H6/H7 | 4.5 | 9.0 | 4.5 | |

| EUR | 109.48 | 108.95 | -0.53 | |

| CRUDE (CLF4) | 75.54 | 74.07 | -1.47 | |

| SPX | 4559.34 | 4594.63 | 35.29 | 0.8% |

| VIX | 12.46 | 12.63 | 0.17 | |

Against the wind

December 1, 2023

*******************

–SFRU4 settled -7.5 at 9547.0, at the first buy level of Wednesday’s block buying spree. The final purchase price was 9555.0. This morning the contract is printing 9553.0; last Friday’s settle was 9520.5. The market synthesized Waller and Ackman’s comments from earlier in the week and essentially priced another 25 bp cut. The most inverted one-yr calendar is March’4/March’5 at -126. Last Friday’s settle was -110. SFRZ3/Z4 was -91.5 last Friday and -117.25 yesterday, a net change of almost exactly one-quarter pct.

–PCE inflation news was good with PCE yoy 3.0 and Core 3.5%. WSJ’s Timiraos notes that the six-month annualized rate for Core is 2.5%, nearing the 2% target. The question is whether that data gives the Fed confidence that inflation is going to hit its 2% goal. Powell will weigh in on that today (11:00 EST), and I suspect he will say that much more evidence is needed. DJIA made a new high for the year yesterday and other financial conditions have eased significantly, reversing factors that had supported the fight against inflation. Oil’s a wildcard, with murky prospects regarding production cuts. Powell has every incentive to lean against easier pricing.

–ISM Manufacturing this morning expected 47.8 from 46.7 last. It’s been sub-50 for over a year. Payrolls are next Friday.

Big Buyer

November 30, 2023

*********************

–Job Claims expected 218k from 209.

PCE prices 0.1% m/m vs +0.4, with yoy expected 3.0% vs 3.4% last. Core yoy 3.5% from 3.7%. Eurozone inflation printed 2.4%. Despite yesterday’s 5.2% Q3 GDP print, Bill Ackman’s comments during an interview with David Rubenstein sparked buying across the curve. Ackman said he thinks the Fed will be forced into easing earlier; the market expects somewhere around July and he thinks perhaps in Q1.

–Huge run-ups in rate contracts the past two days. SFRU4, settled 9554, +29 since Monday settle. SFRZ4 the strongest, +30 since Monday at 9588.0, SFRH4 +28.5 at 9617.0. 5yr note down around 19 bps to 4.22% and 2’s down almost 1/4% exactly to 4.643%. There were a series of BLOCK trades in SFRU4:

10k 9547

10k 9549

20k 9550.5

30k 9555

Open interest in SFRU4 was up 74.6k to over 1m contracts, now the third most on the SOFR strip. Total +121k, so almost all due to the big buyer in U4. Contract settled 9554.0 and this morning prints 53. Around 100 bps of cuts would support that price, which could well occur. However, I think Powell has every incentive to lean HARD against the market when he speaks Friday. As Waller said, the Fed would like to see more slowing in the economy (and by extension, employment) before loosening the reins of monetary policy.

–New lows in near SOFR 1y calendars. Dec’3/Dec’4 down nearly 14 bps to -125.5 and March’4/March’5 down 6 to -133. Last week the June’4/’5 spread had vied for most inverted, but yesterday it settled -119.5, actually UP 2.5 on the day and 13.5 bps higher than Mar/Mar. Price action suggests the market is moving the easing timetable forward. The most inverted 3-month calendar is M4/U4 at -36.5, pushed to a new low by the outright U4 buys. Three-month spreads below -40 are pretty hard to sustain.

A look back at the 2018/2019 playbook

November 29. 2023

*********************

Capitalism without failure is like religion without hell.

-Charlie Munger

–This is sort of funny, or maybe it’s not. I don’t really have time to do it justice but am throwing the ideas out anyway.

–This morning the Drudge Report starts with the headline: ‘Masks, Social Distancing Return to China – Europe on Alert’

Here we go again. I started to think about eurodollar call spreads that were bought in Q4 2019 in size.

–About a year ago, Nov 20, 2022, I wrote this on my blog:

“On Friday [nov 18] there was a buyer of 50k SFRU3 9700/9800 cs for 4.25 to 4.5 ref SFRU3 9615.5. Current EFFR is 383 bps.”

–What is amusing is that the same call spread, 9700/9800, 10 months forward has been bought in size this week at, of course, a much lower underlying futures level. SFRU4 settled 9538.5; U4 9700/9800cs settled 6.75. From the same blog linked above I wrote about the 2019 call spread buying. Of course at that time it was eurodollars:

In Q4 of 2018, Powell was talking tough on rate hikes. QT was proceeding at an increasing scale through 2018, and there were four 25 bp hikes in March, June, Sept and finally in December, to a peak 2.25-2.50%. Stocks slid hard in Q4 2018; the ED curve predicted ease with near calendar spreads inverted. From the end of December 2018 to the end of July 2019, FF were kept unchanged. Then there were three 25 bp eases, the last of which was October 30, taking the funds rate down to 1.50-1.75%. At that time, the Fed cited a strong labor market, inflation slightly below 2%, but weak business fixed investment and exports.

In November 2019, large buyers started pouring into 50 bp wide EDU’20 call spreads, starting with 9875/9925c spd for around 3.5 to 4.5 bps and moving up to the 9887.5/9937.5cs. It seemed odd, because EDU0 futures were stable at around 9840 to 9850. The market was expecting the Fed to remain on hold after the October ease.

–These EDU’20 call spreads were a covid play. If a new ‘pandemic’ hits the world, you’re not going to want to be short any 9700 sofr calls, I don’t care what the Fed says.

–However, the Fed isn’t talking about more hikes (well maybe Bowman is). Here’s Waller from yesterday’s Q&A according to ZH:

“If inflation continues to cool for several more months, maybe three to five months, and US central bankers feel confident it’s headed in the right direction, the Fed could lower the policy rate just because inflation is low.”

That doesn’t exactly sound like a sitting Fed Governor. It sounds more like a highly paid consultant. Or maybe a sitting governor lobbying to get on the consultant gravy train. But I digress.

–As noted by @rishisays it’s an invitation to put on the steepener, which of course, wasn’t lost on the market. Two and five year yields sank 10-12 bps, while the ten year fell just 5.2 to 4.336% and the thirty year just 1 bp to 5.522%.

–As mentioned, after the last ease in December 2018, all the trades in the short end were call spread buyers. History rhymes, as they say.

Yesterday: Buyer SFRH4 9487.5/9500/9512.5/9525c condor 1.75/20k

Buyer SFRJ4 9475/9493.75/9525/9543.75c condor 5-5.25/ 35k

Buyer SFR5 9650/9700cs 18.0/20k

This is just an example of some larger trades. On the SOFR curve the red pack was up 15.625, greens +13.625 and blues +10.

On the FF curve, the first contract at a rate below 5% is July’24 at 9503.5 (Note that after the Dec ’18 hike the Fed held steady until July) and the first contract below 4% is April’25 at 9600.5.

–Implied vol a bit higher in FV and lower in US, exactly what might be expected on a steepener that will likely cap any rallies in US relative to shorter maturities.

–News today includes 2nd estimate of Q3 GDP and Beige Book.

Lower rates

November 28, 2023

*********************

–Rate futures rallied yesterday, the ten year yield fell just over 9 bps to 4.388%. On the SOFR curve, greens through golds were +10 to 12. New Home Sales much weaker than expected at 679k (721k expected). Dallas Fed Mfg soft at -19.9. Mediocre 2y auction was followed by a solid showing in 5s, 0.5 bp through at 4.42%.

–Trade of the day was a buyer of over 50k SFRU4 9700/9800cs for 5.75 to 6.0. Settled 6.0 ref 9525.0. This trade is an add, the 9700c strike now has 190k open. New recent lows in some of the one-year SOFR calendars. The most inverted are SFRH4/H5 and M4/M5 at -116.5. Strong support at -122 to -120 in both, but closes below would signify a broader rally, especially in fives.

–Waller speaks on the economic outlook at 10:00. Powell on Friday following Thursday’s PCE inflation data. Several other Fed speakers as well this week, but Waller is probably the most important aside from Powell.

–Today’s news includes Consumer Confidence; perhaps Biden’s pep talk on the low relative cost of Thanksgiving will help. Seriously though, the price of gasoline seems to be trending ever lower, which is clearly a benefit for the consumer.

2 & 5 year auctions today

November 27, 2023

*********************

–Friday’s shortened session featured higher rates. Tens up 6.6 bps to 4.48%. SOFR contracts from March’25 to March’27 were down 6 to 6.5 bps. Rate futures up slightly this morning, regaining part of Friday’s losses. Equities marginally lower, with BBG citing China’s weaker Industrial profits, +2.7% in Oct from +11.9% in Sept (annual rates). “For the first ten months of 2023 profits fell 7.8% from the same period last year…” The Beijing Stock Exchange has ordered large shareholders to stop selling.

–But let’s talk about GOLD! GCZ3 now 2015/oz, testing a big resistance area from 2015 to 2025. WTI down 1.38, nearing $74/bbl and VIX ended at just 12.46 Friday.

–Two and five year auctions in the US today. When-issued yields were 4.92% and 4.48% on Friday. New Home Sales expected 0.723 from 0.759 last. Dallas Fed Mfg expected -17. PCE Prices are Thursday.

Loans

November 26, 2023

********************

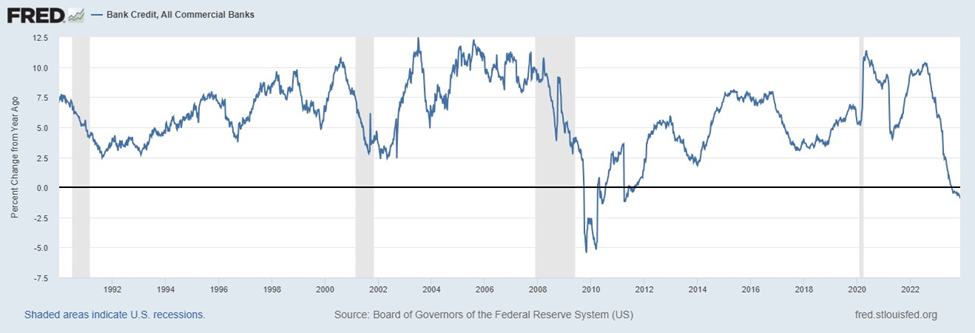

From The St Louis Fed: Bank Credit is a category on the asset side of a banks balance sheet. It is the sum of (i) Treasury, Agency, and other securities, and (ii) loans and leases.

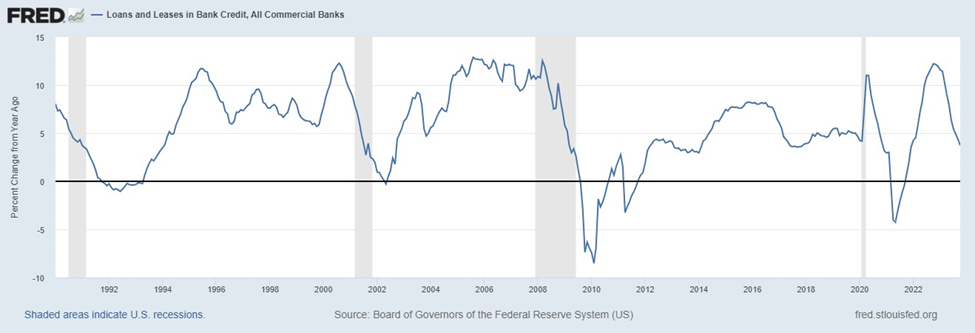

Below charts are % yoy changes from the St Louis Fed (Fred)

The top chart is ‘Bank Credit, All Commercial Banks’ last at -0.9%. Graph starts in 1990, and before now has only been negative In the period associated with the GFC.

The chart below covers the same time period but is just the ‘Loans and Leases’ part of bank credit. Obviously doesn’t look quite as dire, but has also seen a rapid drop, last at +3.7%.

In my opinion, the biggest factor going forward is the health and propensity to spend by the US consumer. I would surmise that the decline in the growth rate of loans and leases suggests a weaker rate of growth in the economy and in labor demand, to be followed by a softening in consumer spending. Q3 Chained $ GDP QoQ was 4.9% (second estimate is out on Wednesday). The Atlanta Fed’s GDPNow projection for Q4 is 2.10% and the NY Fed’s Nowcast is 2.17%.

The Nov 20 edition of Almost Daily Grants has this tidbit:

It’s the choice of a new generation: CEOs are dusting off some old-school vernacular in their communications with investors and analysts. The term “choiceful” – whether used to describe cost-conscious consumers responding to recent price pressures or their company’s own strategic actions – has appeared in 15 S&P 500 earnings calls year-to-date…up from nine mentions last year and just a pair of instances in 2021.

That adjective, which dates from the late 1500s according to the Oxford English Dictionary… resides within a category of terms “which are not part of a normal discourse and would be unknown to most people.”

Continuing:

Growing ranks of cash-strapped Americans, meanwhile, are compelled into some difficult “choicefulness” of their own. Citing data from Fidelity Investments, BBG reports that 2.3% of domestic workers tapped their retirement accounts via a hardship withdrawal to cover emergency expenses last quarter, up from 1.8% during the same period last year.

One might think that Black Friday sales are a solid metric to gauge the US consumer. However, headlines are confusing. The data from Adobe regarding ONLINE spending seems to have garnered the most attention (from Newsweek):

Americans set a new record for Thanksgiving online shopping, signaling robust economic activity despite inflation concerns, according to new data from Adobe Analytics.

Adobe Analytics reported $5.6 billion in online sales during the Thanksgiving holiday on Thursday, marking a 5.5 percent increase from last year. The figure shatters previous records and represents a near doubling of the $2.87 billion spent in 2017. Mobile sales took the lions share, accounting for $3.3 billion or 59 percent of total online sales. [not adjusted for inflation]

It’s got a bit of a cheerleading aspect to it, doesn’t it? A bit more measured take is this clip from Reuters:

Nov 25 (Reuters) – Mastercard (MA.N) Spendingpulse said on Saturday that U.S. retail sales on Black Friday rose 2.5% year-over-year excluding automotive sales, not adjusted for inflation.

And then this from BBG:

Black Friday shoppers spent a record $9.8b online in the US, Adobe Analytics reported… helped boost the day’s online sales by 7.5% compared with last year.

Consumers extended their budgets by leaning on buy-now, pay-later options, which climbed by 72% from the week before Thanksgiving.

The Buy-Now gimmick, though up a large percent, only accounted for $79 million of Black Friday sales according to Amy Nixon. So, miniscule in comparison to total sales, but a stupid idea nonetheless.

My view is that the US consumer either has or is very close to rolling over.

However, even with a tremendous amount of call spread buying in SFRH5, M5 and U5, the SOFR curve is only pricing a modest amount of ease next year (a little over 1%).

Two year and five yr notes saw the largest yield increases on the week: 2s +5.0 bps to 4.955% and 5s up 5.2 to 4.503%. The ten-yr was up 4.3 to 4.48% while the thirty year was up only 1.8 to 4.61%. On the SOFR curve SFRU4 was the weakest, down 8.5 bps to 9520.5 which bolsters the higher-for-longer theme. Another pricing clue along the same line is that the most inverted one-year sofr calendar has moved into the third slot. SFRH4/H5, the second slot, settled -110.0 while SFRM4/M5 settled -110.5. That is, slightly more easing is expected in the year from June’24 forward than March’24.

This week features:

Monday: New Home Sales. 2 and 5y note auctions

Tuesday: Consumer Confidence and 7y auction

Wednesday: Q3 GDP (second est) and Beige Book

Thursday: PCE prices. Deflator expected 0.1% from 0.4% last. YOY 3.1% from 3.4% last. Core yoy 3.5% from 3.7% last.

Friday: Mfg ISM. The Employment report is Friday, December 8.

| 11/17/2023 | 11/24/2023 | chg | ||

| UST 2Y | 490.5 | 495.5 | 5.0 | wi 492.0/915 |

| UST 5Y | 445.1 | 450.3 | 5.2 | wi 448.0/475 |

| UST 10Y | 443.7 | 448.0 | 4.3 | |

| UST 30Y | 459.2 | 461.0 | 1.8 | |

| GERM 2Y | 296.4 | 307.1 | 10.7 | |

| GERM 10Y | 258.8 | 264.7 | 5.9 | |

| JPN 20Y | 146.7 | 149.1 | 2.4 | |

| CHINA 10Y | 265.8 | 270.6 | 4.8 | |

| SOFR H4/H5 | -110.5 | -110.0 | 0.5 | |

| SOFR H5/H6 | -36.0 | -39.5 | -3.5 | |

| SOFR H6/H7 | 2.5 | 4.5 | 2.0 | |

| EUR | 109.20 | 109.48 | 0.28 | |

| CRUDE (CLF4) | 76.04 | 75.54 | -0.50 | |

| SPX | 4514.02 | 4559.34 | 45.32 | 1.0% |

| VIX | 13.80 | 12.46 | -1.34 | |

In: Eurodollar Options

Rates edge higher going into Dec Treasury options expiry

November 23, 2023

*********************

–Rates edged a bit higher Wednesday as U of Mich inflation expectations were higher than projected with 1y at 4.5% from 4.4% and 5-10y at 3.2, same as last but expected 3.1%. A Rainbow Bridge car bomb (yes, it sounds like a politically acceptable cocktail order, but was an actual explosion near Niagara Falls) was dismissed by the market, whether terror related or not. Ten year yield essentially unchanged at 4.414% while the weakest SOFR contract, SFRZ4 fell 4.5 bps in price to 9557.0. 2/10 at a new recent low -49 bps. [buy area]

–This morning yields are a bit higher going into today’s December treasury option expiration. TYZ3 settled 108-26 and is now 108-14 while USZ3 was 115-28s and now 115-00. News today includes S&P PMIs: Mfg expected 49.9, Services 50.3 and Comp 50.4. Next week’s treasury auctions are front loaded: 2y and 5y on Monday and 7y on Tuesday. Jan WTI (CLF4) had a wildly large range Wednesday over $4 (77.97 to 73.79) and is currently 76.70, down 0.40. OPEC+ meeting has been delayed by a few days.

–Turkey in the news but not the pardoned one. The central bank raised rates to 40% to support the lira. Might as well take this opportunity to look at Greece yields, as the 10y is just 3.87%, 60 bps below the US and just 122 over Germany. The yield spread at the beginning of 2012 was 3500 bps.

–I also took a look at Gold vs Palladium with the latter trading at a discount of $934/oz to the former. That’s nearing the 2012 low of 1142 discount. Of course, as a ratio, gold is now nearly 2x more valuable as palladium while at the start of 2012 it was 3x. 2012 was when Draghi uttered his famous line, “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” From that time forward, gold weakened. But there’s no Draghi on the world stage right now…

100 bps here, 100 bps there. It all adds up

November 22, 2023

********************

–SOFR option activity continues to focus on an easing campaign starting next year. Existing Home sales at just 3.79m rate, lowest since 2010, bolsters the rate cut view. Heavy buying of SFRH4 9500/9525cs vs selling 9450p (about 40k). Settled 2.25 in cs vs 3.5 in the put ref 9475.5. SFRH4 9450p now has nearly 300k of open interest, the most of any March put. If one thought the Fed might have to hike further, the 9450p is a buy candidate. More SFRM4 9600/9700c spds bought, 6 paid 20k yesterday, settled 5.75 ref 9500, so exactly 100 bps away. Open interest in this call spread is huge, 309k and 270k. In SFRU4 another 100 higher 9700/9800cs 6 paid 20k, settled there.

–SFRZ3/Z4 one-year calendar settled exactly at -100 (9461.5/9561.5) down 3.75 on the day. Most inverted 1-yr remains H4/H5 at -115.5 (9475.5/9591.0).

–A BBG piece notes that the BOJ has refrained from buying any ETFs or J-REITS this year in a sign of more normalized policy. Of course, Nikkei 225 is +30% ytd. I was thinking a bit more about Binance and bitcoin. Changpeng Zhao was forced to step down and the company ordered to pay $4 billion in fines. I would have thought more selling pressure would occur on bitcoin (I don’t think authorities will accept BTC in fines), now 36600, down around 2%.

–As mentioned, Z3/Z4 calendar exactly at -100. In SOFR options 100 wide call spreads are popular. Last one: 0QU4 9625 straddle settled 100. (underlying is SFRU5 at 9624.5, expires 9/13/24). So breakeven 9525/9725. The 9725c, 100 out, settled 19.0 with 23d while the 9525p settled 13.5 with 20d.

–Jobless Claims today expected 225k. Durable Goods and UofM inflation expectations.

Happy Thanksgiving to all.