Bang

December 17, 2023 -Weekly Comment

****************************************

Just a smattering of disconnected thoughts this weekend. I skimmed the news Saturday morning and this headline from the FT struck me:

Bang & Olufsen says it will defy luxury slowdown as ‘rich will only become richer’

Makes some sense right? It’s an old saying: “the rich get richer”. We used that on the CME floor once in a while. As stocks surge to new highs it feels like the naysayers (yes, I am tentatively raising my hand as I gaze down at the floor to avert eye contact) are all wrong. On the other hand, the BANG headline contrasts with BBG’s: Underwater Car Loans Surge to the Highest Level Since 2020. This article goes on to highlight the resurgence of the REPO man.

This voice inside my head keeps whispering, “The soft-landing crowd are IDIOTS.” (I’m not saying it out loud though).

Out on the road today / I saw a Deadhead sticker on a Cadillac

A little voice inside my head said / “Don’t look back, you can never look back”

-Don Henley, Boys of Summer

I guess it’s the repo man in an Escalade with B&O speakers, deadhead logo on the rear bumper. Business is good.

In what is perhaps a desperate attempt to cling to the idea that Federal Gov’t spending largesse is going to collapse under its own bloated weight of debt and take the economy and financial assets right along for the ride, I looked back.

I always remember riding the Metra commuter train into Chicago one morning in March and reading the WSJ article about Bear Stearns admitting that its two mortgage portfolios were nearly worthless. That was in 2007. I thought “this is it”. A stock market sell-off ensued. It lasted less than a month. Then SPX made a new high in July, followed by a sharp sell-off in the beginning of August. Here’s a snippet from cnn/money from August 16, 2007:

https://money.cnn.com/2007/08/16/markets/markets_1200/index.htm

(Aug 16, 2007) Credit worries took center stage again Thursday after Countrywide Financial, the largest U.S. mortgage lender, said it was forced to tap an $11.5 billion line of credit to offset its liquidity crunch.

Countrywide’s increasing troubles over the last few days have exacerbated fears about a global credit crisis.

After holding short-term interest rates steady at 5.25 percent for more than a year, many investors and other Wall Street pros are looking to the Federal Reserve to cut interest rates at the central bank’s upcoming policy meeting Sept. 18.

“What everyone’s waiting for now is to see what the Fed will do at the next meeting,” Yared said. “Whether they drop 25 basis points or even 50 to really soothe the markets.”

*********************

It’s all so familiar it almost sounds a bit tedious. Except that the $11.5 billion credit line sounds like pocket change in today’s world. And, in fact, the Fed DID “save the day” (S-T-D) on Sept 18, 2007, cutting the funds rate in Sept ‘07 from 5.25% to 4.75%. Here’s a clip:

NEW YORK (CNNMoney.com) — The Federal Reserve cut the target on a key short-term interest rate by half of a percentage point Tuesday to 4.75% in a bold acknowledgement that the central bank is concerned the mortgage meltdown plaguing Wall Street and Main Street could hurt the economy.

Here’s a follow-up on October 1, 2007:

Dow hits all-time high

Big blue-chip barometer hits intraday record of 14,111 as Wall Street resumes the recent advance: Citigroup warning, drop in ISM index fuels hope of Fed rate cut.

October 1, 2007 –Stocks surged Monday afternoon, with the Dow touching an all-time high above 14.110 as investors shrugged off a profit warning from Citigroup and instead focused on the possibility of more Fed rate cuts.

The broader S&P 500 index and the tech-fueled Nasdaq composite both gained 1.3 pct. The Russell 2000 small-cap index jumped more than 2 percent. [Russell surged 5% pre-FOMC to Thursday’s high last week]

“You’re seeing a continuation of the recent momentum,” said Chris Johnson, CEO of Johnson Research Group. “There was unfavorable news in the financial arena, but the market is still rallying, which tells you that investors are afraid of getting left behind.”

**********************************

Now of course, there are NO PROBLEMS with Citi and the banking system this time around. Indeed, C surged from 38 to 50 in the past month and a half! And…they’re paying bonuses to encourage staff departures. Don’t miss out! Everything is wonderful now. However, as an aside I am kind of wondering why CME stock is down nearly 6% from the Dec 4 close of 219.78 and down 2.3% last week, to 206.73. Obviously there’s a large seller taking advantage of a strong market to unload. Does someone know something? [DISCLAIMER: I am long some CME puts. And I don’t know anything except for price action] I would also note that ICE was up 8.6% last week. ZH rhetorically asks, given Powell’s green-lighting of rate cut expectations: “Is that why the Fed needed to bring rates down massively and fast, to reduce the bond losses on banks’ books?”

https://www.zerohedge.com/markets/bank-loan-volumes-shrink-deposits-rise-trouble-brewing

The below chart is an overlay of 2007 SPX against current price action. 2007 is in purple and today’s is in high/low/close format in blue. These charts almost never work. (*still gazing toward the floor). And of course, today we don’t have a mortgage crisis. What we have is a federal gov’t that has eroded personal responsibility and economic stewardship by blowing out the budget, surreptitiously transferring private household debts and obligations to the gov’t ledger and trying to represent it all as an economy that’s firing on all cylinders.

In any case. here’s the current, relatively muted characterization of things, by Investor’s Business Daily:

Stock Market Rally The Dow Jones set a record high, while other indexes set 2023 highs. Megacap techs were relative laggards, but are mostly in or near buy points. Small caps led a powerful, broad advance as the Federal Reserve signaled it will shift to rate cuts next year. Treasury yields extended big losses.

It’s possible to compare this past week’s FOMC press conference with the S-T-D rate cut in 2007. Within the space of a couple of weeks Powell shifted from “not thinking about rate cuts” to “we’re thinking about rate cuts.” It might all work out. It’s just worth a little reminder that about a month after the Sept 2007 rate cut, SPX made its high in October. Then it started to shed weight like a singing fat lady on Ozempic, and was down 46% over the next twelve months.

*************************************************************************************

Last week I wrote this:

My personal bias is to be long SFRZ4. …I would like to buy as closely as possible to the upward sloping trendline which comes in around 9567.0. Stop out 9550, target 9612 to 9625. In options, buy 0QZ3 9575/9600cs for 6 or lower on a dip. I know that I would advise Powell and the Fed to lean hawkish and that being long Z4 might not be appropriate in that case. However, Powell was balanced during Dec 1 comments, and economic data has generally softened. The market is likely to look through restrictive comments, if they occur.

SFRZ4 high last week was 9632, low was 9571. 0QZ 9575/9600cs expired at full value of 25.

My bias now is to set a short in USH4 anywhere between 124 and 125, (settled 123-27). The long end was incredibly well bid last week despite an easing schedule that was clearly brought forward. It should have been an engraved invitation to buy the steepener. However, on the week, twos fell just over 27 bps to 4.451%, fives down nearly 33 to 3.926% and thirties down an astonishing 30 bps to 402.5%. Actually, post-settlement the cash yield ticked just below 4%. My stop-out area is 127, and my target is 117-16 to 118-16.

| 12/8/2023 | 12/15/2023 | chg | ||

| UST 2Y | 472.5 | 445.1 | -27.4 | |

| UST 5Y | 425.3 | 392.6 | -32.7 | |

| UST 10Y | 424.3 | 392.6 | -31.7 | |

| UST 30Y | 432.7 | 402.5 | -30.2 | |

| GERM 2Y | 269.3 | 250.4 | -18.9 | |

| GERM 10Y | 227.6 | 201.6 | -26.0 | |

| JPN 20Y | 153.5 | 142.1 | -11.4 | |

| CHINA 10Y | 268.5 | 263.6 | -4.9 | |

| SOFR H4/H5 | -125.0 | -148.0 | -23.0 | |

| SOFR H5/H6 | -40.0 | -32.5 | 7.5 | |

| SOFR H6/H7 | 4.0 | 5.0 | 1.0 | |

| EUR | 107.63 | 108.97 | 1.34 | |

| CRUDE (CLG4) | 71.44 | 71.78 | 0.34 | |

| SPX | 4604.37 | 4719.19 | 114.82 | 2.5% |

| VIX | 12.35 | 12.28 | -0.07 | |

In: Eurodollar Options

From a minor tweak in position to GET ME OUT

December 15, 2023

***************************

–Hey wait a second…did Gundlach say he expects 10s to trade to the low threes sometime next year? Or by the end of this year? 10y yield dropped another 8.6 bps yesterday to 3.902%. That level corresponds to a 61.8% retrace from the April low of 3.31% to the October high 4.99% (=3.95%). After the jarring re-adjustment of the past couple of days, one would think this area would hold. Of course, I also had thought the 50% area, (around 4.15%) would provide strong yield support.

–On the SOFR curve, near calendar spreads made new lows as the prospect for rate cuts hurtles closer. For example, SFRH4/H5, the most inverted spread, dropped another 9.5 bps to -151 (9496.5/9647.5). Similarly, FFF4/F5 settled -149. It’s not exactly a forecast for 150 bps of cuts over the year, but it’s a fairly aggressive inversion. I was in a brief conversation about what comes next year, and it seems to me that a money spread this inverted means there will still be plenty of action. My own bias is that the curve from 2’s forward will have to slope positive next year (2/10 is currently -46) but I’m not at all confident of the path. As we like to say in this business, “Tell him the good part Mortimer!” In any case, the two week flip from “We’re not considering rate cuts” to “We’re discussing rate cuts” has sparked a firestorm of trade adjustment, and those that believed in Powell’s inflation fighting crusade were left shaken. Political? Maybe…he’s not the only one on the Fed.

–There was heavy volume yesterday and I missed a lot of SOFR option plays, but there clearly was a large exit of SFRM4 9600/9700cs. This call spread had been heavily bought (way too early) and yesterday was used as an opportunity to trim. Open interest fell 46k in M4 9600c and 70k in 9700c. The sprd settled 9.75 ref M4 9540.5. Not even sure if this was a scratch, but I think the same guy has a lot of call spreads in more deferred contracts which are doing fine. In any case, even though this wasn’t a huge trade, it sort of captures the theme. On the SOFR curve open interest fell in futures contracts within the next year, H4 -33k, M4 down 43k, U4 down 29k. The entire strip fell 77k. So shorts have thrown in the towel on fronts, and longs are willing to lighten up. The June call spread sales, as an example, tend to hold down fronts relative to deferred and M4/M5 also made a new low at -127 (M4 9540.5 +5 and M5 9667.5 +13).

–What’s a bit odd is that a spread like 5/30 didn’t rally. I marked at 14.4 at futures settle, down from 19.2 on Wednesday. Bond futures and vol were relative outperformers on the treasury curve. My sense is that it’s a gift to buy 5/30 if the Fed’s going to start easing soon, but perhaps an end to QT is going to influence the curve in unanticipated ways.

–I have to admit I was triggered first thing this morning. Nah, it’s got nothing to do with Harvard… it was a headline on Reuters:

A $6 trillion cash hoard could fuel more U.S. stock gains as Fed pivots

Total money market fund assets hit a record $5.9 trillion on Dec. 6, according to data from the Investment Company Institute

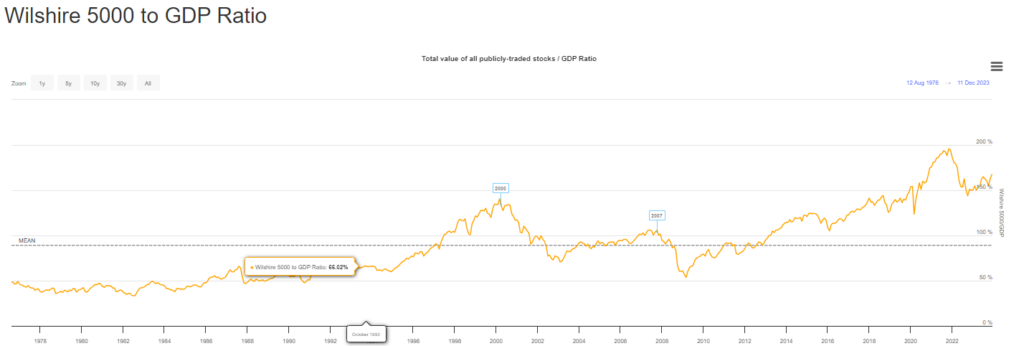

–So…money market funds are going to drain right into stocks. Makes perfect sense to JUMP IN right? Well, according to the Buffet indicator market cap to GDP, we’re not ‘cheap’. Chart attached. In the relatively high-rate years of the early 1990s, the mkt cap to GDP ratio was around 66%. Now around 160%. Maybe that money will just pour into the Hang Seng which is down around 25% from February’s highs. Of course, there are problems in China, different considerations… But there are ALWAYS other considerations. Potential money flows are but one…

https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/.

Rates plunge

December 14, 2023

******************************

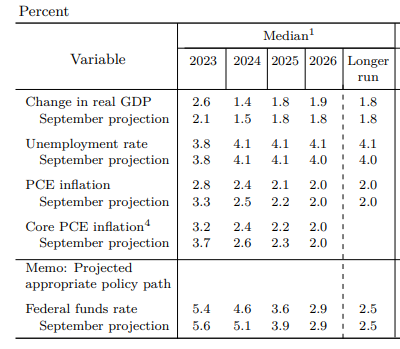

–Monster rally in rate futures resulting from the Fed’s rate cut projections embedded in the dot plot. The FF projection for year-end 2024 was 4.6% in June, then jacked up to 5.1% in Sept and slashed back down to 4.6% yesterday, representing three 25 bp cuts next year. It was shortly after the Sept FOMC that tens tested 5%. Now we’re at 4%. Gundlach said yesterday afternoon: “I would guess that we will see the 10-yr treasury yield in the low threes sometime next year.” This morning I saw a Bill Gross response tweet, “Forecasts of 3% 10-yr in 2024 are farcical. If FFs rest at 3% then 10 year avg term premium of 1.1 indicates at 4% that we are there.”

Farcical! And it was a bit like a farcical aquatic ceremony. Hey Powell, Milei is slashing government and Central Bank jobs in Argentina, NOT in the US! Today we have Lagarde. An article on Reuters features these bullet points:

Lagarde seen pushing back against rate cut bets.

End of bond buys may be brought forward.

Powell did not push back…and Lagarde is on the same script as Powell.

We’re right back to the model of letting inflation occur in financial asset prices (and gold! up $50/oz), rather than goods and services.

–Core PCE inflation was cut to 2.4% at end of 2024, from 2.6%. If we accept the dots, 4.625% FF against 2.4% inflation is still very restrictive. And I certainly think the 4.1% estimate for unemployment will prove to be low.

–Around the futures settle, the 2y was down 27 bps to 4.462% and tens were down 19 bps to 4.018%. Perhaps notable is that the ten-yr inflation indexed tip yield broke decisively under 2% ending at 1.846. Again, it was shortly after the Sept FOMC that the 10y tip yield surged over the 2% barrier to 2.5% a level unseen since the GFC. It held above 2…until yesterday.

–On the SOFR curve near one-yr calendars made new lows as reds led to the upside. SFRZ3/Z4 collapsed by nearly 30 bps to -145.25 as Z4 surged 31, the biggest gainer on the strip. SFRH4/H5 dropped 15 to -141.5 (9494.0/9635.5). M4/M5 was little changed at -119, with front June rallying an astonishing 25 bps to 9535.5 while M5 jumped 26.5. Just to put in perspective, the rate on SFRM4 is 4.645%, already at the END-OF-YEAR dot forecast. SFRM4 9537.5 straddle settled 60.5 (b/e 9477 and 9598.0). There was a huge early block buy of 45k SFRM4 9612.5c for 8.5 covered 9514.0 with 17d. Those calls settled 12 vs 9535.5, slightly underwater if hedge was kept. SFRM4 9637.5c settled 9.0 (100 out) and 9437.5p settled 2.0. Focus is obviously skewed to the upside.

–Retail Sales today expected -0.1%. Jobless Claims 220k.

Fed Day. Get ready for tough Powell

December 13, 2023

*****************************

–Not much change in yields yesterday as CPI came out essentially as expected. Headline m/m was +0.1%, yoy 3.1% and Core 4.0%. Ten year yield fell nearly 3 bps to 4.208%. The curve flattened marginally, just enough to notch a new recent low in 2/10 spread at -52.3. On the SOFR curve reds to deferred contracts also made new lows on spread, for example, the red to green pack spread settled just under -35 (9613.0/9648.125). After Friday’s expiration, the new red/green pack spread will start with H’25 and H’26 contracts and that spread settled yesterday at -17.25 as the Z4/H5 spread is -29.5.

–Moving on, the event of the day is the FOMC announcement and press conference. The last FOMC was Nov 1, where rates were held steady, and the subsequent employment report on Nov 3 was weak. Since that time, as just about every pundit has noted, financial conditions eased substantially. Below are rough levels on Friday, Nov 3 vs yesterday’s

2y 4.83 to 4.73 (10 bp drop)

5y 4.49 to 4.23 (26 bp drop)

10y 4.55 to 4.21 (34 bp drop)

30y 4.75 to 4.33 (42 bp drop)

SPX 4358 to 4643 (over 6.5% gain)

DXY above 105 to 104

HYG 74 to 76 (high yield etf, rough proxy for spread)

WTI 80.50 to 68.61

This list isn’t meant to be exhaustive, but in October, Fed officials uniformly said that tightened financial conditions likely meant that the Fed didn’t have to be as aggressive (as tens had hit 5%). The script has flipped. At the same time, the US federal gov’t is pumping out stimulus thru deficit spending — November’s budget deficit released yesterday was 314 billion. Powell almost HAS to lean against easier conditions.

Argentina’s new Economy Minister Luis Caputo said yesterday “There is no more money.” Could never happen here, right?

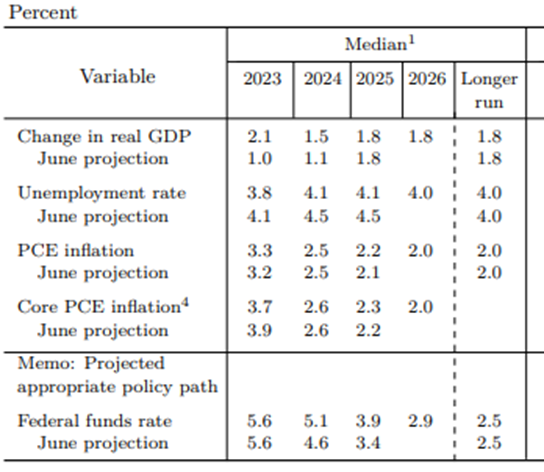

–The Sept FOMC projections for 2024 were:

Unemp 4.1%

Core PCE prices 2.6%

FF target 5.1%

My guesses are 4.3%, 2.6% and 4.9%.

–Yesterday featured continued targeted call buying. Looking for modest easing in Q1/Q2

+12k SFRJ4 9525/9550/9575c fly 3.0

+20k SFRJ4 9475/9500/9531.25 broken call fly 3.25

+5k SFRH4 9487.5/9500/9512.5/9525c cond 1.75

+5k SFRK4 9500/9512.5/9525/9537.5c cond 2.0

A Tale of Two Headlines

December 12, 2023

**********************

WSJ Headline: Underlying Inflation Could Complicate Prospect for Rate Cuts

Bloomberg lead-off headline: CPI Expected to Give Room for Rate Cuts, Bloomberg Economics Says

CPI today, rate cut deliberations tomorrow.

–CPI is expected 0.0 from 0.0. Yoy 3.1 from 3.2% last. Core yoy 4.0 vs 4.0. Thirty-year auction today, but bonds rallied after mediocre 3s and 10s yesterday.

–Trade was quiet yesterday, though there was a new buyer of 12k SFRZ4 9800c (settled 8.25 ref 9578.0) and 8k SFRH5 9800c (settled 12.75 ref 9606.5). Overall yields were little changed.

–April FF settled 9478 vs January at 9467.0. So that spread of -11 captures odds of an ease at the Jan 31 and/or March 20 FOMCs. However, January’25 FF settled 9579.0, so FFJ4/FFF5 is -101. Easing is targeted for the second half of next year, though the Fed dots tomorrow aren’t going to show anything like a drop of that magnitude for the 2024 FF projection. I’m going with 4.875% for the median 2024 dot, from 5.1% last. Given estimates of PCE prices of 2.5%, that’s still a very stingy real rate.

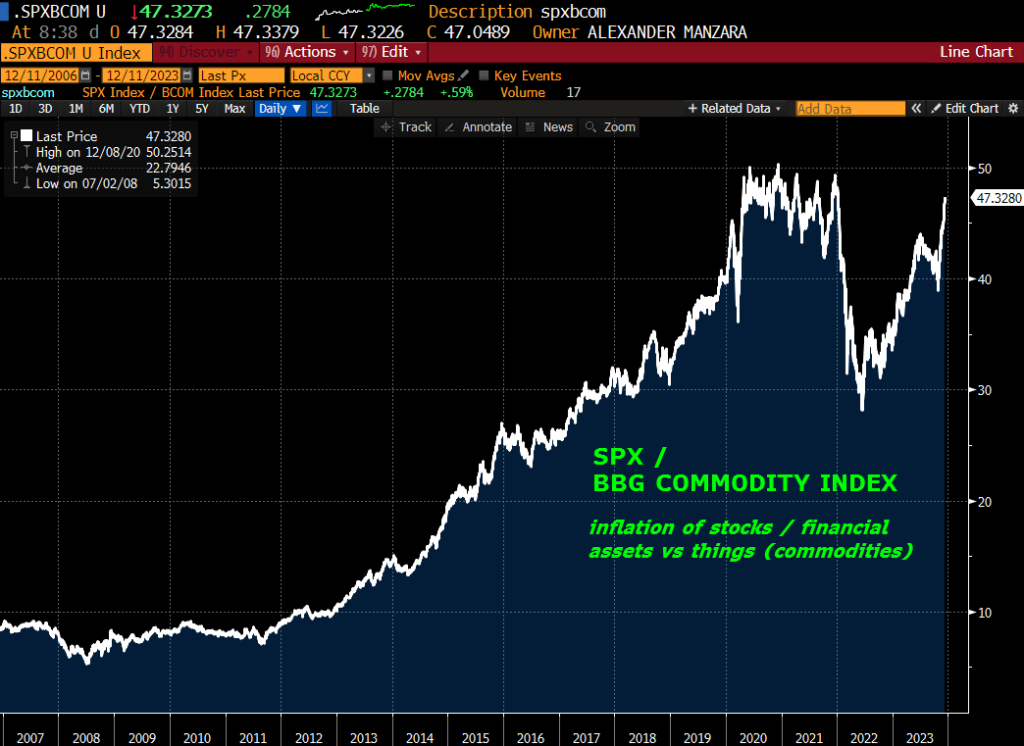

–Attached is a chart of SPX divided by BCOM. Does inflation manifest thru stocks or things? The period from 2012 to 2020 was dominated by financial market inflation as opposed to goods and services (rate repression). Covid arrested the trend, and the resulting goods inflation sparked a resurgence of commodities vs financial assets. Now this ratio appears poised to retest all-time highs, perhaps due to runaway gov’t deficits.

Life is full of trade offs

December 10, 2023 – Weekly Comment

******************************************

Last time I focused on SFRZ4 which had rallied 49.5 on the week ending Dec 1, with a final settle of 9601.0. The settle from the previous Friday was 9551.5. The midpoint between 9551.5 and 9601 is 9576.25. Friday’s settle was right there at 9576.5, a fall of 20.5 on the day, on the back of a stronger than expected employment report. NFP was 199k, the unemployment rate ticked back down to 3.7%, and Average Hourly Earnings rose 0.4% on the month.

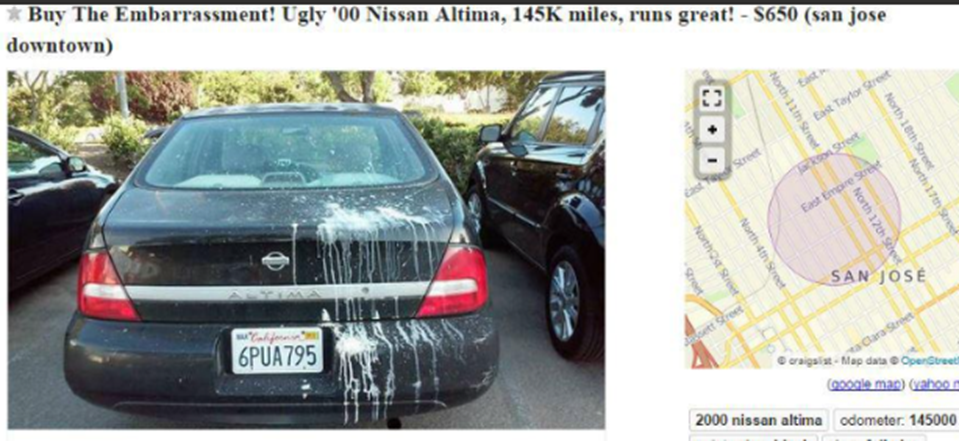

This week brings CPI on Tuesday, expected 0.0% m/m and 3.1% yoy, from 3.2% last. Core is expected 4.0 yoy, same as last. Other inflation measures have been declining, for example the 6-month annualized rate of Core PCE prices was just 2.5%, something mentioned by Powell in his comments on Dec 1, and sure to be trotted out at Wednesday’s FOMC press conference. What’s not likely to be noted is the decline in the Manheim Used Car Index. It’s down 5.8% from a year ago to 205.0. The peak at the end of 2021 was 257.7. The surge in used car prices was one of the leading indicators of inflation to come. It’s over. (See Used Car ad at bottom for reference to today’s title).

This week’s FOMC also features new economic projections. And dots. Which also brings Dec’24 SOFR into focus. In both June and September the median projection for Fed Funds in 2023 was 5.6%. We’re obviously not going to get there. Interestingly, the 2024 projection in June was 4.6% which was jacked up to 5.1% in September. Twelve of the nineteen dots were between 4.875% and 5.375% in September’s projections. In price terms, 9512.5 to 9462.5. Note that SFRZ4 at 9576.5 (4.235%) is 89 bps above the midpoint of those guesses. And that’s with projections of PCE prices 2.5% and Core 2.6%, right at the aforementioned 6-month annualized rate.

It’s likely that the 2024 FF median dots will be lowered at this FOMC, perhaps back down to June’s 4.6%. Even if that DOES occur, a price of 9537.5 (4.625%) is still well under the current Z4 price. Powell should be fighting hard against any tendencies to project easing. Even though a slowing economy and inflation (Atl Fed GDP Now just 1.2% for Q4) might ordinarily support less restrictive monetary policy, we’re going into election season. How do you bolster chances of re-election? By buying votes. Note that in last week’s Fed’l Reserve Z.1 report, the growth in Fed’l Gov’t debt was at a 12.7% rate in Q2 and 10.6% rate in Q3. Household and Business debt growth rates pale in comparison, 2.5% for HH and 1.5% for Business in Q3. Federal Gov’t spending is arguably juicing stocks. The Fed may soon have to end QT. So Powell, who has gone on the record saying that government spending is unsustainable, has every incentive to stick a finger in the dike of election spending, and to lean against rapidly easing financial conditions.

What might be appropriate market moves for a Fed that emphasizes the need to “keep at it until the job is done” with respect to slaying inflation? A rally in near 1-yr calendars, for example SFRH4/SFRH5 went from -137.5 to -125 on the week with the late sell-off in reds (9481.0/9606.0). Might also expect reds to greens to sell off a bit as the one-year forward contracts (reds) decline more in price relative to deferred. For example, SFRH5/SFRH6 went from -26 to -40 (9606.0/9646.0). Precious metals might give a nod to a slightly more restrictive posture. And indeed spot gold had a complete round turn in the past two weeks: 2000.82 on Nov 24, 2072.22 on Dec 1, and 2004.67 on Dec 8. The ten year yield more-or-less held the 50% retracement of the year’s range: 3.31% in April to 4.99% in October. Halfway is 4.15%; last week’s low was 4.105% and we ended at 4.24%.

Usually the market digests the Fed’s dot plot fairly quickly and moves on. Over the 2023 calendar year, the 2nd to 6th contract spread has been inverted all year, in a range of -177 to -62. [Chart above]. I.e. the market has consistently priced lower forward rates. At -125 we’re almost exactly at the midpoint of the year. SFRZ4 9575 straddle settled 110 vs 9576.5, so breakevens at 9465 (approximately the current EFFR) and 9685 or 3.15%. This Friday’s straddle on SFRZ4 (0QZ3 9575^) settled 22.5.

Besides CPI Tuesday and FOMC Wednesday, there are 3 and 10 year auctions Monday ($50b, $37b), followed by 30s on Tuesday ($21b). PPI on Wed. Retail Sales Thursday, S&P PMIs on Friday.

My personal bias is to be long SFRZ4. I know that idea is a bit inconsistent with what I have written above. I also know that trading purely on fundamentals doesn’t generate the greatest results. Life is full of trade-offs.

I would like to buy as closely as possible to the upward sloping trendline which comes in around 9567.0. Stop out 9550, target 9612 to 9625. THIS IS NOT A RECOMMENDATION TO READERS. I know that I would advise Powell and the Fed to lean hawkish and that being long Z4 might not be appropriate in that case. However, Powell was balanced during Dec 1 comments, and economic data has generally softened. The market is likely to look through restrictive comments, if they occur.

In keeping with the Manheim Used Car index idea, I had to include the following ad. This one isn’t AI generated. The owner has lived it!

The Embarrassment is For Sale – Really Ugly Nissan Altima. 145k miles. $650 Runs Great.

What a great running car that is practically theft proof! Meet The Embarrassment.

This no-frills Nissan is absolutely horrendous looking and as dependable as the day is long. Gets about 25-28 MPG plus enjoys a quart of oil for every thousand miles it goes. I call that the ‘self changing oil feature’.

Salvage title, manual transmission. Shakes like it has the DT’s if you drive it over 65 mph. I call that a safety feature. You shouldn’t be driving that fast anyway.

Trunk doesn’t open, gas door is stuck open. You will make lots of new friends as everyone honks and gestures to let you know the gas door is open.

Several panels are different shades of black. Some matte, some shiny. Call it abstract impressionism.

No radio. AC makes noise like a screaming baby is stuck in the fan belt. You can get that fixed for about $300 if you want. Or you can just not use the AC like I did. Save some bucks.

It looks like a pterodactyl crapped on the back of it. I’m trying to clean that off but you might get stuck with it.

Plates are valid through April. Passed smog no problem last time but can’t make any guarantees on next time. Really strong engine that refuses to die. Even when I really wanted it to so I could have an excuse to get a new car. Never left me stranded.

Two new used tires on the front. Unfortunately the guys who sold me them stole the hubcaps. No joke. Life is full of trade-offs.

Great first car, run-about-towner, dog mobiler. Cheaper than a year of zip car if a bit embarrassing. Just park it where no one can see it and you’re fine.

Best offer, cash only, save your shady cashier’s check for grannies in Omaha.

| 12/1/2023 | 12/8/2023 | chg | ||

| UST 2Y | 456.7 | 472.5 | 15.8 | |

| UST 5Y | 415.6 | 425.3 | 9.7 | |

| UST 10Y | 422.6 | 424.3 | 1.7 | WI 424.5/424.0 |

| UST 30Y | 441.9 | 432.4 | -9.5 | WI 433.0/432.5 |

| GERM 2Y | 268.2 | 269.3 | 1.1 | |

| GERM 10Y | 236.2 | 227.6 | -8.6 | |

| JPN 20Y | 143.7 | 153.5 | 9.8 | |

| CHINA 10Y | 268.3 | 268.5 | 0.2 | |

| SOFR H4/H5 | -137.5 | -125.0 | 12.5 | |

| SOFR H5/H6 | -26.0 | -40.0 | -14.0 | |

| SOFR H6/H7 | 9.0 | 4.0 | -5.0 | |

| EUR | 108.95 | 107.63 | -1.32 | |

| CRUDE (CLF4) | 74.07 | 71.23 | -2.84 | |

| SPX | 4594.63 | 4604.37 | 9.74 | 0.2% |

| VIX | 12.63 | 12.35 | -0.28 | |

https://site.manheim.com/en/services/consulting/used-vehicle-value-index.html

In: Eurodollar Options

PAYROLLS!

December 8, 2023

*******************

–Now it all boils down to the payrolls number. For a long time the employment data faded in importance, now it’s back to its rightful place up there with the orange juice crop report.

Wait a second, is that Kent Dorfman (Flounder) on the left side of the screen? Never noticed that before. It’s ALREADY been a good day.

–In any case, NFP expected 180k but I think whispers are skewed lower. Unemployment rate 3.9%, same as last, though I think we’ll see a 4 handle. However, long end yields have already plunged in anticipation, and we have supply coming at the start of next week.

–Yesterday the curve bounced slightly from Wednesday’s flattener. 2y down 2.3 to 4.578% and tens +0.8 to 4.129%. The ten year tip ‘real rate’ has been holding just under 2%, down just over 50 bps from the high in October.

–PNT Options sparked large buying in SFRH4 9475/9487.5/9500c fly from 0.75 to 1.25 yesterday as TO pointed out that market maker inventory made it cheap (settled 1.25 ref 9489.5). However, this is more of a market-maker type trade. Max value at expiry is 12.5 exactly at middle strike and there are 98 days left. To give a little sense of uncertainty, SFRH4 9600c have been trading and settled 4.0 yesterday (300k open). So, someone’s paying 4 for something 110 away from the money but the fly buyers think SFRH4 can just sit for three months? (By the way YZ, Jan 9600c settled 0.5 and Feb at 2.25). Even next Friday’s SFRZ3 9500c traded 0.25 5k and those are 32 out.

–Recall a lot of the initial covid inflation spark was related to used car buying and crazy prices. From Manheim yesterday:

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.1% in November from October. The Manheim Used Vehicle Value Index (MUVVI) dropped to 205.0, down 5.8% from a year ago.

So I guess deflation in used cars will lead to overall deflation, right??

–Household Net Worth showed a rare decline yesterday even as Federal Gov’t Debt exploded at a growth rate of 10.6% in Q3, following a 12.7% rate in Q2. Declining marginal utility of a dollar foolishly borrowed and spent by government?

–Overshadowing the macro picture is the BOJ which is looking for a gentle way to extract policy from super-easy. $/yen yesterday plunged briefly below 142, though now 144.60. It printed as high as 151.90 in November. “Idiot. Get back in there at once and sell, SELL.”

Long bond yield sinks in flattener

December 7, 2023

*******************

–Long end of the market was well bid in conjunction with a hard flattening trade. Two year rose 2.6 bps in yield to 4.601% while the thirty yr fell 8 bps to 4.225%. US vol had a nice jump from 13.9 to 14.5 ( USH4 atm straddle from 6’12 to 6’32). Icing on the cake was a new 5k buy of Jan 134.5c for 2. These expire two weeks from tomorrow against yesterday’s future settle of 120-11. Now THAT’S a reach! Ten year breakeven hit a new recent low of 214.5 bps.

–ADP was only 103k. Unit Labor Costs -1.2%. Today’s news includes Jobless Claims expected 225k, Fed’s Z.1 quarterly report on Net Worth and Debt aggregates, and Consumer Credit. Could HH Net Worth show a rare decline? SPX was down around 3.7% from June to Sept, but of course real estate will be marked higher.

–On the SOFR curve, it was the same story in terms of flattening. Red pack (Z4 start) -4.125, greens +1.875, blues +4.5, golds +5.625. Near contracts settled down on the day in position squaring prior to tomorrow’s NFP. Once again, near SOFR call flies and condors being bought:

+40k SFRF4 9587.5/9500/9512.5c fly 1.75 to 2.0

+40k SFRJ4 9537.5/9575/9612.5c fly 4.5 (these appear to have been buying back shorts on the bottom strikes)

–CLF4 (Jan WTI) settled below $70, marking a roundtrip starting in July with an intermediate high of $90 in late Sept. Copper is also showing signs of weakness. After a surge higher on Dec 1 it has had three big straight-down days in a row, from 3.9315 on Friday down to 3.7345 yesterday. Industrial commodities are reflecting weak conditions.

Cracks in Labor Market Support Treasuries

December 6, 2023

*******************

–Rate futures stubbornly bid yesterday, sparked by a new yearly low in JOLTs at 8733k (expected 9300). ISM Services a bit stronger than expected at 52.7, but the employment component fell to 50.7 vs 51.4 last. This morning ADP is released, expected 130k. Unit Labor Costs projected -0.9 from -0.8. Payrolls on Friday.

–The block buyer of SFRU4 from last Wednesday took advantage of yesterday’s rally to exit. SFRU4 settled 9564.5, up 6 on the day, while open interest fell 93.8k contracts. New lows once again in near 1-year calendars: SFRZ3/Z4 dropped 7.75 to -137.25 (9462.25/9599.6) and SFRH4/H5 fell 6.5 to -139.5 (9489.5/9629.0). The ten year yield fell by 12 bps to 4.169%. This area is almost the exact midpoint of the year’s yield range. Anything can happen going into employment but I would think this is the area to set shorts in TY. Attached is 10y breakeven, which posted a new recent low 217.7.

–A few interesting trades in SOFR options; Buyer of 20k each SFRH4 9600c at 3.5 (3.75s) and 9575c at 4.75 (4.75s). Both appear new from open interest. Also a new buyer of 15k 2QM4 9700/9850cs vs selling the same in 3QM; paid 3.5 to 4.0. Underlying contracts are M6 and M7 which settled 9658 and 9648.5. Expiration is 14-June 2024. On aggressive easing, the back end of the SOFR curve will steepen, at least that’s the rationale for this trade. Described slightly more in this tweet:

https://twitter.com/AlexManzara/status/1732135093685088451

Small pop in yields after last week’s plunge

December 5, 2023

*******************

–Yields reversed part of Friday’s plunge. Yesterday the ten year finished at 4.29%, up 6.4 bps, taking back about half of Friday’s 12.4 bp drop to 4.226%. SFRZ4 was up 21.5 on Friday to 9601.0, yesterday it settled -9.5 at 9591.5. Gold and silver posted huge outside day ranges, having made new highs early Monday morning; upside is likely contained over the short term. Probably worth a mention is that the ten-year breakeven (treasury – tip yield) edged to a new low of 221 bps vs a recent high over 241 bps. Current level is near the low of the year.

–Moody’s cut China’s credit outlook. Maybe Taiwan can be persuaded to be a cosigner on new loans. Taiwan election is January 13.

–Call condors remain a popular trade in SOFR, in an attempt to peg Fed easing scenarios. Examples, 20k each; +SFRF4 9468.75/9481.25/9487.5/9500 c cond 5.25 to 5.5. SFRH4 settled 9486.0, which is in the sweet spot for expiry. SFRJ4 9468.75/9493.75/9537.5/9562.5c condor 11-11.5 paid. Max payout is 25.0 less premium paid, occurs in the 43.75 range between the center two strikes. SFRM4 settled 9521.5.

–ISM Services today expected 52.2 vs last at 51.8. JOLTs expected 9300k vs 9553. This year’s low is 8920k. In 2018 before the wheels came off, it was more like 7200. Atlanta Fed GDP is released tomorrow. The last reading on Dec 1 was 1.2%, down from 1.8% on Nov 30. Fed’s Z.1 quarterly report (HH net worth) is Thursday.