And forward though I cannot see…

December 29, 2023

*********************

–Fairly quiet session yesterday. Yields rose, seven-year auction was a bit weak. Tens finished up 6 bps to 3.846% while 30s added 4.3 bps to 3.986%. On the SOFR curve reds through blues were down 4.5 to 5.5 bps in price. As mentioned earlier in the week, 5s and 10s seem to like 3 7/8% and 30s are comfortable at 4%. I think those yields are too low, but that’s how we’re finishing out 2023.

–Pretty fascinating Doomberg piece out today, mostly about potential energy production in the western hemisphere. President Monroe (and the Monroe Doctrine) are used as the hook to the piece -the US was (unsurprisingly) running federal gov’t surpluses in 1823 – but there’s also this tasty excerpt relating to gold:

How things have changed in just two short centuries! With the price of gold fixed at just under $20 an ounce, US federal government expenditures amounted to the equivalent of less than 600,000 ounces of the stuff over the nine months referenced by Monroe. By contrast, today’s sprawling federal bureaucracy spends that much gold in about 100 minutes, churning through the global market cap of all the gold ever mined roughly every two years.

–Applying some of the bitcoin analysis I’ve seen, that means gold should be a LOT higher! [insert two rocketship emojis here. maybe three]

–Anyway, back to the staid world of interest rates. The Federal gov’t currently has unfettered ability to borrow at low long-term rates to keep the bureaucratic plates spinning, as the leading investment minds focus on the magnitude of rate cuts in the year just before us.

Still, thou art blest, compar’d wi’ me!

The present only toucheth thee:

But Och! I backward cast my e’e,

On prospects drear!

An’ forward tho’ I canna see,

I guess an’ fear!

Happy New Year!

******************

Here are a couple of plays from yesterday. The first is bearish, but still targets FF about 50 lower than current:

SFRJ4 9550/9525/9500p fly 4.75 paid for 10k. Settle 5.0 ref SFRM4 9546.5

SFRU4 9525/9600/9675c fly bought 11k, settled 18.5 ref SFRU4 9587.5.

BLOCK SFRM5 9675/9750/9850/9925c condor bot vs sale SFRU4 9543.75/9475.0ps, paid 6.75 for 20k.

9675c 62.25

9750c 33.25

9850c 13.75

9925c 7.00 >>22.25

9543.75p 22.0

9475.0p 5.75 >> 16.25 6.0 pkg.

In order for the Sept’24 put spread to settle worthless, we need at least 75 bps of cuts, which would take target range to 4.5-4.75% and likely leave EFFR around 4.58%.

Easy markets create false fundamentals, weak fundamentals create tough times

December 28, 2023

*********************

–Spot gold at highest close ever $2077 (though not so in GCG4, which settled at 2093.1, vs a high settle 2128.8 in early May).

–Yields continue to press lower. Solid five-year auction with seven-year coming today. According to BBG the year’s range on tens is 3.31% to 4.99%. Closed out yesterday at 3.79%, almost exactly where we started the year. So, we’re 48 off the low and 120 off the high.

–New low in SFRM4/U4 calendar at -42 (9550.5/9592.5). The most inverted one-year spread remains the first, SFRH4/H5 at -156.5 (9502.5/9659.0), down 4.5 on the day, also at a new low. The lowest level for the first one-yr spread was -192, set in May, and for the second slot it was -177. Currently the second 1-yr spread is SFRM4/M5 at -129.

–Price action in late April and early May, after the regional bank blow-ups, reflected fears of expanding fractures. That period featured a weak dollar, (DXY is now lower than May’s low), soaring gold, and the most inverted one-year SOFR calendars ever. Green SOFR contracts were around 2.75-2.8% (9720). Green pack settled yesterday at 9692.5 or 3.075%. However, it all reversed as the Fed did not ease. This time there’s little push-back against rapidly easing financial conditions, a fact not lost on equities. Is it worth noting a BBG article, ‘Prices of a Vital Food, Rice, Just Surged to a Fresh 15-Year High’ ?

Going Nuke-ular

December 27, 2023

********************

–Quiet session in rates on Tuesday. Front end weakness probably related to bill and 2y auctions. Curve flattened as longer dated maturities saw marginal drops in yield. SFRM4 -4 at 9546.5. SFRM5 +1 at 9672.5, SFRM6 +2.5 at 9684.0 and SFRM7 +2.5 at 9675.5.

–On the treasury curve, the long bond is gravitating toward 4%, (4.043% at futures settle), while 5s and 10s are comfortable around 3 7/8%, (3.875% and 3.886%). Five-year and two-yr FRN auctions today.

–CLG3 traded above $76/bbl yesterday, but is back around 75 this morning. Still a decent rebound from sub-70 early in the month. Perhaps of more interest is uranium (in a longer term timeframe). From Y-charts, price as of the end of Nov is 62.29/lb, having started the year around 40. In June 2007 it hit $136. Just a mention, as nuclear power seems to be ramping up. Reuters reports: ‘Japan lifts operational ban on world’s biggest nuclear plant’, though Tepco still needs local gov’ts to approve the re-opening.

–Below the uranium chart is an interesting excerpt from @WinfieldSmart. I haven’t verified, but SPX adjusted for money supply growth has never taken out the 1929 high.

Buy Now and Really, Really, Really Pay Later

December 26, 2023

********************

–Once again, new low in SFRH4/M4 at -49 (9501.5/9550.5). The lowest of any 3-month spread over the past year was -58, but it was a forward spread, on BBG SFR5 vs SFR6, (though in the old convention I’d call it last white to first red or 4th to 5th). H4/M4/U4 fly settled -9.0 (-49/-40), worth buying -14 to -12.

–Inflation data confirm the Fed is done. Six month annualized Core PCE 1.9%. April FF for the first time settled more than 25 lower in yield than a 25 bp cut. That is, Fed Effective is 5.33% or 9467. A 25 bp cut would be 5.08% or a price of 9492.0. FFJ4 settled 9492.5.

–News today includes Chicago Fed’s National Activity. It’s around the lowest level since covid. November 2022 the low was -54, March 2023 the low was -50. Last was -49. If I know Goolsbee it will be around -30. He’s quite a prankster.

–This week’s auctions kick off with $75b in 13-week bills, $68b in 26-week bills, $44b in 52-week bills and $57b in 2-yr notes. Total $244b, nearly a quarter of a trillion dollars… I guess SOMEONE ran up the credit card bill going into Christmas. And there’s more coming on Wednesday and Thursday (5s and 7s and other various bills and FRNs).

–This is probably nothing (Game of Trades)

Steel

December 24, 2023 – Weekly comment

******************************************

I worked my whole life in the steel mills of Gary

Like my father before me I helped build this land

Now I’m seventy-seven and with God as my witness

I earned every dollar that passed through my hands

Minutes to memories – John Mellencamp

I had watched a TV documentary about old-time steelworkers working the mills. Hard, dirty work. I wish I could find the clip, but one of the men interviewed said (paraphrased). “You were something if you worked in the steel mill. You were paid well. You could afford things.” Pride in the work and in the community, in the classic sense of the word.

I’m a fan of Michael Every of Rabobank, who was recently interviewed on Adam Taggert’s Thoughtful Money. Not that I agree with Every one of his arguments (see what I did there), but he has a breadth of knowledge and historical context that I can only envy. In any case, the main thrust of his comments during the interview was that America’s outsourcing of production and transition to what he calls “frivolity, fictitious capital, and bullshit” is not working. The financialization of the American economy is no longer likely to bring dominant results in a changed global order. So, the idea of some sort of industrial policy, with tariffs and subsidies is his suggestion. I’m not so sure if that’s the correct path to a better tomorrow, but the inward turn toward production and sourcing of inputs makes some sense.

And that’s why the sale of US Steel to Japan doesn’t sit well with me, as I think steel is a strategically important industry. And that’s why the addition of Norinchukin to the Fed’s list of Standing Repo Facility counterparties on Dec 1, while perhaps understandable raises a few questions. If the big banks are strategically critical in our economy to the point of supporting non-US based entities, maybe big supply-chain industries require consideration.

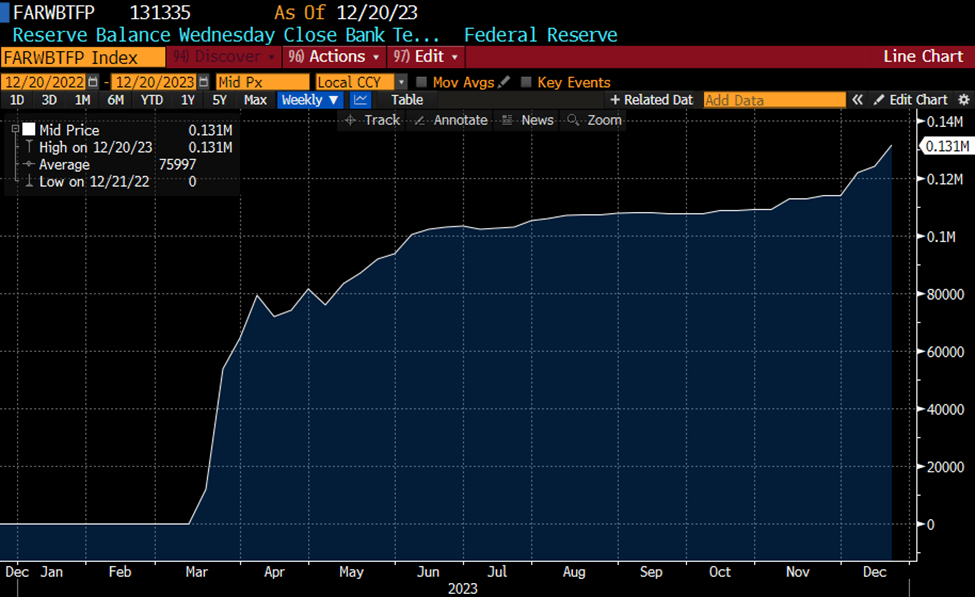

In terms of financialization, the Fed’s Bank Term Funding Program is a case in point. The outstanding amount is currently only $131 billion, not huge in the big picture. It surged with the regional banking crisis of course, but has recently re-accelerated in December. This program allows a bank to pledge treasuries at par value and obtain credit for up to a year, at a rate of the one-year overnight index swap plus 10 bps. Current rate 4.85%. https://www.frbdiscountwindow.org/

Obviously that’s an attractive funding rate, especially given that treasuries trading well below par value can be pledged at par. Below is a chart of BTFP outstanding balance. Though it’s relatively small, is there a possibility of renewed fragility in the system? Note as well that Ueda just signaled a possible shift in the Bank of Japan’s ultra-easy policy. Next BOJ meeting is Jan 22/23.

Treasury is doling out $1 trillion a year in interest on US debt. Outstanding credit card debt (revolving) is around $1.3 trillion, and “accounts assessed interest” are at 22.77%. Excluding non-revolving auto loans, it’s reasonable to assume interest payments of nearly $200 billion per year. Those flows are likely affecting very different parts of the populace. In the aggregate, things may look ok, but certain segments are under increasing duress. Changes at the margin affect the whole.

*******************************

The inflation numbers came in favorably. As Nick Timiraos wrote: “The Core PCE index rose 3.2% in November from a year earlier. Over the last six months, the core PCE price index rose 1.9% at an annualized rate.”

In other words, the Fed’s at target.

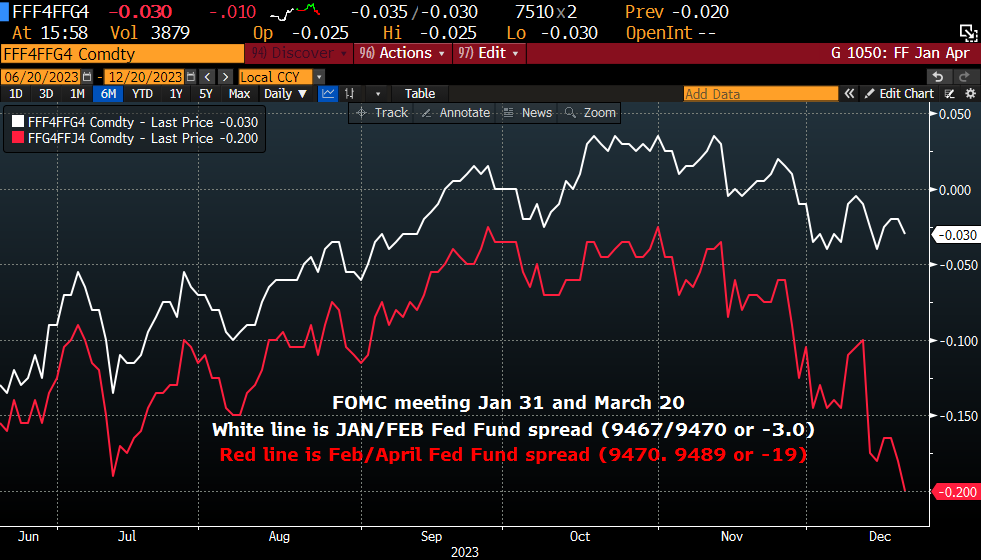

So, there is justification to cut. Which the market has priced. In the clearest example, consider Friday’s settle of FFJ4 at 9492.5, a rate of 5.075%. Current EFFR (Fed Effective) is 5.33%, a price of 9467.0. In other words, for the first time, at settlement, there is slightly MORE than 25 bps of ease reflected in this contract. (FOMC meetings are Jan 31 and March 20). FFF4/FFG4 settled -3.5 (9467.5/9471.0) so there’s a bit over 10% priced for a 25 bp ease at the Jan meeting. Feb/April settled -21.5 (9471.0/9492.5). They’re pretty sure the first ease comes in March. On the SOFR curve, SFRH4/SFRM4 three-month calendar spread settled -49.0 (9501.5/9550.5). A lot of observers are saying an ease will NOT come in the first half. The market is sending a very clear signal that it will.

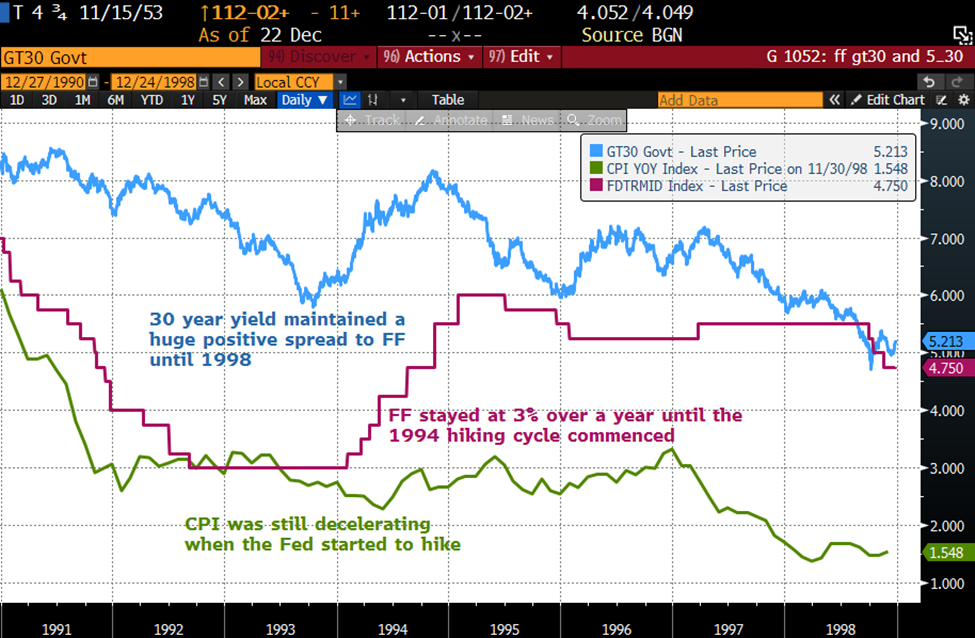

I would note that the highest contract on the SOFR curve is now SFRZ5 at 9684.5 or 3.155%. In the panicked period from March to May, no sofr contract settled above 9750. Perhaps it’s fair to say that the terminal ease won’t go below 2.5% this time around. In that connection, I looked back at 1994. The Fed had eased to the then-low FF rate of 3%. That rate held for over a year. Of course, at that time the thirty year yield had a hugely positive spread to FFs, though the spread declined through 1991.

Perhaps this time the Fed won’t have to test the zero-bound. On Friday, SFRZ4 settled 9624.5 or 3.755%. Given today’s treasury curve, 5’s (3.89%) 10’s (3.90%) and 30’s (4.06%) would all have positive carry by the end of next year.

Could we have a scenario where the BOJ starts to tighten, pulling capital away from longer dated US assets, with the unemployment rate starting to rise, justifying Fed cuts of 125 to 175 bps next year as inflation stabilizes around current levels? Positive curve, but real rates still at relatively restrictive levels.

Treasury auctions of $57b 2-years, $58b 5-years and $40b in 7-years, Tues, Wed, Thurs. Perhaps a bit much to digest in a holiday week.

https://www.youtube.com/watch?v=H4QTQQytnd8

| 12/15/2023 | 12/22/2023 | chg | ||

| UST 2Y | 445.1 | 434.2 | -10.9 | wi 429.0/428.5 |

| UST 5Y | 392.6 | 388.8 | -3.8 | wi 388.5/388.0 |

| UST 10Y | 392.6 | 390.6 | -2.0 | |

| UST 30Y | 402.5 | 405.8 | 3.3 | |

| GERM 2Y | 250.4 | 240.0 | -10.4 | |

| GERM 10Y | 201.6 | 196.5 | -5.1 | |

| JPN 20Y | 142.1 | 133.0 | -9.1 | |

| CHINA 10Y | 263.6 | 261.0 | -2.6 | |

| SOFR H4/H5 | -148.0 | -151.0 | -3.0 | |

| SOFR H5/H6 | -32.5 | -31.0 | 1.5 | |

| SOFR H6/H7 | 5.0 | 7.5 | 2.5 | |

| EUR | 108.97 | 110.14 | 1.17 | |

| CRUDE (CLG4) | 71.78 | 73.56 | 1.78 | |

| SPX | 4719.19 | 4754.63 | 35.44 | 0.8% |

| VIX | 12.28 | 13.03 | 0.75 | |

From the Fed

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), such as U.S. Treasuries, U.S. agency securities, and U.S. agency mortgage-backed securities. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

In: Eurodollar Options

Deflating…except for gold

December 22, 2023

*********************

–Today features PCE deflator, expected 0.0 m/m and 2.8 yoy from 3.0% last. Core expected 3.3 from 3.5. Attention now seems to have shifted to 6-month annualized growth rates in order to illuminate recent improvements in the flight path to target. However, Core Service prices are still sticky and likely require higher levels of unemployment to decelerate. On the other hand, I was pleasantly surprised to fill the gas tank at sub-$3/gallon yesterday. In the first half of December, WTI got below $70/bbl, but this morning CLG4 is $74.50 (up 0.60). Gold currently +16 at 2067.30, a modest effort at an upside breakout (which is about to turn into a full-blown explosion!)

–Curve steepened a bit yesterday as stocks took back some of Wednesday’s sell-off. SFRM4 and SFRM5 both up 3 at 9547.5 and 9673, while M6 was only +1 at 9683 and M7 down 0.5 at 9675. Again, note that every contract from June’25 back is about the same price…around 3.2% yield. On the treasury curve 2s were down 2 bps at 4.347% and 10s rose 2 bps to 3.894%. 2s, 5s and 7s auctioned next week. Stocks a bit weaker this morning, perhaps in sympathy with China as stocks there were hit due to restrictions on gaming. (rather than playing video games, why don’t you all start speculating in stocks…)

–Continued exit of SOFR call spreads. Yesterday about 50k SFRU4 9700/9800cs sold; settled 9.25 ref 9588.0. SFRH4/M4 3-month calendar posted a new low at -48 (9499.5/9547.5) and H4/H5 one-year spread hit a new recent low of -153.5. The front 3m spread, March/June at -48, is more inverted than the front spread had gotten in the aftermath of the regional banking crisis (April into May). However, at that time the second spread had settled as low as -50 and the third at -56. Interestingly, June/Sept (SFRM4/U4) is currently -40.5 and Sept/Dec -36.5. Relative to the hiking pattern that got increasingly more aggressive, the easing path is perhaps perceived as steadier over time. I’m not even sure if that’s a correct interpretation…however, it used to be that rates were slashed in downturns and raised more gradually. This easing cycle could look more like the hiking campaign of 2004 to 2006, i.e 25 bps at a time, at every meeting. As Argentina’s Milei said yesterday in reference to failed socialist policies, “…the problem is not the chef, but the recipe.” Time for a modicum of caution as the recipe may undergo multiple changes in 2024.

–Peace and goodwill towards your fellow man. Merry Christmas!

A bit of volatility at a less liquid time of year

December 21, 2023

*********************

–Afternoon swoon in stocks underpinned the bid in rate futures. Good Reuters headline: Stocks Sober Up, But Rate Cut Party Lives On. SPX fell 1.5% after having made a slight new high. Note that from mid-March to late July SPX rallied from around 3800 to 4600 in four and a half months. Impressive rally. From the end of October to yesterday , not quite two months, SPX rallied nearly the same point amount, from around 4100 to just under 4800, compressed in less than half the time. No wonder there’s a pullback!

–New low in SFRH4/M4 at -47 (9497.5/9544.5). Also a new recent low in SFRH4/H5 at -152.5 (9497.5/9650). Rate cut perceptions are being somewhat front loaded as nearer spreads invert further. Attached is a chart of Jan/Feb FF spread and Feb/April. These two spreads forecast the Jan 31 and March 20 FOMCs. Jan/Feb settled -3 (9467/9470) around a 10% chance of a cut at 2024’s first meeting. But Feb/April settled -19 and was -20 late, indicating about 80% odds of a cut in March.

–30 year yield went out just over 4%, down 3 bps (ref USH settle 124-13). Curve from 2s forward steepened slightly.

–GDP revision this morning. Philly Fed expected -3.0 from -5.9.

Markets expect CBs to be more aggressive

December 20, 2023

*********************

–Relatively quiet day in US rates, with slightly lower yields. Tens ended at 3.92%, down 3.4 bps on the day. Later in the session Bostic said inflation is probably going to come down slowly in the next six months, and penciled in two rate cuts in H2 of 2024.

UK inflation was released this morning at 3.9%, a large drop but still double the BOEs 2% target. Attached is a chart from BBC. The Fed’s preferred measure of prices is released Friday, with PCE expected 2.8% and Core 3.3% yoy, both down 0.2 from the previous month.

–Central banks maintain that rate cuts are likely to be drawn out, but it’s sort of interesting to compare market expectations across western CBs as shown by short-end calendar spreads. At yesterday’s settlements:

SFRH4/SFRH5 -146.0 (USA)

SFIH4/SFIH5 -148.0 (UK)

ERH4/ERH5 -147.0 (eurozone)

These spreads display remarkable agreement and appear to indicate that CBs will be forced into easing more rapidly than they expect. And if easing ACTUALLY moves forward rapidly, then short-end curves will likely steepen from reds back. A couple of trades in SOFR yesterday reflect that view:

Synthetic long SOFR calendars:

+0QM4 9700/9800cs vs -3QM4 9700/9800cs

SFRM5 9661.0s 24.75/6.00 => 18.75

SFRM7 9669.5s 21.50/3.75 => 17.75

paid 0.5 to 0.75 for 9k

I posted a chart related to this one on X yesterday:

https://twitter.com/AlexManzara/status/1737151032252141602

Also:

+SFRU4 9650/9800cs vs 2QU4 9700/9737.5cs

SFRU4 9576.0s 21.00/4.75 => 16.25

SFRU6 9674.0s 30.75/19.0 => 11.75

paid 4.5 for 20k

This trade requires a bit more urgency to rate cuts (perhaps a rhyme of March’s regional banking crisis). Lower strike of front Sept call spread is 74 otm while the green Sept midcurve is only 26 away.

Note that all SOFR contracts from SFRU5 to SFRU7 are between 9676 and 9667.5. A reasonable conclusion is that easing is expected to be completed by the end of 2025, and then we’ll just hang around between 3.0-3.5%. SFRZ5 is currently the peak contract at 9676.

BoJ stays easy

December 19, 2023

**********************

–BOJ maintained its easy policy stance. $/yen up about 1.2% at 144.50. USH4 currently trades 124-00 (+24), around 4% yield and close to the highs of the past two sessions.

–Late yesterday WSJ’s Timiraos cited Mary Daly as saying easing might be necessary. “SF Fed President Mary Daly says it’s appropriate to shift to a more balanced focus on the dual mandate.” Unemployment is at 3.7%. It’s strange to be shifting emphasis back to employment in this environment. I had been reviewing some old articles and back in 2019 the Fed thought full employment was 4.1%. (Wash Post link below).

–Not sure if there’s anything here, but (thanks RL) there’s a tweet and a couple of articles about the Fed having added Norinchukin Bank (NY Branch) to the Standing Repo Facility list of counterparties on December 1. Here’s the tweet:

And here’s a snippet showing a pretty dramatic deterioration in unrealized losses:

https://www.nochubank.or.jp/en/ir/results/pdf/cap_results2023_02_02.pdf

–I’m sure it’s all unrelated. Dec 1, Norinchukin added to SRF. Dec 13, dovish FOMC and press conference. Yesterday, Mary Daly says easing is on the table and BOJ maintains dovish policy. Perhaps just something to be aware of. Just remember, it’s not a loss until you sell it. Right, SVB?

https://www.washingtonpost.com/business/2019/12/11/year-federal-reserve-admitted-it-was-wrong/

Push-back by Williams Flattens Curve

December 19, 2023

********************

–NY Fed’s Williams pushed back against the idea of near term rate cuts on Friday, saying it’s too early for the Fed to be considering lowering rates. In response, the yield curve flattened, with the 2y yield ending up 5.7 bps at 4.451% and tens essentially unchanged at 3.926%. 2/10 treasury spread made a new recent low of -52.5 bps. In the latter part of October it had gotten as high as -15. I marked the 30-yr yield at 4.025% at the futures settle, but it ticked below 4% before the end of the day.

–December options expired on SOFR. While SFRZ3 pegged exactly at the 9462.5 strike, SFRZ4 settled 9609, up 32.5 on the week. The previous Friday, 8-Dec, Z4 settled 9576.5 and the 0QZ3 atm straddle was 22.5. Another instance where the straddle was underpriced relative to actual movement.

–There have been a lot of adjustments in SOFR options: exits of longs — for example about 20k each of SFRM4 9600/9700c sprds and U4 9700/9800c spreads sold. And on the downside 25k SFRH4 9487.5/9475/9462.5/9450p condor exited (sold) at 4.25.

–New low in SFRM4/M5 at -129 (9533.0/9662.0). The most inverted one-year spread is H4/H5 at -148 (now the front spread). SFRH4/M4 settled -41 and M4/U4 at -39. Butterfly at -2 seems a bit expensive.

–BOJ coming up with expectations that policy is held steady until the new year.