Williams tempers Logan

January 11, 2024

******************

–CPI expected 0.2 m/m and 3.2% yoy vs 3.1 last. Core expected 3.8% from 4.0 last.

Jobless Claims 210k. Budget Statement. 30y auction.

–NY Fed’s Williams pushed back on expectations for a near term decrease in QT, saying there’s currently “no signs of adverse effects on market functioning”. He noted that the FOMC said “…it intends to slow then stop the decline in the balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves” adding, “…we don’t seem to be close to that point.”

–Yesterday USH settled 122-05, down 8, but this morning it’s up 17 at 122-22, even as thirties are auctioned this afternoon.

–Option plays in SOFR continue to target upside. For example, a buyer of about 45k SFRH4 9606.25/9612.5cs for 0.75 (Settled there vs 9493.0). Open interest in March SOFR calls rose 95k on the day. There was also a seller of about 20k SFRG4 9500c at 5.0 (settled 4.75). Upside plays on SFRZ3 prior to option expiration ultimately fizzled, but hope springs eternal (for a crashing economy).

Tens and Williams today, CPI tomorrow

January 10,2024

*****************

–SEC site was compromised, leading to erroneous info about bitcoin etf approval. Though it caused a bit of volatility in bitcoin, price action wasn’t easily discernible from any other day’s activity. Of course, they could NEVER hack the BLS right? On the other hand DoD is pretty good at keeping secrets, so we got that going for us.

–Rates were boring yesterday. Tens up 2 bps to 4.019%. Solid 3-year auction, with tens today and thirties tomorrow. NY Fed’s Williams speaks today, shortly after futures settlements are posted, 3:15 EST.

–CPI is tomorrow. Jan midcurve options expire Friday. Both 0QF4 and 2QF4 atm straddles settled 15 (midcurve straddles on SFRH5, 9636.0s and SFRH6 9670.5s). There was a block yesterday, +SFRU4 9500/9450p 1×2 which settled 3.25 (8.75/2.75). This trade works if the Fed just stays on hold and doesn’t ease. Of course, there are also a lot of trades predicated on cuts starting as soon as March, for example a buy of SFRH4 9500/9512.5/9525c fly for 1.25 (settled 1.0 ref 9491.5). SFRZ3 went out at 9463 on option settle, a rate just above EFFR of 5.33%. A cut in March would mean EFFR of 5.08 or 9492.0; the next FOMC is May 1, about six weeks into the period. The 9500 strike could be in play, and of course the contract just traded at that price, but time is starting to bring final settle for H4 into focus (in the absence of large outside catalysts).

–Yesterday, Barr, Fed Vice Chair on banking supervision, indicated that the BTFP would likely NOT be renewed when it ends on March 11. This program was put in place for the regional banking emergency last year. Funds may be borrowed for 1 year; current level isn’t huge at $141 billion. Perhaps a takeaway is that the Fed is slowly pulling back the banking safety nets. Over the weekend, Logan noted that bank reserves are no longer super abundant, and said that repo rates might display some volatility as liquidity is distributed through the system. At the margin there might be a bit more pressure on the banking system. Possible that the de-stigmatized discount window comes back into play?

Digital value

January 9, 2024

****************

–Yields a bit lower yesterday, tens fell 4.4 bps to end just under 4%.

–News today includes NFIB Small Business Optimism expected 91 from 90.6. Trade balance. 3 year auction. 10s and 30s Wed and Thursday. CPI Thursday.

–New all-time high NVDA, up 6.4%. Bitcoin future soared over $3k, now over $47k. CLG4 was down just over $3/bbl to 70.77 at settlement. From Kobeissi letter: Since this morning [Jan 8], the S&P 500 has added ~$500 billion in market cap.

–Consumer Credit released yesterday for Nov was up $23.7 billion, with the total surpassing $5t for the first time. In comparison Home Mortgage Debt is around $13t. Revolving was up $19.1b at a blistering 17.7% annualized pace. A bit odd in a world of 22% credit card rates. Somehow I don’t think the credit card users are the same ones that own NVDA and bitcoin.

Financial Turbulence Ahead?

January 8, 2024

****************

–Once again, a couple of summary points from Lorie Logan, Dallas Fed President.

First, noting that financial conditions (long end rates) eased significantly since October, the Fed may have to hike FFs.

Some model-based term premium estimates remain higher than levels seen last summer, but I’m mindful that all else equal, a lower term premium leaves more work to be done with the fed funds target.

Second, some pressures in repo are normal:

The emergence of typical month-end pressures suggests we’re no longer in a regime where liquidity is super abundant and always in excess supply for everyone. In the aggregate, though, as rate conditions demonstrate, the financial system almost certainly still has more than ample bank reserves and more than ample liquidity overall.

Third, the Fed is going to slow, and likely end QT:

So, given the rapid decline of the ON RRP, I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level.

–Friday’s headline Employment number was solid, with NFP 216k and a rate of 3.7%. However, some of the internals were apparently weak. In stark opposition to NFP, the employment component of Service ISM was just 43.3, the lowest since Covid, and 5 points lower than any reading since 2021. In any case, tens closed back above 4%, up 5.1 bps to 4.042%, and thirties ended at 4.20%. Auctions will be a test this week, 3s, 10s and 30s, Tues, Wed, Thurs.

Like a lot of stocks, Boeing had a spectacular run, jumping over 50% from the late Oct low of 176 to the Dec high 267. With aircraft problems seen over the weekend, pre-market it’s around the 38% retrace, which is 232. JPM had a similar, though smaller magnitude, straight up run since end of October, +28% from 135 to last week’s high 173. Possible that we’ll see financial market turbulence affecting the big banks/XLF?

If You Build It…

January 7, 2024 – Weekly Comment

**************************************

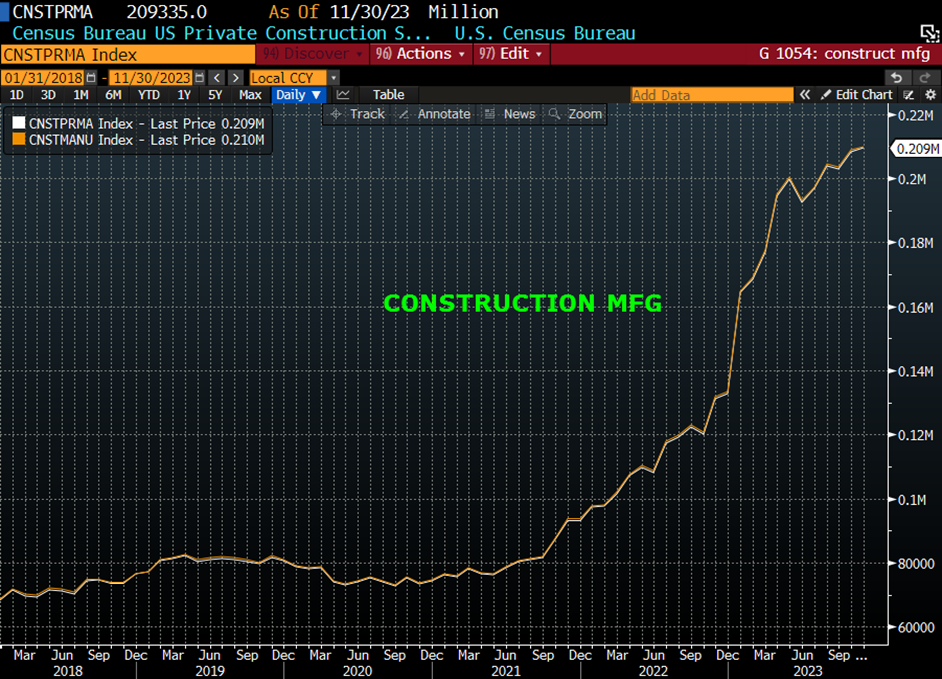

I’m coming right out with an admission that I am lifting this idea from Doomberg, so that I can hopefully tiptoe around the plagiarism peril that plagues our “cut-and-paste” world. I didn’t realize the extent of the construction boom until I saw the Doomberg charts, (copied below). Of course I recall that Lorie Logan, President of the Dallas Fed, made these comments in a speech in October of 2023: [more on Logan and her momentous speech from this weekend below]

Some of my contacts highlight a significant increase in manufacturing and nonbuilding construction, both nationally and in this region. The number of manufacturing construction projects in Texas is the highest in 22 years. With so many projects in the pipeline, construction contract values are also at record highs. Some of this activity appears related to initiatives to spur clean energy, infrastructure and the domestic semiconductor industry.

Last summer, in June 2023, this article from the Treasury Dept cited the surge in construction spending for manufacturing facilities. From the article: “Real manufacturing construction spending has doubled since the end of 2021. The surge comes in a supportive policy environment for manufacturing construction: the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA) and CHIPS Act each provided direct funding and tax incentives for public and private manufacturing construction.”

[CHIPS ACT signed in August 2022]

- The boom is principally driven by construction for computer, electronic, and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component.

- Manufacturing construction is one element of a broader increase in U.S. non-residential construction spending, alongside new building for public and private infrastructure following the IIJA. The manufacturing surge has not crowded out other types of construction spending, which generally continue to strengthen.

Again from Doomberg:

With the country awash in cheap hydrocarbons and the federal government throwing a gusher of cash at the manufacturing sector through laws like the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and CHIPS and Science Act, a boom in manufacturing construction is underway, and this “surge in construction will eventually translate into a surge in hiring for manufacturing jobs.”

I suppose one can make the argument that extraordinary deficit spending by the gov’t has sparked the boom in mfg construction, which will lead to a seamless hand-off of renewed growth to the private sector, which might help pay down the deficits.

Not yet, it seems.

The payroll report was released Friday. Manufacturing payrolls were up just 6k (26k in Nov). From the BLS, “In December construction employment continued to trend up (+17k)… Construction added an avg of 16k jobs per month in 2023, little different [but lower] than the 2022 avg of 22k.”

Over calendar year 2023, payrolls increased by an average of 225k per month. (The outsized month was January at 472k). Of that, government added an average of 56,000 jobs per month in 2023, more than double the average monthly gain of 23,000 in 2022. So, 25% of all jobs added were in government. Still feeling positive about forward growth?

In December, health care added 38k jobs; the average growth was 55k in 2023, compared with the 2022 average monthly gain of 46k. Nearly half of job gains in ’23 were gov’t and health care. A cynic might claim that outsized deficit spending simply added another layer of government on top of government, a likely impediment to forward growth. And it’s making people sick.

**************************

Dallas Fed President Lorie Logan gave a momentous speech Saturday. Here’s the link:

https://www.dallasfed.org/news/speeches/logan/2024/lkl240106

First, from the Dec 13 FOMC minutes:

Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

It’s clear that Logan was a major participant in that part of the discussion, and that slowing QT will likely be announced at the Jan 31 FOMC. From her speech on Saturday:

The emergence of typical month-end pressures suggests we’re no longer in a regime where liquidity is super abundant and always in excess supply for everyone. In the aggregate, though, as rate conditions demonstrate, the financial system almost certainly still has more than ample bank reserves and more than ample liquidity overall.

…

So, given the rapid decline of the ON RRP, I think it’s appropriate to consider the parameters that will guide a decision to slow the runoff of our assets. In my view, we should slow the pace of runoff as ON RRP balances approach a low level. Normalizing the balance sheet more slowly can actually help get to a more efficient balance sheet in the long run by smoothing redistribution [of liquidity] and reducing the likelihood that we’d have to stop prematurely.

In addition, she warned about easing financial conditions since October and said another hike could be needed to counteract the stimulative effects of looser conditions.

Yet over the past few months, long-term yields have given back most of the tightening that we saw over the summer. We can’t count on sustaining price stability if we don’t maintain sufficiently restrictive financial conditions.

Part of what appears to be happening is that when the data are strong, as occurred over the summer, market participants perceive a wider range of potential rate outcomes and require compensation for that risk in the form of higher term premiums. And when the data soften, as happened recently, that term premium comes out because market participants perceive more of an upper bound on policy rates. Some model-based term premium estimates remain higher than levels seen last summer, but I’m mindful that all else equal, a lower term premium leaves more work to be done with the fed funds target.

On Friday, SFRH4 atm 9493.75 straddle settled 18.75 ref 9493.0. There are 68 days until expiration, and the market currently assigns significant odds of an ease at the March 20 FOMC (> than 2 in 3). Logan’s comments about the ‘normal’ return of month-end pressures, and the possibility of a hike, along with uncertainty related to QT, suggest to me that SFRH4 vol is too low. An undercurrent of Logan’s comments is that liquidity distribution may entail some friction, or stress, but in an environment where liquidity is generally ample, some evidence of stress is a feature, not a bug. Logan’s speech is sort of a counterpoint to Powell’s tacit acceptance of easier financial conditions. This was an important speech. It will be interesting to see if her comments are echoed by other Fed officials.

Logan ran the NY Fed’s desk. She is likely more experienced, knowledgeable and connected to the markets than any other Fed President, or board member for that matter. Most Board members are academics.

*****************

Does a 15-17 bp back-up in yields last week suggest enough of a concession for auctions to sail through this week?

3y on Tuesday, $52b

10y Wednesday, $37b

30y Thursday, $21b

CPI is on Thursday. Expected 3.2% yoy with Core 3.8%.

Taiwan election on January 13.

| 12/29/2023 | 1/5/2024 | chg | ||

| UST 2Y | 426.0 | 438.7 | 12.7 | |

| UST 5Y | 385.0 | 400.7 | 15.7 | |

| UST 10Y | 388.0 | 404.2 | 16.2 | wi 404.0/03.5 |

| UST 30Y | 403.0 | 420.0 | 17.0 | wi 420.0/19.5 |

| GERM 2Y | 240.4 | 256.8 | 16.4 | |

| GERM 10Y | 202.4 | 215.6 | 13.2 | |

| JPN 20Y | 138.2 | 136.0 | -2.2 | |

| CHINA 10Y | 256.0 | 252.0 | -4.0 | |

| SOFR H4/H5 | -156.5 | -142.5 | 14.0 | |

| SOFR H5/H6 | -35.0 | -34.0 | 1.0 | |

| SOFR H6/H7 | 8.5 | 6.5 | -2.0 | |

| EUR | 110.38 | 109.43 | -0.95 | |

| CRUDE (CLG4) | 71.65 | 73.81 | 2.16 | |

| SPX | 4769.83 | 4697.24 | -72.59 | -1.5% |

| VIX | 12.45 | 13.35 | 0.90 | |

https://www.dallasfed.org/news/speeches/logan/2023/lkl231009

Hey buddy, can you borrow me $30 billion?

January 5, 2023

******************

–Thursday’s data related to the labor market was solid. Jobless Claims just 202k, ADP 164k, about 40k more than expected. Yields rose across the board, with tens up 8.6 bps to 3.991% and 30s up 8.5 to 4.138%. On the SOFR strip, reds through blues were down 10 to 11.5.

–Today of course, brings the payrolls report. NFP expected 175k from 199k last. Unemployment rate expected 3.8%. Extreme whiplash is possible if the data were to show much weaker labor conditions, as the market appears to have taken a hard lean favoring higher yields. One of the leading headlines on Bloomberg this morning cites a buy of 20k TY week-1 (today expiry) 111p for 2 as an omen for a possible jump in yields on Friday; this play is termed “notably aggressive” with a premium outlay of $625k. That strike is about 15 bps away from TYH settle. I’m a fan of Ed Bolingbroke, the author, but in the big picture, this isn’t much of a trade. What I might note is that Friday-week2 TY options added 127k in open interest yesterday; next week encompasses auctions of 3s, 10s and 30s. Yes: there IS demand for protection against higher yields.

–Of more interest to me was a late story on BBG:

“The California State Teachers’ Retirement System, the country’s second-largest pension fund, may borrow more than $30 billion to help it maintain liquidity without having to sell assets at fire-sale prices, according to a new policy its investment committee will consider this month. “

CalSTRS, at about $320 billion, is the largest teachers’ retirement system and the second largest public pension fund in the nation. My immediate conclusion, likely unfounded, is that this fund has a LOT of assets that are underwater, and the scramble for liquidity represents a search for a life raft. Of course, I’ve seen several stories recently about commercial buildings in CA selling at half of previous prices. Is 50% off a “fire-sale”? Spending a little premium to lock in borrowing costs might seem prudent…

There’s another headline from Pensions and Investments regarding CalSTRS; here’s a clip:

“The Institutional Limited Partners Association, Council of Institutional Investors and 11 public pension funds, including CalSTRS, have filed an amicus brief in federal court supporting the SEC in a lawsuit brought by industry groups seeking to overturn a new SEC rule requiring increased disclosure from private fund advisers and prohibiting certain fee arrangements.”

–This too, is a bit interesting. CalSTRS supports increased disclosure by private equity. Not that a fund like CalSTRS could ever find itself as the victim of a charlatan investment scheme…right? No. Of course not. In fact, according to the website, *since inception as of June 30, 2023, the return of the Private Equity portion of the portfolio is 13.39%…not bad. However, when looking at the holdings, a lot of investments were made in 2020 or prior. So I don’t think that is an annualized return. But, let’s say it is. Total return in the year ended June 2023 is 6.3%. Was private equity more than double? Maybe.

–I am completely out of my depth in analyzing a portfolio like this. What I do know, is that trying to borrow $30 billion all of a sudden after a massive run-up in equity prices at year end is a red flag. Or, maybe it’s just prudent cash management (to borrow at the highest short-term rates in a generation). Increases in borrowing at the Fed’s BTFP are another marker. This Fed program supposedly ends in March. it won’t.

–The discussion of soft- or hard- landings revolves around exactly these types of issues. A given zombie can hold it all together for a while if funding was locked in. The demise of a few companies or funds is no big deal, the system can absorb it. Where’s the tipping point? I’m not saying that Powell knows, but if he thought the Fed was pushing that point a little closer, he might pivot…

https://www.calstrs.com/investment-portfolio#:~:text=CalSTRS%20is%20the%20largest%20educator,November%2030%2C%202023%E2%80%8B%E2%80%8B.

| Investment portfolioCalSTRS is the largest educator-only pension fund in the world with assets totaling approximately $317.8 billion as of November 30, 2023.www.calstrs.com |

https://www.calstrs.com/private-equity-portfolio-performance

https://www.pionline.com/regulation/ilpa-calstrs-among-those-backing-secs-private-funds-rule

| ILPA, CalSTRS among those backing SEC’s private funds ruleThe ILPA, CII and pension funds, including CalSTRS, filed a brief supporting the SEC in a case seeking to overturn a rule requiring more disclosure from private fund advisers.www.pionline.com |

| Private Equity Portfolio performanceCalSTRS uses the dollar-weighted internal rate of return (IRR) to measure portfolio performance, as recommended by the Association of Investment…www.calstrs.com |

..

ILPA, CalSTRS among those backing SEC’s private funds rule

The Institutional Limited Partners Association, Council of Institutional Investors and 11 public pension funds, including CalSTRS, have filed an amicus brief in federal court supporting the SEC in a lawsuit brought by industry groups seeking to overturn a new SEC rule requiring increased disclosure from private fund advisers and prohibiting certain fee arrangements.

Curve flatter on minutes

January 4, 2023

****************

–SOFR curve flattened, partially in response to FOMC minutes. SFRM4, the weakest contract, -4 at 9538, SFRM5 +2 at 9669.5, SFRM6 +3.5 at 9683.0 and M7 +3.5 at 9676.0. Again, note that all contracts from June’25 to June’27 are within a 15 bp range, 9669.5 to 9685. (Consistent with terminal range 3.0 to 3.25%)

–From the minutes: “Sev’l observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated. …Sev’l noted the risk that, if labor demand were to weaken substantially further, the labor market could transition quickly from a gradual easing to a more abrupt downshift in conditions. …All members affirmed their strong commitment to returning inflation to their 2 pct objective.” So that’s, “on the one hand, on the other hand”

–SFRM4/M5 posted a new low at -131.5. SFRH4/H5 is the most inverted spread, now at -153.5. The last hike was in July 2023. About the longest period between last hike to first ease is 9 months. Equities remain pressured with Nasdaq Comp down another 1.2%

–There was some discussion about the lower usage of the Reverse Repo facility (money mkts had shifted to higher yielding bills and private-mkt repo). This discussion is related to the ample (or large excess) reserves regime. The excerpt below indicates, to me anyway, that balance sheet run-off is going to end soon. Emphasis added. Details will likely be forthcoming at the Jan 31 FOMC.

Several participants noted that, amid the ongoing balance sheet normalization, there had been a further decline over the intermeeting period in use of the ON RRP facility and that this reduced usage largely reflected portfolio shifts by money market mutual funds toward higher-yielding investments, including Treasury bills and private-market repo. Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

–Today’s news includes ADP expected 110-115k. Jobless Claims expected 220-225k. S&P Composite PMI 51.0.

Rebalance

January 3, 2024

*****************

–Yields rose on the first trading day of the year, with tens up 6.3 bps to 3.943%. On the SOFR strip, the red pack led the way, settling -11.625 at 96.685, a yield of 3.315%. Stocks were hit as AAPL tumbled 3.7% (a friend noted rebalancing as AAPL had become an outsized proportion of portfolios; Barclay’s downgraded AAPL). SPX -0.57%, Russell -0.72% and Nasdaq Comp -1.6%.

–Large put condor buy as a lean against ease pricing: +40k SFRJ4 9537.5/9525.0/9500/9462.5 broken p condor for 2.25. Settled 1.75 ref 9542.0 in SFRM4. The put tree (9537.5/9525/9500) settled 0.25, but the lower strike bought for protection “just in case” the Fed’s not done.

–Today’s news includes ISM Mfg, expected 47.1 from 46.7. JOLTS exp 8.85m vs 8.75m last. Fed minutes this afternoon. No “push-back on market pricing” discussion?

–From Reuters this morning:

Jan 3 (Reuters) – Some of China’s top banks have sharpened scrutiny of smaller peers’ asset quality and have tightened standards for interbank lending, three sources said, in an effort to curb credit risk as a deepening property debt crisis ripples through the economy.

I’m sure that China’s property woes dwarf those of the US, but CRE problems continue to lurk on regional bank balance sheets. On the other hand, US Gov’t Debt just exceeded $34 trillion. Like everything else, the tacit decision is to surreptitiously transfer problems to the US gov’t balance sheet; then just spend out of it. Eventually it’s a binary outcome, massive depression or inflation.

From friends at RJO London regarding SPX end-of-2024 targets (thanks NL and QB )

FWIW, last year’s average guesstimate was 4000 (ended 4770)!

Oppenheimer 5200

Goldman 5100

Deutsche Bank 5100

Citi 5100

BMO 5100

RBC 5000

BofA 5000

UBS 4850

Barclays 4800

Evercore 4750

SocGen 4750

Wells Fargo 4625

M Stanley 4500

Cantor 4400

JPMorgan 4200

Taking a lap

December 31, 2023 -Weekly comment

****************************************

Another turn of the calendar. I was trying to come up with some sort of analogy and I kept coming back to memories of the old Eurodollar pit at 30 South Wacker. This was a huge complex, a large rectangular center jammed with locals and order-filling brokers and clerks, the option pit on the north end and the back months from reds forward tiered up on the opposite south end. Probably 250-275 feet in length. There were aisles around the perimeter, with trade checkers and runners going back and forth. On either side booths stacked up like a stadium, where desk brokers took phone orders from around the globe. I don’t even know how many people worked in the Eurodollar quadrant at its peak, maybe 1000? It’s not for everyone, but I loved that atmosphere.

This image is from the option pit looking south.

So what’s that got to do with the earth’s orbit around the sun? Not pictured in the image above is FO, a large filling broker in the option pit who had a menagerie of clerks and runners on his payroll, one of which was Frankie [Dion?] a wiry, scrawny kid from the south side with a shock of curly black hair and a big gap-toothed smile. I have no idea how he landed on the CME floor, he was the type who was in a million scrapes as a kid in the neighborhood, and thought everything was pretty funny, even the stories of when he got his own ass kicked. Anyway – and I think it was MRPH who instigated this – Frankie and his brother Spaz would have enthusiastic races around the pit, with requisite wagering among the spectators. (Yeah, ‘Spaz’. I sort of doubt it was his given Christian name though). As it relates to the trading year just passed, a lap around the pit came with many obstacles: people wandering around, floor security guards. I’m pretty sure some of these races also featured unraveling rolls of toilet paper on the runners, but that may well have been another stunt (apropos to 2023). Anyway, this year’s race has been run, the money has changed hands. Sadly, it’s just not quite as much fun anymore.

I jotted down a few themes for the start of the year, and of course failed to organize those ideas into any sort of comprehensive blueprint for the upcoming year (which never works anyway). But first I would like to note a couple of items from the end of October:

Perhaps one of the best calls of the year was Ackman saying he covered his bond short as tens were around 5% citing a slowing economy and a risk of being short with yields at new highs. That was October 23, 2023.

At essentially the same time on October 22, Senator Mitch McConnell was interviewed on Face the Nation and said this:

“If you look at the Ukraine assistance, let’s talk about where the money is really going. A significant portion of it is being spent in the US, in 38 different states. We’re replacing the weapons that we sent to Ukraine with more modern weapons. So, we’re rebuilding our industrial base. …No Americans are getting killed in Ukraine; we’re rebuilding our industrial base. The Ukrainians are destroying the army of one of our biggest rivals. I have a hard time finding anything wrong with that.”

https://www.youtube.com/shorts/slgsZnYnF3k

Though I personally agree that the US should be rebuilding our industrial base, I have a hard time finding much right about the rest of it. It’s like the financialization of the US economy. You can’t always expect a beneficial outcome without the risk of getting your own hands dirty.

In any case, it was right around this time, coinciding with the Nov 1 FOMC (no more hiking), that stocks and bonds started their historic two month sprint into year-end. As many have noted, going into the Nov FOMC, financial conditions were quite restrictive. That has now reversed into a massive relaxation. Ten-yr yield from 4.93% on Oct 31 to 3.80% Dec 27. SPX from 4194 on Oct 31 to 4781 Dec 27 (+14%).

The broader themes are the following:

The US Gov’t has continued to shift more (formerly) private activities onto its own ledger. Kevin Muir was recently interviewed by Adam Taggert on Thoughtful Money and emphasized the role of fiscal dominance in terms of pushing recession off the calendar. Given the upcoming election, the Federal Gov’t will likely continue the same agenda, perhaps with even more gusto. Attitudes like McConnell’s aren’t much of an impediment. And Mideast strife pours gas on the fire. I perceive the government as much less forceful in terms of a multiplier effect than private enterprise. Hangover’s gonna be a bitch.

The Taiwan election is January 13, pitting the DPP party which asserts independence from China vs the KMT party which is seen as more open to pro-China views. China’s economic data continues to show weakness; Mfg PMI data was just released at 49.0, near the low of the year. The Shanghai Shenzhen CSI 300 ended the year 18% lower than the high posted in January. The ten-year yield ended at 2.53% vs a high of 2.92% in February. If the DPP win, then risks of military confrontation increase. If not, then perhaps more peaceful domestic stimulus will occur. Either way, Xi has to lift the doldrums.

Bank of Japan meeting is Jan 22/23. There is likely no delicate way to end negative funding rates in Japan, though the removal of the 50 bp cap on the 10y JGB was accomplished without much of a broader reaction. High of the year in 10y was 95 bps in November, last at 61 bps. Possible withdrawal of Japanese funds invested in other western markets?

Q2 turmoil resulted from regional bank failures, accentuated by bond losses and deposit flight. Money Market Funds siphoned money away from banks as yields exploded. As Doug Noland notes, “One word we didn’t hear much from the Fed in 2023: ‘macro-prudential’.” It’s reported that money market funds now total around $6 trillion; the interest flows on that ($300b ?) go a long way in supporting consumption. Some analysts call it ‘money on the sidelines’ which will flow into stocks as the Fed begins to cut rates. I tend to look at it in a more perverse way, thinking that Asian yields may rise, and that as the Fed begins to cut short-end rates, curve steepeners will become popular, putting upward pressure on long bond yields. Fiscal deterioration will add to long-end weakness. As Torsten Slok of Apollo noted at the end of September, 31% of all US Gov’t debt outstanding, or $7.6t, matures within twelve months. Whether it’s called an increase in “term premium” or a fraying of confidence in the fiscal position of the US gov’t, I believe yields on 10s and 30s will exceed the highs of 2023. The chart below shows Fed’l Gov’t Interest Payments/ Current Tax receipts. A worrisome acceleration in the last two years to a 25 year high of 35%.

This year the ten-year yield ended at the starting point, just like Frankie and Spaz. Another visualization is the Fatboy Slim ‘Weapon of Choice video featuring Christoper Walken, “you could blow with this/you could blow with that” but wind up in the same chair at the end anyway….

For your listening pleasure I’ve also included a piece from Slim Harpo, ‘Scratch my Back’

| 12/22/2023 | 12/29/2023 | chg | ||

| UST 2Y | 429.0 | 426.0 | -3.0 | |

| UST 5Y | 388.5 | 385.0 | -3.5 | |

| UST 10Y | 390.6 | 388.0 | -2.6 | |

| UST 30Y | 405.8 | 403.0 | -2.8 | |

| GERM 2Y | 240.0 | 240.4 | 0.4 | |

| GERM 10Y | 196.5 | 202.4 | 5.9 | |

| JPN 20Y | 133.0 | 138.2 | 5.2 | |

| CHINA 10Y | 261.0 | 256.0 | -5.0 | |

| SOFR H4/H5 | -151.0 | -156.5 | -5.5 | |

| SOFR H5/H6 | -31.0 | -35.0 | -4.0 | |

| SOFR H6/H7 | 7.5 | 8.5 | 1.0 | |

| EUR | 110.14 | 110.38 | 0.24 | |

| CRUDE (CLG4) | 73.56 | 71.65 | -1.91 | |

| SPX | 4754.63 | 4769.83 | 15.20 | 0.3% |

| VIX | 13.03 | 12.45 | -0.58 | |

And forward though I cannot see…

December 29, 2023

*********************

–Fairly quiet session yesterday. Yields rose, seven-year auction was a bit weak. Tens finished up 6 bps to 3.846% while 30s added 4.3 bps to 3.986%. On the SOFR curve reds through blues were down 4.5 to 5.5 bps in price. As mentioned earlier in the week, 5s and 10s seem to like 3 7/8% and 30s are comfortable at 4%. I think those yields are too low, but that’s how we’re finishing out 2023.

–Pretty fascinating Doomberg piece out today, mostly about potential energy production in the western hemisphere. President Monroe (and the Monroe Doctrine) are used as the hook to the piece -the US was (unsurprisingly) running federal gov’t surpluses in 1823 – but there’s also this tasty excerpt relating to gold:

How things have changed in just two short centuries! With the price of gold fixed at just under $20 an ounce, US federal government expenditures amounted to the equivalent of less than 600,000 ounces of the stuff over the nine months referenced by Monroe. By contrast, today’s sprawling federal bureaucracy spends that much gold in about 100 minutes, churning through the global market cap of all the gold ever mined roughly every two years.

–Applying some of the bitcoin analysis I’ve seen, that means gold should be a LOT higher! [insert two rocketship emojis here. maybe three]

–Anyway, back to the staid world of interest rates. The Federal gov’t currently has unfettered ability to borrow at low long-term rates to keep the bureaucratic plates spinning, as the leading investment minds focus on the magnitude of rate cuts in the year just before us.

Still, thou art blest, compar’d wi’ me!

The present only toucheth thee:

But Och! I backward cast my e’e,

On prospects drear!

An’ forward tho’ I canna see,

I guess an’ fear!

Happy New Year!

******************

Here are a couple of plays from yesterday. The first is bearish, but still targets FF about 50 lower than current:

SFRJ4 9550/9525/9500p fly 4.75 paid for 10k. Settle 5.0 ref SFRM4 9546.5

SFRU4 9525/9600/9675c fly bought 11k, settled 18.5 ref SFRU4 9587.5.

BLOCK SFRM5 9675/9750/9850/9925c condor bot vs sale SFRU4 9543.75/9475.0ps, paid 6.75 for 20k.

9675c 62.25

9750c 33.25

9850c 13.75

9925c 7.00 >>22.25

9543.75p 22.0

9475.0p 5.75 >> 16.25 6.0 pkg.

In order for the Sept’24 put spread to settle worthless, we need at least 75 bps of cuts, which would take target range to 4.5-4.75% and likely leave EFFR around 4.58%.