Policies, politics and provocations

January 25, 2024

******************

–ECB meeting today. As usual, news articles are advancing the idea of a Central Bank push-back against near term ease. Reasonable enough, I guess. But calendar spreads in futures continue to signal significant rate cuts. At yesterday’s settles, ERH4/ERH5 -143.5 (9616/9759.5) and SFRH4/SFRH5 -146.0 (9484/9630).

–The Fed announced yesterday it will not renew the Bank Term Funding Program and immediately raised the rate going forward until the program expires in mid-March. This band-aid was instituted due to the regional bank crisis in March of last year. Banks could pledge treasuries at par (even at market prices well below par) and borrow up to a year at OIS +10 bps. This created positive carry as t-bill/ff rates are significantly higher. In December the Fed approved Norinchukin NY branch as a participant; balances increased from about $114b in December to $161b now. I suspect political pressure to end the program started at the same time. The size really isn’t large enough to have a major market impact in my opinion, though discount window usage is likely to surge. The fact that treasuries have rallied and prices are closer to par probably eased some pressure as well.

–Reports this morning that Ukraine hit a Rosneft Refinery. CLH4 currently up over a dollar at 76.26.

–Poor 5y auction: 4.035% at 1:00pm, actual result 4.055, a 2 bp tail. Bid/cover just 2.31. Sevens today.

–Q4 advance GDP expected 2.0. Atlanta Fed GDPNow at 2.4% as of Jan 19. Jobless Claims 200k from 187k last. New Home Sales expected 649k

–A surge to new highs failed in ESH, from up 38 points at high to slightly negative at end of day. After the close TSLA warned of slower growth, down 2.3% in the afternoon and about 7% now.

–Yields a bit higher across the board yesterday. On the SOFR strip reds to golds down 2.5 to 5 bps. In treasuries 10s and 30s up 3.6 bps to 4.176% and 4.411%.

–Attached chart shows the > 100 bp drop in the 30y yield from end of October to end of December, the start of which corresponded to the Treasury’s Quarterly Refunding Announcement which weighted new issuance toward the short end. All yields dropped, so while the auction details may have had an impact, it’s just one factor of many. In any case, the next QRA is January 31, same day as FOMC. Certainly the FOMC will also include discussions about trimming QT. My thought is that 30’s will go into that meeting around the halfway point of the previous two-month rally, that is, around 4.53% or about 12 bps higher than late yesterday. I would guess around 117-16 in USH. If using highs and lows on the USH4 contract, 10/23 low was 107-03 and 12/27 high was 125-30, so halfway is 116-16.

FOMC in one week

January 24, 2024

******************

–Big buyer +23754 TUH vs -9817 UXYH about $895k DV01. Steepener likely works best on rate cut signal at the Jan 31 FOMC, but may also be impacted by the Quarterly Refunding Agreement. Open interest in TU was up 39.6k and UXYH4 OI was up 11.7k, so substantially due to this trade. Prelim open interest also shows a whopping increase of nearly 58k in the FV contract in front of today’s 5y auction. If those were pre-auction hedges I would expect the 5y auction to be solidly bid. Treasury curve did steepen, with (old) 2y up about 0.5 bps to 4.38 and tens +4.6 to 4.14%. 30s + 6 to 4.375%.

–After countless thousands of call fly and condor purchases on March and June SOFR contracts, finally a significant put buyer: on block SFRK4 9475p bought for 3.0 in size 108k. SFRM4 is underlying contract, settled 9527.5. Option expires 10-May, so captures May 1 FOMC. Open interest up just shy of 110k in that put. The pit graciously settled the option at 2.25, though in fairness it did trade 2.5 in the pit after the block. This trade is likely just a protective play for no ease.

–News today includes S&P PMIs expected 47.6 from 47.9 in Mfg, 51.5 from 51.4 Services and Comp 51.0 from 50.9

–Netflix beat and China cut RRR to arrest the freefall in stocks.

–This is sort of a fun chart comparing the size of country’s shares on Global GDP to equity market shares: (Japan’s equity share in the 1980’s is a real stunner)

Is 150 bps six cuts?

January 23, 2024

******************

–Yields eased in quiet trade on Monday; SOFR curve became slightly more inverted. For example, SFRM4 was unch’d at 9527, but M5 was +4.5 at 9653.5 and M6 was +6.5 at 9665.5. SFRM4/M5 settled -126.5. For the past month on settlement basis it’s been between -120.5 and -131.5. The most inverted one-year spread is the front SFRH4/H5 at -148.5. Near one-year calendars: FFG4/G5 is -150, SFRH4/H5 is -148.5, FFJ4/J5 is -154 and SFRM4/M5 is -126.5. The unsurprising conclusion by analysts is that there will be about 150 bps of ease over the year. The January meeting is NOT priced for an ease, and there are 8 FOMC meetings a year, so that pretty much means an ease of 25 bps at every meeting after Jan. While the 2004/2006 tightening cycle followed the 25 bp per meeting schedule, easing tends to be a bit more disjointed.

–There was an interesting Odd Lots podcast (BBG) with Jason Cummins, chief econ at Brevan Howard. His bias is that the Fed will begin to ease, that the labor market is weaker than it appears, and that inflation is likely to undershoot the Fed’s expectations. He notes that in June’23 the Fed’s projection for Core PCE was 3.9% for year end, and it actually finished at 3.2%. The point is that it was a fairly large miss from the Fed. Key points are 1) the Fed has a deep aversion to being forced into quick policy reversals. 2) The employment part of the dual mandate is becoming much more important and 3) the 2007/2008 experience may provide a reasonable template for this year.

–BOJ kept policy steady but noted a gradual firming of inflation. China is unleashing new measures to support its relentlessly offered stock market. Today’s US news includes Philly non-mfg which was 6.3 last. Two-year auction today, wi was 4.34% at the time of futures settlement.

–Yellen slated to give a speech touting the administration’s infrastructure spending/success on January 25, Thursday. FOMC is Jan 31, as is the Quarterly Refunding Announcement.

The Rime of the Ancient Mariner

January 21, 2024 -weekly comment

******************

Day after day, day after day,

We stuck, nor breath nor motion:

As idle as a painted ship

Upon a painted ocean.

-Samuel Taylor Coleridge

I don’t know enough about shipping (and military) affairs to determine how much weight should be placed on current issues. All I do know is that supply chain problems were a large contributor to the initial surge in inflation. I’m sure the current disruptions won’t be nearly as bad as 2020/21, but many analysts have opined that inflationary aspects can’t be ignored. I’m just clipping a bunch of notes together so that I personally have a better understanding.

From the Council on Foreign Relations regarding Houthi attacks in the Red Sea (Jan 12)

The Red Sea is one of the most important arteries in the global shipping system, with one-third of all container traffic flowing through it. Any sustained disruption in trade there could send a ripple effect of higher costs throughout the world economy. This is particularly true of energy: 12 percent of seaborne oil and 8 percent of liquified natural gas (LNG) transit the Suez Canal.

From CNBC (Jan 11) about the Panama Canal and low water levels:

In an advisory to clients, Maersk informed shipping customers that vessels that use the Panama Canal will no longer be traversing the canal with freight from Oceania (Australia and New Zealand) because of the ongoing water situation.

Forty percent of all U.S. container traffic travels through the Panama Canal every year, which in all, moves roughly $270 billion in cargo annually.

From ZeroHedge (Jan 20)

On Thursday, top container shipper AP Moller-Maersk sent a memo to customers, warning how the global shipping network is fracturing because of the elevated risks in the Red Sea:

“While we hope for a sustainable resolution in the near-future and do all we can to contribute towards it, we do encourage customers to prepare for complications in the area to persist and for there to be significant disruption to the global network.”

From Thoughtful Money with guest Jim Bianco (Jan 19)

Sailing around the Horn of Africa rather than traversing the Red Sea takes an additional 3300 miles and ten days.

Obviously the factors above entail significant cost increases in terms of shipping goods. Now let’s move more to the military aspects.

From Geopolitical Futures by George Friedman (Jan 16)

But it is not only the Pacific with which it is concerned. The Atlantic is not at risk right now, but just as it was a central figure in both world wars, so too could it be in the future. AUKUS [Australia, UK, US] members understand that any existential threat they face will come from the sea.

On December 14, Navy Sec’y Carlos Del Toro “called on the nation to help the Navy return to being a global leader in shipbuilding.”

“History demonstrates a clear pattern: no great naval power has ever existed without also being a dominant commercial maritime power, encompassing both shipbuilding and global shipping,”

Del Toro referenced a series of statistics: China dominates the global commercial shipbuilding industry today with over 40 percent of the market controlled by its shipyards. In just 20 years, the People’s Liberation Army Navy has tripled in size and is projected to have a fleet of over 400 warships by 2030.

China also has the world’s largest fishing fleet and third largest merchant marine fleet, exceeding 7,000 ships, compared to the United States’ 178 , which ranks 70th. China controls a significant portion of the global commercial maritime supply chain, he said.

Del Toro envisioned a multi-pronged approach to putting the United States on top in shipbuilding, including investing in the revitalization of the U.S. shipbuilding industry and merchant marine fleet; developing innovative technologies to maintain its naval edge; strengthening partnerships with key allies to counter China’s growing influence; and promoting fair competition.

From Marine Link (marinelink.com Jan 21)

The United States and Japan are looking to make a deal for Japanese shipyards to regularly overhaul and maintain U.S. Navy warships so they can stay in Asian waters ready for any potential conflict, U.S. Ambassador to Japan Rahm Emanuel said on Friday.

China has more than 370 ships and submarines, up from the 340 ships they had in 2023, according to an annual report released by the Pentagon in October, making it numerically the largest navy in the world.

I don’t know what the market implications are, besides higher shipping prices at the margin, and increased hoarding of inventories by businesses and (aware) consumers. It seems to me that no matter which political party wins the upcoming election, shipbuilding is going to be a growth industry, and there are probably a myriad of specialized suppliers that will see large increases in orders.

Like one, that on a lonesome road

Doth walk in fear and dread,

And having once turned round walks on,

And turns no more his head;

Because he knows, a frightful fiend

Doth close behind him tread.

OTHER THOUGHTS

Last week the short end of the curve once again trimmed odds of near-term easing. Twos and fives (both being auctioned this week) rose about 25 bps in yield, while the 30y yield rose 16.5.

SFRH4/SFRM4 three-month calendar has had a huge round-turn move in the past couple of weeks. On Friday, January 5 it settled -41 (9493/9534), obviously reflecting ease in Q2. One week later, on Jan 12, it settled -56.5 (9501/9557.5) as military activity heated up in the Red Sea. On Jan 19, it came right back to -41 (9486/9527). BIG moves for a three month spread. The bias is still heavily weighted toward ease, but the panic of the previous week abated as economic data gives little reason to support lowering rates.

There’s a lot of talk about trimming QT; I think consensus is that the Fed will trim the size of treasury sales right after the March FOMC. Last week Waller indicated that MBS sales should continue at the current pace of $35b per month, saying there’s no reason for the Fed to have MBS on the balance sheet. Since the Fed doesn’t hedge and the private market does, I suppose there’s an argument for slightly higher bond vol.

This week includes 2, 5 and 7-year auctions starting Tuesday. Q4 Advance GDP estimate on Thursday, expected 2.0%. Atlanta Fed GDP Now is 2.4%. New York Fed Nowcast is also 2.4%.

Friday brings Core PCE Prices, expected +0.2 on the month and 2.6% yoy. Core expected +0.2 on the month and 3.0 (from 3.2 last).

| 1/12/2024 | 1/19/2024 | chg | ||

| UST 2Y | 413.4 | 438.9 | 25.5 | |

| UST 5Y | 383.0 | 408.0 | 25.0 | |

| UST 10Y | 394.8 | 415.0 | 20.2 | |

| UST 30Y | 419.5 | 436.0 | 16.5 | |

| GERM 2Y | 251.7 | 273.0 | 21.3 | |

| GERM 10Y | 218.4 | 234.0 | 15.6 | |

| JPN 20Y | 130.7 | 146.0 | 15.3 | |

| CHINA 10Y | 252.2 | 251.6 | -0.6 | |

| SOFR H4/H5 | -163.5 | -144.0 | 19.5 | |

| SOFR H5/H6 | -21.0 | -29.0 | -8.0 | |

| SOFR H6/H7 | 13.0 | 10.5 | -2.5 | |

| EUR | 109.51 | 108.98 | -0.53 | |

| CRUDE (CLH4) | 72.79 | 73.25 | 0.46 | |

| SPX | 4783.83 | 4839.81 | 55.98 | 1.2% |

| VIX | 12.70 | 13.30 | 0.60 | |

https://www.poetryfoundation.org/poems/43997/the-rime-of-the-ancient-mariner-text-of-1834

That’s a lot of derivatives

January 19, 2024

*****************

–Yesterday’s price action featured little change in the front end, but higher yields along the back with pronounced weakness in the long bond. Two-yr yield up 0.5 bp to 4.357, 10s +4.0 to 4.142 and 30s +5.9 to 4.369. Similar changes on SOFR curve, SFRM4 +1 to 9610, M5 -1.5 to 9654.5, M6 -4.0 to 9658 and M7 -5 to 9646. My bias is that this steepening will develop into a strong trend in the back end of the SOFR curve, but more about that later.

–A friend called yesterday in an exercise to try to peg June’24 SOFR. His base assumption is that once the Fed begins easing, it will do so in 25 bp increments at every meeting. The main question became whether the first ease comes March or May. My personal bias is that the first ease will be in March, but of course there are strong arguments against that scenario, some being made by Fed officials. Recall the first ease in 2007 was a 50 bp cut, and we all know that the recent hikes weren’t in clean increments of 25, so the base assumption could well be faulty.

–When Dec’23 options expired, the market pegged the 9462.5 strike exactly. A lot of calls above that level went out worthless. Currently, SFRH4 is 9489.5. The 9487.5 straddle settled 16, so b/e 9471.5 and 9503.5. Open interest in the future contract is 1.16 million, the most of any contract on the strip. What’s somewhat interesting is that open interest in H4 calls (not including Fed serials) is 6.8 million, 4.25x as much as the future. The call strike with the largest OI is 9500c at 774k, settled 3.75. (Call your Congressman and warn her about $7 trillion of derivatives on March SOFR. Her reply, “What’s that? I only trade NVDA”). Anyway, everyone knows that there have been massive buys of call condors and butterflies to peg the March 15 option settle of SFRH4. The FOMC meeting is March 20. It’s almost all about the ease, not much about the ‘hold’. According to settles one could almost sell the straddle and buy the 9500c for 12.5. Complete protection on the upside. But open risk below 9475…

–Blue midcurves don’t really trade much, but IF steepening starts to take hold, then nominal levels of blue straddles should start to converge toward reds. From yesterday’s settles, 0QM4 9650^ settled 70.0 ref SFRM5 9654.5. 2QM4 9662.5^ settled 62.0 ref SFRM6 9658, and 3QM4 9650^ settled 60.5 ref SFRM7 9646.0. Not recommending anything here, but I think blues are a bit low on a relative basis.

–One trade of interest, SFRZ4 9625/9700/9775c fly bought vs selling 9487.5p, paid 5.0 for 20k. Settled 4.0. Max profit at 3% (9700) by the end of the year. SFRZ4 is 9610; the Fed’s FF projection for end-of-2024 is 4.6%.

Push and pull on the Fed’s timetable for ease

January 18, 2024

******************

–Price movements continue to be outsized. For example, on Jan 10, SFRZ4 settled 9608. On Friday the 12th, the settle was 9637.5, 29.5 bps higher. Yesterday’s settle was 9609, a round-turn of over one-quarter percent in a few days. The overall theme of the last several days seems to be that the Fed is now gently pushing back on the idea of a Q1 ease, but option flows are overwhelmingly hedging or speculating on fairly aggressive cuts. For example, yesterday there was a buyer of over 30k SFRJ4 9543.75/9568.75/9593.75c fly for 3-3.5. Settled 3.5 ref SFRM4 9533.0. From the standpoint of futures settle, it seems quite reasonable as the lower strike is only 11 away from the bottom strike. However, the yield on that strike is 4.56%, just over ¾ percent lower than the current Fed Effective.

–Yesterday’s Retail Sales and Ind Production slightly stronger than expected. Today we have Jobless Claims, Housing Starts and Philly Fed Mfg. The latter was -10.5 last, expected -7; we’ll see if it mirrors the plunge in the Empire State survey.

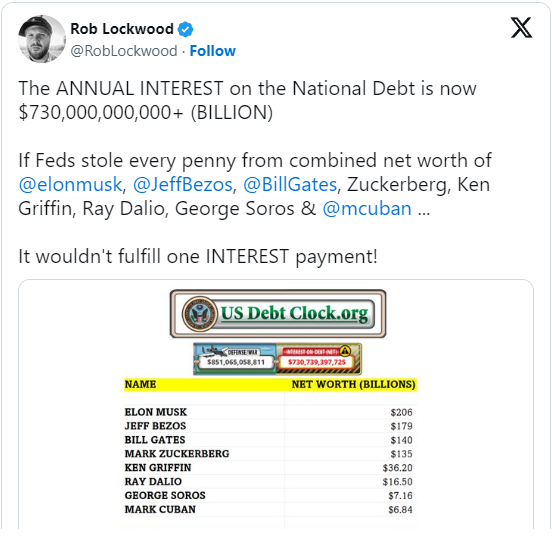

–Stephanie Kelton, the driving force behind MMT is fond of saying that the US gov’t budget isn’t at all like a household budget. I agree, as the gov’t numbers are staggeringly large. However, this little tidbit captures the gargantuan parameters of gov’t (and why “tax the rich” has lost even a slender thread of connection with “paying their fair share”).

Waller pushes ease further back

January 17, 2024

******************

–Waller indicated yesterday that while inflation is within striking distance of target, he’s in no hurry to ease, and he doesn’t see any real urgency to taper QT (and doesn’t want MBS on the Fed’s balance sheet). As a result, SOFR strip was down 8.5 to 12.5 across the board, with noticeable long liquidation in near contracts. SFRH4 settled 9494.5, -8.5 with open interest down 31k. SFRM4 9546, -11.5, OI -73k. SFRU4 9591, -11.5, OI down 42k. However, there are still huge buyers of call spreads in H4, for example 9493.75/9500cs 3.0-3.25 paid 50k (2.75s). SFRH4 9512.5/9518.75/9525c fly 0.25 for 10k. SFRJ4 9531.25/9556.25cs 11.75 – 13.0 paid 20k. It’s worth noting that Empire State Mfg was a huge downside miss, expected -5 but actually -43.7, easily the lowest print outside of the worst of covid.

–From Nick Timiroas of WSJ: Also, small but important: Waller says he’s already circled Feb. 9 on his calendar. That’s when the BLS will release recalculated seasonal adjustment factors, which last year suggested the declines in inflation over the turn of the year had been illusory.

–Lagarde also suggested ease in the summer, later than market expectations. While US equities sometimes react to bad news as good news with the idea that the Fed will save the day, in China bad news is bad news. Q4 GDP slightly missed expectations and China’s population fell 2 million last year. From CNBC, “…CSI 300 fell to an almost five-year low…fell 2.18%. Hong Kong’s Hang Seng tumbled 3.68%.” From the high around 31k in HSI at the start of 2021, it’s now 15275, down 50%. Shanghai Comp is thru the lows of 2022; it started that year around 3600 and is now 2833. A similar decline of just over 20% in SPX would send shockwaves through the US economy.

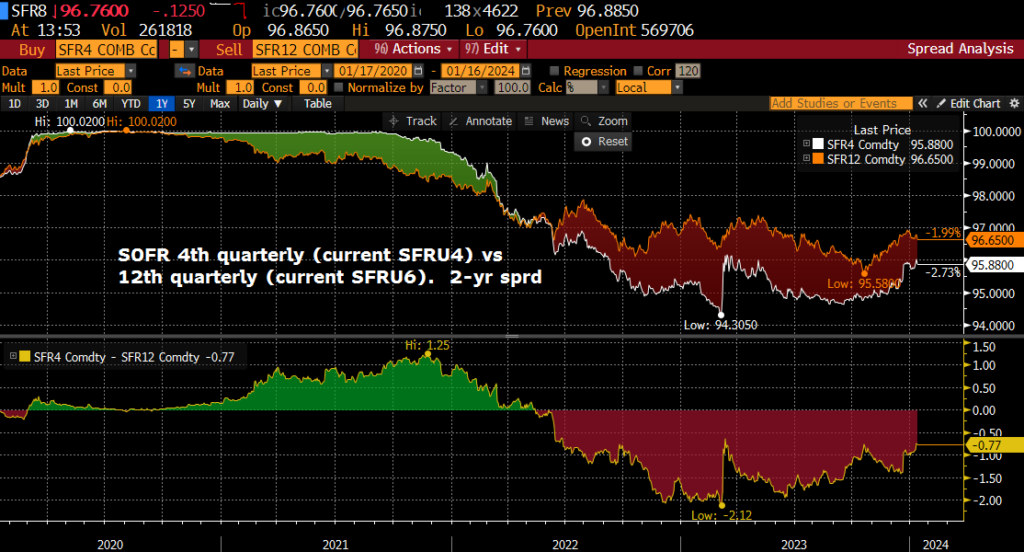

–Attached chart relates to a trade yesterday: +20k SFRU4 9675c vs -20k 2QU4 9750c, pay 3 for front Sept. Synthetic long U4/U6 spread which settled -76.5 (diff between strikes is -75). This trade should work fabulously well if the Fed eases aggressively this year, the earlier the better.

— Retail Sales today expected 0.3 to 0.4. Industrial production 0.0%. 20 year auction, Beige book, several Fed speakers.

Rate cut trades

January 15, 2024

******************

Heavy SOFR options trade Friday. Below are some selected plays.

New low in SFRH4/SFRH5 one-year calendar at -163.5 bps. Every spread from SFRU4 forward made new highs. Rolling red/green SOFR pack spread was pretty much between -40 and -55 from July to the Sept expiration, and between -20 and -35 from early Nov to Dec expiration; it settled Friday just above zero, the first positive settle since early 2022.

–SOFR options trades Friday:

+80k SFRH4 9525.0/9537.5/9543.75/9556.25 c condor for 0.75

+20k SFRH4 9537.5/9543.75cs 0.5

+20k SFRG4 9500/9506.25cs 2.25

+30k SFRG4 9512.5/9525/9537.5c fly for 1.0

-50k SFRH4 9487.5/9500/9512.5/9525 call condor vs 9462.5p sold at 5.5 (exit)

these trades reflect the idea that the Fed will be forced into early rate cuts. SFRH4 settled 9501. Recall first ease in 2007 was 50 bps.

SFRU4 settled above the 9600 strike at 9602.5. Recall in several contract months including U4 there were large buyers of 9600/9700 c spreads for 8 to 13 bps. Settled 39.75/13.0 or 26.75.

+8k SFRZ4 9650/9700/9750c fly for 6.0 (settled 5.5 ref 9637.5). This trade targets 3% by year end. The Fed’s SEP projects an end-of-year FF target at 4.6%.

+250k 2/14/24 expiry VIX 17 calls ~0.79. (underlying 14.46).

Markets with high uncertainty giving me the blues

January 14, 2024 – Weekly Comment

**************************************

Blue Monday is said to be the most depressing day of the year, typically the third Monday in January. It’s on top of us. But, spin a little bit of BB King, and you’ll shake it off pretty fast.

I don’t quite feel like I can trust any of the news or data that’s been spinning out, so I thought ‘Nobody Loves Me But My Mother (and she could be jivin’ too)’ might capture that skepticism. That’s the world we’re trading in.

In the three months since the middle of October every treasury yield from tens in fell over 100 bps. The two-year yield dropped from 5.22 to 4.134 as of Friday’s futures settlement. Same with fives, high of 4.96 to 3.83. Tens hit 4.99 in October, posted a low of 3.79 in December and are now 3.95. Thirties reached 5.11 in October, plunged to 3.95 in late December (so over 100 bps at the low), and are now 4.19.

The first SOFR contract which is lower in yield than the five year is December’24 at 9637.5 or 3.625%. SOFR contracts are above 9617, or 3.83, the 5-yr yield, all the way out to September 2031 (SFRU’31 = 9617). That means positive carry; the yield on longer dated paper can be profitably financed with shorter term borrowing. (High point is SFRZ’25 at 9689)

From BBG: “Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before. Saddled with the kinds of bloated deficits that were once unthinkable, these countries – along with Japan – will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.”

The White House projects a US deficit of $1.8 trillion in 2024, which is, of course, the bulk of what is cited in the BBG article. The last SEP, from the Dec FOMC, projected end of 2024 Fed Funds at 4.6%, end of 2025 at 3.6%, and end of 2026 at 2.9%. The market has airbrushed 2024 out of the picture, and gone right to 2025. The 2025 projection of 3.6% is right where SFRZ4 settled on Friday, 9637..5 or 3.625%. SFRZ5 is approaching the 2026 FF estimate of 2.9 at 9689 or 3.11%. How does the US government shove another 1.8t of debt down the market’s gullet? The Fed can make the whole thing happen with positive carry. Et voila, foie gras.

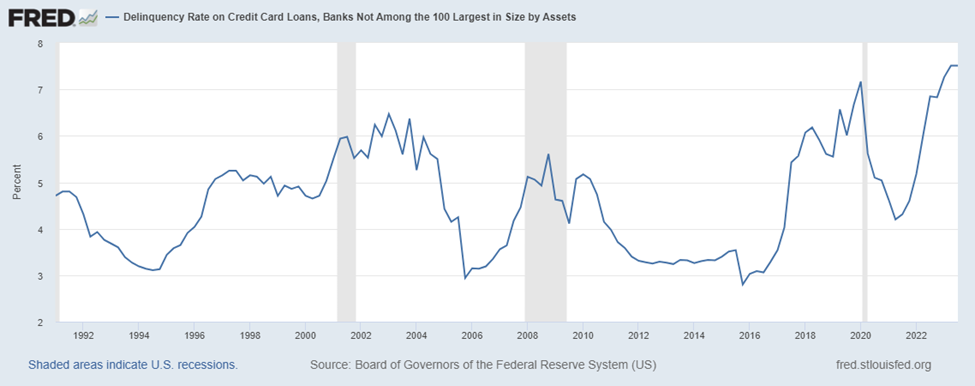

However, accommodating Federal fiscal largesse likely crowds out the private sector and could easily re-ignite smoldering inflationary embers. On the other hand, the household sector is showing increasing signs of stress on the frayed edges. The delinquency rate on credit card loans (all commercial banks) is 3%, which hasn’t been this high since 2012. The delinquency rate on credit cards loans (not among banks in the 100 largest) is a record 7.5%.

A Fortune article from last week sports this headline:

2023 was a worse year for corporate bankruptcies than 2020 – and the highest since the GFC – after a stunning 72% surge, S&P Global finds

At the start of the subprime mortgage crisis in 2007, many labeled problems in that little corner of the market as “a mile wide and an inch deep”. Analysts thought it just wasn’t large enough to spill over into the broader economy. I skimmed through a few articles about subprime in 2007. This one outlines many of the problems quite succinctly. It’s from 1-November 2007.

I love the concluding paragraph:

Now attention focuses on the wider economy. So far, the business sector has acquitted itself decently, manifesting an underlying strength. The global economy also keeps booming. While spreads have narrowed in the wake of the rate move, it will take months to see how consumers react. Will mortgage delinquency rates continue to rise, and trigger financial markets to lose confidence again? Will Wall Street scare Main Street enough for consumers to stop buying? If that doesn’t happen, and we avoid a recession, the credit crunch may go down as a summer squall, rather than a force 10 storm.

Now it’s all about “landing” scenarios rather than perfect storm analogies. Don’t worry comrades, the storm comparisons are right around the corner.

In 2007 stocks topped in mid-October, right after a 50 bp cut in September from 5.25 to 4.75%. A pullback ensued in late October, and another run for the high occurred right at the end of Oct, corresponding to another rate cut of 25 bps to 4.5%. That rally failed. It’s right when the article above was published. We know what happened next. A proper storm.

There are many complicating factors in the present environment. At the top of the list, in my opinion, is the threat of expanding military and terrorism conflicts. Domestically, I think that Stephanie Pomboy (in an interview on Thoughtful Money) synthesizes a huge issue. She said it’s well known and accepted that the government inflated moral hazard relating to banks and the corporate world in the aftermath of covid. But she cites current non-payment of student loan debts and rising credit card delinquencies as akin to a household payment strike, awaiting (another) government bail-out. After all, even after the moratorium on education loan payments ended, the Biden administration keeps dangling out hints that loans will be forgiven. Given the circumstances, and the likely lack of penalties, those who are dutifully making payments are chumps. That mindset is a huge problem going forward.

There’s a lot of talk about the Fed pivoting in order to influence the election. I don’t personally believe that’s in Powell’s DNA. However, the Fed does have to walk the line between the possibility of defaults crushing the economy, and the idea that easier policy feeds into fiscal stupidity (in an attempt to kick a heavier can a bit further down the narrowing road). In any event, the market is forecasting increasing geopolitical risks and a weaker global economy to result in rate cuts. Look back at 2007: 75 bps of cuts in two meetings. On Friday SFRH4/SFRM4 settled at a new low -56.5 (9501/9557.5). SFRH4/SFRH5 settled at a new low of -163.5 (9501/9664.5) down 21 on the week. FFG4/FFG5 settled -182.5! Maybe these spreads aren’t as crazy as they look, even if certain Fed members continue to jawbone higher-for-longer.

The defiant Taiwan election adds to uncertainty of the Middle East.

OTHER THOUGHTS / TRADES

The curve steepened by a lot last week. On 5-Jan 2/10 closed -34.5. On Friday I marked it at -18.6. Last year in July, the low in 2/10 was -108.5. By the end of October it rallied to -16, nearly 100 bps. Recent low in mid-Dec is -53.5, and it’s now back testing last year’s high.

In 2007, 2/10 went from around -15 in March to around +50 in August, before the first ease. By March 2008 It was 200. So, a move of over 200 bps in a year. A similar magnitude would put 2/10 at ~ +100.

On Friday, Feb VIX 17 calls were bought in size 250k. I believe price was 0.79. BBG lists open interest at 91k (cover short and double up the other way?) The highest OI in Feb VIX calls is the 20 strike at 334k, with premium of 0.51. Spot VIX ended last week at 12.7, pretty much at pre-covid levels. In April 2007 VIX was around 12.7. In October it hit 80. I’m not sure that 2007 is the right template for today, but it wouldn’t surprise me at all to see VIX hit 20 before Feb expiration.

Last week I suggested buying SFRH4 9481.25p delta neutral (3.75, -0.29d vs 9493.0). Given Logan’s assertion that we’re no longer in a super-abundant reserve regime, I thought vol might firm significantly in near contracts. It didn’t. However, Friday’s settles showed a small profit due to gamma: puts settled 2.0 and futures 9501. Lose 175 bps on puts per hundred, make 232 on futures.

20-year auction on Wednesday. Ten-year tips on Thursday. There was very heavy trade in SOFR options Friday, weighted heavily to upside. Will summarize on tomorrow’s daily.

| 1/5/2024 | 1/12/2024 | chg | ||

| UST 2Y | 438.7 | 413.4 | -25.3 | |

| UST 5Y | 400.7 | 383.0 | -17.7 | |

| UST 10Y | 404.0 | 394.8 | -9.2 | |

| UST 30Y | 420.0 | 419.5 | -0.5 | |

| GERM 2Y | 256.8 | 251.7 | -5.1 | |

| GERM 10Y | 215.6 | 218.4 | 2.8 | |

| JPN 20Y | 136.0 | 130.7 | -5.3 | |

| CHINA 10Y | 252.0 | 252.2 | 0.2 | |

| SOFR H4/H5 | -142.5 | -163.5 | -21.0 | |

| SOFR H5/H6 | -34.0 | -21.0 | 13.0 | |

| SOFR H6/H7 | 6.5 | 13.0 | 6.5 | |

| EUR | 109.43 | 109.51 | 0.08 | |

| CRUDE (CLH4) | 73.86 | 72.79 | -1.07 | |

| SPX | 4697.24 | 4783.83 | 86.59 | 1.8% |

| VIX | 13.35 | 12.70 | -0.65 | |

Conflict escalates, curve steepens

January 12, 2024

******************

–Solutions are becoming painfully obvious. China CPI was -0.3 in December from a year earlier. All you need is a dysfunctional government that dominates economic activity, crushing debt, and a property bust (CRE). Fold in equity market weakness. The US is on the right path to quell inflation…just need the equity market to buckle.

–CPI in the US was a bit higher than expected, yoy 3.4%. Rate futures sold off post-data, but late buying materialized by those with knowledge of the Houthi bombing plans, and futures closed at the highs. Strongest SOFR contracts were Dec’24 and March’25, both up 14.5 to 9622.5 and 9651.0. As an example of the volatility, SFRZ4 was 9613.5 pre-CPI, traded down to 9605.5, and then soared late in the day to 9624.5. As the US and UK are drawn deeper into the chaos of the mideast, there’s a flight to the safety of shorter maturities. The two-year was down over 10 bps at futures settlement, to 4.26%. Tens fell 5 bps to 3.977%. This morning CLG4 is near $75/bbl, up around $3, and Feb Gold is 2050/oz, up over $30. It’s not clear to me that global military conflict hastens the need to ease monetary policy, but the move toward safety is dominant. FFJ4 settled 9486 or 5.14%, vs what would be 5.08% in EFFR on a 25 bp cut. So, the market is about 75% certain of a 25 bp cut. Taiwan election is this weekend.

–News today includes PPI expected 0.1 with yoy 1.3% from 0.9% last.

–The curve steepened as shown on attached chart. 5/30 made a new high for January at +29, and has taken out highs from October.

–High of last year in 2/10 is -16, set on Oct 31. Subsequent low was -53.6 on Dec 15. We’re now at the highest levels since early Nov at -28.3.

The pattern is a bit different on 5/30. The high was set early in the year on May 10 at 40.8. The Oct high corresponding to the year’s high in 2/10 was 27.4. Yesterday (12-Jan) we exceeded that high at 28.9.