Good demand for 3’s; large ten-yr auction today

February 7, 2024

******************

–Yields pulled back from highs made post-NFP, with tens down 7 bps to 4.09%. However, futures are down slightly this morning in front of today’s FORTY-TWO billion 10y auction. TYH4 settled 111-09 and currently prints 111-03+. Auction coincides with news that the SEC is considering new regulatory “fixes” on the basis trade. Impact on liquidity?

–NYCB back in the news, having been downgraded to junk by Moody’s. KRE, the regional bank ETF was down 1.26% yesterday to 46.97. Post-SVB in May it had reached 35. That’s when the first SOFR 1-yr calendar hit -192 as the Fed held off on the idea of easing despite banking turmoil; fronts were held down while back contracts soared. Around that time the green sofr pack (3rd year forward) traded around 9725. Current SFRH4/H5 is -143 (9478.5/9621.5) and the green pack is 9659.

–Plenty of Fed comments today, including Kugler (new to the Fed board) at 11:00, then Collins, Barkin, Bowman. April FF settled up 1 at 9472.5, about 5 higher than Feb, which is pegging the current EFFR of 5.33%. The May FOMC is May 1, and FFK4 settled 9487.5. If the Fed eases by 25, then EFFR should go to 5.08% or a price of 9492. Recall that FFJ4 had previously settled above 9492 on Dec-27 (high settle 9494).

–Consumer Credit released at the end of the day. Last (November) was $23.75b, with a whopping annualized gain of 17.7% in revolving credit. Expected $16 billion for Dec.

Yields press higher into auctions

February 6, 2024

******************

–Yields continued to rise going into the start of auctions, with the three-year today. Tens jumped another 13 bps yesterday to 4.16% as ISM Service data and prices were stronger than expected. Today also features Fed comments by Mester, Kashkari and Collins. Goolsbee said yesterday that he doesn’t want to rule out a March cut, however, the market has pretty much removed that possibility. FFJ4 settled 9471.5 or 5.285% vs EFFR of 5.33.

–New high settle in SFRH4/H5 at -136.5 as reds were hit hard. SFRH4 fell 12.5 to 9613.5. Red pack -13.5. Everything from June’25 to golds (5th year) were down 13 to 14.

–SNAP yesterday said it would cut about 10% of its workforce (528 people). Not a big number, but layoff announcements appear to be at odds with Friday’s payroll data. Fed’s Sr Loan Officer Survey (SLOOS) was out yesterday. From the report, “…survey respondents reported tighter standards and weaker demand for C&I loans to firms of all sizes over Q4” Same with Commercial Real Estate. “Moreover, for credit card, auto and other consumer loans, standards reportedly tightened, and demand weakened on balance.”

Anecdotal evidence seems to suggest a weakening economy.

–Attached is chart that shows Russell 2k divided by Nasdaq 100. Even lower than the dotcom bubble in 2001. When Nasdaq started to deflate, the Fed was spurred into aggressive easing in 2001 (200 bps in 4 months). CPI at the time was right around where it is now, 3.4%.

Pushing the ease back

February 5, 2024

******************

—Friday’s blowout NFP at 317k caused an implosion in rate futures. Weakest SOFR contracts were Dec’4 and March’5, both settling -23.5 at 9595.5 and 9626.. SFRH6 settled -20 at 9666.5 and H7 -18.5 at 9659, so inversion was accentuated slightly from reds back. The five-year yield jumped nearly 20 bps to end 3.993%, while tens rose 17 to 4.031%. This week features auctions of 3s, 10s and 30s beginning tomorrow. Many have expressed skepticism about the strength of Friday’s data. The workweek was only 34.1 hours, near the depths of covid.

–April FF are the best indication of March 20 FOMC odds; settled 9473 or 5.27%, as compared against current EFFR of 5.33 or 9467. At Wednesday’s press conference, Powell suggested the Fed would not likely have the confidence to cut in March, which he repeated in the 60 Minutes interview aired yesterday. In today’s session, the low so far in FFJ4 is 9471.5 and the low in SFRH4 is 9474. Rate cut odds have been substantially squeezed out of March, and of course rates across the curve have shifted higher. TYH4 settled 111-21 on Thursday and this morning has posted a low of 111-04; the low in 2024 has been 110-26 on Jan 19. SFRZ4 this morning prints 9587.5, which is still about 125 bps above the SFRZ3 price in mid-Dec, but the market is coming a little bit closer to the “three cuts in 2024” implied by the dots.

–In the 60 minutes interview, Powell said, “We looked at the larger banks’ balance sheets, and it appears to be a manageable problem”, referring to CRE valuation issues. Powell openly admitted that the Fed whiffed on SVB. Many have noted that in the December FOMC statement, the second paragraph started with the sentence, “The US banking system is sound and resilient.” That line was absent in the Jan 31 statement. Lower rates and a positive curve would help nurse regional bank balance sheets back to health, but Powell clearly stated the Fed does not take political considerations into account during FOMC deliberations, so the lifeline of lower funding costs for regionals is a little farther away..

–News today includes ISM Services, expected 52.0 from 50.8 last. Bostic speaks at 2, and there are Fed speeches throughout the week. Today also includes the Fed’s Senior Loan Officer Survey at 2:00, which could be important with respect to credit conditions and CRE.

Payrolls and toilet paper

February 2, 2024

*******************

–All I can say is I’m glad I have the Peloton / Novo Nordisk (Ozempic) spread on. If it takes effort, bad. If it’s a simple pill, good. I guess the Shanghai Comp (new lows) vs META is another appropriate spread. META blew away expectations and is up 16% pre-open. China’s stimulus measures have flopped with new lows in SHCOMP.

–SOFR curve flattened hard; a contributing factor was stronger than expected Mfg ISM at 49.1, and Prices Paid at 52.9. SFRH4 settled 9489, -2.5, H5 9649.5, +3.5 and H6 9686.5, +8.0. The highest settle on the SOFR strip is Dec’25 at 9687 or 3.13%. Near one-year calendars printed new lows on the day. SFRH4/H5 printed -165 and settled -160.5 and SFRM4/M5 settled at a new low -132.5 (9538/9670.5). Continued worries about bank contagion saw KRE regional bank ETF close -3.1%. While odds for the March FOMC have clearly shifted toward HOLD, SFRH4 out-of-the-money calls are crazily bid. SFRH4 settled 9489, but calls 111 away, the 9600 strike, settled 1.25 (and were bid there), and 9700c were 0.25/0.75 and settled 0.5 with 42 dte. There are 7.6 million open interest SFRH4 calls, so an insurance bid to cap risk is understandable, but this is like toilet paper during covid.

–Ten-year yield was 3.86%, down 13.5 bps at futures settle. SFRZ4 settled 9619 or 3.81%. Perhaps the curve can move to positive carry by the end of the year…

–Payrolls today expected 185k from 216k last. Unemployment rate to 3.8% from 3.7%, Avg Hourly Earnings 4.1%. Powell will be on 60 Minutes this weekend to hone the Fed’s message.

Lean against politicization

February 1, 2024

********************

–Powell said repeatedly the Fed is committed to its 2% inflation target, a direct repudiation of those who would accuse him of easing policy to help someone else defeat Trump. Stocks were already pressured by GOOGL results released Tuesday post-close, and by NYCB opening 45% lower, but the real downside acceleration came after Powell said the central bank is unlikely to have enough confidence about inflation to cut rates as soon as March. SPX ended -1.6% while Nasdaq Comp fell 2.2%.

–The 50/50 level for an ease or hold is 9479.5 on April Fed Funds. (9467 for hold, 9492 for ease). Yesterday’s range was 9476 to 9486.5, but this morning’s trade is 9476.5, closer to the current 5.33% EFFR of 9467.0. The employment part of the dual mandate, which has now become more balanced with inflation in terms of policy implications, will be on display tomorrow with NFP expected 180k. One interesting aspect of Powell’s comments yesterday was a subtle rejection of rules based policy-making. Powell said he leans heavily on anecdotal information gathered from business connections throughout the reserve system. Soft vs hard data.

–The refunding announcement features large increases in 2, 3, 5 and 10y auctions (up $9b per month in 2s and 5s relative to last qtr). 30y bond is only up $1b (attached link below).

–NYCB, the proud buyer of Signature Bank assets, closed down 38% yesterday after a dividend cut. KRE, the regional bank etf closed -5.8%. It was the regional bank crisis in March which sparked a huge short-end rally based on potential rate cuts – which never came. The Bank Term Funding program was instituted at that time to subsidize the banking system back to health. Right after the announcement that BTFP is not being renewed, a lingering flare-up of questionable asset values is again sweeping regionals. Large lay-off announcements and banking issues will clearly keep hopes alive for a March rate cut, though if those factors are the ultimate reason for cuts, stocks likely won’t be cheering the decision.

–Note that the Fed’s dots from the Dec SEP projected 3 eases by year end 2024. SFRZ4 settled 9617.5 or 3.825%, or 150 bps below the current EFFR. The 9700c, 82.5 otm, settled 21.0 with 26 delta. The 9537.5 put, 80 otm, settled 12.0 with 21 delta. That put strike approximately represents three 25 bp eases from the current level. Clearly the market remains attentive to the possibility of bad things happening which will cause big cuts.

–Today’s news includes Jobless Claims expected 212k. ISM Mfg expected 47 from 47.4. Payrolls tomorrow expected 180k. Earnings this afternoon by AAPL, AMZN and META.

QRA and FOMC

January 31, 2024

******************

–Today’s news includes Treasury Quarterly Refunding Announce at 8:30, FOMC at 2:00 followed by 2:30 Press Conference.

In addition, ADP at 8:15, ECI at 8:30, Chicago PMI 9:45 (all EST).

–Yesterday featured a pre-data buy of 51k TYH4 111.25/110.25ps for 21, settled there ref TYH4 111-20. JOLTs higher than expected 9026 vs 8750. (However, UPS lays off 12k and there have been other significant layoff announcements). Employment data is on Friday.

–At futures settlement (but prior to GOOGL and MSFT earnings) the curve had flattened significantly as odds for a March ease were trimmed slightly. For example, FFJ4 was sold down to 9477 and settled 9477.5 (-1.5) or 5.225, closer to the current EFFR of 5.33 than an ease of 5.08. SFRH4/M4 settled at a new recent high of -40 (9485.5, -2.0 vs 9525.5, -4.0). As the attached chart shows, the red/green SOFR pack spread fell almost 5 bps to -11.75. In treasuries, the 2y yield rose 3.7 bps to 4.357% while 30s sank 5.2 bps to 4.278. I marked tens at 4.057% at futures settle, but down another couple of bps later in the electronic session. All indicative of a slight decline in confidence regarding a March cut.

–Disappointment with GOOGL’s results (and MSFT to a lesser extent) has caused a pullback from all-time-highs. Nasdaq futures currently -1.2% and GOOGL is -5.7% pre-open.

–Fed still likely to set the table for a March ease as inflation levels have neared target. Real rates are significantly positive. 5 and 10 year inflation indexed note yields have been around 1.75% for a month and a half. QT trimming also will be a topic at the press conference, likely to be implemented after the March FOMC.

Treasury shaves borrow estimate

January 30, 2024

******************

–Early trade: buy of 70k TY week-1 110.75/100.00 p spread for 9/64. Expires Friday, so captures FOMC, QRA, NFP and earnings reports. Open interest in the two puts +66k and +59k. Settled 8 vs TYH4 111-165.

–Late trades (post-Treasury borrowing estimate) two block buys of TU (+7.6k 102-218 and +15k 102-223) appear to be exits as OI in TUH4 declined 21k. Block buy of 21742 FVH4 107-30 vs sale 4432 WNH4 126-30 also looked like exit. OI in WNH4 fell 6.8k.

–The late bid in treasuries, which has carried into this morning, was sparked by Treasury’s reduced borrowing estimate for the quarter. ($760b from original estimate of $816b). Actual composition of issuance will be released Wednesday. From Treasury:

- During the January – March 2024 quarter, Treasury expects to borrow $760 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion.[2] The borrowing estimate is $55 billion lower than announced in October 2023, largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance.[3]

- During the April – June 2024 quarter, Treasury expects to borrow $202 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $750 billion.[4]

–Of course, Blinken referring to the MidEast situation as “incredibly volatile” probably adds to treasury buyers at the margin, and China’s ten year yield at a new historic low of 2.45% (just below the 2020 low of 2.47) underlines economic woes there.

–Dallas Fed Mfg was notably weak at -27.4. Outside of Covid there’s but one slightly lower reading from last year. Today’s news includes Consumer Confidence, strong at 110.7 last, JOLTS, expected 8750k vs 8790k last. Earnings post-close from MSFT and GOOGL. MSFT closed at an all-time high yesterday and is > $3T mkt cap. It has doubled 3x since 2016 when it was ~50, now 409.72. GOOGL also at an all-time high yesterday 153.51. Market cap near $2T. So, adding the market cap of those two equates to around 17% of US GDP. The change in Treasury’s borrowing estimate of $50 billion is a 1% change in value of MSFT + GOOGL.

–Ten year yield fell 7.2 bps yesterday to 4.087%…nearing 4 again.

..

https://home.treasury.gov/news/press-releases/jy2054

Fed week

January 29. 2024

*****************

–Yields rose Friday in a relatively quiet session, net changes on the week in rate futures were small. On Friday the weakest contracts were the first two reds, SFRH5 and M5, both down 8 at 9629.5 and 9648.5. On the week those two contracts were -0.5. The ten year yield was up 3.1 on Friday to 4.159%. PCE Core prices yoy +2.9%, but just 1.9% six-month annualized, below target.

–Today’s news includes Dallas Fed Mfg expected -11.8 from -9.3 last. Treasury releases its financing estimate for the quarter; QRA is Wednesday. FOMC also Wednesday.

–China’s Evergrande has been ordered to liquidate, but there’s a news bullet this morning: *China to step up support for listed firms, Vice Premier He Says. SOFR and treasuries trading modestly higher this morning; ten year yield currently 4.10%.

Big Week

January 28, 2024 – Weekly Comment

******************

There’s a lot going on this week. FOMC and Refunding Announcement on Wednesday. Payrolls on Friday. Earnings announcements by MSFT and GOOGL on Tuesday, AAPL, AMZN, META on Thursday.

Not much change in rates last week. SOFR contracts were 1.5 bps on either side of unchanged out four years. Treasuries Fri to Fri: FVH4 107-217 to 107-207. TYH4 111-04 to 111-01, USH4 120-00 to 119-18.

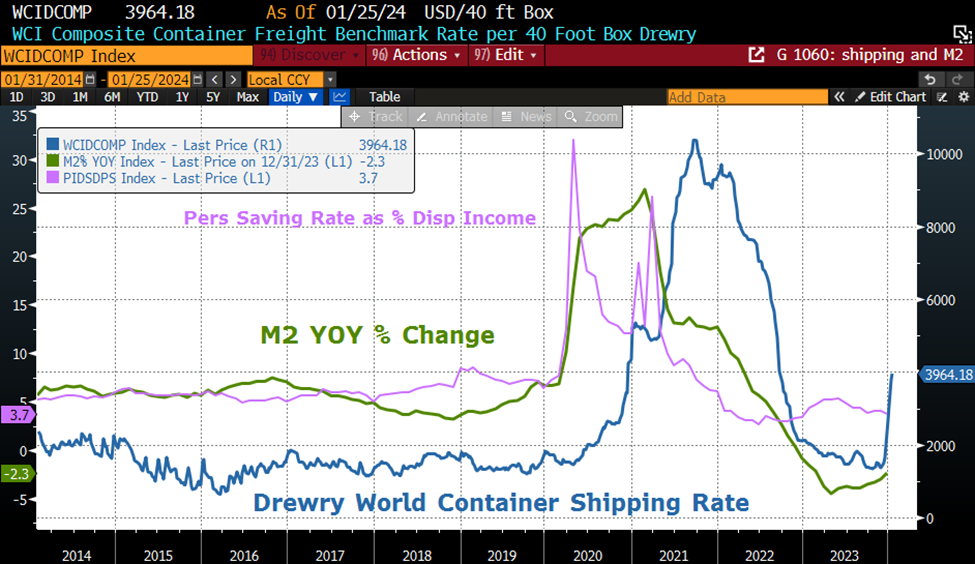

One thing that did have a significant move was oil, with CLH4 settling 78.01, up 4.76 or 6.5% on the week, highest since November. Of course, that move is due to Red Sea attacks and other geopolitical issues. I saw a chart of Container Shipping Rates which is included on the chart below. The recent surge is thought to be inflationary as oil prices and shipping/insurance costs jump.

Many charts over the past five years follow the same basic pattern: a huge spike associated with covid shutdowns and stimulus, followed by reversion lower. What’s interesting about the Shipping chart is that it is making a new run. However, I included M2 yoy growth and the Personal Savings rate (as % of Disp Income) on the chart below. M2 is negative and well below pre-covid. The Savings rate is just 3.7, also below covid levels, and that’s with much higher interest rates which should encourage saving.

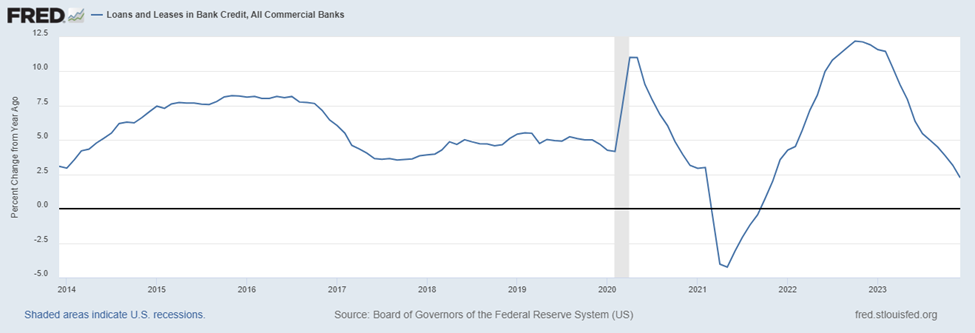

I also include the chart below from the St Louis Fed, Commercial Banks Loans and Leases, % change yoy. It’s a bit difficult to see, but it begins 2014, the shaded area is, of course, the covid recession, which corresponded with large draws on credit lines. The most recent reading of +2.3% is the slowest growth outside of the post-covid reversion.

My point here is that oil and shipping costs may have a temporary effect on inflation, but without support from M2 (or a large jump in velocity) and without credit growth, it’s difficult to see a sustained increase. The low savings rate suggests that consumers are already stretched, and not likely to create a big new surge in demand.

However, that’s not to say that yields can’t move significantly higher, especially on the long end. Both the quarterly refunding plans and the Fed’s discussions about scaling back QT will likely have a large impact. Treasury’s financing estimate for the quarter will be released Monday, Jan 29. The expected composition of issuance is released Wednesday.

Last quarter’s recommended financing table is included below. In the lower section, provisional indications for the upcoming quarter are included.

Total funding needs are huge. According to provisional indications, 7s and 10s could increase $3 billion per month, and 30s $2b per month larger than Q4.

Last quarter the Treasury weighted issuance more heavily toward t-bills. I don’t think that’s as likely this time. The long bond yield topped at 5.11 in October, and plunged in the next two months to sub-4%. However, it appears as if the 4 handle has been rejected, and Friday ended at 4.39%.

Core PCE prices yoy were just 2.9% (released Friday). Payrolls are expected to show lower growth, with NFP expected 180k on Friday. In my opinion, both inflation and growth are trending moderately lower and are inclined to continue along that path (regardless of temporary Red Sea problems). Wednesday’s FOMC is likely to support an ease at the March meeting, though many analysts are emphatically saying it would be a policy error. The Feb/April FF spread at -11.5 (9468/9479.5) currently leans slightly toward ‘no ease’. Of the five huge stocks reporting this week, MSFT, META and GOOGL are at all time highs and AAPL is only 3.5% away. There are clearly arguments to be made both ways. However, longer dated treasuries must contend with supply which could easily push yields higher over the next couple of months.

| 1/19/2024 | 1/26/2024 | chg | ||

| UST 2Y | 438.9 | 436.5 | -2.4 | * no roll adjust |

| UST 5Y | 408.0 | 405.9 | -2.1 | * no roll adjust |

| UST 10Y | 415.0 | 415.9 | 0.9 | |

| UST 30Y | 436.0 | 438.8 | 2.8 | |

| GERM 2Y | 273.0 | 263.3 | -9.7 | |

| GERM 10Y | 234.0 | 229.9 | -4.1 | |

| JPN 20Y | 146.0 | 151.7 | 5.7 | |

| CHINA 10Y | 251.6 | 250.2 | -1.4 | |

| SOFR H4/H5 | -144.0 | -143.0 | 1.0 | |

| SOFR H5/H6 | -29.0 | -30.5 | -1.5 | |

| SOFR H6/H7 | 10.5 | 11.5 | 1.0 | |

| EUR | 108.98 | 108.55 | -0.43 | |

| CRUDE (CLH4) | 73.25 | 78.01 | 4.76 | |

| SPX | 4839.81 | 4890.97 | 51.16 | 1.1% |

| VIX | 13.30 | 13.26 | -0.04 | |

Delusions

January 26, 2024

******************

–Once again, GDP stronger than expected with Q4 Advance reported at 3.3%. ZH notes that in nominal dollars, Q4 GDP rose by $329b, but the US budget deficit over the same period rose $510b…”In other words it now takes $1.55 in budget deficit to generate $1 of growth…” As I mentioned after the last employment report, in calendar year 2023, 25% of all new jobs added were by government.

–Today brings the Fed’s preferred inflation data. PCE prices expected 0.2 m/m and 2.6 yoy from 2.6 last. Core expected 0.2 with yoy expected 3.0 from 3.2 last.

–Attached chart shows 2/10 (amber) and 5/30 (white) with the vertical line being the last Qtrly Refunding Announcement. The initial move was flattening as funding was shifted toward the front end. Currently, 5/30 is actually near a new high at 36.2 (accentuated by a few bps due to the switch to the new 5y). The high in the spread last year was 41 bps in May, in the aftermath of the regional banking crisis. That level has been the highest since March 2022. My bias is for further steepening as the Fed begins to cut rates, though the refunding composition and changes to QT are also important factors.

–Despite GDP, yields were lower on the day. Tens fell 4.8 bps to 4.128%. On the SOFR strip, reds rose over 7 bps and greens 6 bps.

–Next week includes FOMC and Treasury Refunding Announcement on Wednesday. Alphabet and MSFT report on Tuesday, AMZN, AAPL, META on Thursday. Payrolls on Friday.

–I don’t often stray into the political sphere, but here’s a clip from Yellen’s speech yesterday, emphasis added:

“Real wages have risen from their pre-pandemic levels—especially quickly for middle-income households. And because wages have risen more than prices, middle-class Americans now have more purchasing power. New Treasury analysis shows that a worker earning the median wage can today buy the same goods and services as in 2019, with nearly $1,400 left over to save or spend. And families are now putting their extra income and their accumulated pandemic-era savings back into the economy.

Put simply, it’s been the fairest recovery on record.”

In my opinion, the public at large doesn’t seem to view it as a fair and booming recovery. Perhaps it’s a bit closer to Dean Phillips’ characterization:

Rep Dean Phillips, Presidential Candidate: “We have a duopoly, a two-party system that is literally working against voters…. my party is completely delusional right now“