PBOC steps in front of the Fed

February 20, 2024

*******************

–China cut its 5 year loan prime rate by 25 bps to 3.95%. However, US equity futures are moderately lower as of this writing on Tuesday morning.

–Friday featured continued buying of TYJ puts. TYJ 109.5/108.5ps settled 18 with open interest +15k in both strikes. Late buying of TYJ 106.5p and 106p for 6 and 5 (settlement prices), with open int +21k and +36k. On the day, April TY puts gained 131k contracts while March puts dropped 51k. March options expire Friday.

–SOFR contracts continue to be weighed down as Fed cuts drift further out of focus. Weakest contract on SOFR strip was SFRM5, down 10 at 9607. SFRM4 was -5 at 9495; buyer of 35k SFRM4 9493.75/9481.25/9468.75p fly for 3.25 to 3.5.

–New recent low in 2/10 at -36 bps, though it’s just around the 50% pullback from the Dec low of -53.5 to the Jan high -16.5.

Presidents’ Day market notes

February 18, 2024 – Weekly Comment

****************************************

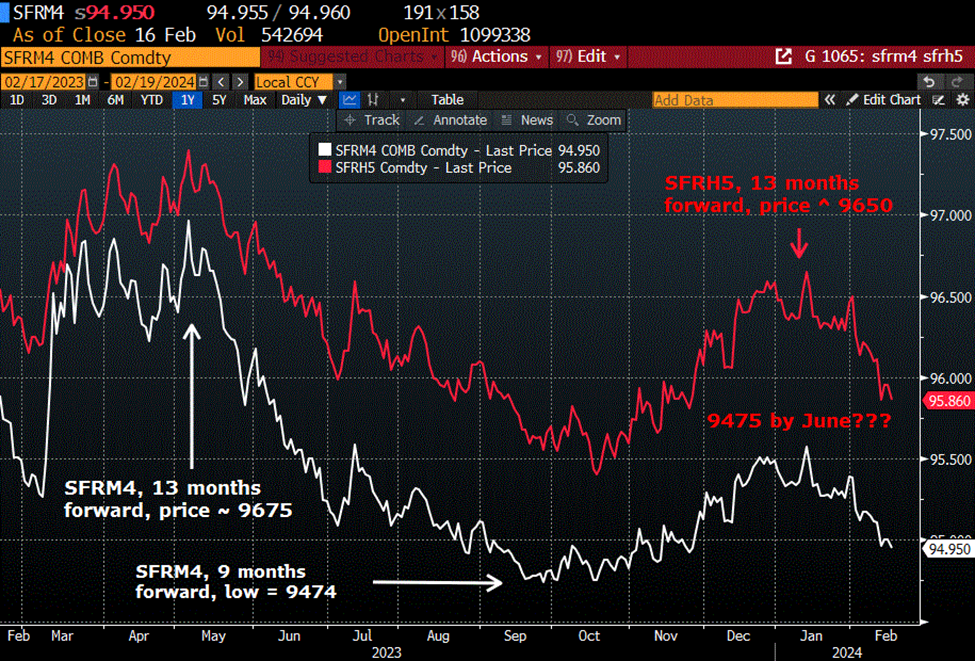

Just three brief observations this week. 1) SFRM4, SFRH5 comparison 2) Huge increases in TYJ put buying 3) Red/green SOFR calendar

In the beginning of May 2023, when concerns about the (regional) banking system were still tender, SFRM4 traded around 9675. The high settle had been 9696 on May 4. It then began a protracted slide with a low settle of 9474 in late September. In May, SFRM4 was about 13 months forward. At the September low of 9474 it was just under 9 months forward. Note that on both May 3 and July 26 the Fed tightened 25 bps, skipping the June meeting. Note also that in April 2023 CPI was 4.8, in May 2023, 4.0 and in June 3.0. Last week’s reading for January was 3.1. The July hike has been the last one.

Now consider SFRH5, which is currently about 13 months forward. It recently traded above 9650 (high settle 9664.5 on Jan 12) somewhat close to where SFRM4 was at the same time of its life. However, as noted above, hikes had occurred in May and July. The recent sell off in SFRH5 hasn’t been quite as fierce as the spring drop in SFRM4, but if the same general pattern were to hold (and the Fed stands pat), one might expect another 100 bps or so to the downside by June. SFRH5 settled Friday at 9586. With that in mind, consider SFRH5 put spreads or midcurve June’24 put structures on SFRM5. In August to Sept SFRM4/U4 was -37 to -25; when SFRM4 traded to 9475 SFRU4 was around 9502. Given that level of inversion, one might target 9525 to 9500 in SFRM5 (current 9607) the contract just forward from SFRH5. For example, 0QM 9562.5/9537.5/9512.5/9487.5 put condor settled 3.75. Assuming a price of 4, breakevens are 9558.5 and 9491.5. Max value 25 between the center two strikes. Expiration 6/14/24.

THIS IS NOT MARKET ADVICE OR A RECOMMENDATION

This trade is sort of a ‘Larry Summers’ play. Last week he said, “There’s a meaningful chance – maybe it’s 15% – that the next move is going to be upward in rates, not downwards.” (How many can I put you down for Larry?). Actually, if talking about the ‘next move’ in terms of an actual hike in the FF target, I think there’s way less than a 15% chance. However, that doesn’t mean that the forward curve can’t shift to higher rates. Higher forward rates should be marginally negative for equities and employment, which in turn should keep Core Service inflation on a downward path. The Fed does not have to overtly hike. Leaving short rates well above inflation works to restrain the economy over time, and coming corporate debt rollovers will become more difficult.

This brings us to point number two, the tremendous amount of buying in TY puts last week, mostly April expiry. Between Thursday and Friday, total open interest in TYJ puts went up by 260k contracts, about 130k each day (to a total of 665.7k). Clearly some of this buying is replacing coverage of March options, which expire Friday. However, it’s still somewhat surprising to see aggressive buys just prior to a three-day weekend, in front of a week that contains little in the way of economic news/data. On Friday there was a late buyer of 15k TYJ4 106.5p for 6 (OI +21k to 29k) and 40k TYJ4 106p for 5 (OI +36k to 41.5k). Early buy of 10k TYJ4 108.5/107.5ps for 11; relatively small delta buys. Thursday’s buys in 110 and 109.5 puts were higher delta, but in any case the overall totals are impressive. On a week which featured higher than expected CPI and PPI data, the 5y yield rose 13.7 bps to 4.286% and tens nearly 11 bps to 4.293%. I would note that April options expire 22-March, just after the FOMC. NFP is March 8, and Powell testimony in front of Congress is March 7.

On the SOFR curve SFRH5 saw the largest net decline, settling -23.5 to 9586. More deferred contracts fell the same sort of magnitude as the 5y and 10y. In this regard, it’s worth looking at the constant maturity red/green SOFR pack spread; red pack is currently the average price of 2025 contracts and green pack is avg of 2026 contracts. [chart below] This spread fell by about 7 bps on the week to -19.5, with the red pack -21 (9632 to 9611) and the green pack -14.5 (9645 to 9630.5). [rounded]. As shown on the chart below, this spread is now at a strong support area. My bias is that it will hold, but if Larry Summers’ sentiment gains wider currency then the spread could test -35 and all rate futures would likely be under selling pressure.

One last quick note concerns the strength in WTI. CLJ4 settled 78.46, up 1.69 on the week; highest settle since early Nov. Near contracts trade at a growing premium to deferred. For example, April 24 contract settled 78.46 and April’25 (CLJ5) at 72.39, a spread of 6.07. On a rolling basis this spread was just 0.28 in December. Strength in near contracts and widening spreads occurred last summer, culminating with a September high in the 2nd to 14th monthly contract (1-yr) spread of 12.20. This period also corresponded with a surge in treasury yields. (Thanks PMV)

One year rolling CL spread, 2nd to 14th.

| 2/9/2024 | 2/16/2024 | chg | ||

| UST 2Y | 448.6 | 465.2 | 16.6 | |

| UST 5Y | 414.9 | 428.6 | 13.7 | |

| UST 10Y | 418.5 | 429.3 | 10.8 | |

| UST 30Y | 438.0 | 444.6 | 6.6 | |

| GERM 2Y | 271.6 | 281.6 | 10.0 | |

| GERM 10Y | 238.2 | 240.2 | 2.0 | |

| JPN 20Y | 150.9 | 151.2 | 0.3 | |

| CHINA 10Y | 243.9 | 243.9 | 0.0 | |

| SOFR H4/H5 | -132.0 | -115.0 | 17.0 | |

| SOFR H5/H6 | -38.0 | -45.5 | -7.5 | |

| SOFR H6/H7 | 6.5 | 3.0 | -3.5 | |

| EUR | 107.84 | 107.79 | -0.05 | |

| CRUDE (CLJ4) | 76.77 | 78.46 | 1.69 | |

| SPX | 5026.61 | 5005.57 | -21.04 | -0.4% |

| VIX | 12.93 | 14.24 | 1.31 | |

Chunky FVJ and TYJ put buys

February 16, 2024

********************

–Large feature yesterday was TYJ and FVJ put buying. A few spread details are shown at bottom. While open interest increases were huge in TYJ puts, which added 132k open in total, (mostly in TYJ 109.5p, +79k), there was clearly some rolling from March to April puts. In futures, TYH4 open interest fell 28.5k and TYM4 increased just 23k. So large put trades, which I would say argue for a bearish outlook today and beyond, didn’t really translate into an increase in futures OI. In any case, as of this writing, TYH is 109-30, -7.5 and, depending on this morning’s data, could easily test the CPI low of 109-17.

–In FV the picture is more clearly bearish: Large put buyer and OI up in futures, both FVH, +29k and FVM, +25k.

–Note that yields ended slightly lower across the board. 5y yield -2.8 bps to 4.215% and 10y -2.5 to 4.24%.

–April options expire 22-March, 2 days after the March 20 FOMC. Also, it was announced yesterday that Powell will testify in front of Congress on Thursday, March 7, the day before NFP. The buy of 33k TY week2 110/108.5ps for 20, covered 110-06, 22d, occurred after the Powell announcement. Week-2 puts expire on 8-March, Employment day.

–This morning PPI is released, expected yoy 0.8 from 1.0 last, with Core yoy 1.7 from 1.8.

–Monday is a US holiday.

+15k TYJ 110/108.5ps 22

+22k TYJ 109.5p 28

+50k FVJ 106.5p covered 107-107, 29d, 22 paid

+5k TYH4 109.5p 7

+33k TY wk2 110/108.5ps cov 110-06, 22d, 20 paid

TYM4 settled 110-23

In TYJ puts the largest increase in open interest was 109.5p, which settled 32, OI gained 79.4k according to prelims

TYJ 108p settled 13 with an increase in OI of 13.3k

In all April puts, open interest added a whopping 132k

The week-2 put spread was also new; settled 30 with OI +37.3k and 24.5k

FVJM4 settled 107-08

FVJ 106.5p settled 24.5 with OI +42.6

Sometimes there’s a small lag

February 15, 2024

*******************

–News today includes Empire State Mfg which plunged last time to -43.7, so likely to see a bounce. Retail Sales expected -0.2 m/m vs +0.6 last. Ex auto and gas +0.2 expected vs +0.6 last. Several analysts are warning of a large downside miss on Retail Sales. Philly Fed was -10.6 last.

–Just about every news site has ‘Japan Slips Into Recession’ as a lead story, along with ‘UK falls into recession’. $/yen is holding above 150 and Nikkei continues to make new highs; it was 30700 at the end of October and is 38150 now, just three and a half months later (+24%). It’s like BOJ’s Ueda said in Sintra last June, “We haven’t had any serious monetary tightening for three decades” and amusingly added, “So in terms of that, the lag in the effect of monetary policy could be at least 25 years.” *nervous laughter by the other central bankers.

https://www.youtube.com/watch?v=DLGomU8iKBg

–Equity melt-up at end of day. SPX +1%.

–A few big trades: New stuff in treasuries: +50k TYJ 108/112 risk reveral vs 110-00, paid 3 for put. Open interest up over 40k in both strikes. As a comparison, with TYM4 having settled 110-175, I checked a late mkt 108.5/112.5 rr vs 110-16, 42d 1/2 for put. Just before CPI premium favored the call in equidistant rr’s. Also looked like new buying in TYH4 109.5p, followed by new sales in 109.25 and 109 puts. March options expire a week from Friday. Settles vs TYH4 110-00+, 15, 10, 7.

–In SOFR a couple of large exits: SFRZ4 9400/9350ps 1.5 paid 100k vs 9463 to 9461 with 5d. This settled 2.75 / 1.75 (so 1.0) vs 9567.0. 0.5/1.5

–SFRZ4 9575/9500/9425p 1x3x2 fly 11.5 paid 25k settled 47.25/13.75/3.75 or 13.5 (has 4 to 5 call delta). Open interest -25k, -61k, -38k.

Tie one end of the string to the tooth, and the other end to a doorknob

February 14, 2024

*******************

-Headline CPI +3.1% yoy vs expected 2.9. Core 3.9% vs expected 3.7%. SuperCore was +0.85 on the month in Jan vs 0.34 in Jan. 3-month annualized was 6.7% in Jan vs 4.0 in Dec. The reversal in favorable inflation readings caused a 25 bp plunge in red SOFR contracts, essentially extracting one ease like a sore tooth. SFRZ4 settled 9558.5, -23.5. At option expiration in Dec’23, SFRZ3 contract pegged the 9462.5 strike. So the current Z4 price is about 100 higher, or 4 eases as compared to the 3 eases suggested by the Fed dots. SPX -1.4%. Nasdaq Comp -1.8%. Ten year yield surged 14.6 bps to 4.314%, though the curve flattened with 2s up 18.4 to 4.651%. 2/10 closed at the bottom of the recent range, -33.7.

–Near calendars settled at new highs. SFRH4/M4 three-month spread settled at -24 (9472/9496) up 10 bps on the day as H4 fell 4.5 and M4 fell 14.5. SFRH4 puts were heavily offered at 1 a couple of weeks ago and now settled 3 in-the-money and traded 6 late. There had been a large buyer of May 9475 puts for 2 (SFRM4 underlying); these settled 5.25. The prospect for an ease in March had already been priced out after Powell’s press conference and subsequent Fed speakers. The next meeting after March is May 1. On no ease, the FFK4 contract should converge to the current EFFR or 9467 (FFG3 settled 9467). On an ease of 25, EFFR should avg 5.088 or 9491.2 in May, given a pass in March. Yesterday, FFK4 settled 9477 (-8.0), essentially 60% for no ease, 40% for ease. The high settle in this contract was 9519.5 on Dec 27! At the last FOMC on Jan 31 it settled 9503.5 while April (FFJ4) settled 9481.

–Uncertainty remains high. The peak SOFR contract is now SFRH6 at a price of 9628.5 or around 3.75%. Discounting forward earnings estimates at 3.75% vs 3.25 to 3.5% (SFRH6 was 9678.5 at the start of the month) suggests lower equity prices. Retail Sales tomorrow.

Benign CPI expected

February 13, 2024

********************

–CPI today, expected 0.2 vs 0.3 last, month/month. YOY expected 2.9 to 3.0 from 3.4% last. YOY Core expected 3.7% from 3.9% last. Yields were down marginally on Monday, with 2s, 5s and 10’s down around 2 bps, 10y yield -1.7 at 4.168%. SOFR curve a bit flatter with H4 -1.0 at 9476.5, H5 +1.5 at 9611.0 and H6 +4.0 at 9651.5. Volume was light. Risk is that CPI comes out hotter than expected. Powell has focused on Core Service prices, as have others, which likely require weaker employment data than we’ve been seeing. CLH4 up another 0.69 this morning at 77.61. Big tech stocks losing altitude.

–NFIB Small Biz Optimism out before CPI, expected 92.3 from 91.9. Been in a tight range near the lows for a year and a half, between 92.1 and 89.0. Inflation and labor quality are top issues.

–Constant maturity red/green sofr pack spread edged to slight new recent low -14 bps, but in general has been moving up since a low of -57 in September. Hi on Jan 16 was +1.625.

–Large trade of the day was buying of 0QU4 / 0QZ4 9650 straddle spread for 14.5 to 15, in 20k. These are midcurves on SFRU5 and SFRZ5 which expire this year, on 13-Sept and 13-Dec. Underlying prices settled 9645 and 9651. Straddles at 82.0 and 97.0, sold Sept and bought Dec. The first thing I’d note is that the 0QG4 (midcurve Feb) atm 9612.5 straddle settled at 15.5 ref 9611, with just 4 days until expiry. So when Sept expires, then one might expect Dec to have a lot more time value than 15 bps. However, I am thinking this might be more of a pre-election/post-election play. In any case, the position added about 15k open interest to all strikes. The idea also traded as 0QU4/0QZ4 9600/9700 strangle spread for 14.5. Strangles settled 42.25 and 56.75. Open interest up about 4k in those strikes.

Eases are still there, just further back

February 12, 2024

*******************

–New recent highs in near SOFR calendar spreads on Friday as back contracts continue to re-price both the timing and magnitude of easing. On Friday, red sofr contracts closed -5.125 at avg price of 9632. SFRH4/SFRH5 calendar settled -132, up 5 on the day (9477.5/9609.5). On Feb 1, the day after the FOMC, the spread settled -160.5. There’s been a lot of talk about the FOMC having 3 cuts priced into the end of this year, and the market having had six or more cuts priced. The March’24/March’25 spread represents a slightly forward one-year period and still indicates 5 to 6 cuts, even though it has rallied somewhat. (Also, while many think of the spread as forecasting the number of eases, it really represents odds of various scenarios related to the timing and magnitude of rate cuts).

–I have attached a chart of the rolling first green SOFR contract. As you can see, recent highs in the beginning of 2023 and again just after the SVB blow-up were around 9740 (high print 9748) and the low in Oct was 9555. The first green (and last red, currently SFRZ5) are the peak contracts on the strip, settling Friday at 9647.5. right around the middle of last year’s range.

–CPI out tomorrow, expected 3.0 to 2.9% yoy from 3.4% last.

Let them eat chocolate

Feb 11, 2024 – Weekly Comment

***********************************

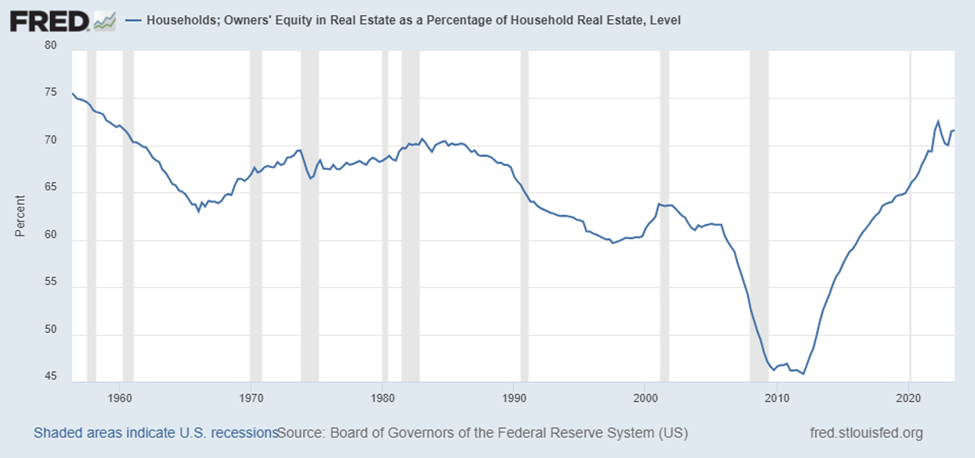

The image below is from the St Louis Fed; Households Owners’ Equity in Real Estate as a Percentage of Household Real Estate, Level. It’s nearly 72%. And surpasses every level since 1960! After the GFC, Homeowner’s Equity fell to around 46%.

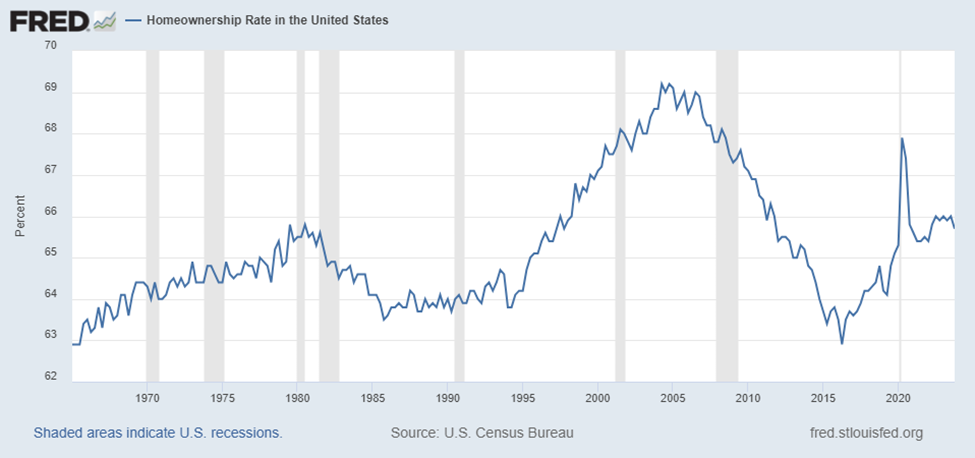

The next image is the homeownership rate (starting a bit later, in 1965).

The homeownership increase from the mid-1990’s peaked right in the middle of 2004, when the Fed began its hiking campaign from 1% to 5.25%. The huge rate cuts in 2001 gave way to the adjustable-rate mortgage spree going into the GFC. The FF target was 1.25% to 1% from late 2002 to mid-2004, and shorter-term adjustable rate mortgages were in vogue.

Currently, there’s hand-wringing about Consumer Credit being at a record high $1.3t, and HH mortgage outstanding also at a record high $12.950t. However, 15 years ago in 2009, HH Mortgage was $10.441t and HH Owner-Occupied Real Estate was valued at $19.417t. Since then, the amount of mortgage outstanding went up 24% but the value of HH RE more than doubled to $45.5t. Nothing to see here.

In 2008 Revolving Consumer Credit peaked at a little over $1t. At the time nominal GDP was $14.97t and now it’s nearly doubled to $27.9t. Again, an increase of 30% in debt vs a double in income. In aggregate the household sector seems rather conservative since the GFC, though perhaps less so in very recent history.

Where HH debt has exploded at a growth rate well exceeding the growth of the economy is Non-Revolving Credit, from $1.64t in 2008 to $3.7t now. The culprit is student loans which went from $135 billion at the end of 2008 to $1.467t now. If student debt is removed from the equation, then both revolving and non-revolving credit have grown more slowly than the economy.

Households that own unmortgaged property and have savings are doing just fine. They had bank deposits that were earning nothing, then the Silicon Valley Bank Crisis focused everyone on the risks of bank bail-ins, while at the same time t-bill and money markets were paying 5% or more. Income from bills and bonds now actually provides a cushion for equity investing. This part of the population is quite different from the portion suffering rising credit card and auto loan delinquencies and complaining about the spiraling costs at fast food restaurants. In last week’s congressional testimony, Yellen said, “We don’t have to bring prices down, because wages are going up.” She might as well have said, “Let them eat chocolate!” (The price of cocoa has doubled in the past year and is up 35% just since the start of 2024).

Back to the charts above. The percentage changes aren’t huge; does it really matter if homeownership goes down from 68% to 66%? Maybe not. However, my interpretation of the data highlights growing wealth disparity. Not exactly a novel topic. However, everything happens at the margin. Fraying begins at the edges.

My personal opinion is that government has accentuated a lot of problems. Whether that’s right or wrong, there is no question about the growth in government. In 2009, Federal Debt outstanding was $8.88t. As of Q3 2023 it’s $28.75t, 3.25 times higher. Compare that with the relatively muted increases in consumer borrowing (ignoring federally funded student loans).

I knew a corporate bond salesman from 20 years ago, who amusingly handed out business cards which listed his title as ‘Treasury Bond Credit Analyst’. Funny. There is no credit aspect of treasuries to analyze. Right? But anyone who looks at the growth of Federal Debt vs Income sees the deterioration.

I saw this item in worthinsurance.com. “Among homeowners, an average of 16.4% of their income goes to housing costs. This includes mortgage, property taxes and homeowner’s insurance. Meanwhile, 45% of renters spend over 30% of their household income on housing costs.”

The big asset managers have loaded up on residential real estate to take advantage of rising rents. Given the current AirBnB bust, perhaps the rental strategy has some holes in it. Is there another government bailout around the corner?

OTHER THOUGHTS

The ten year yield rose 16.7 bps this week to 4.185%. On the SOFR curve, the biggest declines were Sept’25, Dec’25, March’26, June’26, all down 19 bps (9642, 9647.5, 9647.5, 9645.5). The middle two of those contracts are the peak, or lowest rates, on the SOFR strip, at about 3.5%. It’s not surprising to see yields moving higher in this part of the curve, given relatively strong economic data, large treasury auctions, and Fed officials pushing back against the magnitude of rate cuts that had been priced in STIR futures. However, the curve really didn’t flatten much. Gold SOFR contracts, the fifth year forward, were down 15.75 bps on the week. Consider this longer term chart of the 2/10 treasury spread:

There’s a double bottom from March and July 2023, at about -108. Recently the chart has a double top around -16. The curve has flattened since the last FOMC, but the move has been muted. Closes above negative 16 would suggest Fed rate cuts of more than 75 bps by year end. I favor a steepening curve, easily expressed using SOFR contracts and or options. I will post specific rec by e-mail on Monday.

CPI is out on Tuesday, expected 2.9% yoy vs 3.4% last. If expectations are correct, it would be the first sub-3% print since Q1 2021. Core CPI yoy expected 3.7% from 3.9% last. Retail Sales on Thursday. The chart below shows CPI vs the 6-month t-bill yield. The cross to a positive ‘real yield’ only occurred about eight months ago. This spread has only been above 200 bps (currently 190) a few times since 2000: In 2000, corresponding to the dotcom bubble burst, in 2006/07, about a year before the housing bubble burst, very briefly in 2009 and now. 2001 and 2008 landings weren’t all that smooth.

| 2/2/2024 | 2/9/2024 | chg | ||

| UST 2Y | 437.0 | 448.6 | 11.6 | |

| UST 5Y | 399.7 | 414.9 | 15.2 | |

| UST 10Y | 401.8 | 418.5 | 16.7 | |

| UST 30Y | 422.7 | 438.0 | 15.3 | |

| GERM 2Y | 256.9 | 271.6 | 14.7 | |

| GERM 10Y | 224.1 | 238.2 | 14.1 | |

| JPN 20Y | 145.0 | 150.9 | 5.9 | |

| CHINA 10Y | 242.9 | 243.9 | 1.0 | |

| SOFR H4/H5 | -146.0 | -132.0 | 14.0 | |

| SOFR H5/H6 | -40.5 | -38.0 | 2.5 | |

| SOFR H6/H7 | 7.5 | 6.5 | -1.0 | |

| EUR | 108.09 | 107.84 | -0.25 | |

| CRUDE (CLH4) | 72.28 | 76.84 | 4.56 | |

| SPX | 4958.61 | 5026.61 | 68.00 | 1.4% |

| VIX | 13.85 | 12.93 | -0.92 | |

https://www.federalreserve.gov/releases/z1/20231207/html/b101.htm

In: Eurodollar Options

Treasury having no problem placing debt

February 9, 2024

******************

–Quiet day in rates. Thirty year auction was solid, WI 4.38 at time of auction, but the actual result was 2 bps thru at 4.36%. Barkin added his voice to Fed speakers who, outside of Goolsbee, don’t seem to be in any hurry to cut rates. From the bullet points prefacing Barkin’s speech, “Given robust demand and a historically strong labor market, we have time to build that confidence before we begin the process of toggling rates down.” Lorie Logan, Dallas Fed President, speaks this afternoon and is likely on the same page; from her Jan 6 speech, “…the job of restoring price stability is not yet complete.”

–Today’s brings annual seasonal revisions to CPI. In case missed yesterday:

https://think.ing.com/articles/why-us-cpi-revisions-could-be-a-big-deal-or-mean-nothing-at-all

Monthly CPI release is Tuesday.

–Yellen’s comment yesterday that “We don’t need to get prices down because wages are going up” rings a bit hollow to the average household. If she had said “we don’t have to get prices down because the tech darlings are going up” it would be more truthful. Feels a lot like the dotcom run up. Uber is up 75% since end of October, 40 to 71.66. Dash is up a similar amount, 70 to 118.30. Certainly doesn’t feel as if financial conditions are tight. However, it depends on one’s location on the economic spectrum. McDonald’s CEO acknowledged that his consumer base is increasingly strapped and McD needs to focus on affordability.

–Crude oil has had a nice pop of $4/bbl this week. Last Friday’s settle in CLH4 was 7228 against yesterday’s 7622, +236 on the day.

Disinflation from China, NatGas, tightened lending standards. BUT…Feb 9 CPI revisions

February 8, 2024

*******************

–The backdrop continues to be weakness in regional banks, but KRE (regional bank ETF) came back from lows to close nearly unchanged. US yields rose slightly, but the ten year auction went surprisingly well; WI was 4.105 and actual was 4.093%. TYH4 settled 111-06, down just 3 on the day. SOFR contracts from March’25 to March’28 were down 2 to 3 bps. Probably the cleanest expression for rates a year from now is the FFG4/FFG5 calendar, which settled -135.75 (9467.75/9603.5). So Fed Funds for Feb of next year pricing right around 4% (First meeting in 2025 should be Jan 29).

–US news today includes Jobless Claims, expected 220k and the 30y auction. Every financial news site this morning has a clip about deflation in China. This is from NikkeiAsia:

Figures released by the National Bureau of Statistics on Thursday showed that prices for consumer goods slipped 0.8% [expected -0.5%] from the same month a year earlier, the biggest such drop since September 2009 and steeper than the 0.3% decline in December. It was the fourth straight month of falls in China’s consumer price index (CPI).

–In the US, yesterday the Nat Gas contract hit a new low sub- $2; it was around $5 at the end of 2022. Biden admin’s suspension of LNG exports is, of course, adding downward pressure. Also, Consumer Credit figures for December were in stark contrast to November’s surge. In Nov, Revolving Credit grew $17.9b. In Dec it grew $1.1b. At annualized rates, Revolving was up only 1.0% in Dec and Non-revolving +0.2%.

–Even though Powell poured cold water on a March rate cut, the market is still assigning small odds. For example, a buyer yesterday of 25k SFRH4 9481.25/9487.5cs for 1.25. April FF settled 9472.5 or 5.275% vs current Fed Effective 5.33%. CPI is released on Tuesday, though the Fed’s Waller mentioned in his last speech that he was circling the date of Feb 9, tomorrow, to study the impact of annual seasonal revisions made to CPI. From Waller’s Jan 16th speech:

One piece of data I will be watching closely is the scheduled revisions to CPI inflation due next month. Recall that a year ago, when it looked like inflation was coming down quickly, the annual update to the seasonal factors erased those gains. In mid-February, we will get the January CPI report and revisions for 2023, potentially changing the picture on inflation. My hope is that the revisions confirm the progress we have seen, but good policy is based on data and not hope.

Nat Gas below: