Debasement

March 3, 2024

***************

“Throughout history, many campaigns had been lost by stopping on the wrong side of the river.”

–attributed to General Patton

Powell is in front of Congress this week, Wed and Thurs, and Bloomberg declares: Powell about to double down on ‘No Rush to Cut’.

The enemy is within.

BAML (Michael Hartnett) notes:

US national debt rising $1tn every 100 days ($32tn to $33tn took 92 days, $33tn to $34tn 106 days, $34tn to $35tn will take 95 days); financing domestic bliss & overseas wars. US budget deficit past 4 years = 9.3% of GDP…little wonder “debt debasement” trades closing in on all-time highs, i.e. gold $2077/oz, bitcoin $67734.

Pimco urges the resurrection of bond vigilantes:

(Bloomberg) — Pacific Investment Management Co. is warning that US fiscal profligacy threatens to drag the Treasury market back to the 1980s, a time when bond vigilantes demanded far higher compensation to own longer-dated bonds.

“What if we are heading back to the future, to a market resembling prior decades when higher term premiums prevailed?” they asked in a paper published Thursday. Term premium is generally described as the extra yield investors seek to own longer-term debt instead of rolling over into shorter-term securities as they mature. It’s viewed as protection for bond holders against unforeseen risks such as inflation and supply-demand shocks, beyond other drivers of Treasury yields including economic growth and Federal Reserve policy.

“If the term premium returned even to levels common in the late 1990s to early 2000s – around 200 bps – that would likely become the defining feature of financial markets during this era,” the California-based money manager cautioned, adding such an outcome “would not only affect bond prices, but also prices of equities, real estate, and any other asset that is valued based on discounted future cash flows.”

Financial analysts use “term premium” as a neatly defined input in the exercise of valuing bonds. I would characterize it more as ‘loss of confidence’. It doesn’t necessarily need to be contained in a tight box with algebraic parameters. Think of it more like Pandora’s box. Think of it as someone simply saying, “Get me out.”

The enemy which is boxing in Powell is runaway federal spending that clearly distributes benefits unevenly and unstably across the economy. The lower segments are scarred by rising delinquencies and inflation, while the top see benefits in rising home values and high yields on savings.

I was prompted by a friend this week to mention the bitcoin rally (thanks PB). The reason I stumbled on the quote at the top of this note is because I was searching for a General Patton strategy, which I recall this way: Fierce fighting at the front lines, which may involve heavy casualties, once broken can lead to relatively easy, wide-open gains. It’s an appropriate analogy for market behavior. The ‘stopping on the wrong side of the river’ refers specifically to Powell’s campaign to bring inflation back to target. That goal risks being thwarted by what BAML refers to as “debt debasement”. Friend Rob Luxem at TJM (from whom I gain valuable crypto insights) had pointed out this week that bitcoin is making new highs vs yen, yuan and other global currencies. And, are you sitting down for this? Even against the Turkish Lira. But not against gold.

Total crypto market cap is currently about $2.34 trillion. Bitcoin is about half that at $1.2 trillion. The market cap of NVDA is just over $2 trillion. It has added $1 trillion of market cap in the past four months. So, the increase in the value of NVDA in four months is nearly worth the total market cap of bitcoin. Now it’s true as well that bitcoin has doubled since the middle of October. The point is that huge nominal dollar values are rapidly changing across the financial landscape. Which makes the job of all central banks that much more difficult. I’m sure Senator Warren and others will take that into account as they warmly welcome Powell with the express purpose of shifting the blame for fiscal irresponsibility onto the Fed’s plate.

What happens if the “bond vigilantes” return? I suppose we’ll know by how many times ‘term-premium’ is mentioned in the financial press. In terms of yield, in 2023 the ten year posted a low in April of 3.31% and a high in October of 4.99%. The midpoint is 4.15%, exactly where tens were trading Friday. A move above this year’s high of 4.32% would probably suggest a revisit of 5%. The area around 4% should provide strong support.

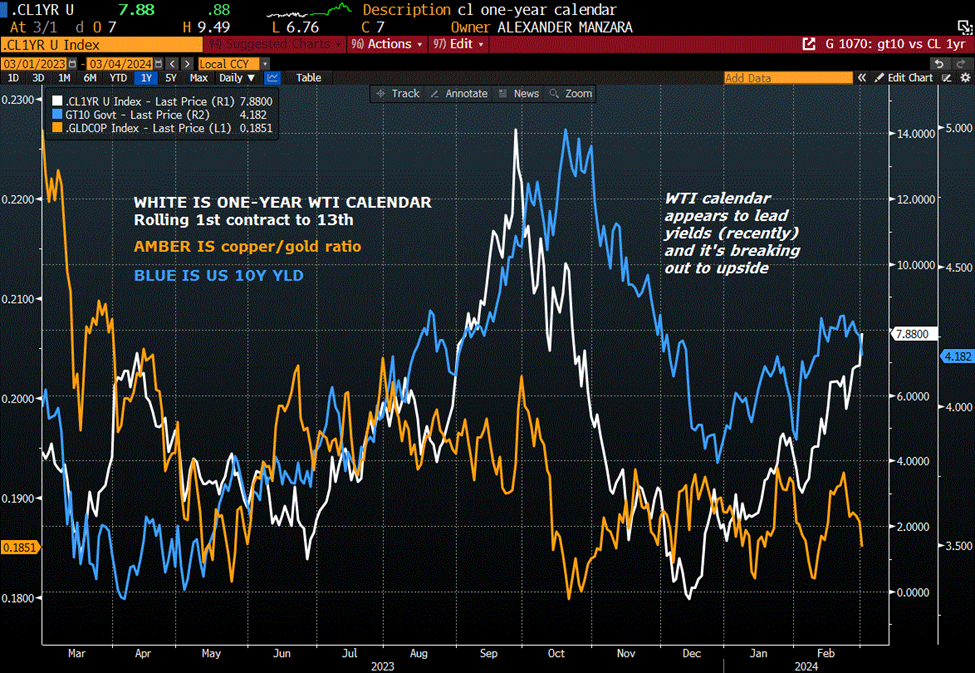

Below I have updated a chart that I first posted last week, the rolling one-year WTI calendar vs the US ten year yield. The oil calendar appears to lead the move in yields; higher near-term oil prices suggest tightness for physical and is perhaps an inflationary signal. I added Gundlach’s copper/gold ratio, which is indicating LOWER rather than higher yields. The global economy is soft. The US has been supported by fiscal largesse. Does it all end post-election?

Upcoming events include:

Powell testimony on Wednesday and Thursday.

Employment on Friday

March 20 FOMC/ discussion about trimming QT

XBT halving in April

BOJ possibly ending negative funding rates in April

| 2/23/2024 | 3/1/2024 | chg | ||

| UST 2Y | 465.7 | 452.9 | -12.8 | |

| UST 5Y | 426.8 | 415.7 | -11.1 | |

| UST 10Y | 425.6 | 417.8 | -7.8 | |

| UST 30Y | 437.8 | 432.7 | -5.1 | |

| GERM 2Y | 285.3 | 289.0 | 3.7 | |

| GERM 10Y | 236.3 | 241.3 | 5.0 | |

| JPN 20Y | 144.5 | 144.3 | -0.2 | |

| CHINA 10Y | 240.0 | 238.3 | -1.7 | |

| SOFR H4/H5 | -110.3 | -119.0 | -8.8 | |

| SOFR H5/H6 | -53.0 | -54.0 | -1.0 | |

| SOFR H6/H7 | -1.5 | -0.5 | 1.0 | |

| EUR | 108.23 | 108.41 | 0.18 | |

| CRUDE (CLJ4) | 76.49 | 79.97 | 3.48 | |

| SPX | 5088.80 | 5137.08 | 48.28 | 0.9% |

| VIX | 13.75 | 13.11 | -0.64 | |

Regional banking issues are… contained

March 1, 2024

***************

–NYCB back in the news, reporting an additional $2.4 billion hit as the fallout from the regional banking episode continues in a slow burn, a year later. It’s more controlled, but underlines weak CRE valuations and lingering effects of deposit flight.

–China’s Mfg PMI down for a fifth month, as expected at 49.1. Today’s US Mfg PMI expected 49.5 from 49.1. Fed’ Kugler speaks at 2:30 today on the Fed’s dual mandate. Powell in front of Congress next week on Wed and Thursday. Employment report on Friday.

–Somewhat odd trade given that easing prospects have been pushed further forward in time: new buyer of 35k SFRM4 9550/9575cs for 1.0 (settled there ref 9489). Perhaps systemic banking issues are going to flare up once again. In any case, if I needed upside, I might look at spending an extra 0.5 for the 9550/9600cs, which settled 1.25 (but was offered 1.5). Current FF are 5.25 to 5.5%; this call spread would need about 100 bps worth of cuts to play, but using the easing models of 2001 and 2008, it doesn’t seem to be a completely outlandish scenario, though there are only 3.5 months to go.

–Yesterday’s PCE data were as expected , leading to relief rally. Net changes across curve were small. Vol continued to compress, as shown below.

–Just an example of vol slide over the week in SOFR. I am just looking at contracts from SFRZ4 to SFRH6.

The futures settlements on Friday, Feb 23 and yesterday Feb 29 were nearly identical as shown in left columns. The atm straddle prices are immediately following, showing declines of 4-6 bps over those few days. and down 3 or more in midcurves.

From 2/23 to 2/29

Z4 9551.0 9550.0 84.50 to 78.00

H5 9579.0 9578.5 104.25 to 98.00

M5 9601.5 9602.0 118.50 to 112.50

U5 9618.0 9619.0 127.75 to 122.75

Z5 9628.0 9628.5 135.35 to 130.75

H6 9632.0 9633.0 140.75 to 135.75

mids

H5 30.0 to 25.0

M5 64.5 to 61.5

U5 82,5 to 79.5

Z5 97.5 to 94.5

Searching for divergence

February 29, 2024

*******************

–PCE prices today. M/M headline expected +0.3 from +0.2 last and Core +0.4 from +0.2. Yoy expected 2.4 from 2.6 with Core 2.8 from 2.9.

Regarding inflation, the Bureau of Labor Statistics sent out a note to ‘Super Users’ yesterday which contained this line:

The weights for single family detached homes increased materially from December 2023 to January 2024. All of you searching for the source of the divergence have found it.

–From the BBG article on this story:

The pop in owners’ equivalent rent was a major factor behind the strength of the overall January CPI figure — which was published on Feb. 13 — given its outsize weight in the index. The higher-than-expected CPI numbers have been cited by Federal Reserve officials as a reason to delay widely anticipated interest-rate cuts.

–Regarding the pace and magnitude of expected eases, Williams said yesterday that we have a ways to go to reach 2% inflation, and that three cuts in 2024 is a reasonable starting point. Collins sees “methodical” and gradual easing. I think that’s the key message from the Fed: ‘methodical’. Almost on auto-pilot going into the craziness of the election. Powell will have a chance to hone the strategy next week, beginning with testimony in the House on March 6. Employment data released March 8.

–Yields eased yesterday with tens down 4.7 bps to 4.266%. On the SOFR strip reds (2nd year out) contracts were the strongest, settling +6.75. SFRZ4 settled +7 at 9551.5 near 4.5%, consistent with three cuts by year end and more to come in 2025. However, rate futures are lower this morning, going into PCE price data; near the lows of the move. SFRZ4 currently prints 9546, -5.5, very close to last week’s low of 9544.5. Feels to me more like long liquidation rather than new shorts pressing the narrative of near-term inflation acceleration. Open interest fell across the treasury curve, though that’s mostly related to the roll.

–Volume was light yesterday; option trades were mainly premium sales.

Targeted ease plays

February 28, 2024

*******************

–SOFR theme yesterday: plays for ease. In the beginning of last year that theme consisted of 100 bp wide call spreads being bought for significant premium, 8-12 bps. Yesterday, trades were more targeted and less aggressive. Buyer 35k SFRM4 9500/9525/9550c fly for 2.5 (settle 2.75 ref 9486). Buyer 45k SFRM4 9525/9550/9575c fly 0.75 (settled 0.75). Buyer 25k SFRU4 9506.25/9518.75/9550/9562.5c condor for 3.0-3.25.

–With respect to the first fly, I looked at the last time SFRH4 settled above 9500, which was Jan 12 at 9501. That date is about two months before option expiration. The 9500/9525/9550c fly settled 3.0 on Jan 12, so just 0.5 over the price paid for June yesterday, which is about 3.5 months away from expiry. If the Fed skips the March 20 FOMC as is expected, then May 1 is in play. Yesterday’s trade was mostly at 9472 in FFK4, or 5.28, as compared with the current 5.33 EFFR. If the Fed eases in May then the contract should settle just above 9491. Then there are meetings June 12 and July 31. Final for SFRM4? 9512 to 9518 seems reasonable (just my opinion). While the Fed might see deterioration in the private sector that justifies easing, the fiscal authorities are not likely to take the foot off the gas (and/or electric) pedal going into the election. It’s likely to make the Fed’s job harder.

–Q4 GDP revision expected 3.3%. Yesterday’s Atlanta Fed GDP Now model has 3.2% as a forecast for Q1. Bostic, Collins and Williams today.

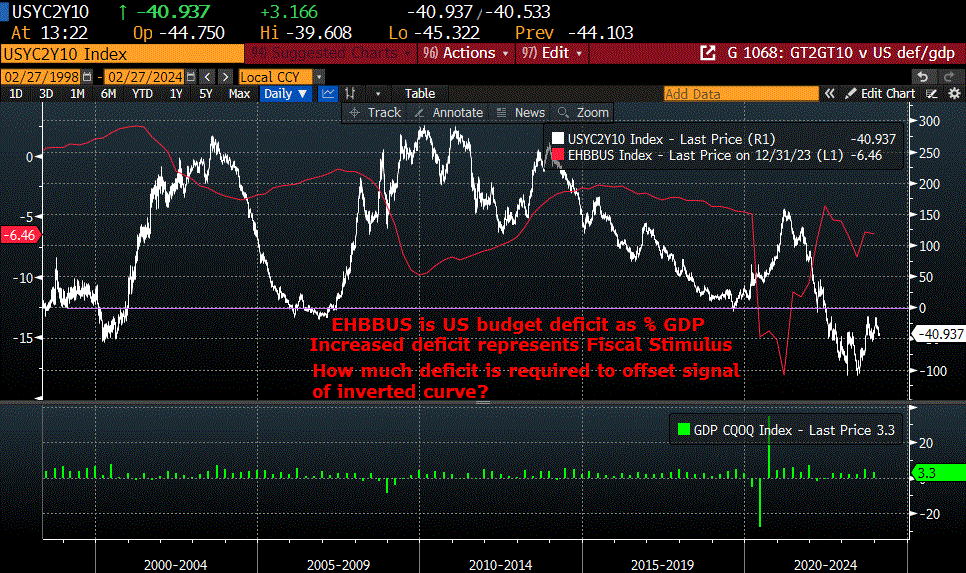

–Attached chart is the Federal Budget Deficit in red, vs 2/10 treasury spread in white. When the curve inverted at the end of the hiking cycle in 2006, the budget deficit was around 2.5 to 3%. Even at that time, many were wondering whether curve inversion was giving a “false” signal with respect to future econ activity. It wasn’t. In the current case, the inversion has been much more dramatic, reaching -108 bps, and the same “false signal” with respect to forward growth has been a topic in the financial press. My thought is that a budget deficit that’s more than twice the percent of GDP (-6.5%) as it was in 2006 has masked the message of the curve, but hasn’t changed the basic forecast.

February: a month of paring back ease expectations

February 27, 2024

*******************

–Price concession allowed the market to absorb two and five year auctions, and contributed to new recent lows in the curve. 2/10 closed -44, down about 1 bp. Red/green SOFR pack settled near -28, down nearly 2 bps on the day. The 2y and red SOFR pack both rose 5 bps in yield; 2y to 4.735% and Red pack to 9601.625. In early February, the peak contract on the SOFR strip was SFRZ’25, which settled 9687.0 on 1-Feb. Yesterday that contract settled 9623.0 (down 64 from Feb 1), and the peak contract has moved over a year further back in time to SFRH’27 at 9631.5. Just another reflection of eases being squeezed out and the curve flattening. Currently, every SOFR contract from Dec’25 through Dec’28 is between 9622.5 and 9631.5, right around 3.75%. The lowest contract is still SFRH’24, which made a new recent low yesterday of 9467.

–Japan’s inflation data showed Core Prices +2.0% in Jan, down from 2.3% in December but higher than the 1.8% expectation. BOJ expected to end negative rates in March or April.

–7 year auction today, $42b. Yesterday the 10y rose 4 bps to 4.295%. Durables and Consumer Confidence, amid more reports that consumers are trading down in terms of brands and generally being more frugal. Confidence expected 115 from 114.8. The administration seems desperate to get out the message that the economy is doing great (with the implicit undertone that only the stupid can’t see it).

–Interesting line by Matt Taibbi yesterday (Nikki Haley’s $100 million faceplant)

“All of this speaks to one of the major unreported stories of our time: a dramatic political realignment by income and class, presented as a schism between smart and ignorant, ‘normal’ and not.”

For now, higher for longer has the upper hand

Feb 26, 2024

**************

–Friday featured further curve inversion from reds back as easing expectations are squeezed out of near term pricing. 2/10 treasury spread fell to a new recent low -43 bps (-4.2 on the day). In 2023, 2/10 has a range from -108 to -16. In 2024 the high is -16.5 and the low for the year is right here. On the SOFR curve the red/green pack spread range in 2024 is +1.6 on 16-Jan to -26.25, Friday settle. Low in December’23 was -35. Low in Sept -57, Low in June -63.25.

–A large trade Friday was a buyer of 35k SFRZ4 9450/9437.5/9412.5/9400p condor for 1.0 covered 9544 to 9548. So net premium was less than 1. Obviously, this trade needs the Fed to re-start the tightening process. Note that the top put spread, 9450/9437.5 settled 1.5 vs 9551. SFRZ4 9300p settled 1.75.

–A friend (thanks JK) highlighted an interesting post by Jim Bianco, responding to Mark Zandi. Zandi says the Fed should cut, because stable inflation & employment have been achieved and FF at “…5.5% is difficult to justify, as it is 3 pct higher than the Fed’s own estimate of r-star.” Bianco responds that BofA’s Global Financial Stress Indicator shows the LEAST stress in 4 years. “In other words, 5.50% is NOT a stressful rate. The Global Financial Stress Indicator above says markets are enjoying the least amount of stress at any time in the last four years. — Restated bluntly, a 5.5% funds rate is not restraining anything. So, cuts are not necessary.”

–Dudley’s inputs for financial conditions were: long and short term rates, the value of USD, equity prices, credit spreads. Obviously financial conditions are NOT the same as financial stress. Clearly financial conditions re: FF have been constant since July, but the 10y yield is down 75 bps from October’s high. DXY hit a peak near 115 in 2022, was 107 in Oct and is now 104. Big cap tech as a proxy for stocks have soared. Credit spreads are at pre-pandemic low levels. In general conditions are easier than they were.

–I suppose Zandi could have re-stated to say real rates are high and restrictive, there’s a lot of debt that needs to be rolled, consumers appear to be pulling back and employment is likely to weaken, so modest cuts can be justified. Low financial stress now can turn fairly rapidly into tomorrow’s pain, as was seen in 2001. The snapshots presented by both Zandi and Bianco don’t really capture how the rest of the film might play out, but they do capture the core opposing viewpoints of the market.

Quiet Firing

February 25, 2024 – Weekly Comment

****************************************

The big data point of the week will likely be PCE prices on Thursday. Month-over-month is expected to show some acceleration with headline +0.3 from +0.2 and Core +0.4 from +0.2. Yoy measures are expected 2.4% from 2.6% and Core 2.8% from 2.9%. The concern of course, is possible near-term reacceleration. Powell and others have noted that goods inflation has come down appreciably, but core services have been much slower to recede. The implication has been that unemployment needs to increase, euphemistically “the labor market needs to come into better balance” and that equity prices need to decline.

With respect to equity prices and labor, Scott Galloway in a note titled ‘Corporate Ozempic’ cites the amazing revenue and profit increases in some of the big tech firms, concluding that AI is a huge factor in sparking lay-offs that support the bottom line:

What’s really going on? I believe AI is playing a larger role in layoffs than CEOs are willing to admit. There have been hints: IBM’s chief said the company plans to pause hiring for positions that could be replaced by AI, and UPS acknowledged that AI factored into its recent layoffs. But as a general rule, expect a CEO to be reluctant to state on an earnings call that the fastest-growing technology in history is already giving her “the ability to lay off people without any impact on the top-line.”

You’ve heard of “quiet quitting”. Call this “quiet firing”.

A more muted outlook on AI was espoused by NY Fed Pres John Williams in an interview with Axios:

“One way to think of it is AI is – and this is my own, but based on what I heard from others – is AI is just that new thing that’s going to get us that 1% to 1.5% productivity growth that we’ve been getting for decades or even a century.

It’s the thing that gets us that, just like computers did or other changes in technology and how we produce things in the economy. So it’s just the thing that gets us that 1% to 1.5% productivity growth.

The other view, which I think has some support, is AI is more of a general purpose technology. …So there is a possibility that we could get a decade or more faster productivity growth if this really is its general purpose and revolution. You can’t exclude that.”

“Today we produce a very small share of computers and chips. It’s produced in other countries, which just means that that productivity growth might happen in other countries more than it happens here.”

https://www.axios.com/2024/02/23/federal-reserve-bank-ny-john-williams-transcript

We have an incredibly complex economy; the outlook needs to be analyzed by both policymakers and investors. Is it more complex than the Greenspan years? Perhaps, but many challenges of price and asset measurement were voiced by Greenspan then, perhaps most memorably with this line from Dec 1996:

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

This is an appropriate look back, as Japan’s Nikkei only last week exceeded the 1989 high. Greenspan’s view was that prices are set by millions of knowledgeable investors, and that the central bank can only clean up afterwards (from Jackson Hole, 1999):

To anticipate a bubble about to burst requires the forecast of a plunge in the prices of assets previously set by the judgments of millions of investors, many of whom are highly knowledgeable about the prospects for the specific companies that make up our broad stock price indexes.

History tells us that sharp reversals in confidence happen abruptly, most often with little advance notice.

Enough with the Greenspan stuff (though both speeches are linked at bottom and have fascinating insights). Switching from AI to more prosaic concerns about food production, here’s a chart of the BBG Agricultural Commodity Index:

From this chart, it’s clear that prices are deflating. Call me crazy but I think food is more important than AI. There’s hardly a day that goes by that at least one snippet about farmer protests doesn’t pop up. Most frequently it’s about tractors clogging traffic in European cities. If one googles “Angry farmers” the results point mostly to the French, who are apparently madder than most, taking the boiling point to the extreme by throwing eggs at Macron. Angry. However, “farmer protests” gives results across Europe, India, and the US. I’m making light of a situation that should be taken seriously. Food supplies aren’t to be trifled with, a fact that appears to have escaped politicians imposing green regulations on growers.

OTHER THOUGHTS

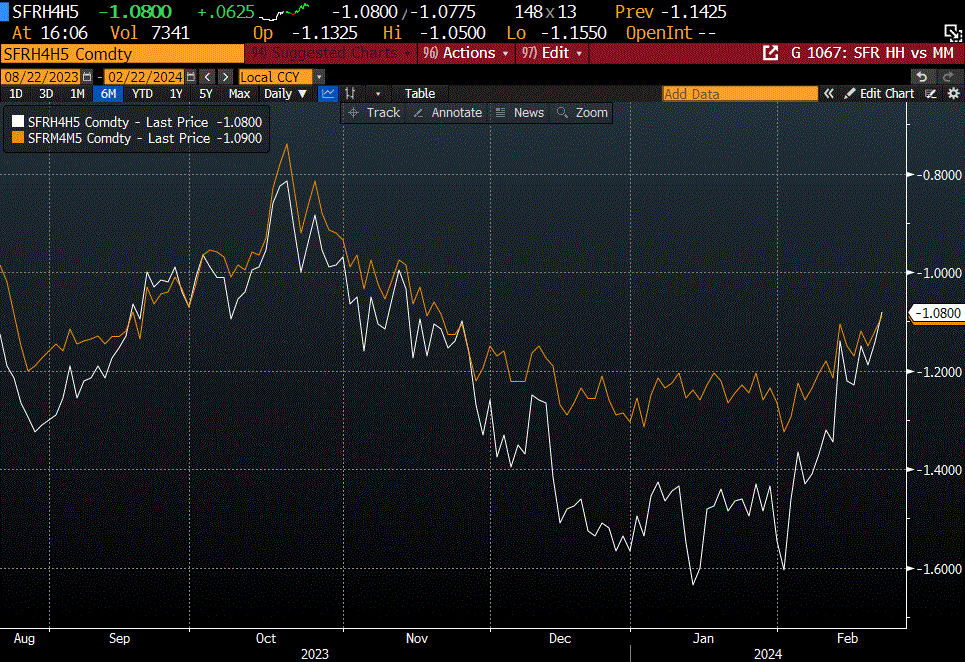

The yield curve continued to flatten/invert last week. Last week I highlighted the red/green sofr pack spread which I had expected to hold the lower channel line. It broke that level (-19) and settled -26.25. On the week SFRM4 was -5.0 to 9490, SFRM5 (red) was -5.5 to 9601.5, SFRM6 (green) +2.0 to 9633.0 and SFRM7 (blue) +6.0 to 9633.0 (same as M6). On the treasury curve, 2/10 moved similarly to red/green, falling 7 from -36 to -43 (4.685%/4.255%).

Given rhetoric from Fed officials and renewed inflation concerns, the market continues to push back the timing of Fed cuts and lessen the total magnitude. The most inverted SOFR 1-year calendar has moved back a slot from SFRH4/H5 at -110.25 to SFRM4/M5 at -111.5. On Feb 1, SFRH4/H5 settled -160.5, so low to high has been an astonishing 50 bps just this month.

On the treasury curve the two-year rose 3.3 bps to 4.685% while the thirty-year fell 6.8 bps to 4.378%.

On Monday Treasury auctions $65b in 2’s and $64b in 5’s, followed on Tuesday by $42b in 7’s. With the addition of t-bill auctions, on the first two days of the week $398 billion in debt will be sold. Of course, a large amount of bills and notes are maturing, so much of the supply will simply be absorbed by rolls. However, it’s still worth noting that $400 billion used to be a significant deficit for an entire year. There’s recently been concern that corporates won’t be able to roll existing debt at favorable terms. The treasury seems to assume that bond issuance will never encounter a bout of indigestion.

| 2/16/2024 | 2/23/2024 | chg | ||

| UST 2Y | 465.2 | 468.5 | 3.3 | wi 465.7 |

| UST 5Y | 428.6 | 428.2 | -0.4 | wi 426.7 |

| UST 10Y | 429.3 | 425.6 | -3.7 | |

| UST 30Y | 444.6 | 437.8 | -6.8 | |

| GERM 2Y | 281.6 | 285.3 | 3.7 | |

| GERM 10Y | 240.2 | 236.3 | -3.9 | |

| JPN 20Y | 151.2 | 144.5 | -6.7 | |

| CHINA 10Y | 243.9 | 240.0 | -3.9 | |

| SOFR H4/H5 | -115.0 | -110.3 | 4.8 | |

| SOFR H5/H6 | -45.5 | -53.0 | -7.5 | |

| SOFR H6/H7 | 3.0 | -1.5 | -4.5 | |

| EUR | 107.79 | 108.23 | 0.44 | |

| CRUDE (CLJ4) | 78.46 | 76.49 | -1.97 | |

| SPX | 5005.57 | 5088.80 | 83.23 | 1.7% |

| VIX | 14.24 | 13.75 | -0.49 | |

https://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm

https://www.federalreserve.gov/boarddocs/speeches/1999/19990827.htm

In: Eurodollar Options

What’s the rush?

February 23, 2024

*******************

–Hard flattener yesterday as the higher for longer theme dominated. Several Fed officials including Waller, “What’s the rush?” Jefferson and Cook echoed the same message of patience with respect to rate cuts. Cook gave a thorough overview of the economy and did note some deterioration of household balance sheets: [unless they’re long NVDA].

In addition, consumer spending growth may face increasing headwinds from deteriorating household balance sheets. Savings built up during the pandemic are diminishing, especially for those with low or moderate incomes. Some measures of credit use, such as credit card and buy-now-pay-later use and the share of households carrying a credit card balance, have risen above their pre-pandemic levels. And delinquencies on auto loans and credit cards, which fell to near-record lows during the pandemic, have risen back to near their long-run averages. Thus, although the consumer has been surprisingly resilient, there are reasons to expect some moderation going forward.

Most commentators seem to think households have solid balance sheets, which may be true in aggregate due to wealth disparity, but not for a large percentage of consumers. The question becomes “how long can a smaller group of households maintain aggregate spending?” Of course, pre-election gov’t efforts to juice the economy might mask underlying problems…for a while.

–The two-year yield jumped 6 bps to 4.712%, while the 10y was nearly unch’d at 4.325% and 30s fell by 3.7 bps to 4.462%. On the SOFR curve reds -6.625, greens -2.25, blues -0.25 and golds +1.75. I attached a couple of charts showing notable spread shifts. First, on the treasury curve 5/10 inverted for the first time since December (4.33/4.325), having been as high as +12.5 in Jan.

Second, in SOFR, the first one-year calendar, H4/H5 at -106.75 is no longer the most inverted, as the second slot M4/M5 settled -108.5. It’s all indicative of the same sentiment, namely that the Fed is going to slow-play any cuts. SFRH4/H5 had actually settled as low as -163.5 in mid-Jan (when 5/10 was +12.5). Now all the one-year spreads suggest only about 100 bps of ease over a given year. (FFG4/G5 settle -95 and FFJ4/J5 settle -107.5).

–Art Main of TJM sums up SOFR options plays:

A notable theme was liquidation of upside on SFRU4 and SFRZ4 via call spreads and call condors as follows:

-30k SFRU4 95.25/95.4375 call spread at 5.75

-20k SFRU4 95.00/95.50/95.75/96.25 call condor from 13 to 12.75

-20k SFRZ4 95.50/96.25/98.00/98.75 call condor from 19 to 18.75

-20k SFRZ4 95.50/96.50/97.50/98.50 call condor from 21 to 20.5

From a new directional risk perspective flows were balanced with the most notable as follows:

+8k SFRJ4 95.25/95.75 call spread covered 94.91 delta .10 at 1.75

+10k SFRK4 95.0625/95.1875 call spread covered 94.925 delta .10

+15k SFRM4 94.875/95.00/95.125 call fly from 2.25 to 2.5

+9.5k SFRM4 95.50/96.00/96.50 call fly at 1.25

+55k SFRJ4 94.9375/94.8125/94.75/94.625 put condor from 4.875 to 5

+20k SFRU4 95.25/95.00 SFRN4 94.875/94.625 put spread at 7.5 (+SFRU4 -SFRN4)

+8k 2QM4 96.00/95.625 put spread vs. 2QJ4 96.00 put at 0.5 (+2QM4 -2QJ4)

Nikkei and NVDA

February 22, 2024

*******************

–Two dominant stories this morning are Japan’s Nikkei finally surpassing the high from 1989, and NVDA soaring to new highs after hours. I suppose a natural comparison to make is how the Nikkei looked in 1989 compared to NVDA now. At the end of 1988 NKY was around 30159 and in December 1989 topped, at around 38600, a blistering gain of 28%. NVDA jumped 13% after yesterday’s close, adding about $225 billion in market cap.

–I suppose the other linked question is what the central banks are going to do about it. In the late 1990’s irrational exuberance era, Greenspan didn’t really lean into it, suggesting instead that the Fed would just clean up after the winners and losers were shaken out. In the case of the Fed, yesterday’s minutes said members expressed caution about easing too quickly. Does the BOJ look to ‘normalize’ funding rates in April, following year-end?

–In US rates, fives and tens both saw yields rise by 4.8 bps to 4.295% and 4.321%. On the SOFR strip reds fell 5.75 to 9610.25 (~4.9%) and greens -5.0 to 9630 (4.7%). One interesting trade in SOFR was a new seller of 35k SFRZ4 9475/9525 strangle at 69 covered 9558.5. Open int in both strikes up >20k so trade is new, settled 11.0 in put and 57.25 in call, so 68.75 ref 9557.0s. Obviously the call is in the money, but if the Fed holds steady, then SFRZ4 should roll down to SFRU4 which settled exactly at 9525. Same strangle in SFRU4 settled 40, with calls 30.5s.

–News today includes Chgo Fed National Activity, Jobless Claims, expected 215k, PMI Composite expected 51.9 from 52, and Existing Home Sales.

below from macrotrends.net

They still like April TY puts

February 21, 2024

*******************

–Light volume Tuesday with yields edging a bit lower. Tens fell 2 bps (from Friday’s level) to 4.273%. Red SOFR pack strongest on the strip settling up 5 at avg price 9616. As March treasury options expire on Friday, focus has shifted to April options, primarily puts, which in turn has accelerated the roll in TY. About 6% of open interest has shifted to TYM4 with shorter durations having rolled about 4%. DV01 on TYM4 is over 5% larger than TYH4 which is also a likely factor in spurring the roll. Buyer yesterday of another 20k TYJ 106.5p which settled 5 with -0.06d, open interest up 18.5k (adding). Market makers selling April puts need deltas in TYM4 to be properly hedged.

–On the shorter end, buyer of about 35k SFRU4 9500p for 16 to 16.5 covered 9531 to 31.5. Settled 16.75 vs SFRU4 9529 with open interest up 19k. In terms of ease timing, FFN4 settled 9493.0 or 5.07%. Current EFFR is 5.33% or 9467, which is exactly where FFG4 is pegged. One cut would move EFFR to 5.08% or 9492. The next FOMC meetings are March 20, May 1 and June 12. FFK4 still prices for some chance of an ease at the May 1 meeting settling at 9476.5. However, July is the nearest contract which fully reflects one 25 bp cut.

–On my weekend note I compared the May through Sept sell-off in SFRM4 with current price action in SFRH5 and suggested if the pattern holds and the Fed stands pat, then put plays on SFRH5 make sense. Someone had a similar thought and bought 9k H5 9625/9562.5/9500p fly which settled 13 ref 9590. Obviously the price target isn’t as low as the SFRM4 price, but a stingy Fed should see H5 grind lower on the roll.

–Today brings $16 billion of 20s to be auctioned, followed by FOMC minutes. NVDA reports after the close (Astonishing $1.7t market cap). There are indications that NQH4 has rolled over, but this afternoon will be important for near term direction.