OpEx on the Ides of March; hang on to your toga

March 15, 2024

****************

–Hard sell off in treasuries, as PPI came in hotter than expected, 0.6 vs 0.3 m/m and 1.6 vs expected 1.2 y/y. Fives and tens ended at the same yield of 4.294% which was +10.9 bps in 5y and +10.4 in 10y.

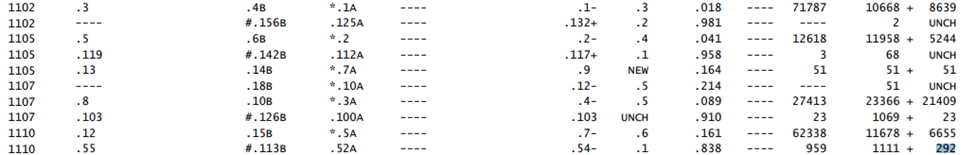

–New highs in some of the near one-yr SOFR calendars. SFRM4/M5 is the most inverted at -105, but it rose 10 on the day as M4 was -2 at 9486.5 while M5 was -12 at 9591.5. Of note, SFRU4/U5 jumped 9.5 to -94.0, highest that spread has settled in a month. Notable because this is the one Bill Gross had cited as a long. Greens (3rd year forward) were weakest on the strip at -14.875.

–Retail Sales printed weaker than expected, but inflation is the dominant factor. As mentioned yesterday Crude Oil remains bid, adding to Wednesday’s gains with CLK4 settling 80.74, +1.44; highest settle in this particular contract since October. Recall, mid-October is when yields made their highs last year. Of course, the front contract at that time, in late September, had reached 93.68. May Copper also held gains from Wednesday.

–Implied vol slightly better bid in treasuries with TYM4 settling 110-06+, -23+. April puts have over 1 million in open interest relative to 4.3m in the outright future. Largest strikes, 110.5 with 78k open (0’37s, -0.62d), 110.0 with 86k open (0’21s, -0.42d) and peak OI 109.5p with 133k (0’11s, -0.25d). April options expire next Friday, covering BOJ and FOMC. The 109.5 strike should equate to around 4.39%.

–Big quarterly expiration day in stocks. MSFT new all-time high yesterday, while TSLA closed 162.5 after being near 300 in July, and AAPL closed 173 from near 200 in December. Bitcoin continues a 2-day pullback this morning printing 68k. AMZN near ath, but META and NVDA look like potential tops.

–Today’s news includes Empire Mfg, expected -7.0. Import and Export prices. Industrial Production expected 0.0 from 0.1. Then Michigan Sentiment and Inflation surveys.

Keep an eye on Oil and Copper

March 14, 2024

****************

–Solid 30y auction at 2.375%. USM4 contract immediately popped from 120-07 to 120-20, but then slid back down to its starting point (120-08s). Ten year yield finished +3.4 on the day at 4.18%.

–A lot of Wednesday puts on TY expired worthless yesterday, but shorts are being replaced with TYJ puts (22-March expiry). TYM4 settled 110-30. Buyer of about 40k TYJ4 110.5/109.25 ps for 13 to 14 covered 110-31+ to 111-01. The put spread settled 15 ref 110-30. Put buying in TY has been pretty relentless for the past couple of weeks.

–A couple of large downside SOFR trades: SFRM4 9487.5/9475ps 5.5 paid 16k covered 9489, 25d. Settled 5.5 vs 9488.5s. Also new buyer of 50k SFRH5 9600/9550/9500 p fly for 10.5 to 11.0. I marked settles 58.5/32.25/16.75 so 10.75 vs 9578.0. Going into next week’s FOMC, April Fed Funds (FFJ4) are right on top of EFFR (5.33) at 9467.5. One year forward FFJ5 is 9577.5 or 4.225%, 110 bps lower. In general, the market appears comfortable with the idea of four rate cuts over a year.

–Worth noting strength in economically sensitive prices: CLK4 this morning is at a new high for the year at 79.91 (+0.61). Copper is also at a new high for this calendar year, with HGK4 printing 4.08 this morning. A few sessions ago on March 6 it was 3.83. Apparently inventories are quite low, as they are across a lot of economically sensitive materials. Nice jump in open interest on HG’s rally yesterday (thanks TD).

–Today’s news includes PPI expected +1.1 yoy from 0.9. Core 1.9% from 2.0. Retail Sales is the more important report, expected +0.8% m/m. Jobless Claims expected 218k.

No help from CPI; wage gains in Japan clear the way for BOJ hike

March 13, 2024

****************

–CPI higher than expected yesterday, pushing yields up. Headline 3.2 and Core 3.8 yoy, both 0.1 hotter than forecast.

From Michael Ashton @inflation_guy

Now, the story starts to become a little clearer, albeit concerning. Core services rose to 5.4% y/y from 5.2% y/y, while core goods was unchanged as I noted above. Rents are coming down, but outside of rents we are seeing some stabilization at higher-than-pre-COVID levels.

…With this, and with Core Services ex-shelter (“Supercore”) at +0.47% m/m – which means supercore accelerated to +4.3% y/y – it is inconceivable that the Fed will yet consider cutting rates. It is possible that they may later in the year, but there is far too much exuberance in the bond market about that prospect.

Tens rose 5.3 bps to 4.153%. Twos up 6.3 to 4.595%. 2/10 only 1 bp above its recent low of -45.2. On the SOFR strip reds down 9 bps, greens down 7.25. This spread is right at its recent low, just above -33. Ten-year re-opening was 4.152% at cut-off but actual result was 1 bp through at 4.162%. Thirty year auction today.

–Implied vol was hammered across the curve. For example, SFRH5 9587.5^ settled 95.75 on Tuesday, and 93.25 yesterday. (Futures from 9591.5 to 9582.5). TYJ4 111.5^ was 1’10 Monday vs 111-19; yesterday TYJ4 111.25^ settled 0’61 vs 111-055. Of course, April options expire just one week from Friday, but the market perceived CPI as the big event of the week. Late seller (adding) to TYK4 109.5/113 strangle, -12k at 0’44, settled 0’46.

–There is still considerable expectation for ease reflected in near FF contracts. July (FFN4) settled 9486.5 or 5.135 bps vs current EFFR of 5.33. Assuming next week’s FOMC is dead, this contract captures May 1 and June 12.

–From the Japan Times regarding wage negotiations (clearing the way for a BOJ hike):

This year’s annual negotiations, known as shuntō, conclude this month and are being monitored especially closely by policymakers, as developments could be a decisive factor in the Bank of Japan’s decision on whether to adjust its ultraloose monetary policy next week or next month.

Toyota, Japan’s largest automaker, has fully accepted workers’ demands and offered its largest wage hike since 1999. The carmaker’s labor union had demanded a hike of between ¥7,940 ($54) and ¥28,440 for monthly wages depending on job type and position. Toyota will also raise salaries for new employees.

–It’s plausible that a hike next week by Japan could undermine support for long US treasuries, thus tightening financial conditions.

–Interesting post re: US Gov’t spending by EJ Antoni

Over 52% of federal gov’t spending in Feb was financed by debt – MORE THAN HALF:

Place your inflation bets

March 12, 2024

****************

–CPI is the big event today, expected 0.4 from 0.3 m/m, with Core 0.3 from 0.4. Year/year expected 3.1, same as last, with Core 3.7 from 3.9. Curve flattened yesterday with 2s up 4.8 bps to 4.532% and tens up 1.3 to 4.10%. The three year auction went well, going off at 4.256% vs 4.277 at the cut-off. Tens today and thirties tomorrow.

–There continues to be heavy buying of high-gamma weekly 10y puts. Yesterday it was mostly in TY week-3 (this Friday). Early buyer of 40k TY week3 110.75/110.25ps for 5, covered 111-15, 5d. Settled 5 (8 / 3) vs 111-19. Late there was a buyer in clips totaling 40k 111.0/110.75 put spd for 4, covered against 19.5 to 20.5, 6d. Settled 4 (12 / 8). TYM4 settled 111-19. Total OI in week-3 puts up 108k. It wasn’t uncommon to see some high gamma put buys before big economic releases, but recent activity is taking it up a notch. Feels like more than just short-term protection for a bond portfolio. In any case, 0-dte (or close to it) is making the leap from stocks to bonds. On a day when open interest fell in almost all other treasury futures, TY was up 30k.

–Kevin Muir (MacroTourist) notes that the inflation swap curve is raising forward inflation expectations. However, the ten year breakeven is well behaved, at 2.273 on yesterday’s mark at futures settle (range of 2.34 to 2.24 over the past month). Elevated shipping costs and crude oil/gasoline prices are likely keeping inflation in focus. However, retail sales are out on Thursday and may show waning consumer enthusiasm.

No auction concession, yet

March 11, 2024

****************

–Japan revised an initial negative print for GDP (last three months of the year), to positive 0.4%, providing cover to end negative rates and YCC. Ten year JGB prints a new high for this calendar year at 75.5 bps and $/yen is pressing lower, now at 146.60. The 200 dma is 146.22; we’ve been above that moving average since early Jan, but it now appears that 145 is a target. BOJ is March 18/19. Last year’s JGB high was nearly 1% in October.

–Three-yr treasury auction today, followed by 10s and 30s Tuesday and Wednesday. CPI is tomorrow. Headline yoy expected 3.1% from 3.1 last. Core expected 3.7% from 3.9. Friday’s employment report featured higher than expected NFP at 275k, but revisions and other aspects of the report were soft. Yields were mixed, with 2s down 2.8 bps to 4.484% but tens nearly unch’d at 4.087%. As mentioned in yesterday’s note, TY puts expiring this Wednesday, March 13, were heavily traded (bought). Open interest just on Wednesday puts rose 76k. TY wk2 Wed 110.75 puts settled 4 adding 21.4k in open interest. The 111p traded 62k in volume and settled 7, adding 6.6k in open interest. Futures settled 111-23+. Current print is 111-25+.

–Bitcoin has exploded to a new high of 71700. Can crypto strength spark renewed buying in Nasdaq after the huge reversal in NVDA on Friday?

Auctions and CPI

March 10, 2024 – Weekly Comment

**************************************

The Fed’s Z.1 quarterly report was released last week for Q4. While the data is perhaps a bit stale, the debt levels are still somewhat eye-opening. Total Household Debt ended 2018 at $15.582 trillion. By the end of last year it had grown to $19.955T, an increase of 28% over five years. Total business debt grew at a similar rate, from $16.151T in 2018 to $21.126 in 2023, or 31%. Surprisingly, on the Gov’t side, State and Local Gov’t debt was $3.124T at the end of 2018, and rose to just $3.255 in 2023, an increase of just 4%! (Did they even have Chicago in there?) But Federal Gov’t Debt over that time period grew 65% from $17.865t to $29.472T. The one-year increase from 2022 to 2023 was $2.621T. In one year Fed’l Gov’t Debt rose almost as much as total State & Local debt. That deficit spending is what is driving economic “growth”.

Yields ended a bit lower last week, with twos down 4.5 bps to 4.484% and tens down 9.1 to 4.087%. Powell repeated that the Fed needs more confidence that inflation is trending to target before easing. The employment report featured a strong headline NFP gain of 275k, but the previous number was revised lower by 124k, the unemployment rate ticked up to 3.9% and average hourly earnings were up only 0.1% month/month. Overall, a moderately weak report.

This week brings auctions of 3-yr notes on Monday ($56b), 10-yr notes on Tuesday ($39b) and 30s on Wednesday ($22b). CPI is released on Tuesday, expected 0.4% m/m with Core 0.3%. Yoy expected 3.1% from 3.1% last and Core 3.7% from 3.9% last. Energy prices firmed over the month of February. On Thursday, PPI and Retail Sales are released.

The FOMC meeting is one week from Wednesday. The BOJ meeting is March 18/19. $/yen had a significant move on the week, falling from 150.12 to 147.06 as an end to negative rates is being considered. From Reuters:

A growing number of Bank of Japan policymakers are warming to the idea of ending negative interest rates this month on expectations of hefty pay hikes in this year’s annual wage negotiations, four sources familiar with its thinking said.

Many BOJ policymakers are closely watching the outcome of big firms’ annual wage negotiations with unions on March 13, and the first survey results to be released by labour umbrella Rengo on March 15, to determine how soon to phase out their massive stimulus.

A shift in BOJ policy could reverberate throughout global markets, strengthening the yen further, making yen carry trades less attractive. While US and European yields were lower on the week, the 10y JGP ended at 73 bps, near the high of this calendar year (up 2 bps on the week).

******************************************

A large amount of Wednesday (March 13 expiry) treasury options traded Friday, weighted heavily toward puts. About 9.8k calls traded, but put volume was over 220k with open interest increasing 76.7k. The 30yr auction is Wednesday (3s and 10s Monday and Tuesday) so all auctions are captured. CPI is Tuesday. It’s a bit hard to see on the CME volume and open interest site, but Wednesday week-2 110.75 puts settled 4, and added 21.4k in open interest. The 111p traded 62k in volume and settled 7, adding 6.6k in open interest. Underlying TYM4 settled 111-23+.

April puts on TY expire on 22-March, just after the FOMC. Put open interest is 1.045 million, with the peak strike being the 109.5p at 129k, settled 3/64. TYJ4 call OI is just 575k.

Does it matter? My sense is that the market’s underlying concern is higher long end yields. Whether these put trades are sparked by fears of inflation due to energy cost spikes, or shipping and other supply chain issues, or just massive bond supply, a ten-year yield nearing 4% requires upside yield protection.

A friend asked where I thought TY Wed 111p would be on CPI if futures printed exactly 111-00. I would imagine the straddle would still be about 7-9 bps given unknown results for 10 & 30 auctions, and figure the puts would be about 15/17.

*****************************

I have to mention NVDA which posted a huge key reversal Friday (new high, outside range, massive volume, closed near the bottom of the range). Volume was over 114 million shares. There have only been three other days in the past year with larger volume: Aug 24 with 115m, closing price 471.63, and May 25, with 154 million volume and a close of 379.80 (both coinciding to earnings reports). On a $2 trillion market cap the range of 974 to 865 represented a swing of over $200 billion.

Technical markers like key reversals haven’t been all that valuable recently in terms of identifying trend changes. For example, March Bitcoin futures had a huge 10k outside range day on Tuesday, 60120 to 70195. Big volume, and price settled in the bottom quarter of the range. Classis reversal. However, on Friday BTCH4 made a new contract high 71055.

My bet is that NVDA will see further weakness going into Friday’s option expiration, which will likely take Nasdaq along for the ride.

*******************************

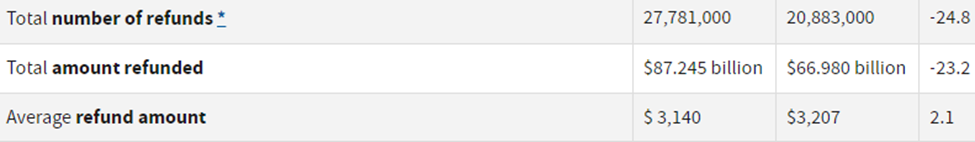

I don’t follow tax refunds closely. However, it’s worth noting that the average refund amount, as of Feb 16, 2024, was $3207 vs $3140 in 2023. That’s an increase of just $67 or 2.1%. Relative to CPI of 3.4% at the end of 2023, this data suggests that aggregate wage increases aren’t keeping pace with inflation. Likely due to calendar quirks, the total amount refunded so far is $66.9 billion vs $87.2 billion last year. Hey Krugman, tell me again why the average consumer should be thrilled with Bidenomics. A podcast by Grant’s noted that auto insurance has increased by about 20% over the past year, partially due to the fact that social inflation has been staggeringly large, contributing to outsized jumps in insurance costs. [Social inflation is related to large jumps in jury awards] Your government at work?

From the IRS as of Feb 16, 2024. First column is 2022, middle is 2023, followed by percentage change

| 3/1/2024 | 3/8/2024 | chg | ||

| UST 2Y | 452.9 | 448.4 | -4.5 | |

| UST 5Y | 415.7 | 406.1 | -9.6 | |

| UST 10Y | 417.8 | 408.7 | -9.1 | wi 409.0/08.5 |

| UST 30Y | 432.7 | 426.0 | -6.7 | wi 426.5/26.0 |

| GERM 2Y | 289.0 | 275.9 | -13.1 | |

| GERM 10Y | 241.3 | 226.7 | -14.6 | |

| JPN 20Y | 144.3 | 149.5 | 5.2 | |

| CHINA 10Y | 238.3 | 229.3 | -9.0 | |

| SOFR H4/H5 | -119.0 | -126.3 | -7.3 | |

| SOFR H5/H6 | -54.0 | -58.5 | -4.5 | |

| SOFR H6/H7 | -0.5 | -1.5 | -1.0 | |

| EUR | 108.41 | 109.41 | 1.00 | |

| CRUDE (CLJ4) | 79.97 | 78.01 | -1.96 | |

| SPX | 5137.08 | 5123.69 | -13.39 | -0.3% |

| VIX | 13.11 | 14.74 | 1.63 | |

Payrolls

March 8, 2024

***************

–NFP expected 200k. Yields eased yesterday with 2s down 4.6 bps to 4.512% and 10s down 1.6 to 4.09%. Little change this morning though yen continues to strengthen with $/yen 147.16 as the BOJ is expected to end negative rates. Borrow yen, convert to dollars, buy NVDA. Can’t lose, right? But a strengthening yen can put a nick in expected profit.

–Next week brings auctions of 3s, 10s, 30s Monday, Tue, Wed. CPI Tuesday. With one week to go, midcurve straddle levels are fairly high. 0QH4 9687.5^ is 21 ref SFRH5 9592. 2QH4 9650^ is 18.5 ref SFRH6 9651.0. While there has been vigorous debate about the amount of easing that can occur this year, note that slightly forward one-year calendars are all around 125 bps, or roughly 5 eases. SFRH4/H5 is -121.75 (9470.25/9592), SFRM4/M5 is -121 (9495.5/9616.5). FFJ4/J5 is also -121. The yield on SFRH5 is 4.08%… one year away.

–Game of Trades X post says the the Mag-7 market cap is greater than that of all equity markets outside of the US.

–Consumer Credit bounced back in January, with revolving increasing at a 7.6% rate, to a level of $1.327T outstanding. The rate on “accounts assessed interest” is 22.75%. Assuming actual payment, that amounts to about $25 billion per month in interest.

–Yesterday I posted a SOFR option trade (condor) and incorrectly said it was M4 when it was actually MAY expiry.

Record Net Worth, Record Gov’t Debt

March 7, 2024

****************

–Curve continued to flatten (invert further) as Powell stayed on script, repeating that the Fed needs more confidence inflation is moving to target. At the end of January, 2/10 was -28, yesterday the spread was down 4 at -45.2, a new low for this year. The low in mid-December was -52.5. My opinion is that 2/10 will hold -55 to -50. Red/green SOFR pack spread edged to a new low near -33 bps, at the end of January it was +3. [red/green is second year to third year]. The easing schedule is being nudged further back on the calendar.

–Today brings Productivity and Unit Labor Costs, expected +3.1% and +0.7. Jobless Claims 217k. Powell in front of the Senate.

The Fed’s quarterly Z.1 report, which summarizes HH Net Worth and Debt metrics across sectors for Q4 is released. Given the end-of-year surge in stocks, household net worth will likely post a record high. Of course, Federal Gov’t Debt will also hit a new record.

–Employment report is tomorrow with NFP expected 200k from 353k.

–Yen getting a nice pop as the prospect of BOJ ending negative rates draws closer. $/yen was 150.50 on Monday and is now 147.80. Gold hit an all-time high yesterday at $2152. News about NYCB problems only underscores the likelihood of other banks struggling with similar issues.

–Large trades yesterday: +40k SFRM4 9493.75/9487.5/9475/9468.75 put condor for 1.5. Underlying SFRM4 settled 9493.

TYJ4 113c 14 paid for 15k, settled 11 vs TYM4 111-155.

TYK4 109/113 strangle sold at 54 about 7k, settled 51.

Half empty

March 6, 2024

***************

–Yields fell, curve flattened. Tens down 8.2 bps to 4.135%. New low in red/green SOFR pack spread to -30.625 (9617.5/9648.125). Red pack+7.125 and green pack +8.25. Perhaps of note is that SFRU4/U5 posted a new recent low at -105, down 3 on the day (9525/9630). This is the spread the Bill Gross cited as a long. It hasn’t had a lot of volatility; last 20 trading day range is -93.5 to -102. Related to this spread was a new buyer of 60k 9600/9700cs for 6.5 (settled 11.0/4.5). The 4% strike (9600) seems a bit optimistic given a narrowing time window. Maybe optimistic isn’t the correct word, as some bad stuff would have to occur to spark >150 bps in cuts. See Egypt, below.

–News today includes ADP, expected 150k. Powell at 10:00am and JOLTs also at that time, expected to extend its decline a bit more to 8.9m. Beige Book in the afternoon.

–A couple of other significant trades: new buyer of 30k TYK4 110.5p for 54. Settled 50 ref TYM4 111-095, -0.38 delta. Seller of over 10k TYK4 109.5/113 strangle 63 to 62; settled 62.

–Massive volatility in bitcoin, with the March futures having a range of about $10k. Key reversal with outside day after a new historic high of over $70k, but I’m not sure the technicals mean much in this market.

–After a pullback in the past two sessions, CLJ4 is back near $79/bbl (up 73 cents). Does Egypt’s massive hike and currency devaluation have an impact? Hike of 600 bps to 27.25%, ccy down 30%, apparently closer to the black market level. The collapse of Egypt would add to the region’s instability and further complicate oil transport.

Ain’t it a BTCH?

March 5, 2024

***************

–In rates futures, much of Friday’s rally was reversed. The curve flattened, with 2y +7.7 bps to 4.606%, 5y +5.1 to 4.208%, 10y +3.9 to 4.217% and 30y 2.6 to 4.353%. On the SOFR strip, reds were weakest, settling -7.625 at avg 9610.375. Red/green pack spread closed at a new recent low of -29.5 (Grns down 4.375). Not particularly surprising to see relative pressure on the front end as Powell goes before Congress tomorrow; he will likely emphasize this line released in Friday’s Monetary Report: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

–Explosive moves in bitcoin, gold and silver probably don’t help the case for those betting on a quick ease. March bitcoin (CME symbol BTCH; an appropriate twist of the knife for shorts) which was below 40k in Jan, settled 68480, +4655. GCJ4 settled 2126.30, +30.6. As various House members righteously criticize Powell for the Fed’s mismanagement, he might remind them that reckless fiscal spending factors into the demand for alternatives to USD. He won’t do that of course…

–News today includes Factory Orders and ISM Services, expected 53.0 from 53.4. Prices paid 62.0 from 64.0. Given that Core Service prices have been cited by the Fed as a sticking point in the inflation fight, this release could have a bit more importance than usual.

–A couple of exit trades in SFRZ4 options. SFRZ4 9600/9550/9500 put fly sold at 11.5m 20k, settled 12.25 ref 9552.0. This trade gains value over time if the market sits right around the center strike. Straddles have come down a reasonable amount in the past week, but my guess is that mid-March to mid-April will get a bit more wild.

SFRZ4 9475p cs covered 9552, 16d vs SFRZ5 9475/9400ps covered 9632.5 8d, 2.5 paid for front Dec on exit, 26k. Settled 10.75 and 9.0.