Balance of risks says WAIT

March 28, 2024

*****************

–From Waller last night:

My judgment on the balance of risks for monetary policy, which I explained in a speech on February 22, hasn’t changed: The risk of waiting a little longer to cut rates is significantly lower than acting too soon.

https://www.federalreserve.gov/newsevents/speech/waller20240327a.htm

–Curve flattened in response with red SOFR contracts bearing the brunt of selling. Currently SFRM4 is 9485.5 -3.0, M5 is 9592.5 -7.0, M6 is 9630 -6.0, M7 is 9639.5 -2.0.

–CBO director Phillip Swagel, in an interview with the FT warned about the trajectory of US borrowing:

“The danger, of course, is what the UK faced with former Prime Minister (Liz) Truss, where policymakers tried to take an action, and then there’s a market reaction to that action,” he told the newspaper, referring to the investor backlash against plans for unfunded tax cuts that forced Truss to resign after just 45 days in office.(CNN)

–Today’s news includes final Q4 GDP, Jobless Claims 212k, Chgo PMI 46.0 from 44.0, Uof Mich final Sentiment and inflation expectations.

–The SOFR option pit closes at noon, so all month-end settlements will be at noon. Markets are closed on Friday. PCE prices are released tomorrow and Powell speaks at the SF Fed.

Fed HODL

March 27, 2024

*****************

–Yields down slightly in a quiet session. Tens -1.7 bps to 4.234%. Implied vol continues to compress in front of the long weekend. Good 5yr auction. Capital Goods Orders non-defense solid at +0.7. However, consumer confidence slipped to 104.7, lower than 107 expected (middle of the 2023 range, so no big deal).

–Buyer of 20k SFRQ4 9487.5/9475/9462.5p tree at 1.25 and slightly higher synthetic. Settled 1.25 ref 9517.0 in SFRU4 (4.0/1.75/1.0). The July version settled 1.0 (3.0/1.25/0.75). The June version is 3.75 (6.5/2.25/0.50), and that’s with SFRM4 settling close to the upper strike at 9488.5. Looking for a Fed on hold; see Waller below.

–7 year auction today.

–Waller speaks at Econ Club of NY tonight at 6:00pm. His speech on Feb 22 was titled “What’s the Rush?” [to ease]. One line: “I am going to need to see at least another couple more months of inflation data before I can judge whether January was a speed bump or pothole.” In terms of El-Erian’s assessment that the Fed is shifting to a target range on inflation somewhat higher than 2%, we’ll see if Waller modifies his stance from the Feb 22 speech. This doesn’t sound like a guy abandoning the 2% target:

…we could take our time and collect more data to ensure that inflation was on a sustainable 2 percent path.

This means waiting longer before I have enough confidence that beginning to cut rates will keep us on a path to 2 percent inflation.

More data, and more time, will tell whether January’s CPI report was just a bump in the road to 2 percent inflation.

…continued progress toward the Federal Open Market Committee’s (FOMC) 2 percent inflation goal.

…I still consider them to be somewhat elevated to achieve our 2 percent goal.

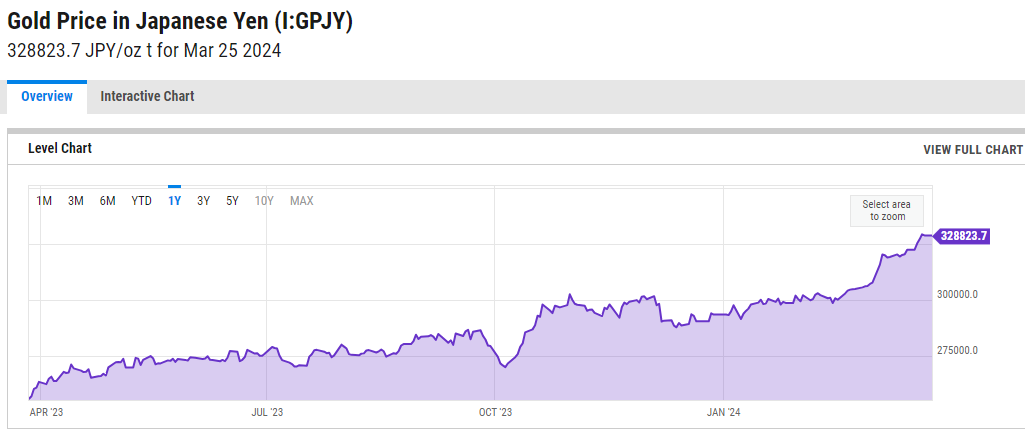

–BOJ’s recent rate hike did little to stem the slide in the yen. Today there are official warnings of intervention with $/yen above 151. A year ago gold priced in yen was 255961. Now it’s 328823, up 28%.

From ycharts.com

Accidents will happen

March 26, 2024

******************

–Yields rose Monday with tens up 3.5 bps to 4.251% and SOFR contracts down 3.5 to 4.0 from Dec’24 to Dec’28. The lowest contract on the strip is front June’24 at 9489.0 while the peak is Dec’26 at 9635.5, a spread of just -146.5 over two and a half years. Just in January the near 1-year calendar was more inverted (around -160). Current SFRM4/M5 is -107.5. Forward rates have moved slightly higher, and of course there are still trades fading the three-cut dot plot. For example, yesterday a buyer +20k SFRU4 9512.5/9493.75/9487.5p tree 2.50 to 2.75, which would probably work best in the scenario Bostic mentioned yesterday: just one ease this year. (SFRU4 9518.5 settle).

–I looked at the dot-com unwind from 2000, and it’s worth noting that the FF target was slashed by 250 bps in just six months starting in 2001, from 6.5 to 4.0%. That was before 9/11, which prompted a 50 bp cut to 3.0%, followed by another in October. Sort of a reminder not to leave open upside shorts.

–Solid 2y auction yesterday, with 5s today and 7s tomorrow. Cocoa prices continue to skyrocket, having more than doubled since January. From Barchart: “Cocoa prices catapult to record highs as Ghana’s output expected to plunge.” What? We’re depending on Ghana for chocolate? Yes, and dependent on Taiwan for semis.

–On the other hand, US oil production has been increasing. However, CLK4 remains stubbornly bid at 81.85 late (+1.22). Near contracts trade around a $7 premium to next year, for example CLM4/M5 was 7.29/7.32 late. RJOs Tom Fitzpatrick made the point that since high oil prices don’t seem to be driven by demand, they act more as a tax on the economy.

–The dramatic collapse of a bridge in Baltimore as a ship accidentally hit a support, will likely spark calls for infrastructure investment. Broken bridge (window) fallacy?

Lemons

March 24, 2024 – Weekly Comment

*************************************

The Fed kept three cuts for 2024 in the Summary of Economic Projections (SEP). The Bank of Japan hiked, eliminating the negative funding rate and YCC. The Swiss National Bank eased by 25 bps.

Mohamed El-Erian says this might be the week that Central Banks (with emphasis on the Fed) moved away from a strict 2% inflation target to a broader range above 2%. He notes that Chair Powell dismissed easier financial conditions, a tacit indication of accepting higher inflation. I disagree.

It was August 2020 that the Fed adopted FAIT (Flexible Average Inflation Targeting) seeking “to achieve inflation that averages 2 percent over time.” Obviously, that statement was crafted during a low inflation environment, otherwise we would expect, after recent history, that the Fed would have to undershoot 2% for a while to achieve the average. Powell has repeatedly committed to the 2% target. He speaks Friday in a moderated discussion at the San Francisco Fed; we’ll see if he drops the Fed’s explicit 2% target. I don’t think so. Note that the Fed’s preferred inflation measure, Core PCE prices will also be released Friday when markets are closed for Good Friday. Yoy PCE expected 2.5% from 2.4 last, with Core 2.8% from 2.8% last. Core PCE has been down every month since January 2023. A print above 2.8% would likely elicit bearish headlines.

On the topic of financial conditions, I theorized last week that the Fed could dampen long-dated assets, stocks and bonds, by raising longer dated FF dots in the SEP, thus strengthening the perception of higher for longer. That’s exactly what was revealed by the dot plot (2025 FF projection notched up to 3.9 from 3.6 and 2026 to 3.1 from 2.9). However, the market, as usual, focused on short-term relief as the Fed left three cuts in place for 2024 and ignored longer term implications. I have the ‘watch what we do, not what we say’ philosophy regarding financial conditions and the Fed. Although Powell addressed the taper of QT, there didn’t seem to be particular urgency in outlining the plan. Relatively higher funding rates over a longer period should have tightened financial conditions. Perhaps there will be a lag. However, there wasn’t much of a lag with the yen and yuan. After the BOJ’s (dovish) tightening, $/yen made a new high and closed the week at 151.41. DXY also ended at the month’s high. On a long-term chart (below) it looks like 175 might be the next target for JPY. Somewhat interesting to note that the yen soared in the late 1980’s as the Nikkei exploded to new highs. Now it has generally been a weaker yen/stronger dollar that has accompanied the Nikkei’s revisit to the historic 1989 high.

With respect to rates, yields fell on the week but the curve steepened. Twos and fives fell 12.4 bps in front of this week’s auctions of 2s, 5s, 7s. The 10y yield fell 8.5 bps to 4.302%, while 30s eased only 3.5 to 4.426%.

The Fed characterizes monetary policy as restrictive. Many take issue with that assessment. However, the real FF rate, EFFR – CPI at 2.13% is the highest it has been since 2009. For most of the period between 2010 and 2020 the spread was below zero, only briefly positive in 2015 and 2019, but never above 100 bps. Likewise, the ten-yr tip yield poked above 2% this week (ended at 1.87%). This is well off last year’s high of 2.52%, but again, well above every level since late 2009 (high in ’09 1.92%).

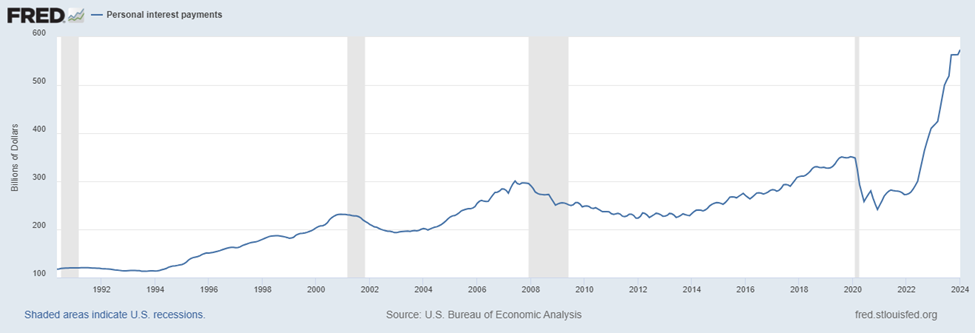

I am just going to close with one other indicator of restraint. The image below is Personal Interest Payments. Last of $573 billion annualized.

Now, perhaps the level is meaningless when taken on its own. As Yellen might say in her inimitable deadpan cadence, “Wages have also gone up.” So let’s take a look at this value over nominal GDP: This chart starts in 1980, and at first glance, the current level appears consistent with periods around recession. Of course, one might note that personal interest paid looks much like the chart of gov’t interest payments which are a bit over $1 trillion. But those gov’t payments likely benefit a much different segment of the population.

Now I know the Fed has a myriad of consumer strength indicators. Way more than I can ever hope to familiarize myself with. So I’m not sure if this single data point has predictive power.

My more mundane question is, (without the help of AI): Is the woman pictured being stressed on spendable cash? Lulu lemon clothes, CHECK. I-phone, CHECK. Starbucks, CHECK.

Lululemon’s shares dropped 16% Friday on waning North American demand. Many popular consumer brands seem to be experiencing underwhelming sales. I just chose four stocks for the chart below, which are all lower in 2024. Of course, there are many consumer companies that are up on the year, and the ones I selected could be special cases, but perhaps there really is some restraint in buying power, whether engineered by the Fed or not.

OTHER THOUGHTS

While the last few weeks have seen large high-gamma put buys on TY, on Friday the switch flipped to calls.

+50k wk2 110.75c cov 110-18, 37 paid, 0’43s

+8k wk1 111.5c cov 110-155, 11 paid. 0’15s

+20k TYK 114/114.5c stupid cov 110-255, 10 paid, 0’05s and 0’04s

+10k TYM 114.5c 12, 0’11s

Week-2 treasury options expire 12-April, as do April SOFR midcurves. Data encompassed by that period includes:

2/5/7 year auctions this week

3/29 PCE prices and Powell on Friday

4/1 ISM

4/2 JOLTs

4/3 ISM Services

4/5 NFP

4/10 CPI & Fed minutes

4/11 PPI

| 3/15/2024 | 3/22/2024 | chg | ||

| UST 2Y | 472.1 | 459.8 | -12.3 | wi 455.5/55.0 |

| UST 5Y | 432.3 | 420.0 | -12.3 | wi 420.0/19.5 |

| UST 10Y | 430.2 | 421.6 | -8.6 | |

| UST 30Y | 442.6 | 439.1 | -3.5 | |

| GERM 2Y | 294.6 | 282.7 | -11.9 | |

| GERM 10Y | 244.2 | 232.3 | -11.9 | |

| JPN 20Y | 154.8 | 149.2 | -5.6 | |

| CHINA 10Y | 234.7 | 230.9 | -3.8 | |

| SOFR M4/M5 | -101.5 | -109.0 | -7.5 | |

| SOFR M5/M6 | -36.5 | -37.0 | -0.5 | |

| SOFR M6/M7 | -6.5 | -1.5 | 5.0 | |

| EUR | 108.90 | 108.12 | -0.78 | |

| CRUDE (CLK4) | 80.58 | 80.62 | 0.04 | |

| SPX | 5117.09 | 5234.18 | 117.09 | 2.3% |

| VIX | 14.41 | 13.06 | -1.35 | |

Pitchforks and Torches

March 22, 2024

****************

–April treasury option expiration today.

–Rates showed little net change, weakest SOFR contract was SFRM5, closing -3.5 at 9596.0. Tens were about unchanged at 4.269 while twos rose 3.2 bps to 4.63%.

–A couple of large new trades:

In TY Week2 (April 12 expiry)

+50k 110.75c 0’42 covered 110-23, 50d

+50k 110.50p 0’42 covered 110-18, 46d

Strangle 1’20, settled 1’14 vs 11012+ Call 0’32 and put 0’46

+41k SFRM5 9637.5/9587.5/9537.5 p fly 10.0 to 10.5. Settled 10.25 vs 9596.0. Vol lower across the SOFR curve.

–One week from today, 3/29 the CME is closed for Good Friday. PCE prices are being released, and Powell is scheduled to speak at a moderated discussion at the San Fran Fed.

Other events prior to the week2 Treasury expiration:

Next week auctions of 2/5/7 year notes

4/1 ISM

4/3 ISM Services

4/5 NFP

4/10 CPI and Fed Minutes

*********************

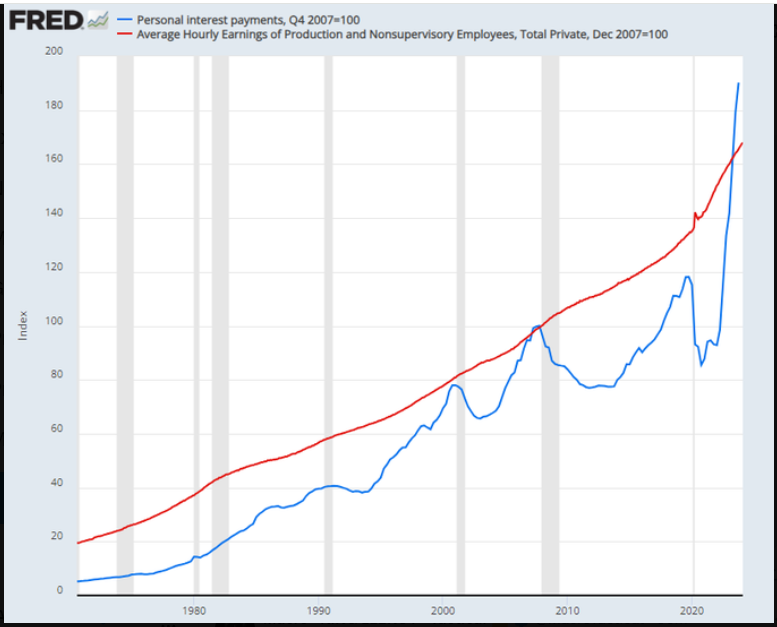

Chart on X, posted by Samantha LaDuc

All I can see when looking at the below chart is this:

Pitchforks and Torches

I am not 100% sure I am interpreting the data correctly; it looks like Personal Interest Payments are exceeding wage income.

However, the Y-axis is an ‘Index’. Not at all surprising that the growth of interest payments is exceeding wages. Everything is.

https://twitter.com/SamanthaLaDuc/status/1770791896559800526

Right trip, wrong car

March 21, 2024

****************

I been in the right place

But it must have been the wrong time

I’d have said the right thing

But must have used the wrong line

I been on the right trip

But I must have used the wrong car

Head is in a bad place and I wonder what it’s good for

-Dr John

–The risk was that the 2024 dot would only project TWO 25bp eases instead of the three which had been penciled in at the Dec FOMC. As it turned out, the 2024 dot remained at 4.6 (3 eases) and there was a collective sigh of relief. The market was caught wrong-footed, having prepared for a less accommodative 2024 dot. Mad rush into stocks by the grasshoppers.

–Yesterday I wrote: “I would recommend leaving 2024 at 4.6, but push 2025 back up to 3.9 and notch 2026 up to 3.1. The front end of the SOFR curve is already fairly priced with the current 2024 projection, but forward rates would likely achieve tighter financial conditions which will support deceleration in Service inflation.” Right church, wrong pew. Rates fell across the curve and stocks jumped even though I correctly pegged the SEP.

–Precious metals exploded higher with April Gold now 2203.50, +42.50. Spot gold hit an all-time high of 2222. DXY had an outside range and closed lower, but is firming this morning. The 2y yield fell 9 bps to 4.598% while 10s fell only 2.4 bps to 4.271%. 2/10 edged to new recent high of -32.7 while 5/30 popped 7.6 bps to +21.4. SOFR curve steepened accordingly with reds +7.875 and golds actually lower on the day by -0.75. Avg pack prices (rounded): Whites 9535.5, Reds 9617.0, Greens 9633, Blues 9631, Golds 9621. Two observations: the first to second year is -81.5 (3 to four rate cuts). But then all contracts are 3 5/8% to 3 7/8%. Forward rates are not projecting inflation falling back to 2% with rates at 3%. Ants take notice.

–On the topic of QT, Powell said a decision to slow the pace would be made “fairly soon”. He said the Fed is closely monitoring money markets, and that reserves are now “abundant” but the goal is for reserves to be “ample”. Almost sounds as if the Fed is waiting for overt tightness in money markets before committing to a change in QT.

–Either the market is missing the Fed’s signal of relative forward restraint, or just doesn’t care or believe. Probably the latter. Given FF and Core PCE projections, real FF are 2.0 in 2024 (4.6 vs 2.6), 1.7 in 2025 (3.9 vs 2.2) and 1.1 in 2026 (3.1 vs 2.0).

Forward Restraint

March 20, 2024

****************

–What’s the problem? The problem is that service inflation is not coming down; we think goods inflation is probably under control. The three elements of financial conditions that have become easier are 1) equity prices are frothy 2) credit spreads are tight 3) long rates are relatively low. Service inflation would likely decelerate and employment, which is already edging slowly higher, would likely respond in our favor if we could reverse the stimulative effects of the loosest aspects of financial conditions.

–We already are debating the end to QE for technical reasons. There is a risk that both equities and bonds might embrace reduced QE as a reason to run higher. However, the already restrictive stance in the current FF target likely warrants some easing, as was forecast in the last SEP. The deleterious effects of a weaker yuan and recession in Europe might be accentuated by a signal that we no longer intend to ease in 2024. The lower end of the income population is already straining under high short-term funding rates.

–How can we officially signal a monetary posture to support our goals? Rather than flip-flop on our near term FF projection, let’s move the 2025 and 2026 projections higher. That will counteract QE trimming and will discount forward cash flows, taking stocks lower and bond yields higher.

In December, the FF projection went from 5.1 to 4.6 in 2024, 3.9 to 3.6 in 2025, and remained steady at 2.9 in 2026. I would recommend leaving 2024 at 4.6, but push 2025 back up to 3.9 and notch 2026 up to 3.1. The front end of the SOFR curve is already fairly priced with the current 2024 projection, but forward rates would likely achieve tighter financial conditions which will support deceleration in Service inflation.

BOJ ends negative yields. TYJ put position adjustment

March 19, 2024

*****************

–As had been consistently telegraphed, the BOJ ended negative rates, and YCC, and ended purchases of ETFs and REITS. Currently $/yen is near its recent high, well above 150.

–Yesterday yields rose across the board, with tens +3.6 bps to 4.338%. On the SOFR strip reds thru golds were down 3.0 to 4.5. New highs in a few of the near calendars: while SFRM4/SFRM5 remains the most inverted 1-yr calendar, it rose 1.5 to a new high of exactly -100 (9483.5/9583.5). The near 3-month calendars are all right around one-qtr pct: M4/U4 -26.5, U4/Z4 -28, Z4/H5 -25, H5/M5 -20.5. Suggests a smooth, continuous flight path of easing. Like Boeing stock.

–Crude remained bid with a late price on CLK4 82.28 (+1.70). On this particular contract, CLK4, the high last September was 84.87. The front contract high at that time was just over 95. Bitcoin is undergoing significant long liquidation.

–Of note: while all yields are around new highs for the year, the ‘real’ ten-year inflation-indexed note yield edged back up above 2% ending at 2.015%. The 5y tip is 1.95%. These are restrictive levels.

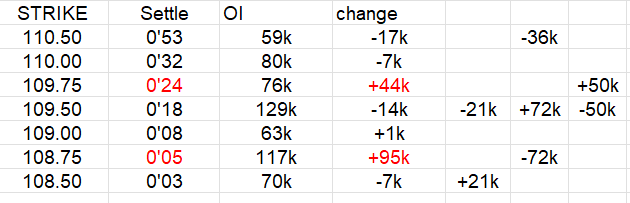

–Large position adjustment in TYJ puts as yields edged to new recent highs. On balance, it appears as if a long TYJ 110.5/109.5 ps was replaced with long 109.75/108.75p 1×2, which settled 14 (24 and 5). Summary below. April options expire Friday.

–Housing Starts and $13b 20y treasury auction today (re-opening).

TYJ 109.5/108.5ps cov 109-28, 27d, 21k at 13

TYJ 110.5/109.5/108.75p fly 1x2x2 cov 109-22, 30k, -36k at 31

TYJ 109.75/109.50ps cov 109-30, 9d 6 paid 50k

Dec and Dots

March 18, 2024

*****************

–Several near SOFR contracts made new lows on Friday, and treasury yields are at or close to new highs for this calendar year. Tens ended at 4.302%, up about 1 bp; high of the year has been 4.323%. Fives ended at 4.323%, high in Feb is 4.329%. SFRZ4 posted a new low settle for the year at 9540.5 (down 2.5 on the day). Last October’s low settle was 9519.5, of course at that time the contract was 14 months forward as opposed to 9 currently. I highlight December simply because that contract has the most relevance with respect to Wednesday’s dot plot.

–The surprise at the December FOMC was that the 2024 estimate for FF was moved down to 4.6% from 5.1 in Sept. As a price, that’s 9540, exactly where Z4 is currently. Some are expecting one of those three eases to be withdrawn on Wednesday. Perhaps of equal interest is the end-of-year 2025 projection for FFs. The December estimate was 3.6 which had been reduced from 3.9 in Sept. In futures terms, 3.6 is 9640, or 100 lower than the Dec’24 estimate. However, the Z4/Z5 calendar settled -72.5 (9540.5/9613.0), about 1/4% away from the dot plot of -100. A strong signal of ‘higher for longer’ would be a bump back up to 3.9 for 2025, which would also perfectly sync with the current SFRZ5 price.

–There were a few 10-15k blocks which went through on Friday which sort of target 4% for 2025:

SFRM5 9637.5/9587.5/9537.5 put fly 9.5 paid 17.5k

SFRU5 9675/9600/9525 p fly 17.5 paid 7k

SFRZ5 9675/9600/9525 p fly 15.5 paid 9k

The latter two have 9600 as middle (target) strike, which is 4%. Not that these will be held to maturity, but the implication is that these red contracts become less volatile and gravitate around current levels.

–BOJ expected to end negative rates and perhaps lift the yield cap on JGBs tomorrow. FOMC announcement Wednesday. 20-year auction tomorrow.

Gresham’s Law

March 17, 2024 – Weekly Comment

**************************************

The crosscurrents, dislocations and uncertainties in the present situation point up one uncomfortable but inescapable fact: we are dealing with a situation marked by gross imbalances that can neither be sustained indefinitely nor dealt with successfully by monetary policy alone, however it is conducted.

We are borrowing as a nation far more than we are willing to save internally.

We are buying abroad much more than we are able to sell.

We reconcile borrowing more than we sell by piling up debts abroad in amounts unparalleled in our history.

Seems like a quote from one of today’s financial blogs. But it’s Paul Volcker from 1985. The issues never change. It’s only where we are on the spectrum.

What it boils down to is confidence. Trust in national institutions that safeguard justice and monetary integrity. Integrity with respect to the store of wealth and medium of exchange.

It relates to Gresham’s Law: “Bad money drives good money out of circulation.” In my mind, the rallies in gold and bitcoin are a reflection of this phenomenon. I googled Gresham’s Law and bitcoin as I was thinking about this, and unsurprisingly there was already an article about it, by a person (again unsurprisingly) named “Sheepy” on Linked-In. “…more established cryptos like Bitcoin or Ethereum might be considered ‘good money’ due to their wider acceptance and relative stability. In contrast, lesser known or more volatile cryptos might be ‘bad money’… The way gov’ts and financial institutions approach crypto can also affect the perception of good and bad money.”

A real-time example is afforded by El Salvador’s President Nayib Bukele, who is transferring a “big chunk” of its bitcoin assets to an offline physical vault. Hold your good assets out of circulation.

The period before the 1896 Democratic National Convention (which was held in Chicago, as will be the next one on Aug 19-22, which ought to be a doozy) was dominated by attacks on the gold standard by opponents who wanted bimetallism, re-introducing silver as legal tender. From Wikipedia:

This would inflate the money supply, and, adherents argued, increase the nation’s prosperity. Critics contended that the inflation which would follow the introduction of such a policy would harm workers, whose wages would not rise as fast as prices would, and the operation of Gresham’s law would drive gold from circulation, effectively placing the United States on a silver standard.

Sound familiar? The huge Covid increase in fiscal transfers and M2 sparked inflation. As Powell frequently reminds us, inflation hurts the lower income end of the population most as wages lag.

The 1896 convention was famous due to William Jennings Bryan’s Cross of Gold speech. I include this excerpt as it strikes me in its relevance for today:

There are two ideas of government. There are those who believe that, if you will only legislate to make the well-to-do prosperous, their prosperity will leak through on those below. The Democratic idea, however, has been that if you legislate to make the masses prosperous, their prosperity will find its way up through every class which rests upon them. You come to us and tell us that the great cities are in favor of the gold standard; we reply that the great cities rest upon our broad and fertile prairies. Burn down your cities and leave our farms, and your cities will spring up again as if by magic; but destroy our farms and the grass will grow in the streets of every city in the country.

In my mind, the “farms” of the 1800’s can be equated to domestic productive capacity and enterprise. Capital deployed to enhance productivity raises the nation’s standard of living; it benefits the “masses”. Anyone can see the decay of big cities.

In the Roman Empire it was Diocletian in 301 A.D. who fixed prices because of debilitating inflation, caused by debasement of the currency. A Mises Institute article notes that in the time between Nero and Diocletian, “the denarius (standard silver coin) had been reduced to one-tenth of its former value.” The vast ’Price Setting Edict’ failed of course and was repealed in 307. Nixon echoed the strategy in 1970.

The Fed is trying to get us back to where the purchasing power of the currency is officially devalued by just 2% a year. However, the Fed’s efforts are being thwarted by Fed’l Gov’t spending. One quarter of last year’s job growth was government. A recent tweet by EJ Antoni notes that “Over 52% of fed’l gov’t spending in Feb was financed by debt.” The White House press release announcing Biden’s 2025 Budget blares that it “Advances Gender Equity and Equality”. A budget blog notes, “…the level of borrowing under the President’s budget would be unprecedented outside a war or national emergency.” Is gender equity a crisis? The blog continues, “…spending would rise from 22.7% of GDP in FY 2023 to 24.6% in 2024 and 24.8% in 2025. …Revenue which fell to 16.5% of GDP in 2023, would rise to 18% of GDP in 2024 and grow to 20.3% of GDP by 2034.” When Gov’t spending is 25% of GDP, but tax revenue is only 16.4% of GDP (long term average 17%) there’s a problem. Ken Rogoff noted this weekend that “Washington has a very relaxed attitude toward debt that I think they’re going to be sorry about.”

All of this brings us to the topic of US treasury yields, especially at the long end. Vol is not screaming. Credit spreads are tight. But inflationary signals are tipping slightly higher. Oil and copper are at new highs for 2024. Good assets are being accumulated (gold, bitcoin) relative to treasuries. Not that treasuries are ’bad money’ but the architecture underlying their value is obviously being eroded.

The BOJ and FOMC meetings this week aren’t likely to improve sentiment for longer maturity bonds. Ten-year JGBs ended the week at a high for 2024 at 77.8 bps. Last year’s high was just over 95 bps. Wage increases in Japan make it likely the BOJ announces a hike March 19. Near SOFR contracts are at new lows for the year, having significantly repriced easing over the next year or so. For example, SFRZ4 settled at a high of 9639.5 in January (3.605%) but was almost exactly 100 bps lower just two months later with Friday’s settle at 9540.5 (4.595%). That yield is almost exactly 75 bps lower than the current Fed Effective of 5.33%, synching with the last dot plot which indicated three cuts. There are some that think Fed members may trim back their assessments of appropriate cuts for this year to bring the median to two but I personally don’t see much of a chance of that. Indeed, there has been heavy trade in SOFR options suggesting increased confidence for 2-3 eases. SFRZ4 9537.5 straddle settled 68.5 on Friday. The previous week, the Z4 atm 9562.5^ settled 76.5. With SFRZ4 settling at 9540.5, the 9500p settled 16.25 with 31 delta. The 9600c settled 18.0 with a 28d. SVB failed just one year ago; the market is still sensitive to potential issues that could cause emergency easing. Calls are bid vs puts.

However, what is perhaps more likely than a repeat of last March, is a repeat of the following period. From last May to October the 10y yield soared from 3.4% to 5%. That yield increase led many to say that tightening financial conditions were doing the Fed’s job.

From October to December the 10y yield plunged from 5% to 3.8%. Since then it has been generally rising, though at a much slower pace than last summer’s increase. The 50% retrace of Q4’s move is 4.39% and 61.8% is 4.53%. I can envision a scenario where the Fed remains fairly neutral pre-election, but long end yields adjust higher with a tipping point realization that debt levels are out of control. A deterioration in employment data might not do anything to stop a rise in longer end yields. Ironically, Fed easing could accentuate negative sentiment toward bonds. The odds of such a scenario playing out may not be high, but I believe they are increasing. If so, the attached chart points up an opportunity.

The chart is the 30-year bond yield with 3-month vol on the US contract overlaid. The ten year looks much the same, but I highlight longer maturities as we go into the 20-year auction on Tuesday. Vol is back where it was on the SVB unwind, having continually compressed in the aftermath of October’s yield surge. However, yields are moving higher. OTM puts might be considered relatively cheap.

| 3/8/2024 | 3/15/2024 | chg | ||

| UST 2Y | 448.4 | 472.1 | 23.7 | |

| UST 5Y | 406.1 | 432.3 | 26.2 | |

| UST 10Y | 408.7 | 430.2 | 21.5 | |

| UST 30Y | 426.2 | 442.6 | 16.4 | |

| GERM 2Y | 275.9 | 294.6 | 18.7 | |

| GERM 10Y | 226.7 | 244.2 | 17.5 | |

| JPN 20Y | 149.5 | 154.8 | 5.3 | |

| CHINA 10Y | 229.3 | 234.7 | 5.4 | |

| SOFR M4/M5 | -125.5 | -101.5 | 24.0 | |

| SOFR M5/M6 | -35.0 | -36.5 | -1.5 | |

| SOFR M6/M7 | 1.0 | -6.5 | -7.5 | |

| EUR | 109.41 | 108.90 | -0.51 | |

| CRUDE (CLK4) | 77.50 | 80.58 | 3.08 | |

| SPX | 5123.69 | 5117.09 | -6.60 | -0.1% |

| VIX | 14.74 | 14.41 | -0.33 | |

https://fraser.stlouisfed.org/title/federal-reserve-bulletin-62/september-1985-20761/fulltext

https://www.linkedin.com/pulse/good-money-bad-deciphering-greshams-law-era-cryptocurrency-2zjze/

https://www.crfb.org/blogs/overview-presidents-fy-2025-budget