OTM treasury puts popular

April 9, 2024

*************

–Once again new highs in near SOFR spreads. On March 27, SFRM4/M5 settled -111. Yesterday -88 (9481.5/9569.5), so that’s 23 bps in 7 sessions, mostly due to the drop of 30 bps in SFRM5 from 9599.5 to 69.5. The front M4/M5 spread is still the most inverted, but there’s less variation, for example, SFRM5/M6 is -38.5 or just 49.5 higher than the front; on March 27 it was -40. The adjustment in price has been in reds forward. My personal view is that the upward shift in Fed dots in 2025 and 2026 at the last FOMC was more important than the market gives credit for; higher rates a couple of years into the future affect cash flows on everything. (Perhaps clues in tomorrow’s FOMC minutes)

–The other theme yesterday was new buying in treasury puts:

FVM4 106p covered bought 40k; settled 41 vs 106-01, OI +32k, straddle settled 1’20

Others were otm buys:

FVM4 102.5p 1.5 to 2 paid 50k, 2 settle, OI +46k

FVM4 102.75p 2.5 paid 10k, 2.5 settle, OI +9.6k

FVM4 103.0p 3.0 paid 10k, 3 settle OI +8k

TYM4 104p, 3.0 paid 10k, 3 settle, OI +9.7k

TYM4 103p 2.0 paid 20k, 2 settled OI +20k

CPI tomorrow along with the 10yr auction. Three-year auction today, 30s on Thursday. These put buys are longer dated and wingier, they’re not just short term protection. They’re for Jamie Dimon big risks type stuff.

It’s a hardball world, son. We’ve gotta try to keep our heads until this peace craze blows over.

–Full Metal Jacket

Auction concession or something more?

April 8, 2024

*************

–Friday’s higher than expected payrolls at 303k with an unemployment rate of only 3.8% contributed to a jump in US rates. Tens rose 5.8 bps to 4.373%. The SOFR curve flattened with reds leading the way lower. Red pack (M5, U5, Z5, H6 avg) ended -11 bps at 9597.0. close to 4%. Greens were -7.875 at 9621 (rounded) and blues -6 at 9622.5.

–Near one-year calendars made new highs with SFRM4/M5 at -93.5 (9483.5/9577.0) +6.5 on the day, and U4/U5 at -86.0 (9507.5/9593.5) +4.5 on the day. This was a spread Bill Gross had highlighted as a long a couple of months ago when it was sub -100.

–Treasuries have continued lower this morning with TYM down half a point at 109-05 and USM down a full point at 116-17. Ten year yield now 4.45%, well through the 50% level from last October’s high of 4.99% to December’s low of 3.795%. Next yield resistance should be the 61.8 level of 4.53% which should equate to price support around 108-18 to 108-20 in TYM4. Note to self, total eclipse is bearish.

–Dollar/yen near 152 (151.90 last) pinned at recent highs and near the high print in 2022 of 151.95. It’s the highest level since the early 1990’s.

–3, 10 and 30 year auctions this week. CPI is on Wednesday, expected 3.4% yoy from 3.2% last with Core 3.7% from 3.8% last. FOMC minutes also on Wednesday.

A flight into ‘Quality’ assets

April 7, 2024 -Weekly Comment

*************

The wave of crystallization rolled ahead. He was seeing two worlds, simultaneously. On the intellectual side, the square side, he saw now that Quality was a cleavage term. What every intellectual analyst looks for. You take your analytic knife, put the point directly on the term Quality and just tap, not hard, gently, and the whole world splits, cleaves, right in two…hip and square, classic and romantic, technological and humanistic…and the split is clean. There’s no mess. No slop. No little items that could be one way or the other. Not just a skilled break but a very lucky break. Sometimes the best analysts, working with the most obvious lines of cleavage, can tap and get nothing but a pile of trash. And yet here was Quality; a tiny, almost unnoticeable fault line; a line of illogic in our concept of the universe; and you tapped it, and the whole universe came apart, so neatly it was almost unbelievable. He wished Kant were alive. Kant would have appreciated it. That master diamond cutter. He would see. Hold Quality undefined. That was the secret.

Phædrus wrote, with some beginning awareness that he was involved in a strange kind of intellectual suicide, “Squareness may be succinctly and yet thoroughly defined as an inability to see quality before it’s been intellectually defined, that is, before it gets all chopped up into words — .We have proved that quality, though undefined, exists. Its existence can be seen empirically in the classroom, and can be demonstrated logically by showing that a world without it cannot exist as we know it. What remains to be seen, the thing to be analyzed, is not quality, but those peculiar habits of thought called `squareness’ that sometimes prevent us from seeing it.”

Thus did he seek to turn the attack. The subject for analysis, the patient on the table, was no longer Quality, but analysis itself. Quality was healthy and in good shape. Analysis, however, seemed to have something wrong with it that prevented it from seeing the obvious.

–Zen and the Art of Motorcycle Maintenance

*************************************************

It’s not that US bonds are of unsound quality. The coupons will be distributed and principal (if not the principles) honored. It’s the future purchasing power of the US dollar that seems to have something wrong with it.

SPX fell 1% last week. The thirty-year bond yield rose 18.5 bps to 4.528%.

Gold was up 4.4% to a new record high of $2329.75. Quality asset.

Gold is not the patient. The sickness lies within the entirety of the government’s debt addiction.

The chart below shows SPX/XAU and SPX/BCOM. With all the AI hype, SPX priced in gold is not taking out the high from the end of 2021. Even against the commodity index there has been a slight turn down.

The chart on the next page is the 10-yr yield. The current yield is about 4.38%, essentially at the halfway point of the October 2023 high of 4.99% to the Dec 2023 low of 3.79%. It’s the same with the 30-yr bond, the halfway point is 4.53% and we’re right there. The large drop in yields in the last two months of last year is partially attributed to the Treasury’s Quarterly Refund Announcement on Nov 1, which increased t-bill issuance and slowed the pace of longer dated treasuries. The low yield of that move was in late December, shortly after Powell indicated a “dovish pivot” at the Dec 14 FOMC. Since then, yields have stair-stepped higher. This week features inflation data, treasury auctions and FOMC minutes:

Tuesday – 3-yr auction ($58b)

Wednesday – CPI expected 3.4% yoy from 3.2 last, but Core 3.7% from 3.8. FOMC minutes. 10-yr ($30b)

Thursday – PPI expected 2.2% yoy with Core 2.3%, both higher than last. 30-yr auction ($22b)

The next Quarterly Refunding Announcement is May 1.

Recall that in October, several Fed officials suggested that the rise in long-term yields was tightening financial conditions, obviating the need for the Fed to overtly raise the FF target. For example, here’s an excerpt from Lorie Logan on October 9, 2023:

Financial conditions have tightened notably in recent months. But the reasons for the tightening matter. If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate. However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more.

Expect to hear a lot about an increase in ‘term premium’ in the coming days. Perhaps this year’s rise in longer maturity yields can be partially explained by the Dec Fed pivot; a shift away from the single-minded goal of slaying inflation. Of course, the Federal Gov’t is completely focused on re-election. Might the QRA factor into that? The cancellation of SPR purchases to replace previous sales is a case in point, as is the administration’s displeasure in Ukrainian attacks on Russian oil infrastructure. As a final note, WTI closed at a new high for the year (CLM4 up 3.68 on the week to 86.10). Also, I track the rolling one-year calendar 2nd to 14th CL spread. The high was made last year at the end of September, with the front contract at $12.20/bbl premium to deferred. That period, incidentally corresponded with rising bond yields and an increase in ‘term premium’. Currently, this spread is represented by CLM4/CLM5 which has rallied to a new high this year, settling 9.69 on Friday, up from around 4.00 at the start of February.

I’ll admit, it’s not exactly a sharp analytical knife. But I’ll take a lucky break whenever I can! As an old friend used to say: Sell bonds. Wear diamonds.

| 3/28/2024 | 4/5/2024 | chg | ||

| UST 2Y | 462.2 | 473.0 | 10.8 | |

| UST 5Y | 421.1 | 436.5 | 15.4 | |

| UST 10Y | 419.8 | 437.3 | 17.5 | |

| UST 30Y | 434.3 | 452.8 | 18.5 | |

| GERM 2Y | 284.8 | 287.5 | 2.7 | |

| GERM 10Y | 229.8 | 239.9 | 10.1 | |

| JPN 20Y | 145.2 | 153.1 | 7.9 | |

| CHINA 10Y | 230.6 | 229.1 | -1.5 | |

| SOFR M4/M5 | -107.0 | -93.5 | 13.5 | |

| SOFR M5/M6 | -44.0 | -40.5 | 3.5 | |

| SOFR M6/M7 | -5.5 | -7.0 | -1.5 | |

| EUR | 107.89 | 108.40 | 0.51 | |

| CRUDE (CLM4) | 82.42 | 86.10 | 3.68 | |

| SPX | 5254.35 | 5204.34 | -50.01 | -1.0% |

| VIX | 13.01 | 16.03 | 3.02 | |

I love this story below. Now here’s INNOVATION!

Payrolls – all prices will be met

April 5, 2024

*************

–Payrolls today expected 200k with the unemployment rate at 3.9% (vs 275 and 3.9 last). The last time the UE rate was 4.0 was in January 2022, it has been in the 3’s since then with a low of 3.4. Consumer Credit at end of day, was +$19.49 billion for Jan.

–Yesterday afternoon stocks tumbled, with SPX ending -1.2% and NasComp -1.4%. Kashkari warned the Fed may not ease at all this year; Israel put forces on high-alert in expectation of Iranian response, Blinken said Ukraine will become a member of NATO. Oh, and bird-flu is making the rounds. Markets have become a lot more uncertain, with VIX jumping to 16.6.

–Rate futures experienced some flight-to-quality buying, though tens ended down only 3.8 bps to 4.315%. Every SOFR contract from Sept’24 to Sept’27 was up 3.5 to 4.5. Treasury auctions 3s, 10s and 30s next week. You need ‘quality’? The treasury is here to help. In size. By the way, these auctions settle on 15-April which is also tax day, a temporary withdrawal of private liquidity bestowed upon the Solons of the federal gov’t for benevolent distribution to weapons manufacturers.

Positioning for NFP

April 4, 2024

*************

–New lows in treasury futures on heavy put buying first thing yesterday morning. TYM4 low 109-09+ which was -13+ and USM4 116-24 which was -31.

Big pre-data TY put buys

TY wk-1 109.00p cov 109-135, 11 paid 10k

TY wk-1 109.25p cov 109-125, 18 paid 15k

FV wk-1 105.75p 5.5 paid 50k

Week-1 options expire tomorrow, which is also the employment report.

–However, ISM Services and Prices lower than expected: Services 51.4 vs 52.8 exp and Prices lower than any time since 2020 Covid low, at 53.4 vs 58.4 expected. Both stocks and bonds reversed early weakness and traded higher. Curve edged slightly more positive. 2/10 squeaked out a marginal new recent high at -32.3; 2’s -2.3 bps at 4.676% and 10s -0.8 to 4.353%. SFRZ4 thru reds and greens +2 to +2.5. Powell often cites Services as a sticking point hampering the Fed’s inflation goal, so this report keeps easing hopes alive.

–Bowman talked about the discount window (it seems the Fed is getting ready for usage to ramp up since BTFP ended). Powell repeated that the Fed can wait to see how data develops before easing.

–There were also some large SOFR option plays: SFRN4 9462.5/9450ps 0.5 paid 35k, appears to be rolling up from 9450 longs. Settled 0.5.

SFRZ4 9600/9650/9700c tree bought for 0 to 0.25 30k and the 9600/9700c spd bought for 8.0, 25k. Open interest indicates that longs in the upper strikes were exited to roll into 9600 calls.

9600c 14.0 settle, open int +48k

9650c 8.5 settle, open int -9.6k

9700c 5.25 settle, open int -31k

The 9600c now have 185k open, the most of any call outside of the 9700 which still has 226k. Obviously the 9600 or 4% strike would take a lot more than three rate cuts to achieve.

–A more specific rate cut play was a sale of 30k FFN4/FFQ4 spreads at -8.5. The FOMC meeting is July 31, so anything that occurs at that meeting will not affect FFN4 but will be fully priced into FFQ4. In early Feb the spread was near -25, indicating near certainty of a quarter-point cut at that meeting. As easing hopes faded, the spread rallied (said another way, both contracts sold off, but August harder). The spread of -8.5 is about 1-in-3 chance of ease. Spread settled at 9483.0 (5.17%) and 9492.5 (5.075%) or -9.5. Note that current EFFR is 5.33% so the August contract has one ease fully priced (5.08%). There are three FOMC meetings before August, May 1, June 12 and July 31.

–A few more Fed speakers today but it’s hard to believe anything new will be said. Jobless Claims expected 215k. Trade figures. NFP tomorrow expected 200k.

Powell again; Taiwan earthquake

April 3, 2024

*************

–7.4 earthquake in Taiwan. (sell USD assets to pay for re-building?)

–Eurozone inflation falls to 2.4% vs expected 2.6%. Core 2.9% vs 3.1% last.

–From MNI yesterday: Cleveland Fed Mester (’24 voter but retiring in June) won’t rule out a rate cut in June, while SF Fed Daly said three rate cuts in 2024 is still a “reasonable baseline”.

–Powell speaks today at 12:10 EST on the Economic Outlook. Preceded by Bowman on the Fed’s Role as Lender of Last Resort and followed by Kugler, again on the economic outlook. Mester mentioned the discount window yesterday and making sure banks have proper collateral to pledge (almost as if they expect it to become much more important).

–Other news includes ADP expected a bit higher than last reading of 140k. ISM Services expected 52.7 from 52.6.

–Curve bear steepened yesterday. 2y note down 1.5 bps to 4.699%, while 10y rose 3.2 to 4.361% and 30y rose 4 bps 4.507%. Both the 10y and 30y are right around the halfway back levels from the high yields of last year (set in October) to the December lows. The 50% levels are 4.39% and 4.54%.

–Large open interest change in FV, +86k even as the futures were only -1.25/32 to 106-135s. Early new buys of way-out calls: +25k FVK4 108.75c for 2 (1.5s) and 50k FVK4 109c for 1.5 (1.0s). Large open interest numbers are sometimes thought of as tinder for the next big move as one side or the other is forced out. In SOFR large buyer of about 35k SFRU4 9500/9525/9550 c fly for 4.5 to 5.0, settled 4.75 ref 9509. We’ve flirted around with longs at the 9500 strike with March’24 and June’24; as of now that strike is in the money in Sept, but I think there’s about as good a chance that we blow through the top strike as fall below 9500. Of course the long fly targets the middle at 9525.

–Crude oil CLK4 is holding above 85. Silver breaking out to the upside, following gold’s strong lead. Gold/silver ratio easing lower.

–Here’s the earthquake map from USGS.gov

Oil bid

April 2, 2024

**************

–The May WTI contract (CLK4) hit a high of 84.96 this morning, up 1.25. This eclipses the high from last September. Escalation in mideast hostilities as Israel bombed Iran’s embassy in Syria is a likely contributor. However, US treasuries aren’t really seeing a safety bid, even after a hard sell off yesterday.

–ISM Mfg was stronger than expected, first time above 50 since October 2022. Actual 50.3 vs 48.3 expected. Prices were 55.8 vs 53 expected. New Orders 51.4 vs 49.8….but Employment 47.4 vs 47.5. Eurozone Mfg PMI this morning weak at 46.1.

–Treasury yields soared with tens up 13 bps to 4.329% and 30s up 12.4 bps to 4.467%. On the SOFR strip greens and blues were weakest (3rd and 4th years forward) with SFRM6 through SFRH8 down 15 to 15.5. A few near SOFR calendars made new highs. For example, while SFRM4/M5 is still the most inverted one-year calendar, it made a new high above -100, settling at -98.5 (9482.5/9581.0). SFRM4 was -4 on the day, but M5 was -12.5. Forward contracts continue to squeeze out easing expectations; Powell speaks again tomorrow.

–Today’s news includes JOLTs and Factory Orders. A few Fed speakers: Bowman on Bank Mergers and Acquisitions (important given renewed stress in regionals). Mester on the economic outlook.

Record high Gold

April 1, 2024

*************

–Little reaction to Friday’s PCE data (essentially as expected with PCE yoy 2.5% and Core 2.8%) and Powell’s patience with respect to cutting the funds rate (“we don’t need to be in a hurry to cut”).

–TYM4 settled 110-255 Thursday and prints 110-265 this morning while USM settled 120-14 and prints 120-05. Stocks are, of course, higher. China’s Caixin Mfg PMI rose to 51.1, supporting equities there. No yen intervention yet with $/yen 151.38. CNY at its weakest level of 2024 at 7.23. New all-time-high gold above $2250.

–On Thursday, there was a new buyer of 50k TY 112c for cab-7 (= $7 or $350k total prem). This was an add to the previous day’s buy of 50k 112.25c for the same price. Monday options don’t generally have large activity, but on Thursday the calls saw an open interest increase of 103k. On the CME website the symbol is VYO for Monday opts.

–News today includes Mfg PMI, expected 48.3 from 47.8 last. It’s been sub-50 since October 2022. Prices paid expected 52.9 from 52.5. Construction Spending expected +0.7. Powell speaks again on Wednesday.

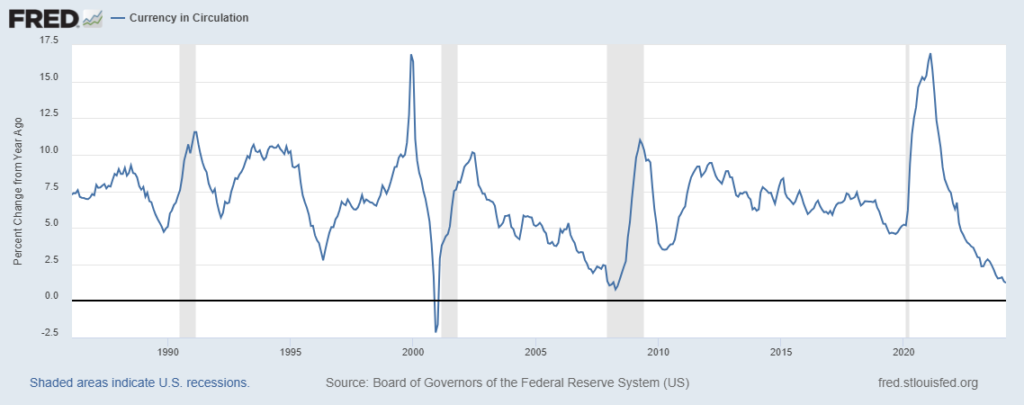

–I attached a chart of US currency in circulation (% change yoy). I suppose it’s an anachronism since few purchases are made in cash anymore. It’s been said there are more $100 bills in Russia than in the US as it’s a convenient store of value in many countries. Current level is $2.339T, a bit less than the total crypto mkt cap. Probably just a coincidence but the current growth rate of 1.2% which has been in steady decline since covid, is about where it was just prior to the 2001 and 2008 recessions.

Is Treasury Issuance an Emergency?

March 30, 2024

*****************

A Fed paper from June 29, 2023 is entitled ‘Impact of Leverage Ratio Relief Announcement and Expiry on Bank Stock Prices’. That’s one of the google results when I searched for information on the March 5, 2024 ISDA letter requesting agencies (starting with the Fed) to “…revise the SLR to permanently exclude on-balance sheet US Treasuries from total leverage exposure.” (SLR is Supplementary Leverage Ratio)

I only became aware of this ISDA request because I listened to the most recent MacroVoices podcast featuring Luke Gromen (thanks DK). I searched for more information but the search didn’t really turn up much, though I am sure it was addressed (without bias) in papers by bank research depts.

From the June 29, 2023 Fed Note:

On April 1, 2020, as part of these efforts, the Federal Reserve announced an interim final rule, set to expire on March 31, 2021, that would temporarily exclude U.S. Treasuries and deposits at Federal Reserve Banks from the calculation of the Supplementary Leverage Ratio (SLR). One of the main goals of this interim rule was to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses.

Relief from the SLR regarding Treasuries was an EMERGENCY measure.

Now here are a couple of excerpts from the March 5, 2024 ISDA request: (ISDA is Internat’l Swaps and Derivatives Ass’n)

A permanent exclusion would better promote the stability and resilience of the U.S. Treasury market than the current framework, which has required adjustments during periods of significant market stress. More broadly, an exclusion would help support market liquidity in the context of projected increases in the size of the U.S. Treasury market and the importance of bank participation in the market.

An exclusion for U.S. Treasuries from the SLR and GSIB surcharge would provide more capacity for banks to expand their balance sheets and provide liquidity during times of stress. There are significant benefits to bank participation in these markets given that banks are highly capitalized, have sophisticated risk management processes and are subject to comprehensive prudential regulation and supervision. [page 7]

THEY ARE ASKING FOR PERMANENT EMERGENCY RELIEF AT A TIME OF ROBUST GDP, TIGHT CREDIT SPREADS, AND UNEMPLOYMENT NEAR HISTORIC LOWS. Where’s the potential emergency? Government debt.

Here’s how I might summarize this request, using slightly different language.

The Federal Gov’t is spending like a drunken sailor. You know it, I know it. The risk is that a high degree of market stress will ensue if debt associated with spending can’t be absorbed. As the biggest banks, we know this request is basically a subsidy…now that deposits have flowed into G-SIBs from risky regional banks we can fund the debt with positive carry – if we don’t have the SLR weighing us down. We added the bullshit line about macroprudential oversight as cover, everyone knows the regional bank crisis was partially the result of failed supervision. Sure, this exemption will benefit G-SIBS… and maybe as the Commercial Real Estate bubble drags down a few more regionals we can gracefully absorb them given the extra capital we’ll be generating. You help us, we’ll help you.

There’s the proposal. It’s not exactly bending down on one knee. More like a threat. What if treasury yields scream back to October’s highs (or higher) before the election? What would happen to stocks? Where would mortgage rates be? How would that impact the election?

Note that there’s another Fed paper from August 2023 examining Dealer’s Treasury Market Intermediation and the Supplementary Leverage Ratio. It concludes:

Overall, our inspection during the temporary exclusions of Treasury securities and reserves from TLE between April 2020 and March 2021 does not show a noticeable effect on the big six dealers’ Treasury intermediation, including direct holdings of Treasuries and SFTs backed by Treasuries.

We’ll ignore that conclusion.

******************************************************

The PCE price data came in essentially at expectations with Core Deflator +0.3 MoM and 2.8% YoY though there was a slight revision higher for the previous month.

Powell on Friday: “…the decision to begin to reduce rates is a very, very important one because the risks are two sided. If we reduce rates too soon there’s a chance that inflation would pop back… There’s also a risk that we would wait too long and …in that case it could be an unnecessary, unneeded damage to the economy and perhaps the labor market.” [the dual mandate]

“The economy is strong. …growth around 2% this year… That means that we don’t need to be in a hurry to cut.” [slightly softer than Waller’s comments]

By the way, what was the deal with interviewer Kai Ryssdal’s ‘Where’s Waldo’ socks?

Anyway, the NY Fed Q1 Nowcast is 1.9%, and the Atlanta Fed’s GDPNow which was updated Friday is 2.3%.

The Employment Report is Friday 5-April. On Friday (March 29) ZeroHedge highlighted the Philly Fed quarterly report from March 14 showing substantial downward revisions in payrolls.

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/2023/early-benchmark-2023-q3-report.pdf?la=en

The only reason to mention the ZH post is that the Fed’s dual mandate is becoming more evenly balanced with respect to the Fed’s next move. Powell speaks again on the economic outlook on Wednesday, April 3.

Just a few other calendar highlights

4/1 ISM Mfg

4/3 ISM Services

4/3 Governor Bowman (before Powell) on Bank Liquidity. She also speaks 4/2 re: Bank Mergers

4/3 Chair Powell

4/3 Governor Kugler on policy outlook

4/4 Richmond Fed Barkin on Econ Outlook

4/5 NFP

4/10 CPI & Fed minutes

4/11 PPI

SLR could be a topic for Bowman and might pop up in FOMC minutes

Curve flattened (became more inverted) last week on Waller’s comments, echoed by Powell on Friday. However, 2/10 closed Thursday at -42.4, still above the low of the year of -45.4 on March 6. Low from December of last year is -53.6. Strong support -62 to -53.

| 3/22/2024 | 3/28/2024 | chg | ||

| UST 2Y | 455.3 | 462.2 | 6.9 | |

| UST 5Y | 419.8 | 421.1 | 1.3 | |

| UST 10Y | 421.6 | 419.8 | -1.8 | |

| UST 30Y | 439.1 | 434.3 | -4.8 | |

| GERM 2Y | 282.7 | 284.8 | 2.1 | |

| GERM 10Y | 232.3 | 229.8 | -2.5 | |

| JPN 20Y | 149.2 | 145.2 | -4.0 | |

| CHINA 10Y | 230.9 | 230.6 | -0.3 | |

| SOFR M4/M5 | -109.0 | -107.0 | 2.0 | |

| SOFR M5/M6 | -37.0 | -44.0 | -7.0 | |

| SOFR M6/M7 | -1.5 | -5.5 | -4.0 | |

| EUR | 108.12 | 107.89 | -0.23 | |

| CRUDE (CLK4) | 80.62 | 83.17 | 2.55 | |

| SPX | 5234.18 | 5254.35 | 20.17 | 0.4% |

| VIX | 13.06 | 13.01 | -0.05 | |

https://www.isda.org/a/h3sgE/ISDA-Submits-Letter-to-US-Agencies-on-SLR-Reform.pdf

https://www.federalreserve.gov/econres/notes/feds-notes/dealers-treasury-market-intermediation-and-the-supplementary-leverage-ratio-20230803.html

Balance of risks says WAIT

March 28, 2024

*****************

–From Waller last night:

My judgment on the balance of risks for monetary policy, which I explained in a speech on February 22, hasn’t changed: The risk of waiting a little longer to cut rates is significantly lower than acting too soon.

https://www.federalreserve.gov/newsevents/speech/waller20240327a.htm

–Curve flattened in response with red SOFR contracts bearing the brunt of selling. Currently SFRM4 is 9485.5 -3.0, M5 is 9592.5 -7.0, M6 is 9630 -6.0, M7 is 9639.5 -2.0.

–CBO director Phillip Swagel, in an interview with the FT warned about the trajectory of US borrowing:

“The danger, of course, is what the UK faced with former Prime Minister (Liz) Truss, where policymakers tried to take an action, and then there’s a market reaction to that action,” he told the newspaper, referring to the investor backlash against plans for unfunded tax cuts that forced Truss to resign after just 45 days in office.(CNN)

–Today’s news includes final Q4 GDP, Jobless Claims 212k, Chgo PMI 46.0 from 44.0, Uof Mich final Sentiment and inflation expectations.

–The SOFR option pit closes at noon, so all month-end settlements will be at noon. Markets are closed on Friday. PCE prices are released tomorrow and Powell speaks at the SF Fed.