Manipulating long treasury yields lower wont necessarily boost the economy

February 16, 2025 – Weekly Comment

___________________________________________________________________

A friend sent me a link to the latest MacroVoices which this week featured Jim Bianco (thanks DDK). The beginning 5 minutes or so is Bianco’s excellent summation of a proposal that’s being called the Mar-a-Lago Accord. A rough outline is that Treasury would issue 100-year bonds that pay no interest. Foreign countries which hold US Treasuries and benefit from US Defense services, would be invited swap their interest-bearing treasuries with the new bonds, essentially paying for defense services by foregoing interest. (No swap, no defense). The Fed could then set up swap lines for any country needing liquidity, and would accept the zero interest bonds as collateral at par.

As mentioned last week, long dated swap spreads continued to surge as regulators are likely on the verge of loosening Supplementary Leverage Ratio (SLR) and G-SIB surcharge rules. (RTRS) “In April 2020 the Fed temporarily excluded treasuries and central bank deposits from the SLR to boost liquidity… But it let the exclusion expire the following year.”

From Fed’s Michelle Bowman speech Feb 5, “Where we can take proactive regulatory measures to ensure that primary dealers have adequate balance sheet capacity to intermediate Treasury markets, we should do so. This could include amending the leverage ratio and G-SIB surcharges…”

From a 2024 ISDA letter to the Fed, FDIC and Comptroller of the Currency:

To facilitate participation by banks in U.S. Treasury markets—including clearing U.S. Treasury security transactions for clients—the Agencies should revise the SLR to permanently exclude on-balance sheet U.S. Treasuries from total leverage exposure, consistent with the scope of the temporary exclusion for U.S. Treasuries that the Agencies implemented in 2020.

Obviously, with massive deficits and the administration seeking to get long-term yields down, it’s important for US banks to absorb UST issuance. A permanent exclusion of SLR rules dovetails with this goal. While it might lessen costs for the US Gov’t, rates on private debts may not see as much relief, but I suppose, at the margin, the ‘crowding out’ effect is reduced.

I did not read the paper, but ZH quotes BofA’s Hartnett: “…rising inflation means Trump in coming months has to go ‘small’ not ‘big’ on tariffs and immigration to avoid fanning 2nd wave of inflation.” Personally I think that’s wrong. Trump is looking to alter incentives, not at the margin but at the core of the system. If it results in some wrenching short-term pain, I think the administration is willing to pay that price, even if stocks falter. Better to take the pain early. I refer once again to Nayib Bukele’s speech on taking decisive action to change incentives:

https://www.facebook.com/nayibbukele/videos/522919087190090/

The MOVE chart below is, perhaps, a reflection of confidence in that idea. Bond vol is dropping. I would note as well that VIX at 14.77 is nearing the lower portion of its range.

Market color

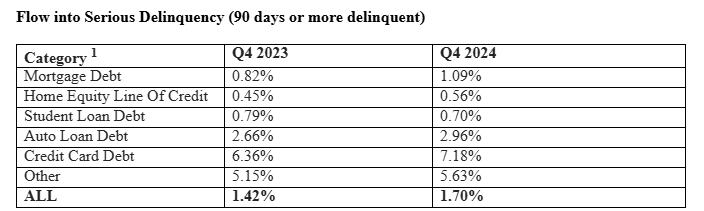

CPI was higher than expected. Retail Sales were weak. The NY Fed’s Consumer Credit report shows that Flows into Serious ( > 90 days) Delinquency on all categories of Consumer loans edged up in Q4, except Student Loan Debt. Mortgages from 0.82% in Q3 to 1.09% in Q4. Auto Loans 2.66% to 2.96%. Credit Cards 6.36% to 7.18%. Conclusion that some analysts are drawing: Stagflation.

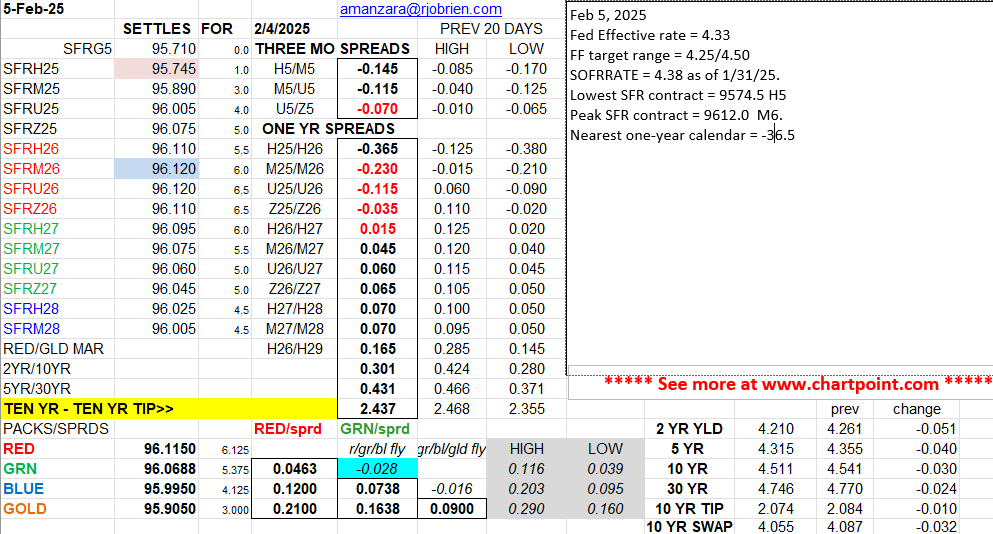

Yields ended little changed on the week. On the SOFR strip the largest decline was SFRH5 at 9569.25, down 2.75. The largest gains were SFRZ5, H6 and M6 all up 2.5, prices of 9602, 9606 and 9608. Due to inflation concerns, near contracts are gravitationally pulled down towards the Fed Effective rate of 4.33%, as the Fed is expected to hold steady in the near term. The peak SOFR contracts are closer to 4% reflecting a modest adjustment over time towards the neutral rate. The ten-year yield was nearly unchanged despite auctions, ending 4.48%. Though inflation expectations have increased, the market is looking past these concerns. Last week’s price action simply indicates that a possible acceleration in inflation has been dismissed. The big question is whether the US economy surges due to relaxed regulatory burdens and new domestic investment in energy and manufacturing. Or whether tariffs, an immigration crackdown and decelerating gov’t spending tip the country towards recession. Over the short term, I lean towards the latter and over the longer term, the former.

Regarding SOFR option plays, I personally favor long call spreads, though the 9562.5/9537.5ps in SFRU5 for 1.75 was a popular buy last week. (Settled 1.5 vs 9594.0). This post from George Austin at Pricing Monkey sums it up:

Heavy options skew in SFRU5 (Sept SOFR) centred around 4.37%.

If you need a hedge for a rate hike, put strategies are cheap with the skew (see lower chart).

For upside exposure, call spreads, flys, and condors are all near the bottom of their price ranges, making them attractive plays in this skewed environment.

Friday is March treasury option expiration. Peak open interest is TYH 108.5c with 179k open; settled 55 ref 109-10. These calls were originally purchased in size vs futures, when they were just out-of-the-money. Currently, the 108.5p is just 3/64s. The 109p, which has been heavily jobbed around in the past week or so, settled 9 and has 90k open. I would expect futures to edge toward the 109 strike going into expiry.

(This note is NOT intended as financial or trading advice).

| 2/7/2025 | 2/14/2025 | chg | ||

| UST 2Y | 427.7 | 425.5 | -2.2 | |

| UST 5Y | 433.1 | 432.7 | -0.4 | |

| UST 10Y | 448.0 | 447.4 | -0.6 | |

| UST 30Y | 468.1 | 469.4 | 1.3 | |

| GERM 2Y | 204.8 | 211.3 | 6.5 | |

| GERM 10Y | 237.2 | 243.1 | 5.9 | |

| JPN 20Y | 196.6 | 201.3 | 4.7 | |

| CHINA 10Y | 160.6 | 165.0 | 4.4 | |

| SOFR H5/H6 | -31.5 | -36.8 | -5.3 | |

| SOFR H6/H7 | -2.0 | -1.0 | 1.0 | |

| SOFR H7/H8 | 4.5 | 5.5 | 1.0 | |

| EUR | 103.30 | 104.93 | 1.63 | |

| CRUDE (CLJ5) | 70.74 | 70.71 | -0.03 | |

| SPX | 6025.99 | 6114.63 | 88.64 | 1.5% |

| VIX | 16.54 | 14.77 | -1.77 | |

| MOVE | 93.13 | 84.67 | -8.46 | |

https://www.isda.org/a/h3sgE/ISDA-Submits-Letter-to-US-Agencies-on-SLR-Reform.pdf

In: Eurodollar Options

Bonds and Wheat

February 14, 2025

**********************

–PPI was also higher than expected, with yoy 3.5% vs 3.3 exp, but rather than extend the sell-off from Wednesday’s hot CPI, the market completely erased the move. On Tuesday, TYH5 settled 108-305. On Wed (CPI) 108-085. Yesterday, 108-31. Similar in SOFR, for example SFRH6 9601.5, 9591.0, 9598.5. Today’s news includes Retail Sales for Jan, expected -0.2 but +0.3 ex-auto.

–Perhaps part of the move is related to the surge in swap spreads, with the 30-yr pictured below. This move is being attributed to possible relaxation of G-SIB surcharges and a loosening of SLR (Supplemental Leverage Ratio) rules, according to BBG:

https://blinks.bloomberg.com/news/stories/SRMK84T0G1KW

–Rally has been similar in the ten-yr swap spread. I take marks at the time of daily futures settles, of 10y cash (PX1) and 10-yr swap (page IRSB ). On Jan 3, I marked 10y 4.61 and the swap at 4.133, a spread of negative 47.7. Yesterday, 10y 4.523% and swap 4.146 or negative 37.7. In other words, the 10y yield fell by 8.7 while the swap was up nearly 2 bps in yield.

–Wheat threatening new recent highs, up 9 cents to 601. “BREAKING: Ukraine says Russia has struck the Chernobyl nuclear plant with a drone attack.” The 1986 Chernobyl incident sparked a hard rally in grains (at the time, April 1986, front wheat 289 to 360 in ten sessions). Of course, we don’t know who hit the plant, but it’s being reported as Russia, with no radiation leak. Silver also seeing an upside breakout.

–Yes, I know the new administration is scary and corrupt, so it’s nice just to retreat back into Illinois politics:

NY Times: ‘Mike Madigan, former Illinois House Speaker, found guilty in corruption trial’

Chicago Tribune: Three top city officials stepping down after Mayor Brandon Johnson’s message: ‘If you ain’t with us, you just gotta go’

–Below the chart is a table from Fed’s Consumer Delinquencies. All moving higher, notably auto loans and credit cards.

Inflation… in WIG20

February 13, 2025

*******************

–CPI sent yields soaring, +0.5% m/m vs expected +0.3. Yoy was 3.0%. Recent peak was Sept 2023 at 3.7%. The yoy low was Sept 2024 at 2.4%. Ten year yield jumped 10 bps to 4.635%. On the SOFR strip, blues (4th year forward) were weakest, -14.5 on the day. Typically, reds (2nd yr) would be weakest on a day like yesterday, but there was actually a bit of steepening in the short end as all contracts give up on the idea of easing, with Powell saying the Fed’s in no hurry while data raises fears of actual rate hikes. Five year note was weakest, up 11.2 bps to 4.482%. Once again, treasury vol was slightly lower, especially in March, which expires one week from tomorrow. As of now, panic about soaring yields is NOT being reflected in treasury premium.

–PPI and 30yr auction today.

–One new trade yesterday that I would note: buyer of 20k SFRU5 9562.5/9537.5 ps for 3.5. Not particularly large, top strike is 20 otm with U5 settling 9582.5. In a bearish market with NO ease, the top strike might be near the money. For example, SFRH5 settled at a new low yesterday of 9568.5. But the Sept put spread really requires a hike to pay off at expiration. Back to SFRH5: the 9568.75 straddle settled 3.75 with 30 days until expiration. Remarkably cheap, given the geopolitical backdrop. It’s as if monetary policy is now iced, while the rest of the world is spinning faster. SFRM5 9575^ settled 15.5 with 121 dte vs 9575.

–This morning as I skimmed news I saw something about WIG20, the Poland equity index. It has gained 18% since the start of the year, supposedly on hopes that the Ukraine conflict is nearing an end. Looked similar to BABA chart (China) so I overlaid that stock price, up nearly 50% since early Jan, but obviously for a much different reason, as China is pulling out all stops to support equities.

Inflation expectations have risen. What will CPI say.

February 12, 2025

*******************

–Not much reaction to Powell’s appearance. Yields ended higher on the day with tens up 4.2 bps to 4.535% in front of today’s CPI data and 10y auction. Three year auction was solid at 4.30%. Odds for an ease in March (and beyond) are being squeezed out. Current SOFRRATE is 4.35% or a price on 9565 (ignoring daily compounding). SFRH5 settled -0.5 at 9570.5, while SFRM5 settled 9581.0, down 2 on the day. April Fed Funds are 9568.5 against a Fed Effective of 4.33% or 9567. Peak SOFR contract is SFRU6 at 9604.0 or 3.96%.

–CPI expected 0.3 both headline and core m/m. Yoy 2.9% from 2.9 last, with Core 3.1 from 3.2 last. Whisper numbers appear to tilt higher. Long maturity treasury futures are currently unch’d from yesterday’s settles.

–Late new buyer 37k TYH5 109.75/110.5cs for 6 ref 108-31. Settled 6 ref 108-30+ (8 & 2). Also buyer 20k TYH 109p 18 to 20. Someone seems to be jobbing around 20k clips of 109 puts. In any case, settled 28 with futures 108-30+. TYH5 109 straddle expires one week from Friday and closed 0’53, which I calculate just under 13 bps. For a rough comparison, blue Feb midcurves expire this Friday. SFRH8 settled 9597 and the 9600^ settled 10.5. Slightly cheap in my opinion.

Powell faces off with the Senate

February 11, 2025

********************

–Yields little changed yesterday with tens +1 bp at 4.493%. Interest rate premium hit across the board, with many SOFR straddles losing a couple of bps. For example, on Friday, SFRU5 9593.75^ settled 40.75. With the contract +0.5 to 9593.5, that straddle settled 39.25 yesterday. SFRZ5 9600^ went from 60.5 to 58.5 with Z5 +1 to 9600.5. Large exit seller yesterday of 40k 0QZ5 9700/9800cs at 8.25 to 8.0, settled 7.75 vs SFRZ6 9607.5. In TY, the April 109^ was 1’62 on 3-Feb vs 108-30, yesterday down to 1’43 vs 109-065. Price action and volume are muted.

–Today brings Powell’s testimony to the Senate at 10. Prior to that Hammack (dissented in December to hold rates steady) speaks on the economic outlook. 3y auction of $58b. CPI tomorrow. Perhaps the most important issue for the Fed is that inflation expectations have been pushing higher. Overt recognition of that fact by the Fed Chair would likely be bearish. I’ll just note one SOFR option trade that would probably work on one hike by summer: +15k SFRN5 9562.5/9537.5/9525 put fly 1x3x2, for 0.75. Currently EFFR is 4.33 and SOFRRATE is 4.35 to 4.36, which wouldn’t quite get to the 9562.5 strike even with full convergence. So, this trades needs a hike, or a very strong perception of tightening, to work out.

–There have been obvious signs of stress for lower income consumers, and the middle market has been trading down to lower priced venues. From a BBG piece yesterday citing McDonald’s CEO:

“Across the industry, purchases from low-income guests were down substantially in the fourth quarter, Chief Executive Officer Chris Kempczinski said Monday on a call with analysts following the company’s earnings release.”

–Just a brief note about Treasury rolls, specifically TY:

In the past four days, the roll has traded -0.25 to +0.50. Currently 0.25/0.50.

For the first time in a while, there is very little duration difference between the two contracts,

DV01 in TYH5 is $64.09

DV01 in TYM5 is $64.22

–Yesterday morning there was a block roll of TYH puts to TYJ puts, which typically affects the futures roll. I would expect option rolls, given large open interest levels in TYH would become the primary driver of the TY spread. However, as of now, open interest in TYH5 is 4.888 million while TYM is just 46k. March options expire one week from Friday.

Note that FVM5 has about 6.5% more duration than FVH5 and UXYM5 has less than 1% more than UXYH5:

DV01’s on the contracts ($100k notional)

FVH5 $41.25

FVM5 $43.90

UXYH5 $87.45

UXYM5 $88.02

Peak Taylor

February 10, 2025

*******************

–Front end bore the brunt of selling pressure Friday. Payrolls were mixed with NFP 143k (175k exp) but previous revised up 51k to 307k. Avg Hourly Earnings jumped to 4.1% yoy vs expected 3.8. Unemployment rate fell to 4.0%. The big surprise was U of Mich 1-yr inflation expectations which surged to 4.3% vs 3.3 expected. 5-10 yr inflation expectations also rose to a new cycle high of 3.3%. last seen in 2008.

–Weakest contracts on the SOFR strip were -9, SFRZ5 at 9599.5 and SFRH6 at 9503.5. (Still right around 4%). The two-yr note rose 7.1 bps to 4.277% and 10s rose 4.7 bps to 4.483%. Auctions this week of 3s, 10s and 30s begin tomorrow. New recent lows in both 2/10 at 20.6 bps and 5/30 at 35.1. SFRH5 settled at a new low 9572, at 4.28%, just 5 bps under EFFR at 4.33%. SFRM5 settled new low at 9583 or 4.17%. All SOFR contracts from SFRU5 (9593) to SFRU9 (9589.5) are within 10.5 bps of 4%. The peak contract is now SFRU6 at 9606.5. Easing hopes continue to be squeezed out (though there was significant buying of call spreads last week).

–Powell in front of Senate tomorrow. Most worrisome for the Fed are increases in inflation expectations.

–Peak Taylor as Chiefs were destroyed. Cracks were already showing. Mag7?

Shorter runway to runoff

February 9, 2025

*****************

Futures Clearing and Execution/ amanzara@rjobrien.com

Truckin’, like the doo-dah man

Once told me, “You got to play your hand”

Sometimes the cards ain’t worth a dime

If you don’t lay ’em down

Truckin’ – Grateful Dead

I always thought it was “…the cards ain’t worth a ‘damn’” not ‘dime’. Another one of my long-held beliefs, shattered. I’m getting used to it. But I’ll double check with Liesman anyway. He’ll know.

These are hard hands to play. Plenty of bluffs. Sometimes better to just fold and preserve capital.

*This note is a little long. Can probably skip the following section; the point is that reserves may not be abundant or even ample; the end of QT draws near. Long-dated swap spreads shifted higher last week. I think the Fed will be extremely careful as it doesn’t want to risk a repo blow-up like that of September 2019. Market color below the charts if you want to skip forward.

*******************************

The Fed’s ‘Monetary Policy Report’ was released Friday, in preparation for Powell’s appearance before Congress this week.

https://www.federalreserve.gov/publications/files/20250207_mprfullreport.pdf

The report is comprehensive, but almost feels dated in some respects. We’re in an environment where things can change rapidly, and the confidence that reserves are ample may be misplaced.

Pages 43 and 44 of the pdf (pp 33 and 34 of actual report) were interesting: Nonfinancial business and household debt-to-GDP trending down since 2020. Bank credit continuing to decelerate.

Regarding reserves, from the Jan 29 press conference, Powell said, “So the most recent data do suggest that reserves are still abundant. …As always, we stand ready to take appropriate action to support the smooth transition of monetary policy, including to adjust the details of our approach for reducing the size of the balance sheet…”

Page 52 of pdf (pg 42 actual report)

Reserves, the largest liability item on the Federal Reserve’s balance sheet, have edged down $68 billion since late June 2024 to a level of about $3.2 trillion. Since the beginning of balance sheet runoff, reserves have been little changed because the reserve-draining effect of balance sheet runoff was largely offset by a $1.8 trillion decline in balances at the overnight reverse repurchase agreement (ON RRP) facility. Since June 2024, usage of the ON RRP facility has continued to decline to levels below $200 billion (figure B). Reduced usage of the ON RRP facility largely reflects money market mutual funds shifting their portfolios toward higher-yielding investments, including Treasury bills and private-market repurchase agreements. Conditions in overnight money markets remained stable. The ON RRP facility continued to serve its intended purpose of supporting the control of the effective federal funds rate (EFFR), and the Federal Reserve’s administered rates—the interest rate on reserve balances and the ON RRP offering rate—remained highly effective at maintaining the EFFR within the target range. Following the December 2024 FOMC meeting, the Federal Reserve made a technical adjustment to lower the ON RRP offering rate 5 basis points. The technical adjustment aligned the ON RRP offering rate with the bottom of the target range for the federal funds rate.

Below is a chart of the RRP. Indicates to me that perhaps reserves aren’t as abundant, and that the end of balance sheet run-off might be a lot closer. The second chart appears to support the thesis, swap spreads surged last week. Another nugget in the Fed’s report is that Hedge Fund Leverage is concentrated in treasury basis trades. Bessent’s comments that the administration is more concerned with ten-year yields rather than the Fed Funds rate might also provide a nudge to end QT.

Market color

Friday’s employment report sparked an increase in yields, most notably in shorter dates. The 2y rose just over 7 bps to 4.277%. SFRZ5 and H6 were weakest on the SOFR strip falling 9 to 9599.5 and 9603.5. SFRZ5 at 4.005% is right on top of the Fed’s FF projection for end of 2025, 3.875%. Notable is that bond vol didn’t ratchet up. The market doesn’t seem all that concerned about the idea of long rates shooting higher. While the 2y jumped 7.1 bps and the 5y rose 6 to 4.331%, the 30y yield only added 3.8bps to 4.682%. Peak open interest in March TY options remains 108.5c with 187k (paper long). On Wednesday there had been a buyer of 100k TYH 109p for 26 down to 18. On Wed that strike settled 20 vs 109-24 with a delta of 32. On Friday, futures settled 109-075 and the put settled 25, 42d (there were exit sales Friday of 20k from 29 to 30). With flat vol, value should have been 29.8, or just above 27 if taking out weekend time value.

Could 2/10 invert again? Sure is starting to feel that way. There was heavy call spread buying in SOFR options last week, but SFRH5 settled 9572, the lowest settle since November. SFRM5 settled 9583, -6.0. In the last several months there is only one lower settle in M5, 9582 on Jan 13. Short-end charts look an awful lot like a hiking cycle since Sept, but they are actually NO EASE charts. How does 2/10 invert? The Fed holds firm, and if data supports economic deceleration, buyers will move a bit further back on the curve. Fed ends QT and we could easily see 2/10 back at the December starting point of 0. Stocks are the wildcard. A hard slide would instantly spark calls for rate cuts.

Inflation expectations seem to be creeping up. A lot of talk about eggs, but since end of September, Live Cattle up 9.2% (ath this year), Corn +14%, Coffee up 50% (ath), Gold up 8.6% (ath). On the other hand, CLH5 settled Friday at 71.00 bbl, down from a high of 78.71 in mid-Jan. Forward oil contracts are lower. For example, CLZ5 contract is 67.70.

On Friday the U of Mich 1y inflation expectation surged to 4.3% from 3.3% and the 5-10 yr measure firmed to a new high of 3.3% from 3.2%, highest since 2008. The five-year breakeven (treasury vs inflation-indexed note) which made its low of the cycle in early September at 187 bps, is 262 bps now, up 75 bps in the five months since the first Fed cut (high since early 2023). 10y breakeven is 243, up 40 bps since mid-Sept.

On Tuesday Cleveland Fed President Beth Hammack gives a speech on the economic outlook. She dissented at the December FOMC, preferring no ease given the healthy labor market and elevated inflation. Powell appears in front of the Senate at 10, just after Hammack’s speech.

In ESH5, the last two Mondays featured hard breaks. First related to DeepSeek and second to tariffs. On Friday 1/24 ESH high was 6162.25 and Monday’s low 5948 (Range 214, midpoint 6055). On Friday 1/31 the high was 6147.75 and Monday’s low was 5936.50 (Range 211, midpoint 6042). Friday’s high was 6123.25 and the settle was 6049.50, right in between the last two midpoints. Weekend risk is back. Tomorrow’s low 5913??? (210 off Friday’s high).

A friend mentioned that spreads between one-month SOFR (SER) and FF contracts have been widening. I would note that FFH5/SERH5 has moved from 0 on 12/17 to 3.0 now, and FFJ5/SERJ5 has gone from 0 on 12/20 to 2.5 now. Below is a chart of FEDL01 (Fed-effective rate) to SOFRRATE.

End of quarter tends to spike. Both FF and SER contracts are arithmetically averaged over the contract month. But these spreads bear watching as March is end-of-quarter and end of Japanese year (March 31 is a Monday). April 15 is tax day. I would NOT be inclined to sell SFRH5 premium at these levels.

***********************

News this week includes:

Monday:

NY Fed 1-yr Inflation Expectations 3.0% last. Perhaps important due to huge jump in U of Mich 1 yr expectations at 4.3%.

Tuesday:

6:00 NFIB Small Biz Optimism

8:50 Hammack on Econ Outlook. Dissented in December

10:00 Powell testifies to Senate

1:00 3yr auction $58b

Wednesday:

8:30 CPI yoy expected 2.9 from 2.9, Core 3.1 from 3.2 Also Annual Revisions

10:00 Powell testifies to House

1:00 10yr auction $42b

2:00 Federal Budget

Thursday:

8:30 PPI and annual revisions. Jobless Claims

1:00 30yr auction $25b

Friday:

8:30 Retail Sales

9:15 Industrial Production

| 1/31/2025 | 2/7/2025 | chg | ||

| UST 2Y | 423.0 | 427.7 | 4.7 | |

| UST 5Y | 436.4 | 433.1 | -3.3 | |

| UST 10Y | 457.1 | 448.3 | -8.8 | wi 448.0 |

| UST 30Y | 482.2 | 468.2 | -14.0 | wi 468.1 |

| GERM 2Y | 211.9 | 204.8 | -7.1 | |

| GERM 10Y | 246.0 | 237.2 | -8.8 | |

| JPN 20Y | 192.6 | 196.6 | 4.0 | |

| CHINA 10Y | 163.0 | 160.6 | -2.4 | |

| SOFR H5/H6 | -33.5 | -31.5 | 2.0 | |

| SOFR H6/H7 | 5.5 | -2.0 | -7.5 | |

| SOFR H7/H8 | 7.5 | 4.5 | -3.0 | |

| EUR | 103.63 | 103.30 | -0.33 | |

| CRUDE (CLH5) | 72.53 | 71.00 | -1.53 | |

| SPX | 6040.53 | 6025.99 | -14.54 | -0.2% |

| VIX | 16.43 | 16.54 | 0.11 | |

| MOVE | 91.76 | 93.13 | 1.37 | |

Payrolls!

February 7, 2025

******************

—Payrolls. NFP today expected 175k from 256k last. I’ve seen some higher estimates. Private payrolls expected 150k from 223k. My personal bias regarding TY and US is that a strong number will be met with dip buyers, while a weak number could cause a powerful rally. In TY I suspect the week’s low at 108-20+ will hold, while on the upside I would target 111 to 111-16. 50% retrace on continuous TY from Sept high 115-07 to Jan low 107-07 is 111-07. (last at 109-19). Consumer credit released at end of the day.

–A few large SOFR opts trades: +50k SFRM5 9612.5/9637.5cs 2.5 vs 9588 and 88.5 with 10d. Settled 2.5 vs 9589. A few sessions ago there was a buyer of 40k same strike April call spread for 1.75. Also a buyer SFRU5 9662.5/9762.5cs WITH 0QU5 9712.5/9812.5cs paid 12 for 10k of each. All new positions. SFRU5 cs settled 5.75 vs 9601 in U5, and 0QU call spread settled 6.0 vs 9614.5 in U6. Currently SFRU6 is the highest point on the SOFR strip.

–In early 2019 after SPX had dumped 20% in Q4 2018 and Powell hiked for the last time in Dec 2018, there was a ton of call spread buyers every day in SOFR. It’s almost starting to feel a little bit like that. I don’t quite understand the catalyst. Stocks are holding near record highs. Data remains generally firm. Powell et al have indicated they are comfortable holding rates steady. However, the flows support the idea of lower rates, in my opinion.

–2/10 spread at futures settle was 23, a new low for this year (2025). This morning prints 20.5 which is the halfway back point of the recent surge, 0 on 25-Nov to +42.3 on 9-Jan.

–Attached chart is the stock of Almonty, the largest tungsten miner in N Amer. China’s tariff retaliation includes export controls on tungsten, of which China is, by far, the largest producer. Used in many industrial applications. Supply chain issues resurfacing?

Interesting article:

“We instantiate this network inside the camera lens with a nanophotonic array with angle-dependent responses. Combined with a lightweight electronic back-end of about 2K parameters, our reconfigurable nanophotonic neural network achieves 72.76% accuracy on CIFAR-10, surpassing AlexNet (72.64%), and advancing optical neural networks into the deep learning era.”

Well, when you put it that way, it’s pretty obvious, isn’t it? I wonder if it requires tungsten.

https://interestingengineering.com/innovation/new-camera-identifies-objects-200x-faster

BIG flattener

February 6, 2025

******************

–Back in the Clinton presidency, there was angst about budget deficits. From Bob Woodward’s ‘The Agenda’:

“Clinton recognized that it was the exact argument that Greenspan had made to him the previous month. Deficit reduction could mean lower long-term interest rates.

… Clinton’s face turned red with anger and disbelief. “You mean to tell me that the success of the program and my reelection hinges on the Federal Reserve and a bunch of fvcking bond traders?”

–There was a tacit, or maybe even overt deal. Get the budget under control and the Fed will cut rates.

–From a BBG summary today: Bessent says the Trump admin’s focus is on bringing down 10y yields, not FFs. Bessent believes expanding energy supply will lower inflation and a lower deficit will reduce 10y yields.

–So there you have it, a drop in the 10y yield yesterday of 9.3 bps to 4.418%. Sure we had a low JOLTs number the other day and yesterday ISM Services were a bit lower than expected. But I believe that Musk’s efforts are going to change incentives throughout government, and help reduce the trajectory of spending. Does that justify a ten year yield that’s rapidly closing in on the Fed Effective rate of 4.33%. Maybe not….but maybe. I am sure Powell and Bessent came to a tacit understanding on the issues.

–The outcome is a much flatter curve. Yesterday 2/10 fell 6.4 bps to a new low for 2025, 23.7 bps. On the SOFR curve, all near calendars collapsed to new recent lows. SFRH5/H6 fell 4.5 to -41 (9574.5/9616.5). Just looking at June contracts, M5 +1 at 9590. M6 +5.5, 9617.5. M7 +9.0, 9616.5. M8 +10. 9610.5. A couple of chunky call spread buyers…again, slightly further back on the SOFR curve:

+23k 0QU5 9712.5/9812.5cs 6.5. (settled 7.0 ref 9618.0 in SFRU6)

+25k 2QH5 9650/9700cs covered 9614, 3.25 paid. (settled 4.0 ref 9617.5 in SFRH7)

–Yesterday, a buyer of 100k TYH 109p, starting early at 26 and ending at 18 at the market rallied. Final settle 20 ref 109-24 with 32 delta. Not saying it’s the same guy, but on Jan 14 there was a buyer of 100k TYH 108.5c 28 covered average 107-10, 30d. On Jan 24 a buyer of 50k TYH 108.5c 41 covered 108-11. Yesterday, TYH5 108.5c settled 1’28 (80 delta). TYH 109p have a delta of 30. Protective buys in front of NFP tomorrow?

–Today brings Nonfarm Productivity (1.2% expected) and Jobless Claims expected 213k.

Rate futures find footing

February 5, 2025

******************

–Near one-year sofr calendars are pressing lower as reds led to the upside (+6.125). SFRH5/H6 settled -36.5 (9574.5, +1 and 9611.0, +5.5). In treasuries the 2y yield fell 5 bps to 4.21% while 10s were down 3 bps to 4.54, so that spread bounced a couple to 30 bps. Overall, the session was quiet.

–JOLTs number was low (7600k vs 8000k expected) which captured the attention of the market. You know it’s boring when JOLTs is the main feature; back to 2019 levels. The inflation mandate still holds sway, but maybe labor concerns will flare again. Payrolls on Friday. By the way, high JOLTs in 2022 was over 12000.

–GOOGL got whacked on earnings and is -7% this morning. On Friday I had thought TY might surpass 109-16 strike. It didn’t, but this morning prints 109-14. USH5 had a low of 113-18 yesterday morning, but now prints 115-07.

–Platinum cheap. New all-time high in gold; platinum is cheaper to gold than it ever has been. (Market Huddle guest Ole Hansen mentioned it this weekend).

–More SFRZ5 9700c vs 0QZ5 9750c 3.5 for 15k. Settles: 10.75 vs 9607.5 and 7.25 vs 9611.0. Buying front Dec…works well in a disaster, otherwise there’s a slow roll down’ negative carry.

–ISM Services today expected 54 from 54.1. ADP expected 150k from 122k last.