Conditions getting tighter

April 22, 2024

***************

–New high copper this morning even as other metals and oil are lower. SFRZ4 is threatening to get above 5% (9503 last) while USM flirts with the 113 handle (114-04 last). Treasury auctions of 2s, 5s and 7s this week ($69, 70 and 44 billion). Ten year up about 4 bps from Friday at 4.652. The 2yr is printing 5%. That’s up about 75 bps from the start of the year, though last October’s high was 5.22%. Earnings reports include TSLA on Tuesday, META on Wednesday and MSFT, GOOGL Thursday. PCE prices on Friday.

–$/yen nearing 155, now 154.75. CNY also weaker, new low for the year at 7.2437. I read a blurb that China is stockpiling base metals in anticipation of devaluation. Or perhaps a move on Taiwan is imminent. The House passed a bill opening the door to transfer Russian assets to Ukraine (still needs Senate approval) and Congress also gave more aid to Ukraine. Not sure why anyone would think the Fed has to tighten. Treasury has a LOT of paper to sell while the US undermines property rights, and spends as if there’s a bottomless pit. Hardly encouraging for foreign buyers. Let financial conditions tighten at the long end.

World of Extremes

April 21, 2024

***************

When I worked on the floor of the CME in eurodollars, there was a guy that had started at the Citi desk. Slight of build, sandy colored hair, ordinary looking. His standout feature was that he was prone to embellishing his accomplishments and intellectual acumen. This being the floor, one of his coworkers created a CV for him with a list of outrageous claims. Of course, everyone jumped in and added bullet points with stuff like this (it was a long list):

Taught Myron Scholes option math

Ran the Boston Marathon in two hours

Received a patent for a perpetual motion machine

and, one of my favorites:

Invented fire

Ruthlessly funny. I don’t know what happened to that guy, but I don’t think he lasted on the floor for long. Probably in Congress. Of course, I don’t think he ever went so far as to suggest his relatives were eaten by cannibals; that’s at another level.

We’re in a world of extremes dominated by outrageous hyperbole. A tired refrain from market pundits is often, “This won’t end well.” Look, it’s ALWAYS not ending well for someone out there. And even the bad stuff is usually good for someone. Let’s try to get on that side.

I’ve become somewhat obsessed with the prices of grains denominated in gold. Wheat priced in gold is at its lowest EVER. But there are a lot of relationships that seem extremely stretched and stressed, not just political. Russell 2k divided by Nasdaq Comp is near its absolute low. Oil priced in gold is compressed. The 2/10 treasury spread reached its lowest level since the 1980s last year (-108, now -36), and has been inverted for over seven quarters, almost the longest period in history. The BBB spread to treasuries is 117 according to the St Louis Fed site; close to its lowest level since 2000 (107).

Emerging mkt currencies are under pressure vs USD. The Indonesian rupiah and Malaysian ringgit have fallen to Asian Crisis (late 1990’s) levels. The Indian rupee made a new low this week, consistently weakening against USD. Same with the Vietnamese Dong; it has collapsed from 24270 to 25430 (17%) this year. $/yen is at its highest level since 1990.

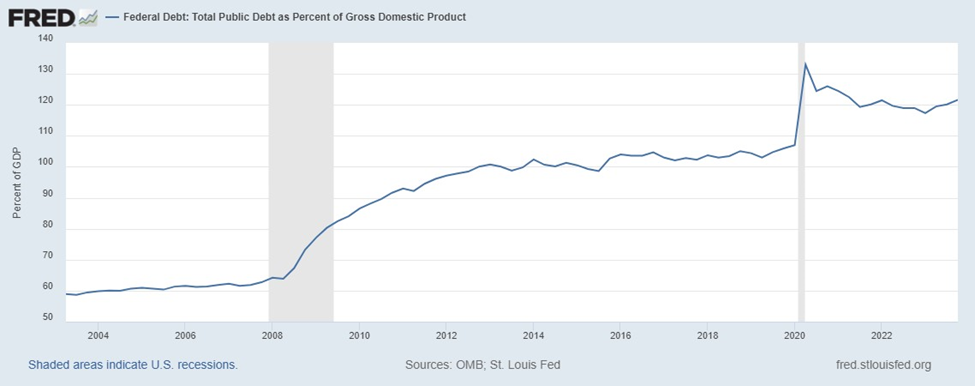

US debt to GDP is over 120% and increasing again. It had hit 133% during covid but was below 65 for most of the period before the GFC.

Below are wheat and oil priced in gold since 2002. I am guessing that these charts might even be slightly more dramatic were it not for the advent of bitcoin, which likely siphoned off a bit of the ‘safe and easily portable store of value’ from gold, if only at the margin.

The next chart is Russell 2k divided by the Nasdaq Composite. I’ve included Fed easing periods which may have nothing to do with the equity index ratio, I only wanted to highlight how quickly the Fed has been inclined to cut the funding rate when stress shows up. The parallel to today might be the dotcom bubble as the calendar rolled into 2000. The Fed didn’t reduce rates right away, but when it did start cutting in January 2001 it went in a hurry. Same for the GFC.

The promise of new technology to increase productivity should benefit Russell companies as well. That was the same dynamic as in the late 1990’s of course, but it resolved with the Nasdaq crash. We experienced a tiny taste of that on Friday, with CCMP -2.05% and Russell +0.24%.

The SOFR curve has been squeezing out the prospect of easing in 2024, belatedly guided by Federal Reserve officials (in a flip from the December pivot). The lowest quarterly contract on the strip is SFRM4 at 9474 or 5.26%, close to the current Fed Effective of 5.33%. The peak contract on the strip is SFRU7 at 9595.5 or 4.045%. The difference between low to high is just 121.5 bps over three years. Most of that difference is contained in the next two years, for example, SFRM4/SFRM6 spread is -107.5 (9474/9581.5). You can see on the chart that recent easing episodes took less time than two years and are of 2x to 5x greater magnitude than M4/M6.

Does it have to play out that way this time. Nope. But it might.

In terms of inflation, we get PCE prices on Friday. Month/month expected 0.3 for both headline and core, same as last month. Year/year headline expected 2.6 from 2.5 and Core 2.7 from 2.8. My sense is that inflation remains sticky, but trending lower. I think there are both upside and downside risks. Regarding AI, I saw this twitter quote: “Imagine we discovered a new continent with 100 billion people and they’re all willing to work for free! That’s what’s about to happen with AI…” A stretch? I think so. But I also saw a clip from Goldman hypothesizing that the gap between GDP and GDI is due to immigration: “An undercounting of unauthorized immigration has likely contributed modestly to the sharp increase in the gap between GDP and GDI over the last year. We suspect that GDP which is an expenditure-based measure…may have captured the consumption boost from the recent immigration surge, while GDI which is income-based, may have underestimated total employment and compensation paid to undocumented workers…” There’s a much more prosaic reason that inflation may be contained: new immigrants are being paid much less under the table to work. The pressure to incorporate new entrants legally into the workforce is only going to grow as fiscal largesse runs into a brick wall. That brick wall comes in the form of higher rates at the long end of the treasury curve.

Treasury auctions of 2s, 5s and 7s this week. May 1 is both the FOMC and the Treasury’s Quarterly Refunding Announcement. Thankfully, we’re in the blackout period for Fed speakers. Bonds continue to trade heavy. If Yellen were to weight issuance to the front end again (like November) then USD will further strengthen against EM and hasten a crisis.

Interesting thesis by Gavekal (I think I’m summarizing correctly). In an environment of fiscal dominance, bonds are no longer a safety anchor for a portfolio. They will go down with stocks. Rather, real assets (like gold) should comprise about 30-35% of one’s portfolio as a safe anchor.

| 4/12/2024 | 4/19/2024 | chg | ||

| UST 2Y | 488.0 | 496.9 | 8.9 | wi 495.0 |

| UST 5Y | 453.1 | 465.6 | 12.5 | wi 464.8 |

| UST 10Y | 449.7 | 461.2 | 11.5 | |

| UST 30Y | 460.1 | 470.9 | 10.8 | |

| GERM 2Y | 285.6 | 300.0 | 14.4 | |

| GERM 10Y | 235.9 | 250.0 | 14.1 | |

| JPN 20Y | 162.6 | 160.1 | -2.5 | |

| CHINA 10Y | 228.4 | 225.6 | -2.8 | |

| SOFR M4/M5 | -76.0 | -68.0 | 8.0 | |

| SOFR M5/M6 | -42.5 | -39.5 | 3.0 | |

| SOFR M6/M7 | -14.0 | -13.0 | 1.0 | |

| EUR | 106.44 | 106.55 | 0.11 | |

| CRUDE (CLM4) | 85.08 | 82.22 | -2.86 | |

| SPX | 5123.41 | 4967.23 | -156.18 | -3.0% |

| VIX | 17.31 | 18.71 | 1.40 | |

Still risk over the weekend, but perhaps less

April 19, 2024

****************

–Strong Philly Fed (highest since Q2 2022) contributed to a move to higher yields. In treasuries the 5yr led, rising 7.1 bps to 4.684%. Tens +6.4 at 4.645%. On the SOFR curve reds were weakest, settling -9.0. New high in M4/M5 calendar at -66, up 8 on the day (9473, -1.0/9539 -9.0). SFRZ4 settled 9504, -6.5, at nearly 5%, indicating about 1.5 eases this year.

–Limited Israel strikes on Iran caused volatility overnight, for example, TYM4 surged to 108-22+ up a full point from settle. However, all initial moves have significantly subsided; TYM now 108-04. I don’t know how much copper it takes to keep the war machine running, but we’re seeing a cocoa-like bid there, up another 5 cents today to new highs, with HGK4 4.487.

–Decent amount of downside trades in SOFR options yesterday, the largest being a new buy of 40k SFRZ5 9475/9425/9375p fly for 4.0. Settled there vs 9565.5 in Z5. 603 days until expiry. There was also a buyer of 20k U4/Z4/H5 flies for 1.0 to 1.5. Sept/Dec settled -17 and Dec/March -18 so fly settled +1. In the old days of ED futures, U/Z/H flies would be bought in order to cover the year-end ‘turn’ embedded in Dec contracts. Not sure of the motivation for this one, though M4/U4/Z4 settled +3 (-14/-17). More emphasis on pre- to post- election trades. The U4/Z4 calendar at -17 is a new recent high (9487/9504).

–Perhaps weekend risk is a bit more muted since the Israel/Iran conflict appears slightly less inflammatory. However, large equity option expiration today.

SFRU/V 9462.5p cal 2.25 to 2.5

SFRU4/V4 9450/9400ps spd 1.0-1.25 paid 25k

SFRZ5 9475/9425/9375p fly 4 paid 40k

SFRH6 9475/9425/9375p fly 3.5 paid 5k

SFRZ5 9525/9400ps cov 9566, 22d 30 paid 5k

SFRH5 9825c 2.5 paid 20k

Later TYM4 107.5p cov 107-24, 53 paid 10k

U/Z/H fly 1.25 paid 20k

..

Base Metals

April 18, 2024

***************

–Copper is at a new high this morning, with HGK4 currently printing over 4.42. In mid-Feb it was around 3.75, so it’s an explosive 18% increase in two months. ZH has an article on the surge in tin prices, noting that it’s something of an AI adjunct: ” ‘Every data byte and every electron travels through hundreds of solder joints that connect it all together,’ [said] Jeremy Pearce, head of market intelligence and communications at the International Tin Assn.” Sort of odd in the context of USD strength. I’ve read several articles recently about electricity generation plays; wouldn’t it be funny if basic commodities are the easiest and surest way to bet on cutting edge technology?

–However, that doesn’t seem to be the case for grains, for now anyway. I think I first posted a chart of corn priced in gold in 2020. That year was the absolute low, but now corn/gold is approaching that historic level. Recall it was April 2020, almost exactly four years ago, that WTI futures prices went negative. Currently CLM4 near $82/bbl.

–In any case, there are a lot of wildly shifting prices out there, and likely some spread opportunities for those with deep pockets that can live through squeezes. I guess a core theme would be the idea that commodity prices aren’t encouraging for the inflation outlook, and several Fed officials including Powell have pushed back timing for easing.

–Yields fell yesterday and implied vol compressed in rate futures. Tens ended down 7.6 bps at 4.581%. Stellar 20 year auction helped support futures. Note that deferred SOFR prices tested Tuesday’s lows, but ended up closing above Tuesday’s highs. As an example, SFRZ7 equaled Tuesday’s low at 9489, but made a higher high at 9600.5 and settled 9599.5 (+7.5). This contract currently represents the apex of the SOFR curve, at a yield of 4%. Of particular interest is SFRZ5 which settled 9574.5, up 8 on the day. This contract had been the weakest on Tuesday due to huge buying of the Z4/Z5 calendar spread, which surged to -57.5. It was beaten back down into submission yesterday, settling at -64.0. The decline in red contracts (second year out) makes sense given renewed concern about inflation and a Fed that may just sit on the rate-cut sidelines, but USD strength is tightening conditions in EM countries, and likely accentuating the risk of financial accidents.

Higher for longer; new high SFRZ4/Z5

April 17, 2024

***************

–Powell… “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence” that inflation will return to 2%.

–The higher for longer stance was clearly reflected by the SFRZ4/SFRZ5 calendar spread which traded huge volume and settled at a new recent high of -57.5, up 6 bps on the day. SFRZ4 was unchanged at 9509 and Z5 fell 6 to 9566.5. This morning’s prelims show that open interest rose 20k in Z4 but a whopping 133k in Z5, to 809k. There was also an article dated Monday on Politico (linked below) titled, ‘Trump trade advisors plot dollar devaluation’. (thanks BP). ($ deval probably would result in higher US long rates). Note: $/yen 154.60. And the Korean Won has also depreciated quickly from 1330 in the beginning of March to 1400 yesterday. Stronger USD should be deflationary for the US, but Core Services have been the problem, not goods. The Asian currency crisis was in 1997/98…

–Yields yesterday rose, except for SFRZ4! Two year +3 bps to 4.964%. Tens +2.7 to 4.657%. 20-yr auction today. On the SOFR curve, unsurprisingly SFRZ5 was the weakest contract, -6.0. SFRM5 to SFRM8 down 3 to 5.5 apart from Z5 (-6).

–Flows to hedge against a plunge in risk assets aren’t particularly prevalent, though VIX perked up over 19. Yesterday there was more (new) SOFR call spread buying, adding 30k to Z4 9600/9700cs for 6.75 (settled 6.5) and 15k SFRZ5 9750/9850cs for 8.25 (settled 8.0 ref 9566.5). Yesterday I mentioned a buy of 40k Z4 9700/9800cs; that was incorrect and was probably an intercompany transfer, OI didn’t change. Note that even with a move to new high yields, treasury vol eased; there were some chunky TY put sales. Indication that yield surge has abated for now. Fear of higher rates subsiding.

SUMMARY

–Huge Z4/Z5 buys. Settle +6 at -57.5

Z5 75/85cs 8.25 for 15k

Z4 60/70cs 6.75 for 30k

TODAY: 20y auction, Beige Book, TIC data

https://www.politico.com/news/2024/04/15/devaluing-dollar-trump-trade-war-00152009

Below is chart of Korean Won and Indonesian Rupiah

Easing pace will be slow, unless FORCED

April 16, 2024

***************

–Stronger than expected Retail Sales helped push yields to new recent highs. On a monthly basis +0.7 vs +0.4 expected, with ex-auto and gas +1.0%.

Two year yield was only up 5.5 bps to 4.935 but tens jumped 13.3 to 4.63% and thirties rose 13.9 to 4.74%. Bear steepener. On the SOFR curve reds were -8.5, while greens, blues and golds were -11.5 to -14.5. The 2-yr note that was issued in January was just over 5% late yesterday; probably a great place to park funds for safety. If not already in gold.

–Buyer of 60k SFRZ4 9850/9900cs for 0.625 synthetic. Settled 1.25 and 0.75 ref 9509.0. Also a buyer of 40k SFRZ4 9700/9800vs which settled 4.75/2.0. Israel/Iran conflict risks significant acceleration.

–Stocks closed at new recent lows. SPX -1.2% and Nasdaq Comp -1.8%. ESM4 late 5099, having erased all of March gains (ESM4 high settle on 3/28 was 5308.5). NQM4 settled 17876.25, down 303, and is also below the entire March range. Sell in May and go away has started a little early this year. Because of climate change, of course.

–Treasuries aren’t really benefiting from a safety bid as of yet. China Q1 GDP was +5.3% but the yuan remains under pressure, and $/yen prints 154.50 this morning (new low for yen). If the BOJ supports the yen it sells US assets. Therefore, the risk trades are in the front end, exemplified by SFRZ4 call spread buys. Once again, I think the Fed’s last SEP, which raised the forward estimates for the FF target in 2025 and 2026, was an important signal which has helped tighten financial conditions internationally.

–Housing Starts and Industrial Production today. Powell speaks at 1:15.

1:15 p.m.

Discussion — Chair Jerome H. Powell

Moderated Discussion with Tiff Macklem, Governor of the Bank of Canada

At the Washington Forum on the Canadian Economy, Washington, D.C.

Kon-Tiki

April 14, 2024 -Weekly comment

***************

When I was a kid I read Kon-Tiki by Thor Heyerdahl. It’s an epic tale documenting his 1947 voyage to the Polynesian Islands from South America on a raft. The adventure took 101 days covering 4300 miles.

From Wikipedia:

Heyerdahl believed that people from South America could have reached Polynesia during pre-Columbian times. His aim in mounting the Kon-Tiki expedition was to show, by using only the materials and technologies available to those people at the time, that there were no technical reasons to prevent them from having done so. Although the expedition carried some modern equipment, such as a radio, watches, charts, sextant, and metal knives, Heyerdahl argued they were incidental to the purpose of proving that the raft itself could make the journey.

Fabulous book for a kid. I recall one of the problems was that when they were building the prototype, they found that the grass ropes that lashed the raft together would immediately begin to fray from the friction of the logs and motion of the seas. However, they discovered that by using native balsa wood, the ropes would actually cut into the logs, creating channels which prevented the fraying. People solve problems.

The reason I brought this book up is I recall another particular passage. The expedition was approaching the end of the voyage. The seas were wild and the raft was nearing an island with rocky outcroppings. The crew of six were exhausted. They had a meal, and my specific recollection is that Thor decided not to clean his dish and utensils that day, as they probably were destined to crash on the rocks which would tear the 45-foot raft into pieces.

I searched for the specific passage from Kon-Tiki. But internet inquiries now are all about the colonization of indigenous peoples, rather than the spectacular theory and resulting adventure. It’s tedious. I quit.

The weather is beautiful this weekend in the Chicago area. Trees and flowers are beginning to blossom. ‘Nature’s first green is gold’. People are out walking their dogs, kids are playing. I was about to recap the week and organize some thoughts for next week, but instead, I’m having friends over and going to enjoy the backyard as the world hurtles into thoughtless conflagration. Not going to worry about washing the dishes today.

Just one other quick thought. Kevin Muir had a guest on last week’s Market Huddle named Paulo Macro. Though he was mostly raised in the US, his family is from Brazil, and he related an amusing story about when he was a kid in Brazil during hyperinflation. He said that prices were going up something like 2% EVERY day. So, when people went to the store, there was an employee with a price tag gun who would start at the front and just raise prices of everything, every day, working his way down the aisles. The shoppers would, of course, race in front of the guy to buy the items where the prices hadn’t yet been increased. To me, it’s the extreme degree of the ‘inflation expectations’ spectrum. Some people might be thinking about input supplies, etc. but the end consumer just has a mindset that these prices are going to be higher tomorrow, and they act accordingly. The latest US inflation data highlighted a 22% increase in the price of auto insurance since last year. Are expectations here truly anchored?

Untethered expectations can create an almost automatic and unthinking strategy. And that’s where the world seems to be in the geopolitical race toward conflict.

‘Then leaf subsides to leaf/ So Eden sank to grief’

********************************************

Below chart is attributed to BofA

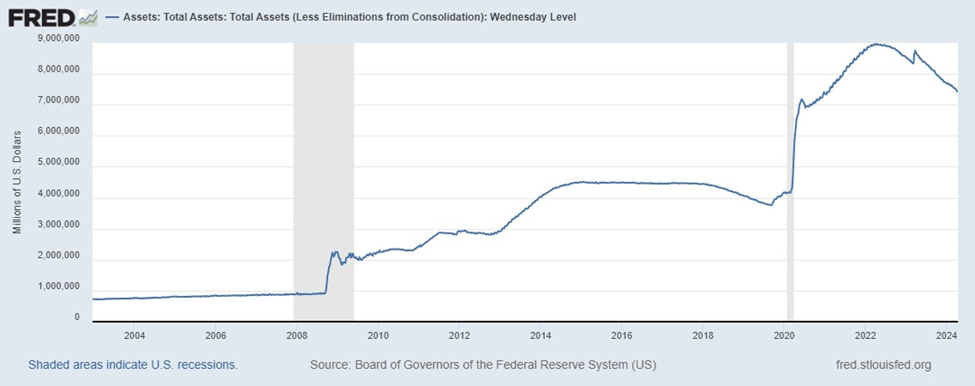

The next two charts are from St Louis Fed’s FRED website. The top is the Fed’s balance sheet, and the bottom is the US Debt as a percent of GDP. In the period after the GFC, both went up and then leveled off. The authorities were, more-or-less, buying prosperity. Then covid hit. The Fed’s trying to dial its initial response down, but the Federal Gov’t isn’t. War is not likely to help.

| 4/5/2024 | 4/12/2024 | chg | ||

| UST 2Y | 473.0 | 488.0 | 15.0 | |

| UST 5Y | 436.5 | 453.1 | 16.6 | |

| UST 10Y | 437.3 | 449.7 | 12.4 | |

| UST 30Y | 452.8 | 460.1 | 7.3 | |

| GERM 2Y | 287.5 | 285.6 | -1.9 | |

| GERM 10Y | 239.9 | 235.9 | -4.0 | |

| JPN 20Y | 153.1 | 162.6 | 9.5 | |

| CHINA 10Y | 229.1 | 228.4 | -0.7 | |

| SOFR M4/M5 | -93.5 | -76.0 | 17.5 | |

| SOFR M5/M6 | -40.5 | -42.5 | -2.0 | |

| SOFR M6/M7 | -7.0 | -14.0 | -7.0 | |

| EUR | 108.40 | 106.44 | -1.96 | |

| CRUDE (CLM4) | 86.10 | 85.08 | -1.02 | |

| SPX | 5204.34 | 5123.41 | -80.93 | -1.6% |

| VIX | 16.03 | 17.31 | 1.28 | |

Real yields are high

April 12, 2024

***************

–Relief rally in stocks but treasuries continued to trade soft late Thursday on auction distribution. USM4 settled 115-08 at 3:00pm but traded 114-31 just before the electronic close. PPI was slightly lower than expected, though anyone that cares to look can see that CLM4 has moved from 71 to 85 since the start of the year. BBG cited the Fed in a story noting that credit card delinquencies are at a record high, with 3.5% being at least 30 days late as of Q4. Can’t pay the juice.

–At the time of settlement rates were little changed though the curve steepened. Red SOFR contracts essentially unch’d but golds -2.625. Two-year down 1 bp to 4.95% while thirties were up 3 bps at 4.657%. Ten year inflation indexed note at 2.165%, a new high for the year. The high last October was 2.53%

–A headline from FT this morning: ‘Value of China’s exports falls sharply on sliding prices’. USDCNY 7.2373 and $/yen remains over 153 as both currencies continue to weaken, portending deflationary exports.

–JPM, Citi, WFC and Blackrock report today. Retail Sales and Tax Payment day on Monday.

A second inflation wave?

April 11, 2024

***************

–CPI lived up to the hype, sparking huge market moves on a ‘hot’ print. CPI m/m 0.4 versus expected 0.3, yoy 3.5 vs 3.4 expected. Core 3.8 vs 3.7 expected. The largest net change across rate futures was SFRM5 which plunged 30 to 9544.5. Two year yield surged 21.5 to 4.96%, while the ten year rose 18.4 to 4.548% after a poorly received auction. SPX ended down 1%. CLM4 was +0.95 late at 85.41.

–New highs in near SOFR calendars as prospects for near-term easing were squashed. The most inverted one-year calendars are still the fronts but June’4/June’5 and U4/U5 are now almost equal. M4/M5 settled -72.5, up 18 on the day (9472/9544.5) and U4/U5 settled -73 up 9 (9487/9560). SFRJ4 (April) reflects no ease, settling at 9466.75. SFRZ4 ended at 9507, just 40 bps above April, about 1.5 eases priced into year end. Last Thursday this spread was -69. FFQ4 was 9492 on Tuesday, now 9479 so about 50/50 being priced for an ease by the July 31 FOMC.

–$/yen was near 153 at the end of the day and is now just above that level, which adds pressure on the Chinese yuan. Summers helpfully repeated that the next Fed move could be a hike.

–The administration’s impulse to hand out gifts to counter bad news is now being confronted by bond vigilantes, with the thirty year auction today (yield was 4.63% at futures settle). They will blame Powell, but perhaps now the Fed can just sit back and let tighter financial conditions tamp down on forward inflation.

–The block buyer of 75k SFRZ4 at 9532 on Tuesday was clearly caught wrong-footed. However, the buyer of 40k SFRU4 9462.5p for 2.25 gained 4.5 at settle (6.75s). The Monday buys of otm treasury puts also did nicely, for example, a buyer of 50k FVM4 102.5p for 1.5 to 2; late quote was 5 mid-mkt ref 105-08. Vol jumped with TYM4 vol marked at 6.8 from 6.0

–News today includes PPI, expected 0.3 m/m with yoy 2.2 from 1.6 last and Core 2.3 from 2.0 last. Jobless Claims expected 215k

We all see the prices

April 10, 2024

***************

–CPI expected +0.3% on the month, with yoy 3.4 from 3.2 last and Core 3.7 from 3.8. ZeroHedge this morning leads with an article about scandal within the BLS regarding technical discussions with ‘super-user’ economists about specific calculations relating to CPI. The intimation is that some market participants have ‘non-public’ info. My working assumption is that someone always has better information and probably has the final number. His name is Clarence Beeks.

–There was a block buyer of 75k SFRZ4 yesterday at 9532.0 (settled 9533.0). New position, as open interest rose 55k. That guy have it? Maybe, But maybe the fact that Yellen is warning about another wave of cheap Chinese deflation has something to do with the SOFR bid, as the yuan is slowly depreciating. Maybe the Fitch downgrade of China’s outlook has something to do with it. $/yen also pinned near 152.

–There was also a buyer of 24k FFN4 at 9481 or 5.19%, Settled 9482.0. Current Fed Effective is 5.33% or 9467. There’s an FOMC May 1, and FFK4 settled 9468, so the market is assigning very little chance of a cut at that meeting. Then there is a meeting June 12. That’s the one FFN is pricing. Assuming May is a no-go, then FFN at 9482 indicates 60% chance of an ease. There’s another FOMC on July 31. FFQ4 settled 9492.0 or 5.08%, exactly 25 bps lower than the current EFFR.

–Yesterday also featured the softest Small Business Confidence (NFIB ) number since 2012 at 88.5. Inflation was cited as a top concern. In many ways, inflation has helped the largest US companies and their stocks. Smaller businesses, not so much. It seems as if today’s CPI is expected to come in soft, but I’m not sure that’s a sustainable positive for SPX from here.

–Ten year auction today, yesterday’s 3-yr was poorly received with a 2 bp tail, 4.548% actual vs 4.528 at cut-off. Tens ended at 4.364%, down 6 bps on the day. FOMC minutes this afternoon.