The Occasional Customer

May 5, 2024 – Weekly Comment

**********************************

SBUX – a canary?

SLOOS – Will be released on Monday. Gained prominence one year ago as Powell mentioned at May 3, 2023 press conference

Large decline oil – CLM4 down 5.74 on the week to 78.11

Treasury Auctions of 3s, 10s, 30s

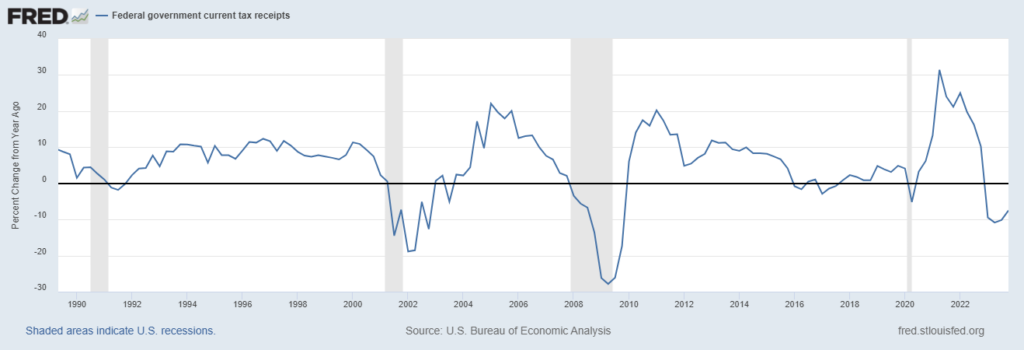

Gov’t tax revenues – when yoy pct change is where it is now, we’re in recession

A couple of bullet points this weekend.

First, the change in trend, or in narrative, tends to happen at the margin. Then it either fizzles or gains traction, culminating in the tipping point. The 2006/07 subprime mortgage crisis was that way; in the beginning it was dismissively referred to as “…a mile wide and an inch deep”. Obviously that one snowballed.

On Thursday May 2, Starbucks CEO Laxman Narasimhan was interviewed by Jim Cramer. The stock was crushed during the interview as Cramer hammered away on lack of strategy. On a macro level, the most interesting excuse for unsatisfactory results was “…unexpected pressures on our occasional customers – more intense than we expected.” Cramer pounded away, saying he had checked with other public and private companies in similar businesses and none of them experienced negative same store sales, capping with this zinger, “Is it possible that your coffee is just too darn expensive?” LN response, “… if I look at the US occasional customer, they have clearly cut back on visits to us.” SBUX is a global company, but it seems to be a US problem.

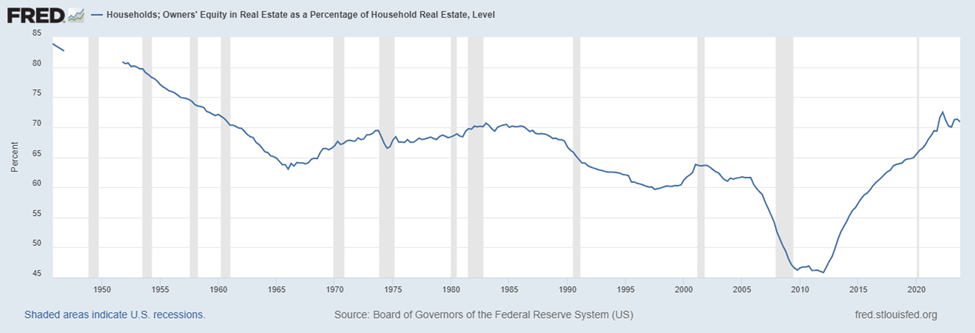

Company specific, or beginning to permeate the economy? That’s the question. The ‘occasional customer’ is the marginal consumer. Last week’s consumer confidence at 97.0 was the lowest since covid, save for one print in 2022 at 95.3. ISM Mfg printed back below 50 at 49.2, but prices paid hit 60.9, highest in nearly two years. Payrolls and ISM Services both lower than expected. Obviously, the CORE US consumer is doing well, according to the numbers. Savers are getting great rates, and Household’s percent of equity in residential real estate, though off last year’s high, is currently 70.9%, which is above every level since 1960. Stocks are bid. Yay boomers. The MARGINAL consumer is getting hammered.

HH Owners Equity as Pct of HH Real Estate

SLOOS on Monday

SLOOS is the Senior Loan Officer Survey which gives an indication of credit tightness. One year ago Powell mentioned SLOOS at the May 3, 2023 press conference, as credit conditions were becoming more stringent (actual report was May 8). I believe SLOOS is released at 2 pm EST on Monday.

A BBG article over the weekend cites CRED iQ noting “Distress in CRE CLO loans jumps back up to record 8.6% in April.” Link at bottom.

CLM4 down $5.74 on the week

CLM4 ended the week at 78.11, right around the midpoint of the past three qtrs (active contract).

FEDL GOV’T TAX RECEIPTS, PCT CHANGE FROM YEAR AGO

This is an ominous chart. Any time it’s at this level, -7.5% in Q4 2023, we’re in recession. Treasury’s recent borrowing estimates indicated a shortfall in tax revenues. In Q1 2008 as this data slipped into negative territory, SPX was down about 38% three quarters later. In Q1 2001, SPX was about even three quarters later, but the trend was down.

Treasury auctions $58b 3s on Tuesday, $42b 10s on Wednesday and $25b 30s on Thursday.

Last week I noted “Demand for insurance continues to be weighted toward lower rates ensuing from an economic or financial ‘accident’.” The relief rally following FOMC and weak payrolls saw SFRU5 as the star contract, up 28.5 bps to 9579.0 or 4.21%. In treasuries 5s were the star, down 21.3 bps to 4.478%. Thirties fell just 12.2 bps to 4.66%. Implied vol was significantly lower to end the week (in front of limited economic data this week).

| 4/26/2024 | 5/3/2024 | chg | ||

| UST 2Y | 499.8 | 480.1 | -19.7 | |

| UST 5Y | 469.1 | 447.8 | -21.3 | |

| UST 10Y | 466.9 | 449.5 | -17.4 | wi 448.7 |

| UST 30Y | 478.1 | 465.9 | -12.2 | wi 465.7 |

| GERM 2Y | 298.8 | 292.4 | -6.4 | |

| GERM 10Y | 257.5 | 249.5 | -8.0 | |

| JPN 20Y | 165.0 | 168.3 | 3.3 | |

| CHINA 10Y | 230.6 | 231.5 | 0.9 | |

| SOFR M4/M5 | -64.0 | -90.5 | -26.5 | |

| SOFR M5/M6 | -41.5 | -39.5 | 2.0 | |

| SOFR M6/M7 | -12.5 | -9.0 | 3.5 | |

| EUR | 106.93 | 107.64 | 0.71 | |

| CRUDE (CLM4) | 83.85 | 78.11 | -5.74 | |

| SPX | 5099.96 | 5127.79 | 27.83 | 0.5% |

| VIX | 15.03 | 13.49 | -1.54 | |

https://twitter.com/JaguarAnalytics/status/1785905153054224854

https://blinks.bloomberg.com/news/stories/SCUYN7T1UM0W

Employment

May 3, 2024

*************

–Payrolls today expected 240k with Unemployment rate of 3.8%. Yields eased yesterday apart from the 30y bond. Twos -6.2 bps to 4.875%, tens -2.4 bps to 4.567% and bonds up just slightly at 4.717%. AAPL had a nice pop post earnings, apparently on buy back plans.

–Open interest in treasury futures up 1% or more as yields pulled back yesterday. An all clear to be long? Maybe, but if ‘term premium’ fears re-emerge there’s going to be that much more to puke. FV open int +69k to 6.085m, TY +58k to 4.457m, UXY +39k to 2.117m. US +13k to 1.588m. A lower than expected payroll number will likely bull steepen the curve, and positioning appears biased for that outcome.

–New buyer of 50k SFRH5 9625/9725cs for 5.5 to 6.0, settled 6.0 vs 9530. They’ve loaded up long SFRZ4 9600/9700 call spreads and are now pushing a bit further out the curve.

–August FF (FFQ4) settled 9476 or 5.24% against current EFFR or 5.33%. About 35% chance of a 25 bp ease at either the June 12 or July 31 FOMCs.

–No missive this weekend.

Relief that Powell wasn’t more hawkish

May 2, 2024

*************

–Yields fell as Powell’s press conference progressed. The FOMC statement cited a “lack of further progress toward the Committee’s 2 pct inflation objective.” However, balance sheet run-off was trimmed from $60b per month of treasuries to $25b, more than expected, while MBS remains at $35b. Powell sought to characterize the QT slowdown as a step to prevent repo rates from experiencing a surge, but the market apparently took it as a step toward ease. On the SOFR curve, SFRU4 +4, U5 +13.5, U6 +11.5 and U7 +10.0 (9483.5, 9558, 9589.5, 9598.5, with U7 being the peak price on the strip). In treasuries, 2’s rejected the pop over 5%, falling 10.4 bps to 4.937% while tens fell 9.1 to 4.591%.

–Powell described current policy as restrictive / weighing on demand. Rate futures slightly lower this morning.

–Buyer yesterday (adding) 50k SFRZ5 9475/9425/9375p fly for 5.0. Only -0.02 delta. Same in U5 settled 4.5 (was 4.5/5.0). Same in M5 and H5 settled 5.0. No benefit from roll. Also a short cover of SFRU4 9462.5p, paying 4.75 to 5.0 before the Fed. Open int fell 38k, settled 4.0.

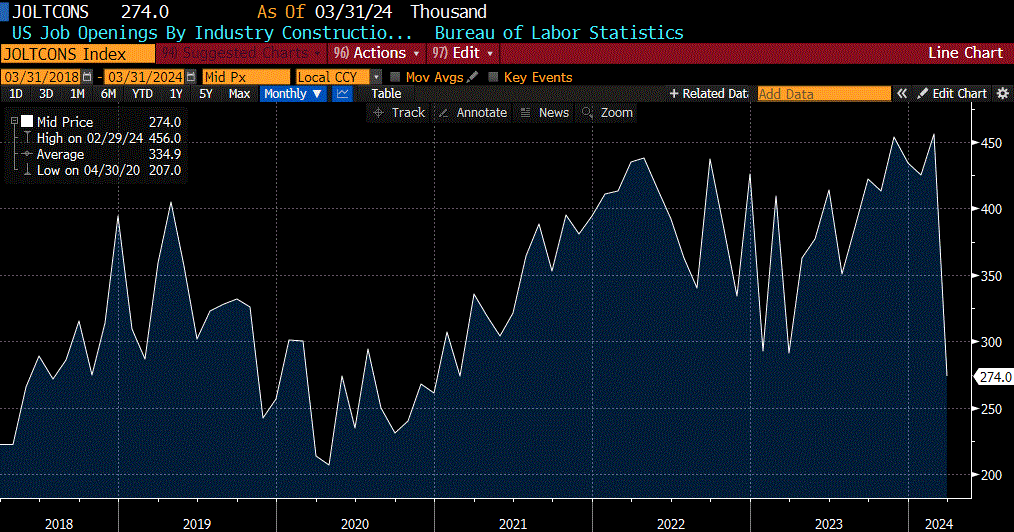

–ADP yesterday was slightly higher than expected at 192k. JOLTs only 8488 vs expected 8680 (chart of Construction Job Openings attached). ISM Mfg 49.2 while prices paid soared to 60.9 from 55.4 expected. New Orders 49.1 vs 51 exp. The other chart is pct change from year ago Federal Tax Receipts. When this goes negative, as it is now, we’re in recession. Treasury’s refunding announcement revealed more than expected issuance of about $40b on the quarter due to less than expected taxes. So the Fed is shaving supply by $35 billion a month while treasury adds about $13b per month ($13b more than expected).

–Japan intervened, likely adding some weight on treasuries. Today’s news includes Jobless Claims and Factory Orders. NFP tomorrow expected 243k. AAPL reports today; the stock has been in a steady slide since February.

% chg year over year tax receipts above

CONSTRUCTION JOB OPENINGS below

Lighten up on risk

May 1, 2024

*************

–Full day. Treasury announces debt issuance composition at 8:30 EST. (Recall that Nov 1 was a surprise shift favoring t-bills, which helped long coupons rally in price). ADP, and JOLTs give clues on the labor market. ISM Mfg expected 50.1 from 50.3. Then the FOMC/ press conference.

–Yesterday the market reacted to a surprise ECI of 1.2% (expected 1.0). Yields higher, with 2’s at a new high for the year 5.041% (+4.1 bps) and everything else pressing against recent highs. Tens ended up 7 bps at 4.682%. Other data indicating economic malaise didn’t help to support fixed income. Consumer Confidence tanked to 97, lowest since covid, expected 104. Chgo PMI just 37.9 vs expected 45.0.

–In 1987 bond yields kept climbing while stocks blithely danced to new highs. Then came Black Monday with a single day drop of 22% in the Dow. Couldn’t happen now. It’s not Monday.

–On the SOFR strip slight new lows in reds to deferred, however, 2/10 at -36 and 5/30 at +7 bps are both holding sideways ranges. Concern about Powell leaning hawkish, but we already know that. SFRZ4 settled 9494 or 5.06%, down 7.5 bps on the day. That’s just 27 bps lower than the current EFFR of 5.33%, so the market is pricing only about one ease going into year end. Of course, the other policy tweak to consider is the slowdown in QT with expectations that MBS will still be reduced $35b per month, but treasuries shaved to $30b from $60b.

–USD continues to strengthen which creates tight GLOBAL financial conditions. DXY is near the high of the year. (Anti-dollar) bitcoin is free-falling to 57k this morning from 75k in mid-March.

Tempering speculative froth

April 30, 2024

***************

–Cocoa slumped yesterday and is lower today: “Cocoa extended a slump in London and New York, dropping 26% over the past two days, following a record-breaking rally.” (BBG)

Sign of a broader speculative unwind? Other commodities are also falling, with gold down over $30 this morning. Copper down a bit as well, though yesterday it posted a new recent high 4.6765 (HGN4) which is up about 26% from early February’s level of 3.70, said to be supported by China stockpiling.

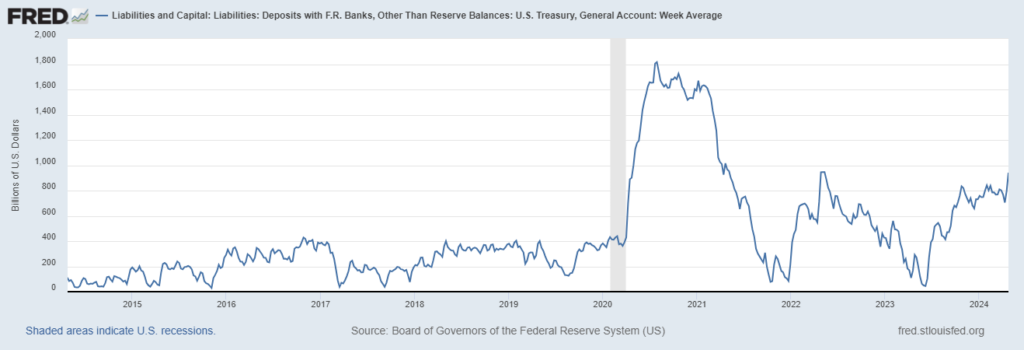

–Rate futures were fairly quiet with yields easing across the board. Ten year down 5.7 bps to 4.612%. At the time of futures settlement, the Treasury released its borrowing estimate for the April-June quarter, which was higher than expected $243 billion (vs $202b). Composition of issuance will be released on Wednesday morning. Tax receipts and borrowing are padding the Treasury Gen’l Account which is back up to $941 billion [chart], essentially matching the last peak in May 2022 of $945b. This provides dry tinder for Fed’l Gov’t objectives, like winning re-election. Fortunately the administration has enlisted the help of Only Fans creators to shower with TGA funds and steer the political narrative. It’s like a Seinfeld episode.

https://www.zerohedge.com/political/do-not-disclose-ad-onlyfans-creator-says-biden-admin-paid-full-political-propaganda

–$/yen holding around 156.60, having been turned away from the surge to 160 yesterday. AMZN and MCD report today.

What’s it going to look like in 2025?

April 28. 2024 – Weekly Comment

************************************

In the past week or so I saw two articles referencing potential moves by a new Trump administration that would impact financial markets.

This one’s from the Wall Street Journal a few days ago:

And this one is from Politico on April 15

There was also an interesting article on Politico about Susie Wiles. I had never heard of her, but she is apparently one of Trump’s closest advisors and a master at using her massive trove of press connections to keep campaigns on message and shape the narrative.

https://www.politico.com/news/magazine/2024/04/26/susie-wiles-trump-desantis-profile-00149654

It’s not that I believe press headlines; these days I don’t believe anything unless it hits the pnl. However, if you were charged with running a campaign to juice the price of gold, these would be valuable press insertions. Equally helpful if the goal was to cause bond yields to soar. Of course, Trump did say that he wouldn’t reappoint Powell. I would also add that the Biden administration is doing as much as it can for the ‘gold bid/bond offer’ equation, for example by allowing the seizure of Russian assets to aid Ukraine.

Despite these factors, gold fell 2.3% last week, and wheat rallied, so the wheat-priced-in-gold historic low that I flagged last week had a nice pop.

This should be an important week with the Quarterly Refunding Announcement, FOMC meeting on Wednesday and NFP Friday. I don’t have a strong opinion on QRA; I would only note that the November 1 announcement which shifted issuance to bills over coupons helped spark a dramatic fall in long-end yields. For example, the 30y fell from 4.93% on Oct 31 to 3.80% on Dec 27. I doubt that happens again. The FOMC will hold rates steady as other financial conditions tighten (long rates up, USD up. $/yen has rallied 12% this year to a new high 158.33). Payrolls expected 250k from 303k last.

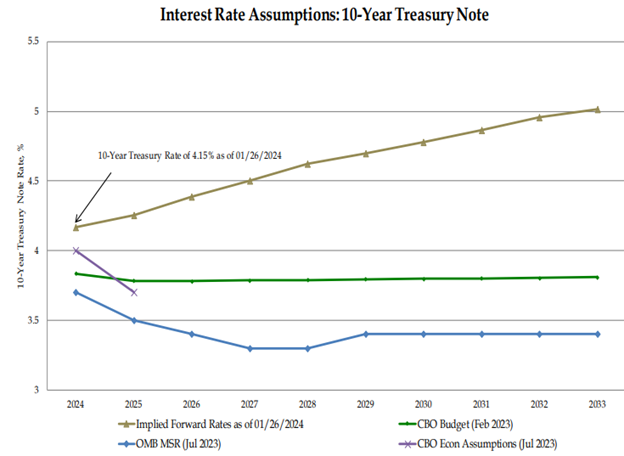

Here’s a fun chart that shows our government at work (from page 13 of last quarter’s Treasury presentation on debt). OMB and CBO completely disregard market prices in their 10y ‘estimates’.

https://home.treasury.gov/system/files/221/TreasuryPresentationToTBACQ12024.pdf

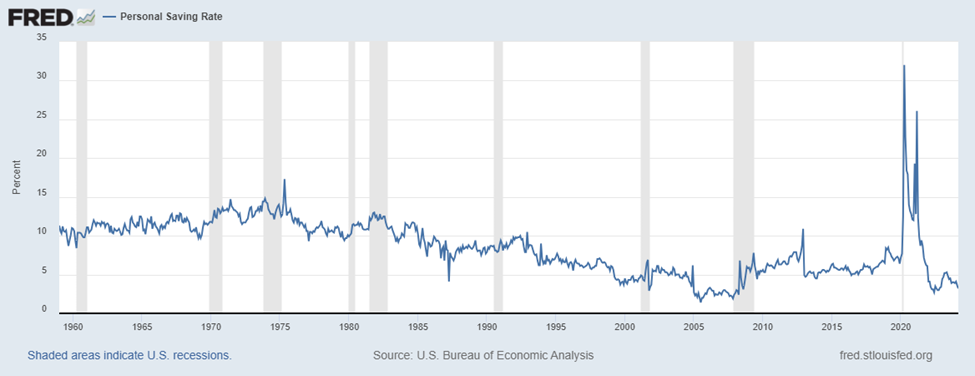

Below is another somewhat interesting chart that shows the US savings rate. Even with t-bills north of 5% the current savings rate is just 3.2%. For historical perspective, in July 2005 it hit 1.4%. Since late 2008 the lowest level is June 2022 at 2.7%. Is a low savings rate a reflection of buy-now to beat further price increases? Or just a sign of stressed households?

One other interesting note from BofA’s Hartnett: The top ten stocks are a record 34% of S+P market cap.

A FEW NOTES ABOUT SOFR OPTIONS

Although short end contracts sold off this week, there is consistent buying of SFRU4 9600 calls and SFRZ4 9600/9700cs. SFRU4 settled 9484.5, down 4.5 on the week, and the 9600c settled 3.75 with 291k of open interest, the most of any Sept call. SFRZ4 settled 9500.0 and the 9600/9700cs settled 5.25 (8.75/3.50) with open interest 334k and 363k, easily the most open interest of any Dec calls. The only SOFR calls with more OI are M4 9500c 2.0s with 393k and 9550c 1.0s with 458k. On the put side, the bulk of positions are in M4 9487.5 to 9462.5 which all have over 300k, based on various spreads to peg final settlement.

Demand for insurance continues to be weighted toward lower rates ensuing from an economic or financial ‘accident’. With SFRZ4 settling exactly at 9500 or 5%, the 9450p, which is only 17 bps away from the current Fed Effective of 5.33% settled 8.0 (-0.22d). The equidistant 9550c settled 6.5 bps higher at 14.5 (+0.28d). 9600c which is twice as far away as the put settled 8.75 (+0.16d), 0.75 more than the put. Sure, there have been various plays made for a Fed hike, but that is definitely not the fear in the market.

| 4/19/2024 | 4/26/2024 | chg | ||

| UST 2Y | 495.0 | 499.8 | 4.8 | |

| UST 5Y | 464.8 | 469.1 | 4.3 | |

| UST 10Y | 461.2 | 466.9 | 5.7 | |

| UST 30Y | 470.9 | 478.1 | 7.2 | |

| GERM 2Y | 300.0 | 298.8 | -1.2 | |

| GERM 10Y | 250.0 | 257.5 | 7.5 | |

| JPN 20Y | 160.1 | 165.0 | 4.9 | |

| CHINA 10Y | 225.6 | 230.6 | 5.0 | |

| SOFR M4/M5 | -68.0 | -64.0 | 4.0 | |

| SOFR M5/M6 | -39.5 | -41.5 | -2.0 | |

| SOFR M6/M7 | -13.0 | -12.5 | 0.5 | |

| EUR | 106.55 | 106.93 | 0.38 | |

| CRUDE (CLM4) | 82.22 | 83.85 | 1.63 | |

| SPX | 4967.23 | 5099.96 | 132.73 | 2.7% |

| VIX | 18.71 | 15.03 | -3.68 | |

5% 2-year and SFRZ4

April 26, 2024

***************

–Bank of Japan sat on their hands and now $/yen is above 156

–US PCE prices out today, m/m headline and Core both expected 0.3 from 0.3 last. Yoy expected 2.6 from 2.5 last and Core 2.7 from 2.8. Yesterday’s higher than expected core price deflator in the GDP data, at 3.7%, sent yields higher, with tens +5.2 bps to 4.704% and thirties +3.6 to 4.818%. Twos ended at 4.995%.

–New highs in near SOFR calendars as the easing goalposts are moved further away. SFRM4/SFRU4 settled -13.5 (9471/9484.5). Last month this spread was below -30. SFRM4/SFRM5 settled -64, up 6.5 on the day (9471/9535). SFRH5, M5, U5 were weakest contracts on the strip, settling -9. Despite the sell-off, there is consistent accumulation of calls: SFRU4 9600c added about 20k, 4.0 paid, settled 3.75 vs 9484.5. SFRZ4 9600/9700 cs 5.5 to 5.75 paid for 25k, settled 5.25 vs 9500.5 (4.995%,same as 2y). In SFRZ4 calls, these two strikes have the most open interest at 320k and 348k. 100 bps out of the money with 232 days until expiry. SFRZ4 futures have the most open interest on the strip, at 1,187,636.

–Stocks surged on MSFT and GOOGL results, more than reversing the early tumble associated with inflation worries.

–CME introducing new credit products. Is the timing terrible (because there’s no such thing as a credit spread anymore) or is the timing perfect, like just before covid? In any case, it’s a welcome development given the lack of a credit component in SOFR as opposed to the discontinued euro$ contract.

It’ll NEVER happen

April 25, 2024

***************

–It used to be a regular question: “What’s the lowest strike call I can buy for 0.25 on the near euro$ contract?” Yesterday someone paid 0.25 for 30k SFRK4 9675c. That’s over 200 bps away with 15 days until expiration (SFRM4 settled 9473.5). Might as well be on a euro$ because it’s a fantasy trade. On the other hand, if this strike starts to make the shorts nervous, then we ALL have to be scared shitless about the state of the world. On a much more mundane level, buyer of 25k SFRU4 9600c 4.25 to 4.5 (4.25s vs 9490.5) and buyer of 12k SFRZ4 9600/9700cs for 6.0, which is where it settled vs 9508.5.

–Speaking of large moves, META took a dump on earnings, down 15% after hours, an evaporation of $180 billion or so in market cap. MSFT and GOOGL today.

–Rates were up yesterday as the market digested the five-yr auction; 7s today. Ten year yield up 5.6 bps to 4.652%. The ten-yr tip ended at 2.24%, a pretty juicy real yield. Of course, part of the return comes from CPI, which means you’re at the mercy of a disgruntled employee working in the basement of the BLS with a red swingline stapler (and a large data base). One day he’s working on payroll number revisions (see below), and the next day on CPI. Last October the high yield on 10y tip was around 2.5%. On the SOFR strip reds were down 4.5 and greens -5.375.

–Aside from the 7yr, Q1 GDP is released. Yesterday’s Atlanta Fed GDP Now was 2.7% while the NY Fed”s Nowcast is 2.23%. Expected 2.3 to 2.5%. Jobless Claims expected 212k, as the needle seems to be stuck there, no matter how many companies announce layoffs. BOJ announcement tonight. PCE prices tomorrow.

–Here’s a link to revisions in payrolls, released yesterday (thanks HB)

From June 2023 to September 2023, gross job losses from closing and contracting private-sector establishments were 7.8 million, a decrease of 37,000 jobs from the previous quarter, the U.S. Bureau of Labor Statistics reported today.

https://www.bls.gov/news.release/cewbd.nr0.htm\

–And here’s an interesting tweet linking yen weakness to the property crash in China, (preceded by a butterfly flapping its wings in Santa Fe, NM).

And here’s a bonus clip

PMI soft

April 24, 2024

***************

–PMI Mfg was 49.9 vs an expected 52.0 and Composite was 50.9 vs 52.0. Yields fell as a result. Tens ended down 2 bps at 4.596%. Strongest SOFR contracts were SFRM5 and U5, both up 6 at 9548.5 and 9563.5. Solid 2y auction. Fives today. Sevens tomorrow. PCE prices are Friday. Next week includes FOMC, Quarterly Refunding Announcement and Payrolls.

–SFRZ4 settled 9511 (+4.5) or 4.89% vs 5.33 Fed Effective. 1.5 to 2 eases priced. SOFR calendars just slightly further back are all around 3/4%. SFRM4/M5 settled -74 (lowest). SFRU4/U4 -71.5. FFQ4/Q5 -74.5. The market is currently comfortable around these levels

–From S&P global : “April saw an overall reduction in new orders for the first time in six months. Companies responded by scaling back employment for the first time in almost four years, with business confidence also waning to the lowest since last November.”

–Indonesia hiked 25 bps to 6.25% which was unexpected, though all Asian currencies have been pressured against USD. $/yen remains pinned close to 155 on the eve of the BOJ meeting.

“This hike in interest rates is to strengthen the stability of the rupiah exchange rate against the risk of worsening global risks,” BI Governor Perry Warjiyo told a briefing.

–TSLA soared after its earnings call, squeezing shorts. META today.

Quiet start to the week (but you never know when something’s gonna blow up)

April 23, 2024

***************

–TSLA reports today. Quiet day in rates to start the week, but a couple of interesting disaster insurance trades.

Buyer of 30k SFRK4 9650c for 0.5. These expire on 10-May, SFRM4 underlying (9473.5). Settled 0.25

Buyer of 2500 SFRZ4 100c for 0.25 vs 9503, 5d. Zero strike? This guy must have misread the dotplot. Never! Right?

Buyer of 0QU5 9600/9650cs cov 9559.0, 10d vs Sold 2QU5 9625/9662.5cs 9625c

So front cs settled 9.5 and back 8.0. Premium paid was 2.0. Only traded 2k, but this is a nice way to fade weakness in reds that has helped U5/U6 invert from flat to -28 since February. 50 wide call spread vs 37.5, so if both contracts explode higher through upper strikes it’s still a winner. Traded just 2k. NOT A RECOMMENDATION.

SFRU5 settled 9557.5 so lower strike is 42.5 out-of-money. SFRU6 settled 9585.5 so 39.5 out.

–New Home Sales and 2y auction today.

–META and CME report tomorrow.