Vol deflation (though not yet apparent in ice cream)

May 16, 2024

**************

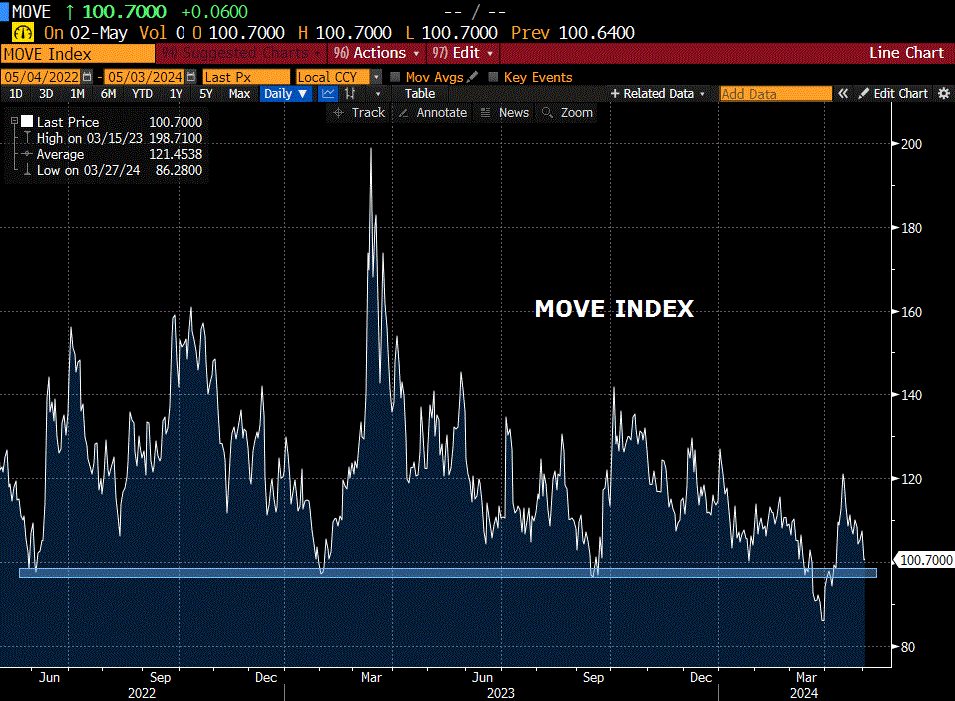

–Implied vol was hammered as CPI eased to 3.4% yoy with Core 3.6%. Retail Sales 0.0% on the month. As yields plunged, calls on treasuries underperformed. Attached chart is 1-month TY vol, about as low as it has been since the hiking cycle started. Ten-year yield fell 9 bps to 4.354%. TYN4 atm 110^ settled 1’42 vs 110-00s, on Tuesday the atm 109.5^ was 1’55. On Tuesday with TYU4 109-115, the 19 delta TYN 111.5c settled 16. Yesterday with futures up 20.5/32s or 41/64s, that same call settled 20. According to the delta it should have been (41*.19) or up about 8/64’s rather than 4 (ignoring gamma). Vol hit across curve, including SOFR. Near SOFR calendar spreads became more inverted as easing pulled forward. SFRM4/M5 plunged 12 to -100 (9470.25 unch’d/9570.5 +12).

–The market has taken the CPI report as an “all-clear” running stocks to new highs as the last big piece of news for the month is now in the rearview mirror. Today’s news includes Philly Fed Mfg, Housing Starts, Jobless Claims, Ind Production. Japan’s Q1 GDP fell 2% annualized, worse than expected. Powell gives a commencement address on Sunday.

–Is it really all clear? FT has the following story: Starwood taps credit line as investors pull money due to concerns over RE valuations. A week ago Starwood CEO Sternlicht warned that regional banks are going to start failing like dominoes…

Starwood’s $10bn property fund taps credit line as investors pull money

Heavy redemption requests come as fears rise over real estate valuations

From a May 7 interview with Barry Sternlicht, CEO of Starwood

“I think people are looking for these cracks, and you’re going to see the crack develop now,” Sternlicht said. “You’re going to see a regional bank fail every day…or every week, maybe two a week.”

CLASSIC representation of consumer indignation (I’m certainly not going to be the one to tell this little girl that the economy is great):

https://twitter.com/GhostofWhitman/status/1790584373072236750

Squeezy

May 15, 2024

***************

–Copper continues to scream higher, now over $5. Chart at bottom, but here’s a chart of the July/Sept calendar spread. There’s plenty of nervous excitement about short squeezes in GME and AMC, but less so about a critical input to energy infrastructure which is in supply deficit (according to Druckenmiller, Gromen, etc). Doesn’t particularly bode well for forward inflation, but that’s a story for the future, not today’s CPI.

–Yields eased yesterday despite higher than expected PPI data, though previous data was revised significantly lower. M/M was +0.5% both headline and Core but previous months were revised down to -0.1 from +0.2. Data releases appear to be a bit more volatile recently. Rate futures spiked lower on the initial release, but then popped right back up. At the end of the day yields were lower, with tens -3.8 bps to 4.443%. Star performer on the SOFR strip was SFRZ5, +6 on the day to 9589.0 or 4.11%. SFRZ4/Z5 thus made a new recent low of -77.5 (9511.5/9589). The most inverted one-year calendar remains the front SFRM4/M5 at -89.0 (9469.5/9558.5). In February the front (most-inverted) spread was -150 to -160.

–Powell’s comments accentuated the inversion: from BBG bullet points, “It’s a question of keeping policy at the current rate for longer. Time will tell if we are sufficiently restrictive.” There was also a financial stability warning: LENDING ACTIVITIES BY NONBANKS ARE GROWING VERY, VERY FAST… WE NEED TO MONITOR THAT VERY CAREFULLY, WE WORRY ABOUT THAT FAST GROWTH… MAKES YOU WONDER IF THERE ARE FINANCIAL STABILITY CONCERNS THERE.

–After Powell admitted the miss on SVB, one has to think these comments would lead to heightened surveillance on shadow banking at a time when many companies are facing debt roll-overs with onerous rates. The NY Fed’s Household survey indicated increased delinquencies. Rates which remain relatively high into the future reduce the present value of future earnings and maintain pressure on companies (and households) that need to roll debt.

–CPI today expected 0.4 from 0.4 with Core 0.3 from 0.4

yoy 3.4 from 3.5 and Core 3.6 from 3.8

Retail Sales expected 0.4% from 0.7%

Labor mandate

May 14, 2024

**************

–Looks like Roaring Kitty has gotten involved in the copper market; HGN4 is 4.83 this morning, which is up about 25% since March. Of course GME was up 74% yesterday alone.

–NFIB Small Business Optimism today, was in the dirt last time at 85.5, now expected 85.2. Indeed, the job search/placement company is laying off 1000, or 8% of the workforce. What else do you need to know? Fed switching to the labor side of the dual mandate? Indeed.

–PPI expected 0.3 from 0.2 with Core 0.2 from 0.2. Yoy expected 2.2 from 2.1 with Core 2.3 from 2.4. The NY Fed releases its Household Debt and Credit report at 11:00am. The headlines will blare NEW ALL-TIME HIGHS in credit card debt (it was $1.338T in the last Consumer Credit report to end Q1). This report includes data on delinquencies, which are also marching higher.

–Yields fell slightly yesterday, with tens down 2.3 to 4.48%. On the SOFR strip reds through golds +1 to +3. 2/10 treasury spread at a slight new low -37.4. Late Friday there were large purchases of July FV and TY puts that were 50+ bps otm. Yesterday there was a little more of that sort of trade. However, I am just highlighting a few upside plays: +40k 2QM4 9650/9656.25 c spd for 0.625. It doesn’t look that way on the Open Interest sheets, looks more like 20k. In any case, this is an add or roll down as there were already about 60k 2QM 9656.25/9662.5cs recently bought. Settles: 9650c 2.5, 9656c 2.0, 9662c 1.5. Underlying SFRM6 settled 9598.5, so this trade targets 50-60 bps of upside with about 1 month until expiry. Interestingly, there was also a much longer dated play on the long end of the maturity spectrum: December TLT 102c were blocked 75k yesterday, said to be a buyer, not sure of price but around 1.07. The last time TLT was 102 the long bond yield was around 3.90%, so this is another 60-70 bp otm trade. Finally, an add of +14k SFRZ4 9600/9700cs for 5.5. Settled 5.25 ref 9509.5.

–Evidence of a consumer-led slowdown appears to be piling up. No matter how much gov’t supported funding there is for AI data centers (which likely displaces workers) the core of the economy is cooling. The administration’s response necessarily is to buy votes. The Fed might lean against more gov’t spending gimmicks, but I wouldn’t count out an ease next month (which obviously is NOT being priced, FFN4 settled 9469 or 5.31 vs current EFFR of 5.33).

PPI and CPI this week

May 13, 2024

**************

–Tomorrow we get NFIB small business optimism, PPI and the NY Fed’s Household finance report. All likely to indicate economic malaise. NFIB has been sinking like a stone. One month ago, on April 12, CLM4 was 85.08. Currently it’s 78.40, down nearly 8%. Two months ago on March 13 it was 78.84 about where it is now. Many indicators suggest that lower-end US consumers are struggling, which will likely be reflected in the NY Fed report. CPI on Wednesday.

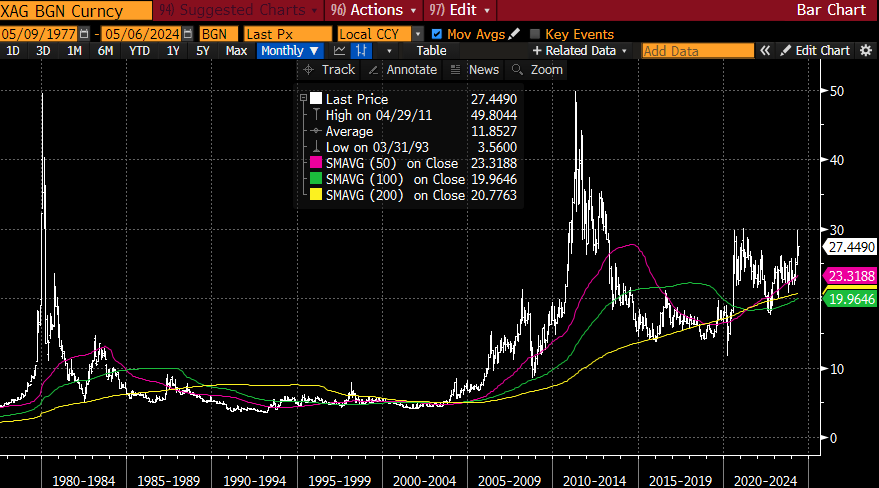

–This morning gold and silver are pulling back from Friday’s rally, but copper is powering higher, now over 4.71. At the start of March it was around 3.87. There’s a lot of press about China buying gold. Copper too? Or is that just a US power generation story? China is selling $138 billion of sovereign long-dated bonds, with a 30-yr tranche on Friday. Selling bonds, buying gold and base metals; the key to global finance.

–US treasuries little changed this morning, edging slightly higher. Late Friday there were large buys of otm puts in TY and FV:

TYN4 105.5p 6 paid for 35k, settled 7

TYN4 104.5p 3 paid for 35k, settled 4

(TYU4 settled 108-305 ref 10y year 4.644%. One point in TY futures is 15-16 bps, so 3.5 points, the 105.5 strike, is around 50 bps away.

FVN4 104.0p 6.5 paid for 35k, settled 6.5

FVN4 103.25p 3 paid for 45k, settled 3.0

FVU4 settled 105-3025 ref 5y at 4.516%. One point in FV futures is 23-24 bps, so 2 points to the 104 strike is also around 50 bps away.

The Hard Part

May 12, 2024 – Weekly Comment

***********************************

“See, you know how to TAKE the reservation. You just don’t know how to HOLD the reservation. And that’s really the most important part of the reservation: the HOLDING.”

“The easy part of private credit is lending money. The harder part is getting it back.”

The first quote is from a Seinfeld episode where the car rental desk does NOT have the midsize which Jerry reserved. The second is from James Morrow of Callodine Capital, cited in an April 18 BBG article and again by Danielle DiMartino Booth in a Blockworks podcast this week. DDB also said this: “Traditional banks are now expediting price discovery [writing down asset values] when it’s incumbent on private equity and private credit to slow the process of price discovery.” She implies that there are a lot of dodgy assets on private equity books that are tucked in dark corners (with fingers crossed for rate cuts). I happen to have first-hand experience with this dynamic. I worked at Refco when it went public. I bought shares in the IPO; as much as I thought was prudent. The CFO assured me I was thinking too small, that Refco was on a path to go head-to-head with the CME. I knew guys that took out second mortgages for this deal. Then, as the stock was climbing, a non-performing, or actually, a non-existent asset was discovered (un-discovered?) on the books. I think it was an uncollectable debt related to the previous blow-up of a famous trader. Fraud. And that, as they say, was all she wrote. Stock went to zero. CEO went to jail. That was in 2005.

They don’t let that happen any more.

If it’s private, you can value it wherever you like. Tough for the end investors to really know. There was a May 7 article by Business Insider for example, saying that Blackstone’s BREIT is not generating the cash flow out of operations with which to pay investors. It’s a pretty harsh accusation: From the article: “Craig McCann, a financial analyst who served as an economist at the Securities Exchange Commission, wrote last year. ‘Investors should not accept anything Blackstone and BREIT state as truthful.’ ” But BX isn’t anywhere near zero. It’s only about 6% away from the year’s high.

I’m not saying these things are true or untrue. But we’ve all seen situations unravel in a hurry. Everyone knows that, but now thinks the Fed will always be there. Bullshit.

Last week I cited the SBUX earnings call as a dead canary regarding the consumer. This week ‘Goldman warns consumers are cracking’ (ZH). McDonalds is vowing to bring back value. Whole Foods is “…expanding its generic brands to offer more affordable options and minimize the impact of inflation.”

In April, Consumer Confidence sank to the year’s low of 97.0 from 103.1 in March. On Friday, U of Mich Consumer Sentiment plunged to 67.4 from 77.2. On Tuesday we get NFIB Small Business Optimism, which was 88.5 last, below the COVID low. Last time it was here was 2012. Also on Tuesday is the Q1 NY Fed Report on Household Debt and Credit. This report is released at 11:00 am, but there’s a press call at 9:30, so someone will have the details before the 11:00 am release. (if not already)

NFIB is tracking the path going into the GFC (in a downtrend from 2005 to the beginning of 2009). Note that the last Fed hiking cycle of similar magnitude ended in June 2006. FFs remained at 5.25% for 15 months, until Sept 2007. In the current cycle, the last hike was in July 2023. Fifteen months puts us just before the election. This weekend Bowman said she doesn’t see the need for cuts this year. Logan said it’s too early to think about cutting and even Kashkari says the FF rate should stay high for an extended period. (I would note that in the Greenspan years, Fed Funds stayed between 5% and 6% from the start of 1995 to the end of 1998, nearly 4 years). Last week’s SLOOS indicated generally tighter credit conditions. While many analysts are complaining that financial conditions are becoming too loose and will re-ignite inflation, I think those fears are overblown. Long-end yields are still being pressured higher by the fiscal situation. Deterioration in consumer finances will keep the Fed on track to ease short rates. The curve should become less inverted.

Along with NFIB, and the NY Fed report, PPI is released on Tuesday. Then on Wednesday, CPI and Retail Sales. CPI expected 0.4 with Core 0.3. Yoy expected 3.4 from 3.5 with Core 3.6 from 3.8.

OTHER THOUGHTS

Overall it was a quiet week. Curve became slightly more inverted. The two year rose 6.5 bps to 4.866%. Tens rose 1.5 bps to 4.644%. On the SOFR strip SFRU5 was weakest, settling -10 at 9569, while three years forward, SFRU8 was only down half a bp at 9604.5.

Somewhat interesting were large (new) out-of-the-money put buys in treasuries Friday, right around the time of futures settlements:

TYN4 105.5p 6 paid for 35k, settled 7

TYN4 104.5p 3 paid for 35k, settled 4

(TYU4 settled 108-305 ref 10y year 4.644%. One point in TY futures is 15-16 bps, so 3.5 points, the 105.5 strike, is around 50 bps away.

FVN4 104.0p 6.5 paid for 35k, settled 6.5

FVN4 103.25p 3 paid for 45k, settled 3.0

FVU4 settled 105-3025 ref 5y at 4.516%. One point in FV futures is 23-24 bps, so 2 points to the 104 strike is also around 50 bps away.

There are some short end trades going on like buys of SFRM4 9475/9500c 1×2 for 0.5 (settled 0.25, 2.25/1.0) and SFRU4 9500/9550c 1×2 (also settled 0.25, 9.25/4.5). Much better to pay up rather than have the open-ended risk to the upside.

| 5/3/2024 | 5/10/2024 | chg | ||

| UST 2Y | 480.1 | 486.6 | 6.5 | |

| UST 5Y | 447.8 | 451.6 | 3.8 | |

| UST 10Y | 448.7 | 450.2 | 1.5 | |

| UST 30Y | 465.7 | 464.4 | -1.3 | |

| GERM 2Y | 292.4 | 296.7 | 4.3 | |

| GERM 10Y | 249.5 | 251.7 | 2.2 | |

| JPN 20Y | 168.3 | 169.2 | 0.9 | |

| CHINA 10Y | 231.5 | 232.0 | 0.5 | |

| SOFR M4/M5 | -90.5 | -82.5 | 8.0 | |

| SOFR M5/M6 | -39.5 | -43.0 | -3.5 | |

| SOFR M6/M7 | -9.0 | -12.5 | -3.5 | |

| EUR | 107.64 | 107.72 | 0.08 | |

| CRUDE (CLN4) | 77.76 | 77.84 | 0.08 | |

| SPX | 5127.79 | 5222.68 | 94.89 | 1.9% |

| VIX | 13.49 | 12.55 | -0.94 | |

https://www.youtube.com/watch?v=4T2GmGSNvaM

https://blinks.bloomberg.com/news/stories/SD3ZUUCGBL6O

Power Play

May 10, 2024

***************

–Market trades as if the liquidity spigots are wide open. Buy everything.

–Druckenmiller suggested a supply shortage in copper…this morning copper futures have exploded to a new high with HGN4 4.74. Gold and silver also bid. Attached is a chart of Dow Jones Utilities, powering higher, due apparently to an insatiable demand for electricity. Utilities are correlated with bonds, and the long bond yield has dropped 20 bps since April 25, from 4.81% to 4.60%. What’s driving what? PPI and CPI next week, Tuesday and Wednesday.

–Seemed like a light volume day yesterday, but there were quite a few bullish option plays on rate futures. Five year yield fell just over 4 bps yesterday to 4.458%, leading the decline in yields. FVM was +6 to 105-267. Open interest surged 64k to 6.15 million. I think that might be a record. Again, volume was quite low.

–On May 1, TYU4 settled 108-115

TYN4 109.5c 0’39s

TYN4 107.0p 0’35s so 4 to the call

Yesterday, TYU4 was almost exactly one point higher at 109-11

shifting strikes one point higher:

TYN4 110.5c 0’30s

TYN4 108.0p 0’26s

Still 4 to the call, though lower vols.

A lot of bullish rate plays. Solid 30 yr auction.

SOFR:

SFRZ4 9468/9443ps cov 9511.5, -27k 3.0

SFRU4 9493/9512/9525/9543c cond 2.75 to 2.875 paid 25k

SFRU5 9550/9650cs 39.0 paid 10k

SFRZ4 9550/9650cs cov 9515.5, 10.75 paid 5k

Early:

TYN 11.5c and 112c 23k bot each, 13 and 9

TYM 108.75/109.75 rr cov 109-01, 59d 0 to 1 paid call 20k

FVM 106.5/107cs 4.5 to 5.25 paid 25k (6s, new)

TYN 108/09/10 c fly 12 paid 10k

Binary outcomes

May 9, 2024

*************

–Quiet session with slightly higher yields, likely due to treasury auctions. Current 10y rose 3 bps to 4.49%. Auction tailed by 1 bp (4.483%). Thirties today. Late WI was 4.637%

–SOFR strip from SFRM5 to SFRM9 down 3 to 4.5. One large option play is an add, +60k 2QM4 9656.25/9662.5cs for 0.625 (synth). SFRM6 is underlying contract, settled 9598.5. nearly 60 otm with 36 dte. Also a buyer of 10k SFRU4 9700c for 1.75, settled 1.5 vs 9488. So that’s 212 away. On the downside the 9456.25p settled 1.5, 32 away. On the upside, risks of massive military escalation, domestic terrorism, political dysfunction, bank failures, mass hysteria, cats sleeping with dogs. Biblical stuff. On the downside, Fed might hike. What’s the more comfortable short?

–Atlanta Fed’s GDP Now estimated yesterday at 4.2% for Q2. However, a lot of data is starting to cast shade on consumer strength. Perhaps next week’s NY Fed Q1 Household Debt and Credit report will help shed some light on the fundamentals.

NEW YORK—The Federal Reserve Bank of New York will release its Q1 2024 Household Debt and Credit Report on Tuesday, May 14 at 11:00 AM.

Anecdotal Evidence of Struggling Consumers

May 8, 2024

*************

–Quiet market Tuesday with a bias toward flatter (more inverted) curve. 2y yield essentially unchanged while the 30y fell 4 bps to 4.604% as the US Treasury auctions 10s today and 30s on Thursday. New recent low in SFRU4/U5 one-yr calendar at -88 (9489/9577). June/June is -89 (most inverted), Sept/Sept -88 and Dec/Dec -76.5. I.e. roughly 3 to 4 eases in a given year.

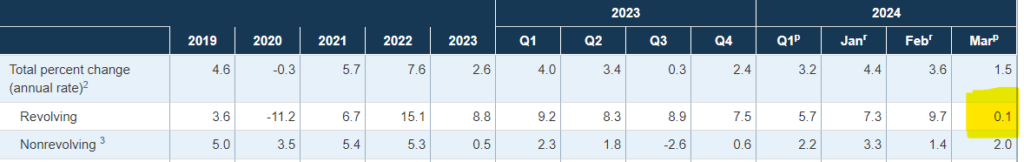

–Consumer Credit for March was much lower than expected at just $6.27B, vs $15b expected. Table below shows the dramatic plunge in revolving growth: from 9.7% in Feb to 0.1% in March.

From the report:

“Consumer credit increased at a seasonally adjusted annual rate of 3.2 percent during the first quarter. Revolving credit increased at an annual rate of 5.7 percent, while nonrevolving credit increased at an annual rate of 2.2 percent. In March, consumer credit increased at an annual rate of 1.5 percent.”

–It appears as though cracks in consumer spending are growing. As mentioned over the weekend, SBUX CEO complained about deterioration in the “occasional customer”. The stock immediately plunged 15% and edged to a new low yesterday. Disney reported yesterday. RTRS cited a drop in traditional TV and weaker box office. BBG cited “tepid outlook for growth in streaming”. Stock closed -9.5%. Does a tapped out middle-to-low end consumer represent a threat to stocks in general? Perhaps just anecdotal evidence…for now. But there’s also a chance that the administration’s “buy [votes] now, pay later” strategy peaked early.

–This is sort of a long article, but interesting with respect to Blackstone’s real estate funds (BREIT). Private fund with investors reliant on the company’s own pronouncements of NAV and investment flows.

Even as commercial real estate has been battered in the wake of the pandemic, BREIT has somehow managed to defy gravity, outperforming comparable funds by seemingly fantastic margins. In the fall of 2022, after the Fed’s interest-rate increases began to shake the commercial real-estate market, investors began asking for their money back — more than $15 billion to date…. Last year, BREIT failed to generate enough cash to cover its annual dividend.

https://www.msn.com/en-us/money/savingandinvesting/ar-BB1lXcUf

Tight now, easy later

May 7, 2024

*************

–Yields were nearly unchanged Monday, although near SOFR contracts were under slight pressure in front of today’s 3-year auction. Tens down 0.6 bp to 4.489%.

–May midcurve straddles expire Friday. On Thursday (pre-NFP) the atm short May straddle (9550) was 19.0. On Friday the atm 9562.5^ settled 14.0 vs 9562 and yesterday it settled 10.5.

–No surprises in SLOOS yesterday:

Over the first quarter, significant net shares of banks reported tightening standards for all types of CRE loans.

Over the first quarter, banks reported having tightened lending standards for some RRE loan categories.

Over the first quarter, banks reported tightening lending standards and most terms, on net, for all consumer loan categories.

Stocks took it as a positive sign. Obviously.

–Silver had a nice pop yesterday, up 92 cents to 27.615.

–Not quite sure how I missed the news that Herbert Hunt died on April 9. He and his brothers Bunker and Lamar tried to corner the silver market in late 1979 to 1980. According to the high price on BBG, at the end of March 1980 the price hit 49.45. It finally re-visited that level in June 2011 as it reached 49.80. Now it’s 27.44 (spot). An article in Time magazine highlighting the episode has some parallels to today: “Inflation had destroyed their faith in the dollar, so they began putting their wealth into a ‘harder’ currency: silver.”

https://content.time.com/time/subscriber/article/0,33009,920875-1,00.html

We can all relate to this:

As the brothers told the tale, they were just worrying, like most Americans, about the worsening economy. As Bunker Hunt has reportedly said, “A billion dollars is not what it used to be.” Inflation had destroyed their faith in the dollar, so early in 1979 they began putting even more of their wealth into a “harder” currency: silver. By late March they allegedly controlled almost two-thirds of the world’s privately held supply of the shiny metal, but “artificial factors,” like higher margin requirements and limits on the amount of silver futures contracts they could hold, spoiled all the fun.

https://www.federalreserve.gov/data/sloos/sloos-202404.htm

Yields and Vol down

May 6, 2024

*************

–Weaker than expected employment report at 175k sparked a rally in rate futures. SFRM5 and U5 were strongest on the strip at +12 (9562 and 9579). Current EFFR is 5.33% and SFRM5 is 4.38%, still nearly 100 lower. Ten year yield fell 7.2 bps to 4.495% in front of treasury auctions starting tomorrow, 3s, 10s, 30s. ISM Services also weak at 49.4.

–With the fall in yields came a fall in implied vol. As the attached MOVE chart shows, we’re now approaching an area of hiking-cycle support. Today Barkin and Williams speak. SLOOS (Sr Loan Officer Opinion Survey) is this afternoon. Could be important as Powell had specifically cited it one year ago at the May 2023 FOMC.

–With May SOFR midcurves expiring Friday, 0QK4 9562.5 straddle settled 14 vs 9562.0. On Thursday the pre-NFP atm straddle was 19. Not a lot of economic data this week; 14 still likely a bit on the high side.