We need an intervention. On many levels

June 27, 2024

***************

–Solid 5y auction but yields rose on the day, with tens +7.8 bps to 4.316%. New Home Sales were weak at just 619k, vs expected 640k. Today brings final Q1 GDP, expected 1.4, Durables -0.1, Jobless Claims 236k and the 7y auction. All capped by the spectacle of the only presidential ‘debate’.

–Yen continues to probe new lows, ignoring repeated calls for an intervention. Micron’s (MU) earnings call disappointed, with the stock dropping 5.8% after hours.

–Everyone gets a trophy, which is to say that all the banks passed the Fed’s stress test. From the Fed:

This year’s hypothetical scenario is broadly comparable to last year’s scenario. It includes a severe global recession with a 40 percent decline in commercial real estate prices, a substantial increase in office vacancies, and a 36 percent decline in house prices. The unemployment rate rises nearly 6-1/2 percentage points to a peak of 10 percent, and economic output declines commensurately.

…the annual bank stress test showed that while large banks would endure greater losses than last year’s test, they are well positioned to weather a severe recession and stay above minimum capital requirements.

–And what if equities drop 50%? Game over for some banks without extraordinary gymnastics by the Fed (Simone Biles type stuff) except that the extraordinary has now become ordinary. It’s called moral hazard.

–Another 15k SFRH5 9675/9775cs bought for 4.5, total now about 140k. Settled 4.25 vs 9540. New seller of 7k SFRZ4 9512.5 straddle from 37.5 to 37. Settled 37 vs 9512. SFRM4 is still trading, and settled 9464.5 yesterday. Therefore, SFRZ4 is about 47 bps higher, roughly two eases. Z4 9537.5c settled 11.25, so straddle sale versus long call fully caps upside in the unlikely event that the gods decide to put the Fed’s stress parameters to the fire test.

SOFR strip was -8.5 to -9 from SFRU’25 to SFRU’28.

Not stressing about banks….stressing about direct US war

June 26, 2024

**************

–Early Tuesday Fed’s Bowman said inflation risks means she doesn’t see an ease in 2024; shifted forward to 2025. 2/10 squeaked out a new ytd low at -49.6, but not much change in SOFR calendars. SFRU4/U5 remains the most inverted at -107, actually up 0.5 on the day (9485.5/9592.5). Net changes on both the SOFR strip and treasuries were miniscule. SOFR from -0.5 in fronts to +1.0 in blues. Ten-yr yield down less than 1 bp at 4.238%.

–Today’s news includes New Home Sales, expected 633k from 634k last. Peak in 2005 was 1.389m. Low in 2011 270k, then a steady rise until the covid spike of a little over a million. Currently back to 2019 levels (but population is larger). 5y auction. Fed releases bank stress test results. KRE, the regional bank etf, ended at 46.93, down 1.4% on the day. This year, the low has been defined by three lows at or just under 46; a close below would be significant.

–Another 30k bought in SFRH5 9675/9775cs for 4.75, bring total to about 125k. Another interesting, though much smaller trade, is a new buyer of 5k SFRH5 9600c vs 0QH5 9700c for 0.5 (buying H5). Settles: 15.75 vs 9546.5 in H5 and 15.25 vs 9619.5 in H6. Similar goal as the plain call spread…works best with rapid, front-loaded easing. SFRH5/H6 currently -73 while strikes are -100, obviously a parallel upward shift in the two contracts would put H5 calls in the money faster. Unexpected, rapid ease would cause the futures spread to move more positive.

–Q1 GDP released tomorrow, final estimate, expected 1.4%. With a price deflator of 3% it’s nominal growth of 4.4%, about 100 bps lower than Fed Funds. Restrictive…except that Q2 GDP as estimated by the Atlanta Fed is 3.0%, so nominal above FFs. If Fed funds represent the first hurdle of capitalism, then a nominal growth rate above financing costs still pushes the cart forward.

–The Biden admin said the US “…may lift restrictions on the deployment of US military contractors in Ukraine so that they can maintain and repair weapons systems provided by Washington.” Another incremental step in removing ‘proxy’ from US war. This, after Russia blamed the US directly for Crimea attacks over the weekend which used US controlled missiles. Dangerous escalation.

2/10 spread at low of this calendar year

June 25, 2024

**************

–Relatively quiet day in rate futures. Ten year yield fell 1 bp to 4.246%. In front of today’s 2-yr auction, 2/10 treasury spread edged to a new low of -48.6. It was not a particularly large move, it’s simply that 2/10 is slowly grinding to new lows for this calendar year, though the entire ytd range is only -16.5 to -49.

–Huge drop in bitcoin Monday. Late futures price (july) of 59950, down 4860. USD vs Asian currencies remains strong (chart attached with Yen, Indonesian Rupiah, Indian Rupee; USD making highs against all).

–Continued buying of SFRH5 9675/9775cs for 4.75 with another 17k bought yesterday, bringing the total to 100k. Settled unch’d at 4.5 ref 9547.

–Today’s news includes Philly Fed Services which was -0.6 last. Also Consumer Confidence expected 100 from 102…remains near the lowest levels since Covid. Two year auction.

–Yesterday I checked July expiry on SFRZ4 9500/9487.5 put spd ref 9515.5; pit market was 1.0/2.0. BBG symbol is UZON4 Comdty OMON, symbol on CME-direct 1YZ. These options expire 12-July into SFRZ4. Shortly after I checked this market, there was a buyer of 5k 9700c for 0.25.

Notable events occurring pre-expiration:

Biden/Trump debate

PCE prices on Friday

NFP July 5

Powell semi-ann testimony 7/9

CPI 7/11

After the weekend attack in Crimea at Sevastopol which for which Russia blames the US (US weapons used in the strike), odds of unexpected military escalation are growing.

More debt

June 24, 2024

****************

–Relatively quiet session Friday with yields little changed. Tens ended up half a bp at 4.255%; the TYU4 contract pinned the strike with a settle exactly at 110-16. There were a couple of large trades targeting lower yields: New buyer 80k SFRH5 9675/9775cs for 4.75, settled 4.5 ref 9546.5 (unch’d). New (adding) buyer of 50k TYQ4 111.5c, settled 27 vs 110-16.

–PCE prices released on Friday, with yoy expected 2.6% from 2.7 last and Core expected 2.6% from 2.8 last. Today’s news includes Dallas Fed Mfg expected -15 from -19.4. Daly speaks on the economy at 2:00pm. 2/5/7 yr auctions beginning tomorrow. Biden/Trump debate on Thursday evening. First round of French vote on June 30.

–Apart from the voracious borrowing appetite of the Federal Gov’t, Credit Bubble Bulletin excerpted this clip from BBG:

June 20 – Bloomberg (Joe Mysak): “The municipal bond market this week soaked up a record 27th deal of $1 billion or more, with overall borrowing accelerating at a torrid pace. Debt sales are being driven in part by a decline in borrowing costs over the past few weeks… Top-rated borrowers can borrow money for 10 years at about 2.80%… That’s down from 3.09% at the end of May. The previous annual record for so-called mega-deals was in 2020, when 26 were sold, totaling $46.49 billion… Through Wednesday, 27 muni megadeals totaling $42.96 billion have been sold. So far this year, states and localities have sold $221.4 billion in long-term debt, 42.8% ahead of last year’s pace.”

–Clearly, $221 billion doesn’t seem like much any more, but corporate borrowing is also accelerating. Debt time bomb.

Carelessness

June 23, 2024 – Weekly Comment

***********************************

“They were careless people, Tom and Daisy- they smashed up things and creatures and then retreated back into their money or their vast carelessness or whatever it was that kept them together, and let other people clean up the mess they had made.”

― F. Scott Fitzgerald, The Great Gatsby

This quote, I believe, describes much of the western political class. Vast carelessness. It’s also a trait regularly on display in finance. What probably needs to occur is not a retreat back into their money, but rather a retreat of the money itself. A bonfire of the vanities ordained by the specter of Girolamo Savonarola.

On the week, changes were muted. US 2s through 30s rose 4.5 to 5 bps, with the 30y yield ending at 4.397%. The German 10y bund was up 5.2 bps to 2.412%. August Crude Oil (CLQ4) was one of the larger movers, rising $2.68/bbl to 80.73. Oil has shown surprising strength given, for example, Friday’s drubbing of copper (and gold and silver). HGU4 settled 442.85, the lowest close since mid-April, and is down 12.4% from the high close in May of 505.70.

******************************************

For the past couple of years, 100 bp wide call spreads have been heavily bought in SOFR contracts. First it was 9600/9700 call spreads and then 9700/9800 call spreads. In March/May 2023 some of these worked out, but for the most part it’s been a slow bleed into worthless settles.

On Friday, there was a new buyer of about 80k SFRH5 9675/9775 call spreads for 4.75. Settlement prices: SFRH5 9546.5, 9675c 6.75 with 12 delta, 9775c 2.25 with 4 delta. Open interest in the two strikes, +59k and +81k. There was also a new buyer of 50k TYQ4 111.5c, which settled 27 with a delta of 31 vs TYU4 110-16; open interest in the strike added 53k to 123k. Aug treasury options expire 26-July.

I’m just going to dig into the March SOFR call prices a little more, and outline some rough comparisons with the regional bank blow-up of March through May 2023. Recall that these bank failures, most notably Silicon Valley Bank, were precipitated by the rapid increase in Fed rate hikes which caused huge losses in un-hedged bond portfolios. Fed regulators were slow to identify problems, but depositors quickly recognized potential risks and sparked runs on the banks. At the time, SOFR contracts violently priced easing, but ultimately the Fed assured (and insured) everyone and continued to raise rates. With respect to the strength of the banking system and the Fed’s stewardship, this note from Friday’s Almost Daily Grants, (citing the FT) is worth a look:

The Federal Reserve has found weaknesses in the plans laid out by BofA, Citi, GS and JPM for how they would handle their own failures.

The US central bank and the FDIC on Friday said that, among the eight largest US banks, they spotted shortcomings in the so called “living wills” of those four lenders.

The FDIC viewed the weakness in Citi’s …as the most serious, saying the lender’s resolution plan was not credible or would not facilitate an orderly resolution under the US Bankruptcy Code.

It’s somewhat amusing as these banks are all too-big-to-fail. I wonder if Norinchukin has a ‘living will’. Someone is going to have to clean up that mess.

But let’s go back to the call spread. On Friday I posted a note on X. It’s a rolling chart of the 4th quarterly SFR slot, now representing SFRH5. The recent jump is due to a change in contracts, as 3-month calendars are about -25 to -30; SFRZ4 settled Friday at 9516 and H5 at 9546.5, so the shift to H5 in the 4th slot added 30 bps. The point is that we’ve had two big rallies predicated on easing…which ultimately never materialized. In the wake of SVB the Fed kept hiking, and the liquidity surge in Q4 of last year, punctuated by Powell’s dovish pivot at the December FOMC, also fizzled. In both cases, the 4th contract topped just over 9600. So, the 9675 strike in our call spread appears somewhat fanciful in terms of a target. Does that mean it’s an easy sale? Read on.

I looked back at monthly statements from April 28, 2023 and May 31, 2023. A client was long some SFRH4 9700c and 9750c. In April of 2023, the SFRH4 calls were 10.5 months from expiry, and of course in May they were 9.5 months away. Actually on May 31, the SFRH4 option expiration was 289 days away. This period was just after the SVB blow-up. Look at the prices:

April 28, 2023 (dte 322) This was near the high settlement for the SVB move.

SFRH4 settle 9605

SFRH4 9700c 34.50s

SFRH4 9750c 24.00s

atm SFRH4 9600 straddle 128.25

May 31, 2023 (dte 289)

SFRH4 settle 9562

SFRH4 9700c 24.75s

SFRH4 9750c 17.50s

atm SFRH4 9562.5^ 123.00

So in April 2023, the 9700c were 95 out-of-the-money and the 9750c were 145 out.

In May 2023, the 9700c were 138 otm and the 9750c were 188 out.

NOW

June 21, 2024 (dte 266)

SFRH5 settle 9546.5

SFRH5 9675c 6.75s

SFRH5 9725c 3.75s

SFRH5 9775c 2.25s

atm 9550^ 63.0

With not much difference in days until expiration, the atm straddle is about half the price. On May 31, 2023 the H4 9700c were 138 otm and settled 24.75. Currently, the H5 9675c are 128.5 otm, but they are only about one-quarter of the price at 6.75. The current 9725c at 3.75 are less than one-quarter of the price of SFRH4 9700 calls on 5/31/23. By the way, on Feb 28, 2023 (just before SVB) SFRH4 9700c settled 5.75 ref 9507.

I’m not saying the current buying of 9675/9775 call spreads is a great idea. But it’s clear, at least to me, that open-ended short calls, no matter how far away they look, are not attractive sales.

It’s a cautionary tale about selling SOFR upside. However, there is also a reasonable amount of press about a possible ‘Liz Truss’ moment in the US, given the constant deterioration in US budget dementia dynamics. Note that in the beginning of August 2022, the ten-year gilt was yielding 2%. Less than two months later, on September 27, 2022, the yield peaked at 4.5%. From the Guardian in October 2022:

Initially hailed by her supporters as “at last, a true Tory budget”, the ‘mini’ fiscal event included the biggest tax cuts since 1972, funded by a vast expansion in borrowing, and with only a vague attempt to argue it could be paid for by an unlikely economic boom.

The MOVE index ended Friday at 94.09. The range this year has been 127.02 in January, to 82.49 in May, so it’s closer to the lower end. VIX at 13.20. On a closing basis, high of year in April is 19.23 and low in May is 11.86. It seems as if current vol levels aren’t quite high enough to discount outliers that may be closer than they appear. I’m not in favor of outright put sales on longer maturities.

Upcoming events:

Stanley Cup Final: Monday night (no missive Tuesday)

Treasury auctions Tues, Wed, Thursday: $69b 2-yr, $70b 5yr, $44b 7yr.

Biden/Trump debate Thursday, 9pm EST.

PCE Prices Friday.

Note that the BLS will release the Employment data on Friday, July 5. Full trading day on July 5. Thursday, July 4 is not an official settlement day, screens are open until 1 pm EST. Stupid and careless.

Powell scheduled for semi-annual testimony on July 9. NOTE: The Semi-annual REPORT is released before the actual testimony. Not sure of the date yet.

French elections June 30 and July 7.

US Republican Convention July 15-18. Dem Convention August 19-22.

| 6/14/2024 | 6/21/2024 | chg | ||

| UST 2Y | 468.3 | 472.8 | 4.5 | wi 468.5/680 |

| UST 5Y | 422.4 | 426.9 | 4.5 | wi 426.7/265 |

| UST 10Y | 420.9 | 425.5 | 4.6 | |

| UST 30Y | 434.9 | 439.7 | 4.8 | |

| GERM 2Y | 276.3 | 278.9 | 2.6 | |

| GERM 10Y | 236.0 | 241.2 | 5.2 | |

| JPN 20Y | 173.9 | 179.7 | 5.8 | |

| CHINA 10Y | 229.7 | 226.0 | -3.7 | |

| SOFR U4/U5 | -112.0 | -108.5 | 3.5 | |

| SOFR U5/U6 | -38.5 | -39.5 | -1.0 | |

| SOFR U6/U7 | -7.5 | -8.0 | -0.5 | |

| EUR | 107.05 | 106.97 | -0.08 | |

| CRUDE (CLQ4) | 78.05 | 80.73 | 2.68 | |

| SPX | 5431.60 | 5464.62 | 33.02 | 0.6% |

| VIX | 12.66 | 13.22 | 0.56 | |

Rate futures ignore weak data

June 21, 2024

****************

–Data weak on Thursday. Housing Starts -5.5% m/m, Philly Fed only 1.3 vs expected at 5.0. However, a brief pop in treasuries immediately reversed. Tens ended +3.3 bps to 4.25%. NVDA posted a new high, outside day, lower close, ending -3.5%. Another high flier, Chipotle (CMG), had nearly doubled from the low in October, but closed -6.2%. Perhaps a sign that speculative froth has run its course.

–Today’s news includes S&P PMI Mfg expected 51.0 from 51.3 last.

–GCQ4 settled 2369, up 22.10 on the day. CLQ4 settled 81.29, up 0.58 on the day. $/yen is 158.60 this morning with warnings of intervention, CNY is 7.26, a new low in yuan for this calendar year.

–SOFR contracts down 4 to 4.5 from reds through golds…from Sept’25 through Sept’29. Every contract between Dec’25 and Dec’30 is between 9609 or 3.91% (SFRZ5) and 9641 or 3.59% (SFRU7, peak on the curve). July Treasury options expire today. TYN4 110.5^ settled 17/64 vs 110-175.

Fed on hold…for now

June 16, 2024

**************

–Once again the near one-year SOFR calendars slipped to new lows. SFRU4/U5 down 7 on the day to -112.5 (9485/9597.5). Z4/Z5 down 4 on the day to -95 (9518/9613). Also, new low in 2/10 at -48.2 with the ten-year yield down 6 bps to 4.217%. Fed officials are in no hurry to cut rates; Kugler’s speech is a case in point. She gave comprehensive evidence to support optimism for decelerating inflation, but concluded by saying, “I believe that policy has more work to do, which is why I supported the FOMC’s decision last week to keep the federal funds rate in a range of 5-1/4 to 5-1/2 percent. We need to see more progress toward 2 percent inflation before I will have confidence that inflation is moving sustainably toward that objective.”

https://www.federalreserve.gov/newsevents/speech/kugler20240618a.htm

–In any case, near contracts are constrained by the Fed’s resolve to hold rates steady in the near term, while back contracts reflect lower future rates, projecting a slower economy and lower inflation. SFRZ’25 at 9613 to SFRZ’27 at 9645 are between 3.5% and 3.875%.

–At the end of the session, just after futures settlements, there was a buyer of 55k FFQ4 at 9469.5. Contract settled 9469; open interest was up 45k so appears to be new buyer. If the Fed were to ease in July, FFQ should settle 9492. Without an ease, a grind down toward June and July contracts at 9467 will occur.

This article by Walter Deemer was posted on x by Helene Meisler. It’s from March 3, 2000, pre-dating the Nasdaq high by only a few weeks.

https://x.com/hmeisler/status/1803070784497209522

This excerpt sums it up:

During my now 36-plus years in this business, I’ve never seen anything even remotely comparable to the current chasm in the stock market between New Economy and Old Economy stocks; the NASDAQ, which rose 85% in 1999, has risen another 16% so far this year while the Dow-Jones Industrial average (whose 30 components happen to earn more than all of the NASDAQ stocks combined do) was recently off more than 14%. But it is not the unprecedented market chasm that prompts this piece — it is the accompanying arrogance on the part of all too many New Economy (aggressive growth) managers, as demonstrated in such things as the writings of James Cramer of TheStreet.com and the utterances of a seemingly-endless parade of hedge fund managers on CNBC. These managers sneeringly inform those unfortunate souls who are not invested in the same Cisco’s and Qualcomm’s as they are (or, more likely, in the same JDS’s and Xcelera’s as they are) that “Old Economy stocks are relics of the past; if you don’t own the Cisco’s and Qualcomm’s of the world, no matter what their valuations may be, you’re living and investing in the past, not the future. This is the way it is and this is the way it’s going to be from now on.” (The logic of the subset of managers who are well aware that this kind of thing can’t last, but are cocky enough to think they can get out before the final whistle blows — even though they readily admit that most players won’t — needs no further comment on my part.)

NOTE: Since the end of October, when Yellen helped juice the market by shifting gov’t borrowing to t-bills rather than coupons, NDX is up 41%.

brief notes

June 18, 2024

**************

–Yields up on treasury curve as part of Friday’s safety bid unwound. Tens up 6.8 bps to 4.277%

–Retail Sales today, expected 0.3%, ex-auto and gas +0.4%. Industrial Production +0.3%

–Speakers includes Barkin, Collins, Logan, Kugler, Musalem and Goolsbee.

–Powell to testify in front of Congress on July 9. July midcurves expire July 12. July treasury options expire Friday. TYN4 110.5^ settled 34 yesterday.

–Ueda suggests that BOJ could raise rates in July, but $/yen still over 158.

10y breakeven supports the Fed

June 17, 2024

***************

–Friday featured new recent lows in near SOFR calendars, with SFRU4/Z4 -33.5 (9487.5/9521) and SFRU4/U5 1-yr calendar at -112 (9487.5/9599.5) down 23.5 on the week. SFRZ5 was the trailblazing contract, surging 30.5 bps since last Friday, to 9615 or 3.85%. This level is right back to the MARCH level for Fed Funds (end of 2025) in the SEP dotplot, which was 3.875%…in June that projection was ratcheted up to 4.125%. Tens ended Friday at 4.21%, down 2.6 bps on the day. SFRM5 also ended Friday at 4.21, or a price of 9579. If the market is right about easing scenarios, then we can roughly expect 2/10 to be dis-inverted by next summer!

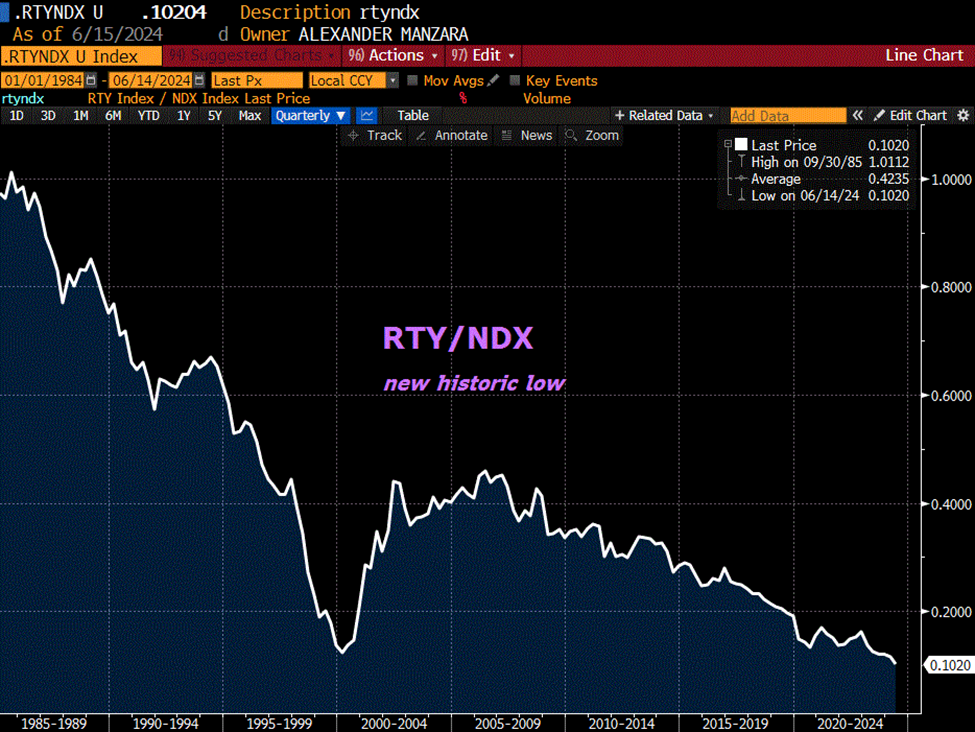

–Other interesting range extensions: 10y breakeven (treasury vs tip) ended Friday at 218 bps, near the low end of the range since the Fed began its hiking campaign. In mid-April this spread was holding above 240. Also, Russell 2k vs Nasdaq 100 as a ratio is making historic new lows.

–Fed officials are generally advocating patience in terms of rate cuts (Mester, Kashkari). There are a lot of Fed speakers slated this week: Harker today. Barkin, Collins, Kugler, Logan, Musalem (new St Louis President), Goolsbee tomorrow. Also tomorrow, Retail Sales and 20y auction. Wednesday is an abbreviated screen session.

Erreurs ont été commises (Errors were made)

June 16, 2024 – Weekly Comment

************************************

“When I make a mistake, I don’t make it twice. I make it 20 times.” – Jimmy Place (Warrior podcast)

SOFR calendars made new recent lows as the Fed pushed easing further out on the calendar with the dot plot indicating just one ease for 2024 (and 4 more in 2025). CPI data was lower than expected – another tailwind for rate futures. Accentuating the move was Macron’s decision to call snap elections in France, which sparked turmoil in European spreads.

All treasury contracts completely erased lingering bearishness from the previous Friday’s NFP (and then some). With June SOFR options having expired, I moved the front spreads to September contracts. The chart below is a constant maturity 3rd to 7th SOFR future spread (bottom panel is spread). For the past three months this chart represents SFRU4/SFRU5, at a level of -112 (9487.5/9599.5). Next week on BBG, U4U5 will be 2nd to 6th.

The exact syntax isn’t important, it’s that calendar spreads are making new recent lows. I used a two-year snapshot in order to capture absolute lows associated with the SVB failure and fallout. At that time, in May 2023, the 3rd to 7th spread posted a low of -177 and 2nd to 6th (what I would consider the front spread) was -192. Those levels reflected potential easing of the magnitudes seen in 2001 and 2007-08, when the Fed slashed a couple of hundred basis points over a few quarters. Obviously, SVB was a false alarm, and relatively contained. Therefore, calendar spreads rallied as deferred contracts sold off in summer and fall of 2023, i.e. easing assumptions compressed. As can be seen on the chart, the current decline is a function of deferred contracts rallying. On the top panel the SFRU4 contract is in white; the move has been sideways. SFRU5 is in amber. Last week SFRU4 rallied 6.5 bps, while SFRU5 and Z5 had the biggest jumps on the curve, +30 to 9599.5 and +30.5 to 9615.0. The ten-year yield declined 22 bps on the week to 4.209%.

In terms of European angst, I would just note that SX7E, the EuroStoxx Bank Index is down 10% from the high posted in mid-May. At 133.73 it’s back where it was in mid-March. The CAC 40 is down 8.9% from mid-May (down 5% last week). By comparison, DAX is only down 4.6% from May’s high.

In the US, the ratio of RTY/NDX (Russell 2k to Nasdaq 100) made a new historic low this week of 0.102. That’s even lower than the dotcom bubble of March 2000, when the ratio low was 0.12.

MSFT, AAPL and NDVA combined are at a record 21% weighting of the S&P500, and each sports a market cap over $3T (each one larger than the total cap of Russell 2k). It’s worth noting that RTY is actually DOWN 1% on the year. However, RTY is handily outperforming KRE (the US regional bank index) which is down 12% ytd.

There’s a clip in The Big Short where Brownfield Capital (Charlie Geller) suggests shorting AA tranches of CDOs, because when the bad stuff implodes, the AAs will also be pulled down. I was taught, and I try to adhere to this rule: short the weakest stuff, not the strongest. Markets typically crash, not from highs, but when they have already been cut in price. So, I am NOT suggesting that anyone follow my lead and buy AAPL puts like I did last week. (Hence the Jimmy Place* quote at top). There’s just no way I buy into the AI hype for AAPL. To cite another line from The Big Short: “It’s possible we’re in a completely fraudulent system.” -Dr Michael Burry.

My sense is that the US consumer is well underway in a process of retrenchment. On Tuesday, Retail Sales may (or may not) buttress that assumption, expected +0.3% m/m and +0.4% ex-auto and gas. Credit card delinquency rates, all commercial banks, are at a new cycle high of 3.16% in Q1 (though lower than they were from the 1990’s going into the GFC). However, credit card delinquency rates in banks not among the largest 100 are at a RECORD high 7.79%. (Short the weakest).

Housing data later in the week. XHB, the homebuilder ETF has been sideways from 100 to 110 since late Feb.

OTHER THOUGHTS / TRADES

FFQ4 settled 9470.5, up just 1.5 on the week. This contract captures the July 31 FOMC, and indicates about a 15% chance of a 25 bp cut. FFV4 captures the Sept 18 FOMC, and it settled 9487 or 5.13%, 20 bps lower in yield than the current Fed Effective of 5.33%. The market is betting on a Sept ease…

August options on SFRU4 expire 16-August. As of now, it’s unlikely that the Fed would ease in July. But IF that were to happen, then the Sept 18 FOMC would be in play as well. The August CPI number is 8/14 and Jackson Hole is August 22-24 (Just after the August 19-22 Democratic Convention in Chicago). SFRQ4 9500/9512.5cs settled 1.25. Reasonable wildcard buy.

Note that Friday July 5 is a normal trading day. The Employment Report is scheduled for release on that Friday, though July 4 will only have an abbreviated futures session (for trade date 7/5).

This Wednesday is also an abbreviated screen session. Might not be at desk, pending Tues conditions.

| 6/7/2024 | 6/14/2024 | chg | ||

| UST 2Y | 487.0 | 468.3 | -18.7 | |

| UST 5Y | 445.2 | 422.4 | -22.8 | |

| UST 10Y | 442.8 | 420.9 | -21.9 | |

| UST 30Y | 454.7 | 434.9 | -19.8 | |

| GERM 2Y | 308.3 | 276.3 | -32.0 | |

| GERM 10Y | 262.0 | 236.0 | -26.0 | |

| JPN 20Y | 176.5 | 173.9 | -2.6 | |

| CHINA 10Y | 231.0 | 229.7 | -1.3 | |

| SOFR U4/U5 | -88.5 | -112.0 | -23.5 | |

| SOFR U5/U6 | -41.0 | -38.5 | 2.5 | |

| SOFR U6/U7 | -10.0 | -7.5 | 2.5 | |

| EUR | 108.18 | 107.05 | -1.13 | |

| CRUDE (CLQ4) | 75.22 | 78.05 | 2.83 | |

| SPX | 5346.99 | 5431.60 | 84.61 | 1.6% |

| VIX | 12.22 | 12.66 | 0.44 | |

*Jimmy Place (ACE if I recall correctly) was a filling broker in Eurodollar futures in the heyday of the contract.