National Debt Relief

July 10, 2024

**************

–I have to start with a story about the yawning gap between asset prices. No, I am not talking about Nasdaq vs Russell, but this example is stark as well. TheRealDeal.com reports that a 41 story office tower in NYC, 180 Maiden Lane, was bought in a short sale for $297m, by Carlo Bellini’s real estate firm 99c. Last trade in 2015 for $470m, partially financed by Blackstone with a $248m loan. Here’s the rich part: it’s 68% occupied, with one anchor tenant being National Debt Relief. At least we can be sure THAT business will remain strong….

(Blackstone’s relationship with Nat’l Debt Relief goes from landlord to client!)

The other story is on BBG: “A penthouse at Aman New York (Crown Building) has sold for $135 million, making it the most expensive home purchased in Manhattan this year.” The five-story unfinished space went for $10k sq/ft. “Priciest deal since 2022”.

https://therealdeal.com/new-york/2024/07/09/carlo-bellini-buys-180-maiden-lane-in-short-sale

–Powell in front of Senate Banking yesterday. He repeated that the Fed needs to see more good data on inflation before cutting. Could it come tomorrow with CPI? Monthly figures expected 0.1% with Core 0.2%. Yoy expected 3.1% from 3.3%. Overall, Powell’s tone was slightly dovish, with emphasis on the slowdown in labor markets; several Senators noted the outsized amount of government hiring in the last payroll data.

–There were several questions/comments about the prohibitive cost of housing, related to high mortgage rates. I thought it would have been appropriate for Powell to mention the rapid increases in insurance and property taxes; if he did, I missed it.

–Semi-annual testimony continues today in front of the House. Ten-year auction as well, which follows a solid 3-yr yesterday. Yields rose a few bps across the curve, with tens +3 to 4.298%. Worth a note is that several of the deferred SOFR calendars are edging to new recent highs. For example, SFRM26/SFRM27 settled -7.5 (9632/9639.5). The past month’s range has been -15.5 to -8.5. SFRM7 is currently the highest point (lowest yield) on the SOFR strip with a yield of 3.605%.

–Several large SOFR option trades yesterday (not covering all, just a few).

New buyer 35k SFRU4 9500/9506.25cs for 0.5 (SFRU4 settled 9487)

New buyer 10k SFRU5 9575/9525p 1×2 vs 9600 and 9599 for 2 bp credit. Settled -1.75 vs 9601.

Exit put buys

+50k 0QU4 9500p for 1.0 (100 bps out of the money with 66 dte).

+30k 2QZ4 9550p for 6.5, covered 9636.5, 15 delta. Underlying SFRZ6 settled 9638.

Powell today

July 9, 2024

*************

–NFIB Small Business Confidence expected 90.2. The lowest print of the year was in March, at 88.5. That has also been the lowest since 2013; there’s been almost no bounce. From the last report: “Main Street remains pessimistic about the economy for the balance of the year,”

–Powell testifies today in front of Senate Banking Committee at 10:00, tomorrow at the House.

I’m just glad Bob Menendez is still sitting on the committee, because he and I share an interest in the value of gold and maybe he can ask Powell a few questions about it. Of course, Menendez got his gold bars as a bribe… [if there’s anyone in politics who should step down, it’s this guy]

https://www.justice.gov/usao-sdny/pr/us-senator-robert-menendez-his-wife-and-three-new-jersey-businessmen-charged-bribery

–Former Dallas Fed President Kaplan on CNBC yesterday: “I think risk management will dictate a rate cut in September”…but he characterized it as more of game-day decision. In any case, FFV4 settled 9487 or 5.13%, -1 on the day. A Fed cut would bring EFFR to 5.08%, so odds for an ease in Sept are currently around 80%. Rates trading was subdued yesterday, with little net change. Near SOFR contracts were -2 but everything else showed net change of -1.5 to 0, and that includes the treasury curve.

–Three year auction today followed by 10s and 30s Wednesday and Thursday.

–Michigan’s Whitmer appears to have dropped out of the Dem presidential race. Biden’s bravado is buying time to whittle down the potential list of replacements to one or two that the establishment can support. Illinois Governor Pritzker is trying to buy his way onto that list, though his policies have caused residents to flee. “Illinois lost 83839 residents who moved to other states, one of the highest rates in the US, driving a 10th consecutive year of population decline.” Who lost more than Illinois? CA, and Newsom is also running. If either one of these guys wins, the immigration problem will be solved, as they are experts at driving people out of their jurisdictions.

Chicago shootings: At least 103 shot, 19 fatally, in citywide holiday weekend gun violence, CPD says

https://abc7chicago.com/post/chicago-shootings-weekend-least-101-shot-18-fatally/15041696

Soft employment sparks new low in SFRU4/SFRU5

July 8, 2024

************

–Though the NFP print was higher than expected at 206k, the unemployment rate ticked up to 4.1% (highest since Nov 2021) and private payrolls were just 136k (only 4 lower prints in past 3.5 years). Average Hourly Earnings yoy were 3.9%. Yields fell, with tens down 7.4 bps to 4.271%. Both twos and fives sank 9.2 bps to 4.597 and 4.216. New high in 5/30 to 25.1 bps (upside breakout). With SFRU4 increasingly constrained as it nears the IMM date (up only 2 bps to 9489) near calendar spreads made new lows. SFRU4/U5 plunged 11.5 bps to a new low of -114.5 (9489/9603.5). U5 jumped 13.5 bps, largest change on the strip. SFRU4/SFRZ4 also made a new low at -34 (9489/9523). FFQ4/FFQ5 settled -122.5 (9469/9591.5)…nearly five eases priced over next year.

–On the SOFR strip, the red/gold pack spread closed at -9.375, the least inverted on a rolling basis since March. I use the old definition, with U5 as the front red contract and U8 as the first gold. Using average prices, the red pack (2nd year) is 9620.875 and the gold pack (5th year) is 9630.25. In a more normal world, that spread is positive…we’re getting there.

–Today brings Consumer Credit for May, expected +$10b. Auctions kick off tomorrow, starting with the 3y, and Powell begins Congressional semi-annual testimony before the Senate Banking Committee. This morning bonds have pulled back a bit, perhaps as a concession to auction supply. Precious metals have likewise eased from strong rallies last week.

Nominal growth below cost of funds

July 7, 2024- Weekly Comment

*********************************

Never interfere with an enemy while he’s in the process of destroying himself.

–Napoleon Bonaparte

This quote could apply to many of the plots and subplots swirling around the modern world. The most obvious application is to Biden and the Democratic party, but it has some bearing on the economic landscape as well, with Powell holding rates steady rather than interfering with decelerating economic trends – which are moving in his favor in the fight against inflation.

The latest indication comes from jobs figures. Sure, JOLTs had a small rebound to 8140k, but the trend has been decidedly lower since the peak in February 2022 of 12182k. In Friday’s employment report, Private Payrolls were up only 136k. Since 2021 there have only been 4 months out of 42 with lower Private Payroll prints. Total NFP of 206k included 70k gov’t jobs. Let’s consider gov’t ‘job creation’ over a longer period.

The BLS website says that just a shade under 25% of jobs created in 2023 were government jobs. By examining St Louis Fed data and checking monthly totals, it’s clear that NFP is the sum of private payrolls and gov’t jobs. This year so far, government has accounted for just over 22% of new jobs. However, the birth/death adjustment for private business has overstated private payroll data. I conclude that gov’t payrolls as a percentage of total are even greater than the amounts indicated above. In any case, I am confident that increases in gov’t payrolls don’t directly feed into productivity gains.

[The Fed’s semi-annual report specifically cites strong gains in healthcare and in state and local gov’t hiring. Pg 18 of pdf]

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

Now consider real GDP and annualized inflation figures. CPI comes out on Thursday, expected yoy 3.1% from 3.3% last. GDP Price Index for Q1 was 3.1% (released on June 27) and Q1 GDP was 1.4%. PCE Price Index yoy was released on June 28, and was 2.6%. Taking the highest measure of inflation at 3.3% and adding it to real GDP of 1.4% yields nominal growth of 4.7%. The FF rate is 5.25 to 5.5%. Two-year treasuries yield 4.6%. Cost of funds is now exceeding nominal growth, which likely puts a damper on business expansion plans.

Going forward, the Atlanta Fed’s GDP Now forecast for Q2 is 1.5%. The Blue Chip average, which hasn’t been updated as recently, is 2.0%. The NY Fed’s Nowcast for Q2 is 1.79% (July 5) down from 1.93 at the end of June. If we take the (higher) NY Fed growth estimate and add the CPI projection of 3.1%, then we get 4.9 nominal. The math for new expansion isn’t working out.

Let’s compare recent data with the Fed’s June (SEP) Projections. For 2024, Real GDP in the SEP was estimated at 2.1%. Both Q1 and likely Q2 are lower. Unemployment 4.0%, with Friday printing above that level at 4.1%. PCE inflation 2.6%, last at 2.6%, so right at projection. The year-end 2024 FF projection is 5.1%. FFV4 (which captures the Sept 18 FOMC) settled Friday at 9488, or 5.12%. FFF5 (which covers the Dec 18 FOMC) settled 9520 or 4.8%, essentially forecasting TWO 25 bp cuts by year-end.

Powell appears in front of Congress on July 9 and 10. The actual Monetary Policy Report was released on Friday. I posted the link above, but here it is again with a couple of excerpts:

https://www.federalreserve.gov/monetarypolicy/files/20240705_mprfullreport.pdf

In asset markets, corporate bond spreads narrowed, equity prices rose faster than expected earnings, and residential property prices remained high relative to market rents.

Therefore, measures of market rent growth for new leases can help predict future changes in the PCE price index. Since mid-2022, market rents have decelerated and returned to a growth rate similar to or below their average pre-pandemic pace, while the PCE index continues to show elevated inflation, reflecting the gradual pass-through of market rates to existing tenants. As this process continues, PCE housing services inflation should gradually decline, though much uncertainty remains about the extent and timing.

The report’s Special Section on Housing Services Inflation (page 15) cites alternative shelter price measures including those published by CoreLogic, Zillow, Apartment List and RealPage. All are below the Official PCE Housing Services.

******************************

Friday’s data led to a drop in yields. Tens fell 7.4 bps on the day to 4.271% with 30s down 5.1 bps to 4.467%. Changes on the week were -6.8 bps and -3.3 bps; the largest change on the week was a 12 bp fall in the two-year yield to 4.597%.

This week brings auctions of 3s, 10s and 30s starting Tuesday. ($58b, $39b and $22b). CPI Thursday and PPI Friday.

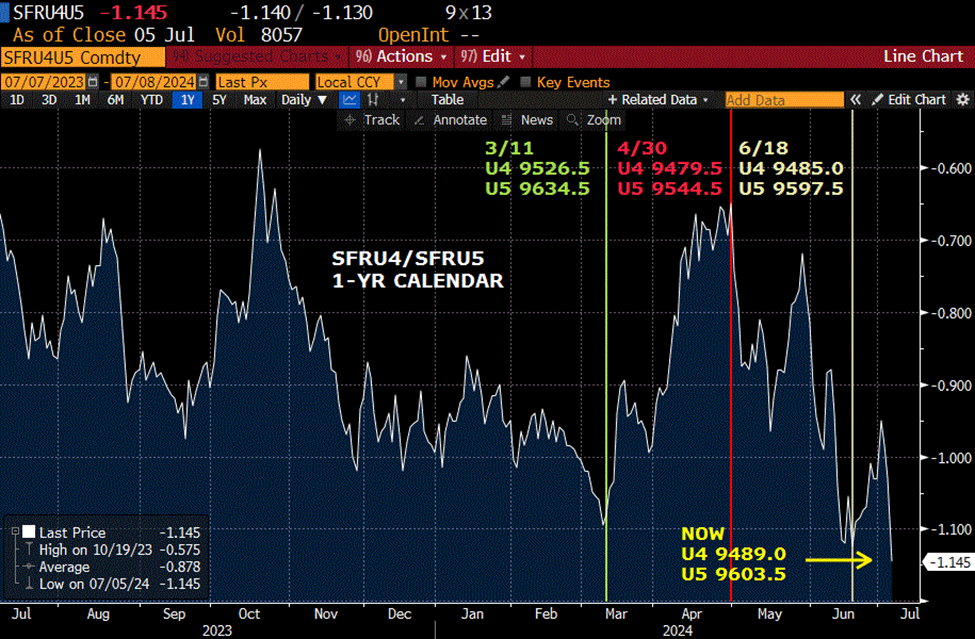

Below is a chart of SFRU4/SFRU5 one-year calendar. On Friday, this spread made a new low of -114.5 bps (9489 /9603.5). This is not the lowest level for the near 1-year calendar; in May 2023 it was -192!

At the start of this year, the near 1-yr calendar was -146 to -162 (mid-Dec to Jan). At the time, referring in part to the pricing of this spread, analysts were saying the market expected 6 to 7 rate cuts. Even at that time, many traders thought that pricing was far too aggressive, and by April the near 1-yr calendar peaked at -70 to -60 as forward contracts sold off. However, at present, the first calendar is projecting 4 to 5 rate cuts over the period from Sept’24 to Sept’25. On Friday SFRU5 settled 9603.5 or just below 4%, while the Fed’s end-of-2024 FF projection is 4.1%. By the way, SFRZ5 settled 9618, or 3.82%. With economic data slowing, is it possible to see SFRU4/SFRU5 print below -150? Note that in mid-March, SFRU5 was 9634.5. If SFRU4 remains pegged near its current level of 9489, easing prospects may be pushed forward to just after the election, and -150 could easily print.

Last week I wrote this:

Adjusting for new 2 and 5yr notes, I marked 2/10 up 5.1 bps on the week to -37.7 and 5/30 up 4.2 bps to 17.3. If this latter spread closes above 20 a couple of times, the next test will be upper 30’s. Target should be 60 to 70. 58.5 is the 50% retrace from the 2021 high of 163 to the March 2023 low of -46. The double bottom target from 9/2022 and 3/2023 (both lows around -46) is +68 bps.

On Friday I marked 5/30 at 25.1. Feels like a breakout. Any hawkish comment out of Powell and it could slip back down to 20, but it will likely start moving towards the 60-70 bp initial target.

OTHER THOUGHTS

Referring again to the quote at the top of the page, I think the upcoming Democratic Convention, August 19-22 in Chicago, is becoming more important. It’s not surprising that Biden is still insistent that he’s in the race. Whether he knows it or not, he isn’t. However, the distraction is helpful in giving strategists time to shape a united front (wealthy donors) for the new front-runner. There are already major concerns about violent protests which might echo the Dem Convention of 1968, also held in Chicago. Mayhem at this year’s Dem convention would lead to an easy Republican jab: “They can’t even control protests at their own convention, how are they going to run the country?” I wouldn’t be surprised if those visuals aren’t being planned and plotted right now. Note that September treasury options expire 23-August, just after the convention.

SFRU4 options expire 13-Sept. The FOMC is 18-Sept, but it should be fully priced by the 13th. The Kansas City Fed’s Jackson Hole Symposium is August 22-24 (Sept treasury options expire 8/23). Prior to SFRU4 option expiry we get two more payroll reports and two more PCE price releases. Including this week’s there are three CPI reports, the other two being 8/14 and 9/11. The July FOMC is 31-July. The election is Nov 5, followed by another FOMC announcement on Nov 7. I believe the Fed will ease in September, and pricing will lean towards better than 50/50 for another in November. If so the 9500 strike could play. SFRU4 9500c traded and settled 3.0 on Friday ref 9489.

Payroll Friday (when no one is actually working given the 4th holiday)

July 5, 2024

************

–Yields fell Wednesday in the wake of a weak ISM Services number. On Monday ISM Mfg was 48.5 and Wednesday the Service side was 48.8 (expected 52.5). Both are now in contraction territory, with the Service Employment number at just 46.1. Goods inflation has already been moderating, it looks like services might follow suit. Today is the Payroll data, with NFP expected 190k. Get ready for the Unemp Rate to tick over 4%; the last time it was 4.1% was in November of 2021.

–On Wednesday 10’s fell nearly 9 bps to 4.345%. On the SOFR strip greens, blues and golds (3rd, 4th and 5th years forward) were +10 to +10.5 with prices clustered around 9630 or 3.7%. Forward expectations of rates appear quite comfortable around 3.5 to 3.75% for the time being. Of course, the large recent 100 bp wide call spread being accumulated for around 4.5 bps is SFRH5 9675/9775cs which settled Friday at 4.75 ref H5 9545.5 (Lower strike is just 3.25%). This trade would perform best in an environment of rapid easing (seen in 2001 and 2008). Interestingly, there is now also buying of 100 bp wide PUT spreads. On Wednesday, a new buyer of 30k SFRZ5 9562.5/9462.5 ps for 26.75 to 27; settled 24.75 vs Z5 9605. In the Fed’s latest dot-plot the 2025 FF projection was 4.1 or a price of 9590. If the Fed’s right, then this put spd expires worthless. Of course, the put spread works best if the Fed NEVER eases. Just as a point of comparison, the contract in front, SFRU5 settled 9590, and the same strikes ps settled 26.5. So curve roll-down is pretty much like paddling in place over the near term.

–October FF, which provides a decent guidepost for easing expectations at the September FOMC, settled 9487 or 5.13%, up 1.5 on the day. Current EFFR is 5.33% or 9467 so an ease would take it to 5.08% or 9492. Therefore current ease expectations are around 80%.

Happy 4th!

July 3, 2024

************

–Rates eased yesterday as Powell cited progress on inflation but dangled the carrot of confidence just a bit further forward. Almost a parallel shift…tens down 4.3 bps to 4.434%; on the sofr strip reds, greens, blues and golds +4 to +5.5. Slight new high in 5/30 just above +21 bps.

–Buyer of over 30k FV week2 108/109/110 c fly for 1. Open interest up in all strikes, so completely new position. Expires 12-July. The 108c alone were offered at 2 (settled 1.5) and are about 40 bps out-of-the-money. If someone is concerned about a 40 bp move in a week then there’s not a lot of point in having additional legs. In SOFR, a late add of +8k SFRH5 9675/9775cs which settled 4.5 ref 9541.5 and now has about 190k open in both strikes.

–ADP today expected 165k from 152 last. Jobless Claims 235k. S&P Composite PMI. ISM Services 52.6 exp from 53.8. FOMC minutes after futures close/settlements. Settles in rate futures are at 1pm today, though the screen stays open until 5 for anyone who wants to push the market around in thin conditions. We’ll be leaving shortly after settles today. NFP on Friday expected 190k.

–$/yen holding near 162. Precious metals attempting another stab at the upside out of a basing formation. GCQ4 currently 2355, up 21.6 and SIU4 30.385 +72.7.

Then suddenly

July 2, 2024

*************

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.”

–From Hemingway’s The Sun Also Rises

The Hemingway quote is probably overused, but it naturally came to mind when reading Bill Dudley’s piece from last week (6/26):

It’s impossible to know when investors will decide that such risks are too much to bear, as the bond vigilantes famously did in the 1990s. When it happens, it tends to be sudden and brutal. This is the concern that should be paramount.

–The bond market seems to be suddenly reacting to a confluence of negative factors, including crushing supply, higher oil prices, lack of confidence. Since Thursday’s mark at settlement, the 30y yield has surged from 4.426% to 4.641% or 21.5 bps. Selling continued even as yesterday’s ISM Mfg was weak, with the employment sub-index falling to a contractionary 49.3 from 51.1 last. JOLTs today expected 7.955m vs last at 8.059.

–It’s a bear steepener. In contrast with the bond sell-off, SFRZ4 rose only 1.5 bps in yield since Thursday, falling from 9514 to 9512.5. Yesterday the 2y note was up 5.4 bps to 4.77%, while 10s jumped 13.8 to 4.477% and 30’s +14.1 to 4.641%.

–2/10 at new recent high -29.3, up 8.4 on the day. 5/30 new recent high 20.4 up 3.1 on the day. All back SOFR one-year calendars made new recent highs as futures prices were successively weaker down the curve. Net changes: SFRZ4 -2.0 to 9512.5, Z5 -10.5 to 9592.5. Z6 -14.5 to 9614.5 and Z7 -16.5 to 9617.0. SFRU4/U5 is still the most inverted 1-yr calendar, but yesterday it popped 8 bps to -95 (U4 down only 0.5 while U5 fell 8.5).

–The numbers are horrendous but generally glazed over. I was struck though, by an article in BBG highlighting Chicago’s never-ending, and worsening, pension problems, even as portfolios should be soaring:

The net pension liability across the city’s four retirement

funds rose about 5% to $37.2 billion as of Dec. 31, up from

$35.4 billion a year earlier, according to Chicago’s latest

annual financial report.

–Back to the quote at the top of the page. Sudden realizations:

Bond yield too low given profligate gov’t spending? Adjusts all at once.

Biden cognitively impaired? There were *ahem* clues. But the press response…all at once.

European youth sick of the left’s rules? Rapid shift away

One might ask the question whether a quick shift might occur regarding the rosy prospects of AI and big tech. The large cap tech stocks have almost acted like ‘flight-to-quality’ long dated assets, similar (but better) than bonds. Sudden change in growth scenarios?

***************************************************************************

Interesting trade yesterday; synthetic steepener:

+5k 3QU 9612/9562ps vs sell 0QU 9562/9525ps… pay 3.25 to 3.5. The 3QU put spread settled 13.5 and 0QU 11.25.

Spread is synth long U5/U7, futures settles 9579.5 and 9617.5. That spread has jumped from -50 to -38 in two days.

THIS IS NOT A RECOMMENDATION… but it is a reasonable way to express the steepener on the SOFR curve. All options expire 13-Sept, 2024.

Demanding a larger rate premium for long-term bonds

July 1, 2024

************

–Friday’s late bond meltdown is seeing follow-through this morning with a print of 117-06 in USU4 (settled 118-10, late Friday low was 117-14). This, even as PCE prices showed no inflation month/month, with headline and core both 2.6% yoy. The 10 year breakeven (treasury/tip) has been steady at around 2.25% for the past two months (4.34%/2.06%). This morning’s news includes ISM Mfg expected 49.1 from 48.7 last. Powell speaks at the central bank economic forum in Sintra tomorrow.

–5/30 spread ended at the highest level since early April at +17.3 bps, up 4.6 on the day. On the SOFR strip, the red/gold pack spread (2nd to 5th year) rose 5.25 bps to -18.125. (Red pack 9606.25 and golds 9624.375). Every contract from March’26 to March’29 is between 9613.5 and 9633.5…not deviating much from 3.75%. Obviously things can change, but in comparing the long-term inflation expectation embedded in the 10y breakeven to forward rates on the SOFR curve, a real rate of around 1.5% is being projected.

–The most inverted one-year calendar remains the front SFRU4/U5 at -103 (9485/9588). In Fed Funds the front FFQ4/Q5 is -108 (9469.5/9577.5) so the market is currently comfortable with the idea of four eases over that time frame.

–Macron’s early election gambit failed. Political uncertainty growing globally.

It’s not panic if you’re first

June 30, 2024 – Weekly Comment

***********************************

On Friday afternoon, bonds had a “Um… look. We finally beat Medicare” moment. Which is to say, crystallization that out-of-control government spending is not compatible with sub-4.5% bond yields. On Friday’s settlement the 30y was 4.50%; an hour later it was 4.56% as USU fell from 118-10s to 117-14.

Well, maybe that wasn’t it. There were, perhaps, a confluence of factors that sparked selling:

1) The Supreme Court overturned the Chevron decision; will lead to a rollback of regulatory shackles imposed by overly zealous agencies.

2) Odds shifting in favor of another Trump term; “I am the king of debt. I love debt.” Of course, at the end of this 2016 clip he adds, “…but now you’re talking about something that’s very, very fragile and something that has to be handled very, very carefully.” [Something that hasn’t been done recently]

https://www.facebook.com/watch/?v=10153748022289087

Related to increased odds of a Trump win is the chance of a Powell replacement. His official term as Fed Chair ends May 15, 2026.

3) Having sailed through stress tests, banks are upping their dividend payouts. I don’t know if this follows logically, but if a bank is paying out capital, then maybe there’s less with which to buy treasuries? It’s not a great look with respect to income inequality. I think I saw these two snippets on the same BBG website page: Banks pass Fed stress tests and increase dividends…while a nearby headline was ‘Credit Cards Get Stress Test Spotlight With Losses Hitting 40%’. Too-big-to-fail banks are doling out cash to shareholders while consumers struggle to pay the bills.

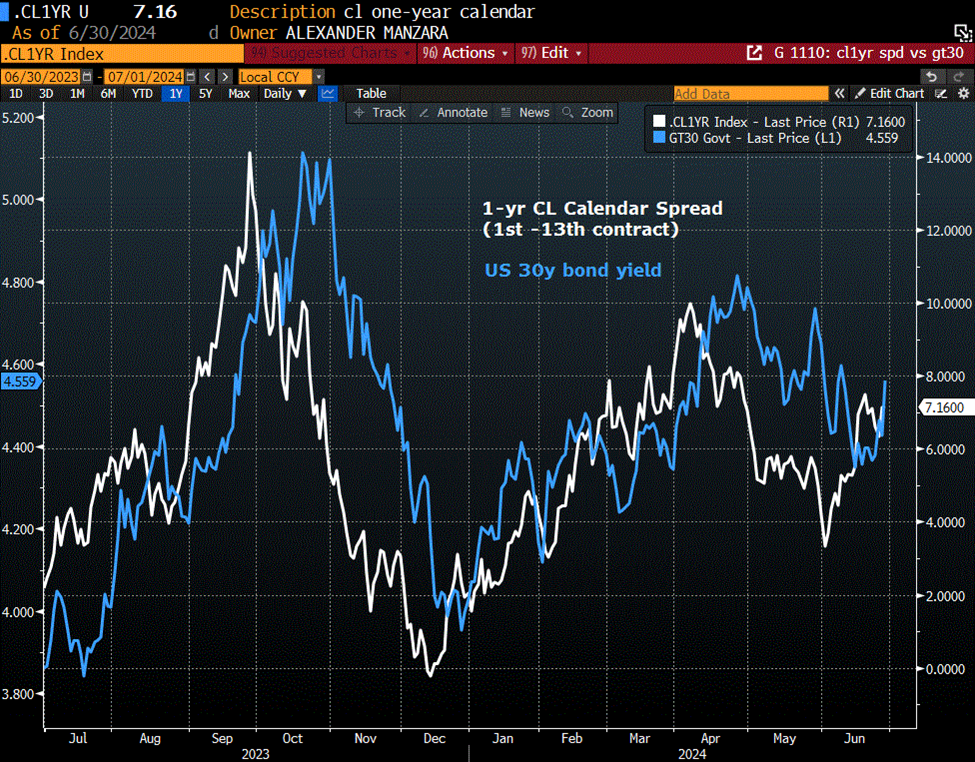

4) August crude oil settled at its highest level in two months at 81.54, and the near one-year calendar, CLQ4/CLQ5 has rallied aggressively, settling Friday at 7.16. Perhaps this move is partially due to increased hostilities and threats between Israel and Lebanon (Hezbollah/Iran). X post example from Saturday: “Multiple sonic booms from Israeli aircraft heard over areas of Southern Lebanon as well as the capital of Beirut.” Chart below overlays CL 1-yr calendar and GT30 yield (oil cal appears to lead).

5) Possible Japanese selling of UST to support the yen.

Adjusting for new 2 and 5yr notes, I marked 2/10 up 5.1 bps on the week to -37.7 and 5/30 up 4.2 bps to 17.3. If this latter spread closes above 20 a couple of times, the next test will be upper 30’s. Target should be 60 to 70. 58.5 is the 50% retrace from the 2021 high of 163 to the March 2023 low of -46. The double bottom target from 9/2022 and 3/2023 (both lows around -46) is +68 bps.

Interesting comments from Market Huddle this week featuring Vincent Deluard of StoneX. He suggests selling French OATS and buying Italy BTPs. The compelling aspects: He noted that France and Italy government deficits are nearly equal at 5.5% of GDP. But then he compared PRIMARY debt, saying that Italy could pay its bills if it didn’t have to pay interest…so Italy has a primary surplus, while France does not. The reason is that ten years ago, when spreads had blown up, Italy was issuing long term debt at 7-8% while long-term rates in France were negative. As time rolls forward and Italy is replacing high yield debt with lower rates, its fiscal position improves; it’s the exact opposite for France. Just the passage of time means that Italy becomes a better credit relative to France. Additionally, the trade carries positively. I think that this type of analysis tangentially underlines deterioration in US debt dynamics.

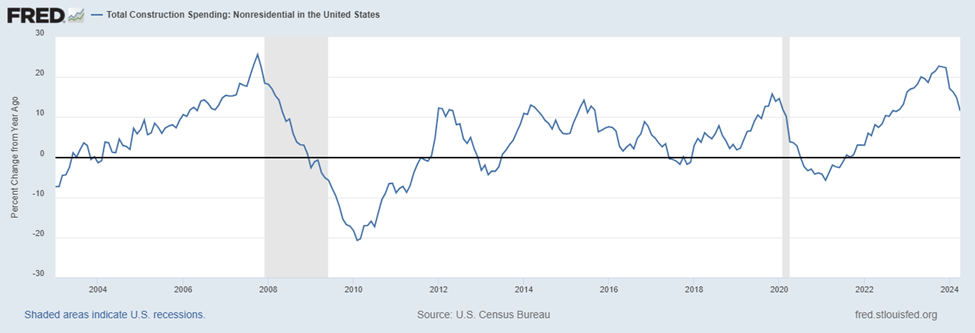

Below are just a couple of charts of non-residential Construction Spending. The CHIPS Act was likely one factor which was instrumental in the steady increase in spending since 2022. However, the growth rate has decidedly turned down (top chart is % yoy change while bottom chart is in dollars).

*************************************************************************

News this week includes ISM Mfg and Services (Monday and Wednesday). Construction Spending Monday. Powell speaks on Tuesday at the Forum on Central Banking in Sintra at 9:30. JOLTs also on Tuesday. ADP and FOMC Minutes on Wednesday.

For some reason, Employment data is released on Friday, after the Thursday 4th of July Holiday. It’s pretty clear that bonds are vulnerable to more downside. If yields can explode higher on a normal Friday afternoon, imagine what can happen on a Payroll Friday when no one is around. Long-end vol ended Friday on a strong note, but I suspect a bid for insurance will be evident on Monday morning.

Powell scheduled for semi-annual testimony on July 9. NOTE: The Semi-annual REPORT is released before the actual testimony.

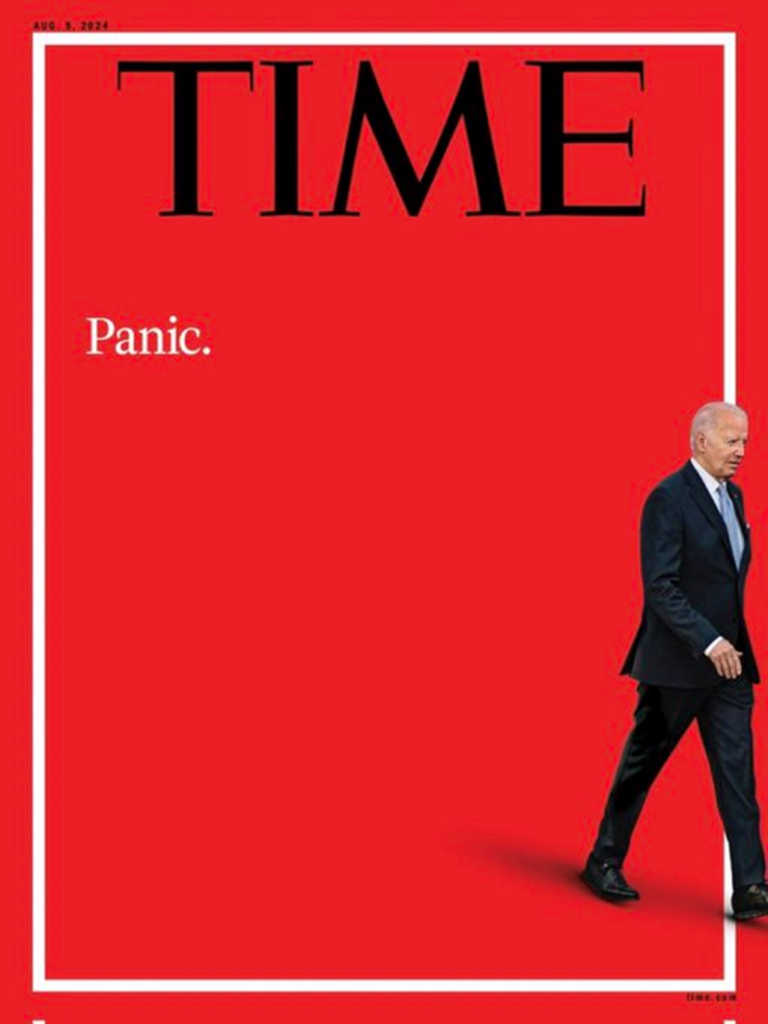

Remember, it’s not ‘PANIC’ if you’re the first one to sell.

There’s almost no open interest in December Treasury futures and options. Dec treasury options expire on November 22, after the election — but who knows if the outcome will have been decided.

However, midcurve SOFR options are liquid with expirations on 13-Dec 2024 and 14-March 2025. Blue midcurves are correlated to longer dated treasuries. As an example, 3QZ4 9550p settled 6.0 with 14d vs SFRZ7 9633.5. The 9525 strike has a 10 delta and settled 3.75. In comparing nominal levels of atm straddles, 0QZ4 9600^ settled 66.0, 2QZ4 9625^ settled 64 and 3QZ4 9637.5^ settled 59.5. Of course, it makes some sense that nominal straddle levels are somewhat lower at higher strikes (representing lower yields). However, IF the curve really starts to steepen, blue puts will get a double kick from higher vols and higher yields.

| 6/21/2024 | 6/28/2024 | chg | ||

| UST 2Y | 468.3 | 471.6 | 3.3 | |

| UST 5Y | 426.6 | 432.7 | 6.1 | |

| UST 10Y | 425.5 | 433.9 | 8.4 | |

| UST 30Y | 439.7 | 450.0 | 10.3 | |

| GERM 2Y | 278.9 | 283.3 | 4.4 | |

| GERM 10Y | 241.2 | 250.0 | 8.8 | |

| JPN 20Y | 179.7 | 188.5 | 8.8 | |

| CHINA 10Y | 226.0 | 221.0 | -5.0 | |

| SOFR U4/U5 | -108.5 | -103.0 | 5.5 | |

| SOFR U5/U6 | -39.5 | -37.5 | 2.0 | |

| SOFR U6/U7 | -8.0 | -8.0 | 0.0 | |

| EUR | 106.97 | 107.23 | 0.26 | |

| CRUDE (CLQ4) | 80.73 | 81.54 | 0.81 | |

| SPX | 5464.62 | 5460.48 | -4.14 | -0.1% |

| VIX | 13.22 | 12.44 | -0.78 | |

You’re Fired!

June 28, 2024

***************

–You’re Fired… I’m talking, of course, about Masato Kanda, Japan’s currency diplomat, who has presided over yen depreciation, with $/yen breaching 161 today. I only watched a couple of minutes of the US presidential debate, but got a sense of it from this morning’s headlines:

Reuters: Biden’s Wobbly Debate

BBG: Biden’s Disastrous Debate

FT: Democrat’s Panic as Biden Stumbles

WSJ: Dem’s Discuss Replacing Biden

NYT: Biden Struggles

Chgo Trib: …a raspy and sometimes halting Biden tries to confront Trump… [charitable]

So we’ll see who the new guy/person is at the convention, I suppose.

The market tentatively is pricing a Trump win; stocks up, bonds a bit weaker. But oil is at a new recent high this morning with CLQ4 82.43.

–Yesterday was quiet. Ten year yield slipped back a few bps to 4.286%. Early buys of 15k SFRZ4 9525/9550/9600/9700c condor 2.5 and 9525/9575/9600/9700cc for 5.75…looks like they’re rolling long 9600/9700 c sprds into tighter, closer to the money call spreads. Indeed, open interest confirms that, with a drop of 37k on 9600c and 44k in 9700c, and of course, a jump of 29k in the 9525c. SFRZ4 settled 9514, so the new lower strike is just 11 otm, but with the Fed Fund Effective at 5.33% or 9467, the 9525 strike needs two to three eases to be in play. Of course, Powell could be out, replaced with a financial wizard like Sam Bankman Fried who can get us back to 1% funding rates…

–Capital Goods Orders non Def, ex-Air was -0.6%; weak.

Today brings PCE prices expected 0.0 with Core 0.1% on month/month.

Y/y expected 2.6 and 2.6%.