Bulletproof

July 22, 2024

***************

–I thought it would be an open Democratic convention when Biden dropped, but the media now claims that all big donors are solidly behind Harris, even though the same media said large donors were left exasperated after a strategy call on Friday. Some of the headlines:

NBC News: ‘Ludicrous’: Donors leave call with Kamala Harris frustrated and annoyed

The Independent: Some Democrat donors reportedly left fuming after Kamala Harris call: ‘A total failure’

–In any case, I am not too sure that a Trump win is positive for markets. Gov’t deficits have been a big growth driver, and may be trimmed. Immigrants have boosted both costs and growth (now may reverse). Core Service prices which have been the inflation thorn, consist of shelter, health costs, transportation. Not sure about shelter, but I would imagine RFK as HHS head would cut health care costs, open drilling would reduce energy/transport costs. High tariffs would be inflationary. Ending Russia/Ukraine war reduces demand for US weapons. Overall, a lot of uncertainty. Copper prices keep going lower, but I would imagine heavy demand as the US turns inward for basic manufacturing, etc.

–China cut the 7-day reverse repo rate to 1.7% from 1.8%. One-year prime lending rate authorized to drop to 3.35% from 3.45%.

–Auctions of 2, 5 and 7 year notes this week starting tomorrow. PCE prices on Friday.

–It’s not quite a bunker, but may have some potential in today’s environment (5 acres on a lake):

“What’s strange? EVERY surface is covered with expensive bulletproof Lexan – and I mean “every.”

https://www.zillow.com/homedetails/1360-Old-Trail-Rd-Maumee-OH-43537/34722959_zpid/

I’ll get you back next week

July 21, 2024 – Weekly comment

**********************************

This is Popeye’s friend Wimpy. Favorite saying: “I will gladly pay you Tuesday for a hamburger today!”

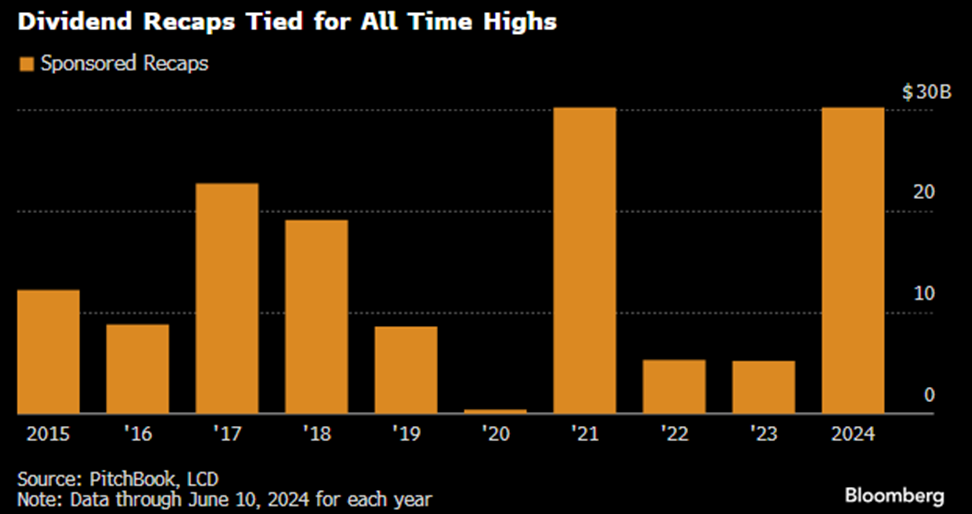

A friend (thanks TMS) mentioned that the recent Elliott Wave Theorist had a section on dividend recapitalizations, which cited a Bloomberg article from June 17: Private Equity Won’t Stop Gorging on Debt to Pay Investors. From the BBG article:

Managers of exclusive pools of capital have long promised fat, and fast, returns to their limited partners, such as endowments and insurers. But their pledges have fallen victim to a serious drought in mergers and acquisitions and initial public offerings that’s upended their normal course of exiting holdings and handing the proceeds over. Dividend recaps are a feasible alternative because debt investors flush with cash are lining up to buy all kinds of credit products.

A dividend recap involves borrowing to pay out cash to investors. The company, which isn’t throwing off the requisite cash flow, is loaded with more debt. Huge red flag, perhaps not at zero rates, but certainly in this environment. There’s a cute article on Axios that has a different take: Another sign of investor optimism: Dividend recaps are back. This one is from January 29, 2024 (link at bottom). The article is actually more balanced than the headline would indicate, but it really tries to put a positive spin on actions taken due to economic stress. Depending on Wimpy to pay you back.

Another article from The Korea Times has this quote, which is related to NVDA, but really captures the broader idea of a slowdown:

Comparing the recent enthusiasm toward AI to the gold rush, the head of Korea’s major chipmaker and the largest business lobby anticipated that the U.S. firm [NVDA] would maintain its lead at least over the next three years, just as the sellers of pickaxes and jeans did during the mass migration of miners to the west of North America in the 19th century.

“When there was no more gold, the sellers became unable to sell pickaxes,”

I’ve copied a couple of charts from the June Bloomberg article below, and the link is at bottom.

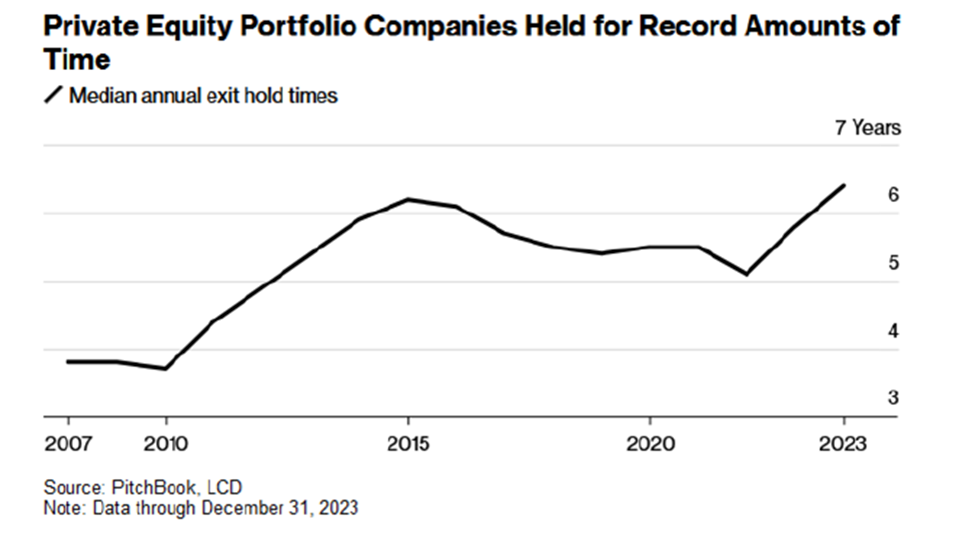

And here’s another chart, which I would caption (from personal experience)

WHEN A TRADE BECOMES AN INVESTMENT:

I absolutely am wading into a topic above my depth here, but it does seem as if non-bank lenders are posing significant systemic risks, or at least are raising odds of a hard slowdown. Another BBG article highlights a similar tactic. From July 18: Private Credit Pushes Deeper Into Risk Wall Street is Fleeing.

Such borrow-now, pay-later deals are proliferating. Payment-in-kind, or PIK debt, allow borrowers to pay interest with more debt. One controversial practice cropping up on more deals involves a “synthetic PIK,” which lets companies defer interest payments without calling the loan PIK.

Of course, there are all kinds of prudent asset managers. The numbers that I have seen from my cursory research don’t look particularly large. But then, they didn’t think subprime mortgage lending was that big of a deal back in the day.

A company called Blue Owl Capital (OWL) is on an acquisition spree, last week buying Atalaya Capital Mgmt “pushing deeper into the red-hot private credit market.” Blue Owl is paying $450m up front, $350m in equity and $100m in cash. In April, OWL bought Prima in a deal comprised of $157m equity and $13m in cash. A BBG note on Owl says: “Overall accrual rates and portfolio measures are solid, though fixed-charge coverage has slipped, PIK income has risen and non-accruals of 2.5% in 1Q are on the rise.” A BBG reporter values OWL’s assets at around $215b. But they seem to be able to use their stock as currency. Market cap is $28b, while Blackrock cap is $124b and Blackstone is $168b. All three surged following the lower than expected CPI data. This topic bears watching…

****************

Last week I posted a chart of the MOVE index and wrote this: “MOVE index, a measure of implied volatility in treasuries… ended the week near the low of the year, as yields eased in the context of a steepening curve with inflation concerns receding. VIX similarly closed near the low of the year at 12.46; in fact it’s near the post-covid low. Insurance is cheap.”

Insurance is still cheap though vols are up. MOVE from 86.8 to 94.3 this week. From Credit Bubble Bulletin:

The VIX (S&P500 volatility) Index jumped 4.1 this week to 16.52, the largest weekly increase since (banking crisis) March 2023. The VIX closed Friday at the high since the April (Israel/Iran missile tit-for-tat) spurt of de-risking/deleveraging.

Note: Israel struck a Yemeni port city in response to Houthi attacks. Netanyahu scheduled to meet Biden on Tuesday in Washington.

Other upcoming events:

Treasury auctions, $69b 2y Tuesday, $30b 2y FRN Wednesday, $70b 5y Wed, $44b 7yr Thursday

Inflation data Friday:

PCE Price MoM 0.0 from 0.0

PCE Price YoY 2.4 from 2.6

PCE CORE MoM 0.1 from 0.1

PCE CORE YoY 2.5 from 2.6

Olympics start Friday, July 26.

JULY 27 Trump speaks at BITCOIN 2024 conference in Nashville

JULY 29 Treasury Refunding Announcement

JULY 31 FOMC

OTHER THOUGHTS/ TRADES

It wasn’t a particularly big week for rates, though treasury yields rose 4 to 5.5 bps across the curve, with notable weakness into the end of Friday.

The types of trades that have become more prevalent on the SOFR curve are buying near calls or call spreads and selling midcurves with the same expiration to express a steepening bias.

For example, there had been a decent amount of SFRH5 9600c vs 0QH5 9700c, buying the near. Futures settlements on Friday: 9568 in SFRH5 and 9637.5 in SFRH6, so 32 otm vs 62.5 otm. Option spread settled -0.75 for the near (17.0 vs 17.75). This futures spread, SFRH5/H6, settled -69.5, but there’s a pretty steep roll as SFRZ4/Z5 settled -97 (9532/9629). SFRZ4 9600c settled 4.0 vs 0QZ5 9700c at 10.0 so if nothing else changes, this trade rolls negatively, but of course if futures remain below strikes both calls go out worthless on March 14. Perception of near-term aggressive ease needed.

Last week the trade was +SFRZ4 9525/9550cs (8.5 settle vs 9532) vs -2QZ4 9675/9700cs (7.0 settle vs 9644.5). So this is an in-the-money cs vs 30.5 otm. Data that doesn’t support a near term ease will probably negatively impact this trade. Similar play: +SFRM5 9575/9600cs vs 2QM5 9650/9675cs, paid 1 for front June. Settled 11.75 vs 9596.5 and 10.5 vs 9646.5.

As the prospects for easing have been moved forward, the peak contract on the SOFR strip has also moved closer. For example, at the end of May, the third blue or the 15th quarterly was the peak, and now it’s migrated one year closer and is the third green or 11th contract (SFRH7 at 9647). In considering a steepener on the SOFR curve, the critical factor is to select the near contract that will be most impacted by ease, and to try to sell something further out, ideally near or past the peak of the strip.

Below is a chart of US (active contract) vs Blackrock. Seems to be some divergence since the start of this year, though perhaps a steepening curve (with lower funding rates in the near term) is the most important catalyst for asset mgrs.

| 7/12/2024 | 7/19/2024 | chg | ||

| UST 2Y | 446.2 | 450.5 | 4.3 | wi 446.5/446.0 |

| UST 5Y | 411.1 | 416.1 | 5.0 | wi 415.0/414.5 |

| UST 10Y | 418.7 | 423.9 | 5.2 | |

| UST 30Y | 440.1 | 445.0 | 4.9 | |

| GERM 2Y | 282.3 | 278.4 | -3.9 | |

| GERM 10Y | 249.6 | 246.7 | -2.9 | |

| JPN 20Y | 187.0 | 183.1 | -3.9 | |

| CHINA 10Y | 225.9 | 226.0 | 0.1 | |

| SOFR U4/U5 | -128.0 | -122.5 | 5.5 | |

| SOFR U5/U6 | -30.5 | -29.0 | 1.5 | |

| SOFR U6/U7 | 0.5 | -1.0 | -1.5 | |

| EUR | 109.08 | 108.85 | -0.23 | |

| CRUDE (CLU4) | 81.02 | 78.64 | -2.38 | |

| SPX | 5615.35 | 5505.00 | -110.35 | -2.0% |

| VIX | 12.46 | 16.52 | 4.06 | |

https://blinks.bloomberg.com/news/stories/SEX54QT0G1KW

https://www.axios.com/2024/01/29/private-equity-dividend-recap

https://www.koreatimes.co.kr/www/tech/2024/07/129_378969.html

https://blinks.bloomberg.com/news/stories/SGO92WDWRGG0

https://blinks.bloomberg.com/news/stories/SGPRECDWLU68

Oh, we got both kinds, country AND western

July 19, 2024

**************

I don’t like country music, but I don’t mean to denigrate those who do. And for the people who like country music, denigrate means ‘put down’.

-Bob Newhart, passed at age 94

–Treasury yields rose despite a continued pullback in stocks. Tens up 4.6 bps to 4.188%. SPX down 44 or 0.8%. On the SOFR strip reds thru golds were down 3.5 to 5 (1 to 4 years forward). The peak contract on the strip is SFRH’27 at a price of 9654, right around 3.5%.

–No economic data of consequence today, but it is July equity option expiration. Beware the gamma vortex. Also, a global tech outage has disrupted airline, media and banking operations this morning. We’ll just call it a ‘glitch’. TRADE RECOMMENDATION: Buy some candles, canned goods and a good paperback; more of this is on the way.

–A couple of interesting snippets.

BBG headline: Texas’ Biggest Pension Fund to Pull Almost $10 Billion from Private Equity.

WSJ by Greg Ip: Why the Fed Should Cut Rates Now – Not Wait Until September

The next FOMC is in 12 days, July 31. August Fed Funds settled 9468, indicating less than 5% chance of an ease at the July meeting, while FFV4 at 9492.5 has fully priced a September cut. It would take something pretty gosh-darn outlandish to make the Fed move in July. However, if anyone should notice Austin Private Wealth buying FFQ4, let me know.

[just prior to last weekend, an SEC filing dated July 12 showed Austin PW reporting a new put position representing a short of 12 million DJT shares. Clerical error. I said, IT WAS A CLERICAL ERROR]

Anyway, it’s now all about the labor market, and Jobless Claims rose to 243k yesterday. Payroll data is released to you and me on August 2, two days after the FOMC, but there have been instances, through clerical error of course, where some market participants randomly received the data early. Now the drama shifts to who Kamala Harris will choose as a running mate…

It’s About Jobs

July 18, 2024

**************

–Rates eased a bit in a quiet session, with tens -2.5 bps to 4.142%. SPX fell 1.4% and NazComp fell twice as much, -2.77%. Waller spoke yesterday; he’s an important voice on the Fed, and while speeches earlier in the year were ‘What’s the Rush’ and ‘There’s Still No Rush’, this one was ‘Getting Closer’ [with respect to cutting the FF target]. He ended his speech with three scenarios: 1) continued good readings on inflation. 2) uneven inflation data, which is more likely but leads to less certainty of a near term ease 3) resurgent inflation data. Before concluding with these scenarios, he had deemed the labor market to be in a ‘sweet spot’, but is quite cognizant that what had been a tight jobs market “has changed dramatically.” I would consider a fourth scenario: uneven price data but notable deterioration in labor. Would that forestall a near-term ease?

–In any case, action in the short end of the curve revealed a modicum of bias in terms of pricing a greater magnitude of ease, pushed slightly further back. SFRU4 settled down 1 at 9495, but contracts from Dec’25 forward were +3 to +3.5. Yesterday I noted that the pre-election, post-election calendar spread of SFRU4/SFRH5 closed at a new low of -79.5 (9495/9574.5). Fairly aggressive to price 3 eases in a six month spread. SFRU4/U5 also closed at new low -131 (9495/9626). Obviously these spreads aren’t always ‘right’, for example the near 6-month calendar in January was -80 to -90. But….No Ease.

–Today’s news includes Jobless Claims expected 225-230k (what happens on >250k) and Philly Fed expected 2.9 from 1.3.

SPX priced in Gold. Waller today.

July 17, 2024

*************

–Retail Sales stronger than expected yesterday, though in real terms, still weak. After fairly aggressive steepening from mid-June to Monday, the curve retraced, with 2’s down only 1.1 bp to 4.442% and tens down 6.2 to 4.167%. Both SPX and Gold made new highs, but as the attached chart shows, SPX priced in gold is breaking.

–KRE regional bank ETF has simply exploded since mid-June, from 46 to a new ytd high of 56 yesterday (+4.6% just yesterday) but somewhat interesting that Schwab (SCHW) was crushed, down 10% yesterday, -7.74 to 67.43 as the company said it would reduce its size. Jeanna Smialek (NYT) tweets:

Donald Trump on Fed Chair Jay Powell’s term (which expires in 2026) in a @BW interview: “I would let him serve it out especially if I thought he was doing the right thing.”

–Waller at 9:30 this morning on Economic Outlook. Beige Book this afternoon. 20-year auction. Housing Starts and Industrial Production.

–Heavy volume in SFRU4/SFRZ4 futures spread yesterday, said to be initiated by a seller; settled unch’d at -40.5 (9496/9536.5). This has been the low of the move; yesterday printed -43. Both contracts saw open interest fall by about 29k. Looking back to last December when the near 1-yr calendar was below -150, the first 3-m calendar had traded to -49. Currently U4/U5 is -128. Three-month calendar near -50 is hard to sustain… Also worth a mention is a decline in open interest in SFRU5 and Z5, -55k and -14k. These contracts were nearly unchanged, 9624.0, unch and 9637.0 +0.5, while contracts a year forward were up 3 to 3.5. I would characterize U5 and Z5 as profit-taking after a large move.

Priming for an ease

July 16, 2024

**************

–Goldman opined that the Fed has solid rationale for a July rate cut; Moody’s had also said something similar. (FOMC is July 31). With current EFFR at 5.33% or 9467, August Fed funds surged up to 9473 before falling back to 9468.5, an unchanged settlement. FFV4 which captures the Sept FOMC meeting as well as July’s, ticked up to 9499 and settled 9494, up 1.5 on the day. A 25 bp rate cut should put the new EFFR at 5.08% or 9492, so a print at 9499 begins to reflect significant concerns that a cut of 50 could occur. A couple of days ago, SFRU4 9500c were sold at 3.0, yesterday settled 5.0 with SFRU4 +2 at 9496.5.

–Powell expressed greater confidence that inflation is moving in the right direction. I’m not sure how much weight should be given to anecdotal evidence, but a friend who is involved with a private airport near Chicago said that business travel is rapidly slowing (thanks DK); last month’s fuel sales were the lowest in years. WSJ has a headline: Evictions surge in major cities in the American Sunbelt. BBG: Salesforce Cuts More Jobs in Latest Sign of Tech Austerity.

-Given a shift in sentiment toward near-term ease, the curve continues to steepen. 2y note fell 1 bp to 4.453% while tens rose 4.2 bps to 4.229%. 2/10 ended at a new high -22.4. On June 27, just over 2 weeks ago, I marked SFRU5/SFRU8 at -47 (9587.5/9634.5). Yesterday it settled -14.5 (9624/9638.5), a surge of over 30 bps. [notice that the price of SFRU8 barely changed]. In tens, there was a late buyer of 30k TY week-1 111.25p for 46. Settled 48 vs 110-315, Settlement date is 2-August, on which NFP will be released. Seeing a small bounce in treasuries this morning with TYU4 111-09.

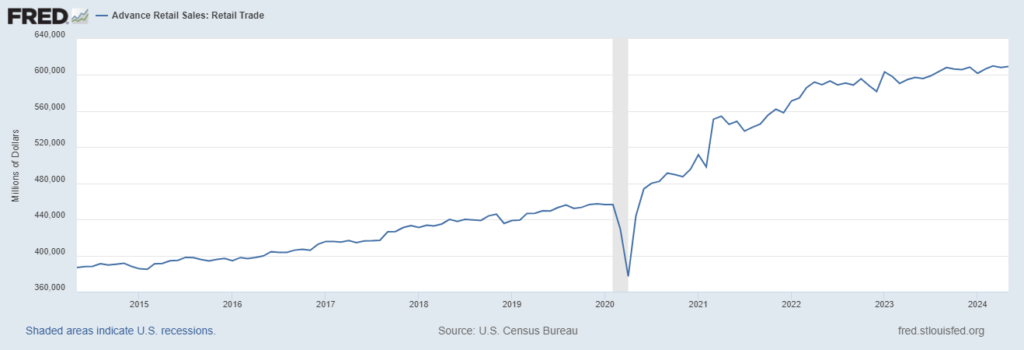

–Kugler speaks today at 2:45 on ‘…Economic Measurement and Creative Solutions’. I guess that just means changing the data! Retail Sales as well, expected -0.3%, but ex-auto and gas +0.2%. From the St Louis Fed website, I pulled the chart below on Retail Sales (nominal). The recent slope of the curve is surprisingly flat given inflation levels of 4-6%. According to my measurements, from April 2022, when the Fed had just started to hike, to May 2024 (last data on chart), total nominal retail sales were up just 3%…over TWO years. Real Retail sales are soft. But maybe we can just measure them differently.

Market reaction muted

July 15, 2024

**************

–Market reaction to Trump assassination attempt is muted. Republican Nat’l Convention begins today. Powell interview with David Rubenstein, Chair of the Econ Club of Washington, DC, at 12:30. Powell likely to emphasize slowing labor market.

–Curve steepened to new recent highs on Friday, with 2/10 +4 bps to -27.5 and 5/30 +1 to 29. Front SOFR calendars made new lows and deferred spreads made new highs as the reds, second year forward, led the rally, settling +3.75. Greens +1.5, blues -1 and golds -2. Both U4/Z4 and Z4/H5 3 month calendars settled at new lows, -39 and -37.5. Near term easing is being priced somewhat forcefully, with SFRU4 to SFRH5 -76.5, over three-qtr pct in the span of six months.

–Empire State Mfg today expected -6.0. Treasury vol and VIX near the year’s lows. TYU 111^ settled 1’40 from 1’44 Thursday. TY vol graph below.

Missed Me

July 14, 2024 – Weekly Comment

***********************************

Post-debate a client had mentioned that the possibility that a Trump win could lead to a Fed HIKE. I dismissed that idea, but after yesterday’s assassination attempt on Trump, perhaps that scenario deserves small odds. The hike part that is, the other is becoming more of a given. Amazingly enough, I had just received one of those “your memories from this day” emails with this particular chart:

I don’t know that Small Business Optimism necessarily translates to economic dynamism. And, the initial plunge in 2020 was likely more associated with Covid than Biden. However, since the middle of 2022, NFIB has never been able to get above 92; this year’s range is 88.5 to 91.5, well below Trump’s average of 104 to 105.

In the week that just passed, Powell leaned slightly dovish in his semi-annual Congressional testimony. A monthly CPI print of -0.1 (3.0% yoy) supports the narrative that inflation is moving sustainably toward target. Focus has shifted to the labor market. An ease for September is now fully priced, with October Fed Funds settling 9492.5 or 5.075% just more than 25 bps below the current EFFR of 5.33%.

As the market gains confidence for near term easing, the back end of the curve steepened. 2/10, which hasn’t been positive since the middle of 2022 (the first hike was in March 2022) closed at -27 (4.462 / 4.187). The ytd low was -50 just three weeks ago on June 25. There should be resistance at -16, a double top from Oct 2023 and January of this year. A close above that level would suggest a target of +20 to +25. I expect that stimulative measures associated with a Trump win would lead to more pressure on the back end of the curve. On the other hand, the current administration has every incentive to juice the economy right NOW. At the end of the month the Quarterly Refunding Announcement could again favor bills over coupons (as it did in Oct 2023, helping to ignite an ‘everything’ rally). The TGA is currently $722 billion. From Q3 2022 to May 2023, it was drawn down from $690b to $48b. I’d wager we will see a rapid drawdown in the next few months, pumping direct fiscal stimulus into the veins of the US economy.

I am simply adding a couple of other charts of interest. The first is the ‘Buffet indicator’ of total US Market Cap to GDP. It’s hard to see on the chart, but it is now at a record 196%.

https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/

Second, here is a chart of the MOVE index, a measure of implied volatility in treasuries. It ended the week near the low of the year, as yields eased in the context of a steepening curve with inflation concerns receding. VIX similarly closed near the low of the year at 12.46; in fact it’s near the post-covid low. Insurance is cheap.

| 7/5/2024 | 7/12/2024 | chg | ||

| UST 2Y | 459.7 | 446.2 | -13.5 | |

| UST 5Y | 421.6 | 411.1 | -10.5 | |

| UST 10Y | 426.9 | 418.7 | -8.2 | |

| UST 30Y | 446.7 | 440.1 | -6.6 | |

| GERM 2Y | 288.9 | 282.3 | -6.6 | |

| GERM 10Y | 255.6 | 249.6 | -6.0 | |

| JPN 20Y | 193.3 | 187.0 | -6.3 | |

| CHINA 10Y | 227.3 | 225.9 | -1.4 | |

| SOFR U4/U5 | -114.5 | -128.0 | -13.5 | |

| SOFR U5/U6 | -34.5 | -30.5 | 4.0 | |

| SOFR U6/U7 | -4.0 | 0.5 | 4.5 | |

| EUR | 108.40 | 109.08 | 0.68 | |

| CRUDE (CLU4) | 82.26 | 81.02 | -1.24 | |

| SPX | 5567.19 | 5615.35 | 48.16 | 0.9% |

| VIX | 12.48 | 12.46 | -0.02 | |

Cutting (talking rates here, not Joe)

July 12, 2024

**************

–CPI hadn’t had a negative monthly print since covid, and yesterday the headline was -0.1% (yoy 3.0) with Core +0.1% (yoy 3.3). Rate futures surged. Curve steepened with the 2-yr down 12.5 bps to 4.505% and ten-yr down 9 bps to 4.191. 2/10 did not quite end at a new high (-31.4) but 5/30 did (+28.0). October Fed Funds (FFV4) settled up 5.5 bps at 9492 or 5.08%, exactly pricing a 25 bp cut from the current EFFR of 5.33%. SFRU4/SFRZ4 settled -37.5 (9493.5/9531) a new recent low. Given that an ease at the Sept 18 FOMC is being fully priced, another 1 to 2 priced for SFRZ4 is somewhat aggressive. However, it’s not out of the question to imagine a 50 bp cut if the data go pear-shaped. The political situation in the US is still… shall we say… fluid. Could that lead to a decline in business confidence?

–SFRU4/SFRU5 settled -124.5. down 10.5 on the day! Almost exactly 5 eases. That’s not, of course, a projection of an exact rate cut schedule, it’s just a range of various odds. But the spread is still equal to 5 cuts! And the KRE (regional bank ETF) was looking for just that sort of liquidity lifeline to get out from under the black cloud of commercial real estate. KRE surged +4.2% to the highest level since January, while SPX was -0.9%. Amazing rotation from Nasdaq to Russell with Nas Comp -1.95% and R2K +3.6%. Big bank earnings today including JPM, C, WFC.

–Note that treasury vol ended at new recent lows. I marked TYU4 111^ at 1’44 or 5.5% (from 5.7). The Sept atm 110.5^ on Monday was 1’56 or 6%. The drop in yields is not related to any type of ‘flight to quality’ panic, rather it’s just relief that funding rates will be coming down. However, there is still a sense that forward rates are limited in terms of how low they can go. Not an environment that sparks a mad grab for premium. The peak contract on the SOFR curve has moved forward a couple of slots and is now SFRH7 at 9653, or around 3.5%. The 5y yield ended at 4.123%. A new catalyst could be lurking around the corner, but lower funding rates can paper over a lot of chronic problems, at least in the short term.

–PPI today expected 2.3% yoy with Core 2.5 from 2.3.

–Heavy trade yesterday, but one noticeable (pre-data) exit was the sale of >50k SFRZ4 9475p at 2.0. On Wednesday there was a buyer of >50k SFRZ4 9525/9550cs for 6.5, and the contract magically vaulted above the lower strike yesterday, settling 9531 (+10.5) with open interest up 32k. The call spread settled 8.75. Nice one.

Inflation improving, job market weakening

July 11, 2024

*************

–Powell says he needs better data to increase his confidence that inflation is sustainably moving towards the 2% goal. Probably get it today (though he again said yesterday that the Fed’s focus is mostly on PCE prices). CPI expected 0.1 with Core 0.2 m/m. Yoy expected 3.1 from 3.3 with Core 3.4 from 3.4. He also again indicated that emphasis has shifted more towards labor market conditions.

Additional releases today:

Real Avg Weekly Earnings yoy 0.5% last

Jobless Claims 235k

30-year auction.

–SFRU4 options expire 13-Sept and the FOMC is 18-Sept. SFRU4 settled 9487.5. SFRM4, which still trades, settled 9464.75. So Sept is close to reflecting an ease (spread of -22.75), as is FFV4 which settled 9486.5. The big trades were in SFRZ4 options. SFRX4 9525/9550/9575c fly bought for 3.5, 25k (expires after election and Nov FOMC), and SFRZ4 9525/9550cs 6.5 paid for 65k covered 9521 with 20d. Both trades are new, and obviously work best as SFRZ trades above 9525. The contract settled 9520.5 with an increase in open interest of 29k. SFRU4/Z4 three-month spread settled -33. SFRZ4 options expire 13-Dec and the FOMC meetings are 7-Nov and 18-Dec. Eases at the last three meetings of the year, Sept, Nov, and Dec, would likely result in the 9525/9550c spread gaining full value.

–Another interesting curve trade, +10k SFRH5 9600c/-10k 0QH5 9700c for flat. Both calls settled 16.0, but the front is just 47 otm (9553) while 0QH is 67 otm as SFRH6 settled 9533. This trade works best on aggressive, forced easing. The roll is a headwind, as Z4 9600c settled 4.25 and 0QZ 9700c settled 9.25. (9520.5/9616.5).

***********************************

This is a rather interesting post with link below (thanks TMS):

chart ranks all $SPX 1m realized vol outcomes from high to low since 1990. At 5.4% right now, we are in the 1st percentile of outcomes. 1m realized vol on $NVDA and $AAPL are 9x and 6x, respectively, the same for the SPX. That is unheard of.

Let’s consider another month, Dec’17, when SPX realized vol was 5.5. The two largest stocks in the index were AAPL and $MSFT. What were their respective ratios of realized vol to the SPX in Dec’17? AAPL was 2.7x the SPX. MSFT was 3.6x the SPX.

There are 100’s of blns of $ of market cap “coming and going” in giant names, especially NVDA. A 3T company moving on a 50 vol is not healthy. There’s rampant speculation that is overwhelming the option market’s capacity to absorb gamma risk. The extent to which these meaningful vols on the single stock level do not translate to index vol (NVDA 50, SPX 5), is very unusual and likely not sustainable. Broken record statement: “The very same conditions that cause stocks to become more volatile also cause them to become more correlated at the same time”

Of course, this vol analysis sort of reflects the same thing that everyone already knows: the market is extremely dependent on just a few names. But the gamma risk associated with the dispersion trade may be underappreciated.